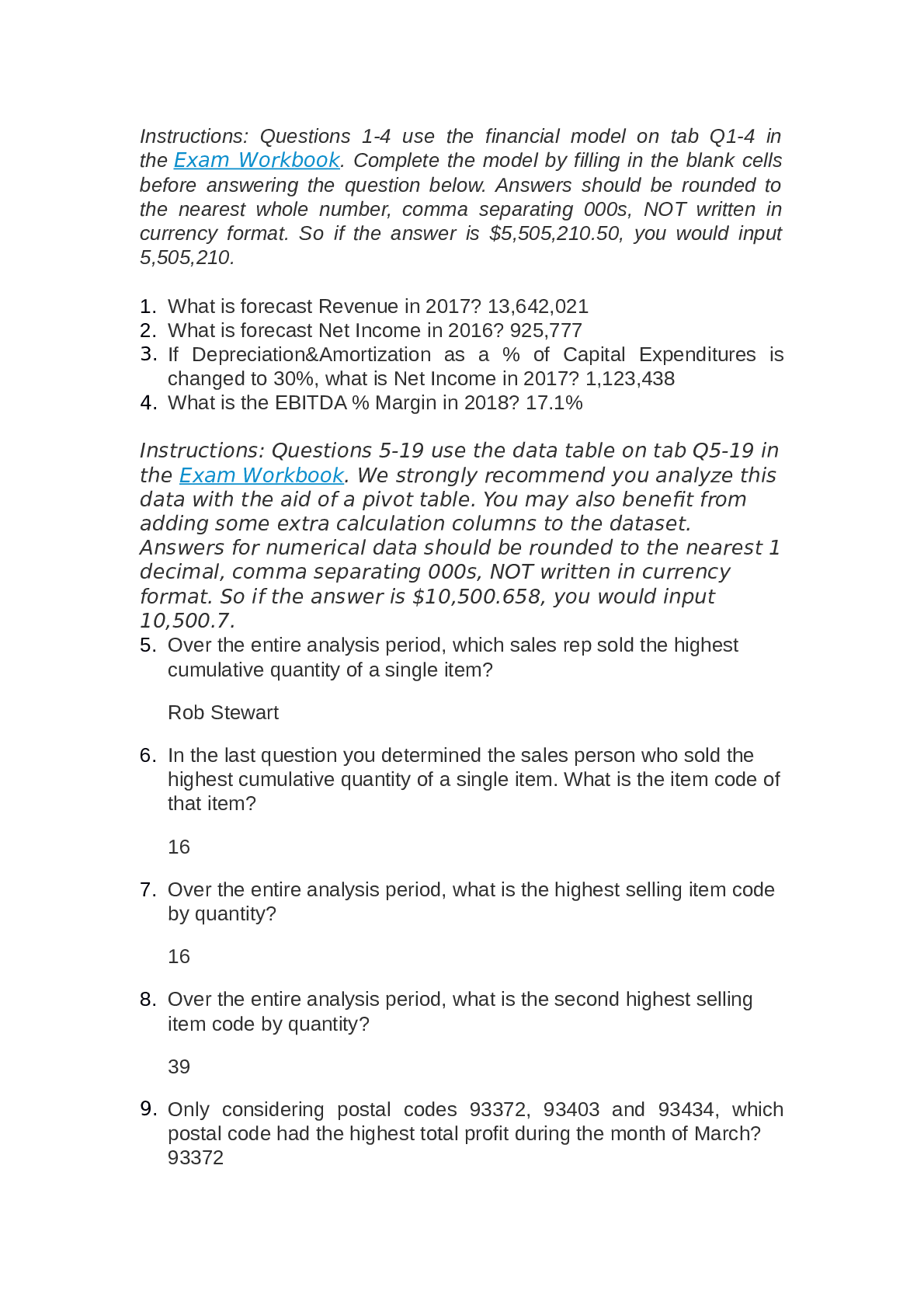

Wall Street Prep Fixed Income and Debt

Document Content and Description Below

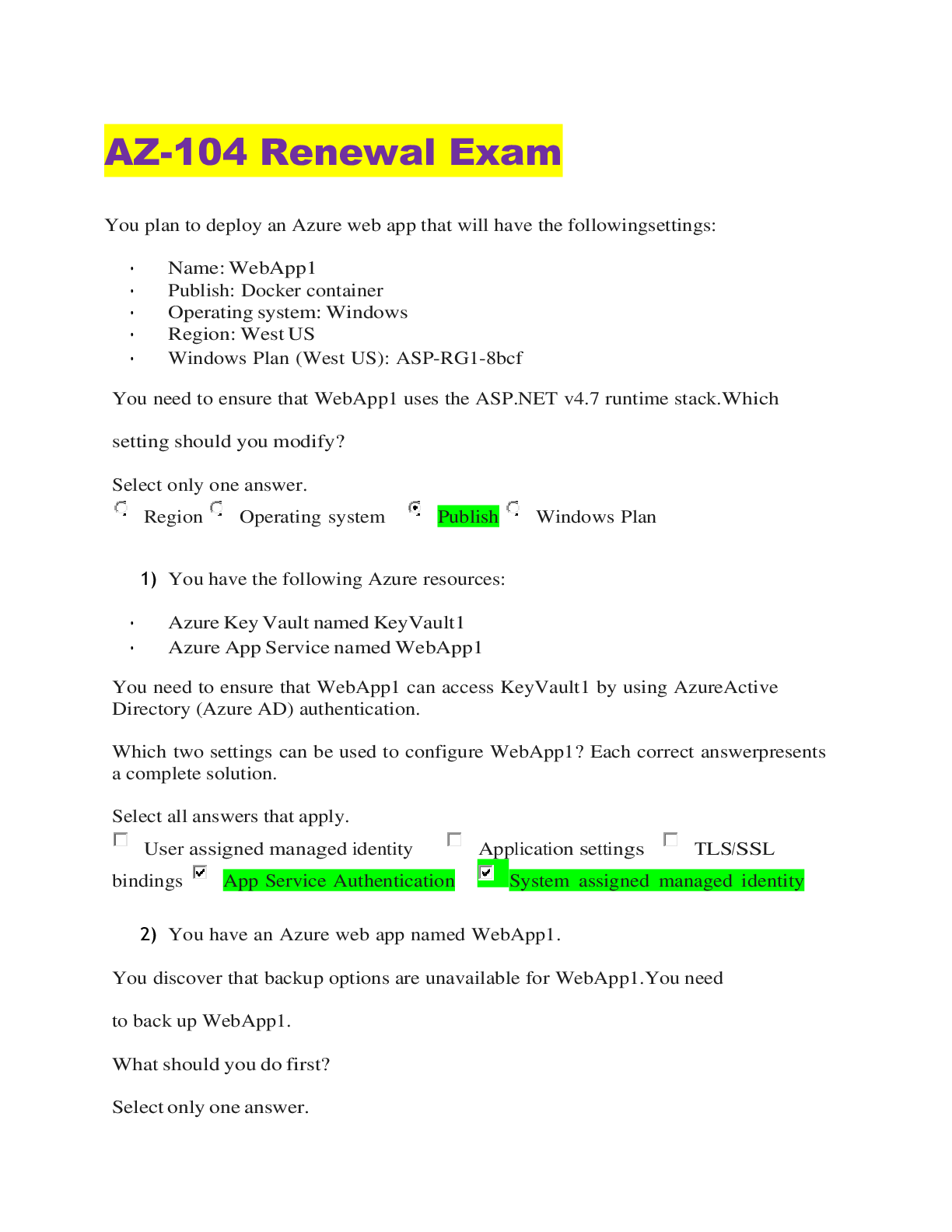

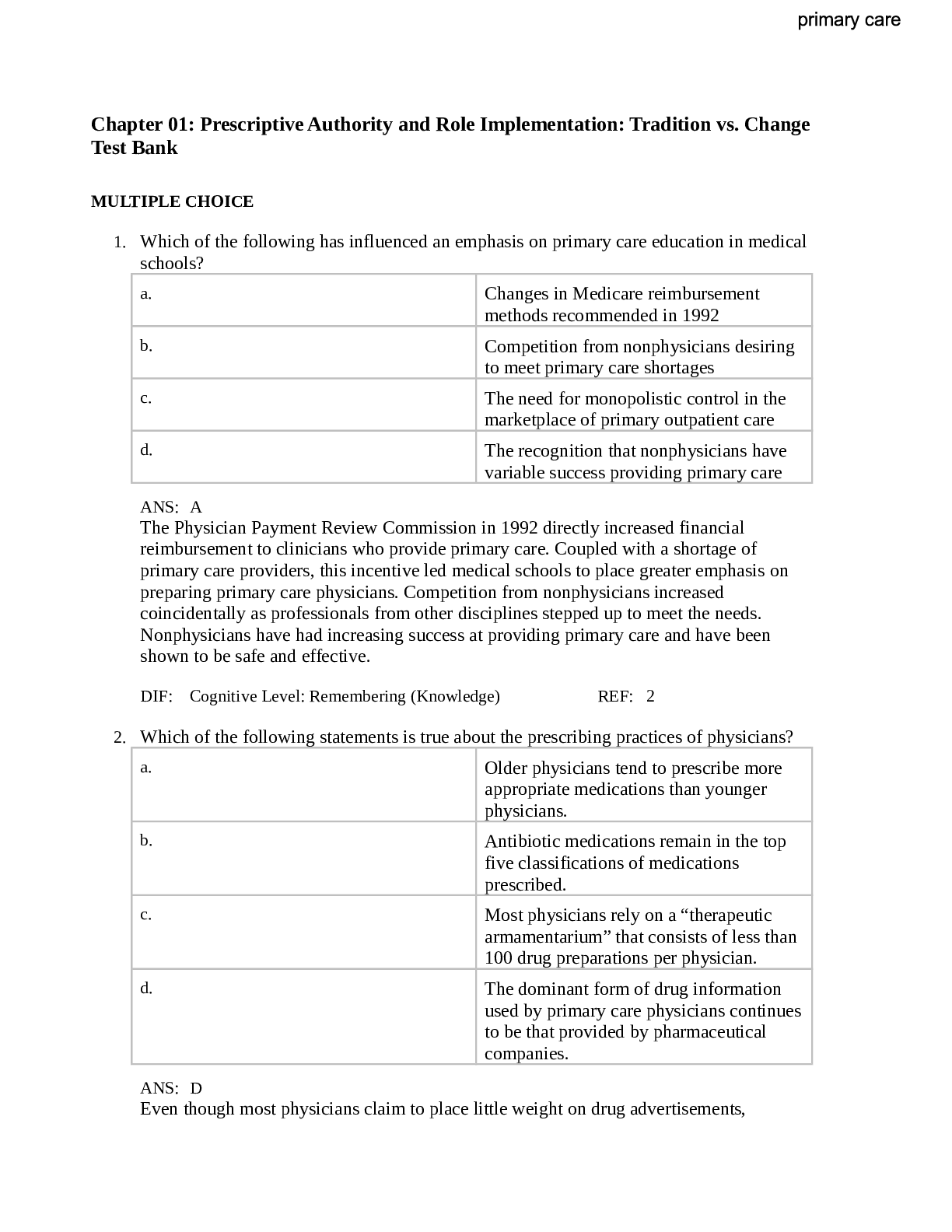

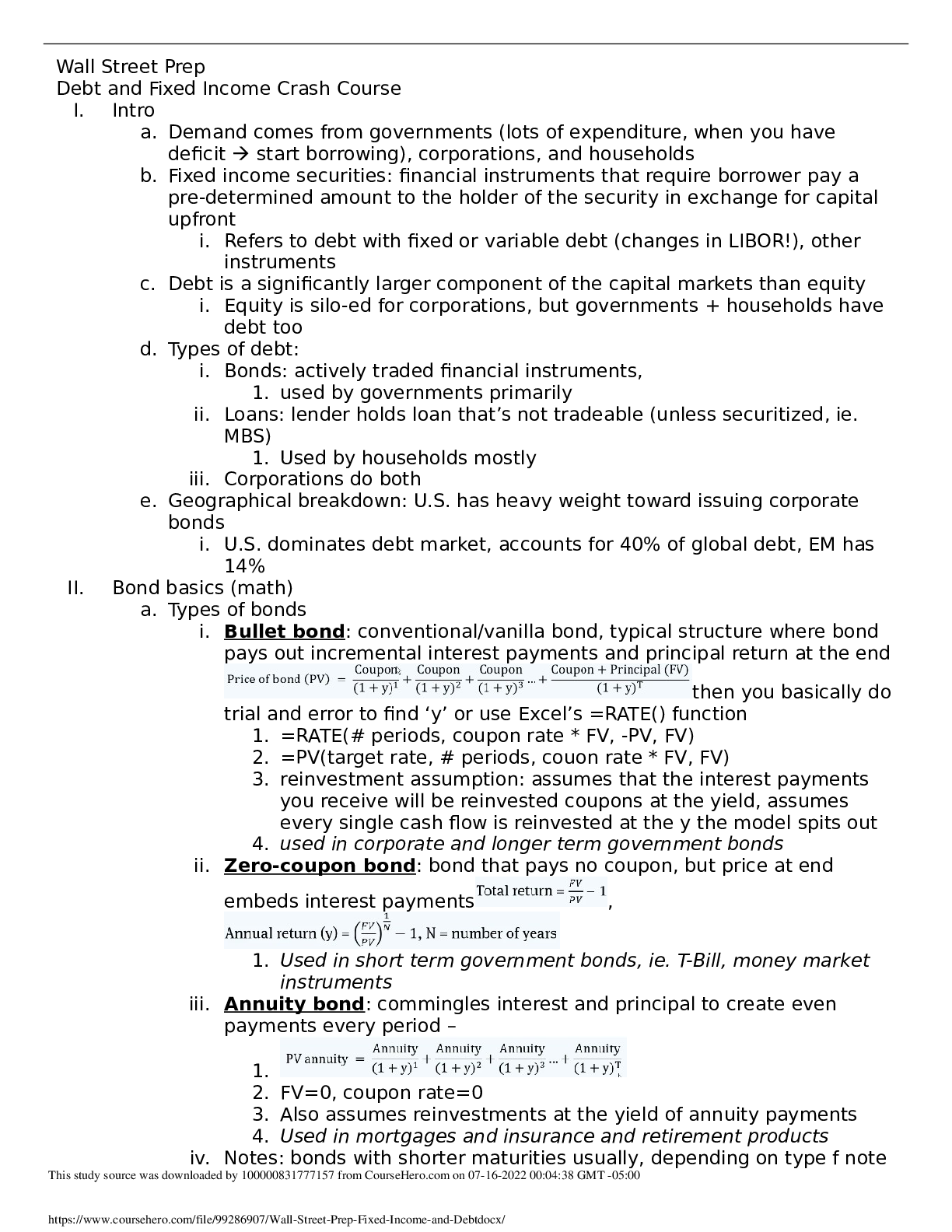

Wall Street Prep Debt and Fixed Income Crash Course I. Intro a. Demand comes from governments (lots of expenditure, when you have deficit start borrowing), corporations, and households b. Fix... ed income securities: financial instruments that require borrower pay a pre-determined amount to the holder of the security in exchange for capital upfront i. Refers to debt with fixed or variable debt (changes in LIBOR!), other instruments c. Debt is a significantly larger component of the capital markets than equity i. Equity is silo-ed for corporations, but governments + households have debt too d. Types of debt: i. Bonds: actively traded financial instruments, 1. used by governments primarily ii. Loans: lender holds loan that’s not tradeable (unless securitized, ie. MBS) 1. Used by households mostly iii. Corporations do both e. Geographical breakdown: U.S. has heavy weight toward issuing corporate bonds i. U.S. dominates debt market, accounts for 40% of global debt, EM has 14% II. Bond basics (math) a. Types of bonds i. Bullet bond: conventional/vanilla bond, typical structure where bond pays out incremental interest payments and principal return at the end then you basically do trial and error to find ‘y’ or use Excel’s =RATE() function 1. =RATE(# periods, coupon rate * FV, -PV, FV) 2. =PV(target rate, # periods, couon rate * FV, FV) 3. reinvestment assumption: assumes that the interest payments you receive will be reinvested coupons at the yield, assumes every single cash flow is reinvested at the y the model spits out 4. used in corporate and longer term government bonds ii. Zero-coupon bond: bond that pays no coupon, but price at end embeds interest payments , 1. Used in short term government bonds, ie. T-Bill, money market instruments iii. Annuity bond: commingles interest and principal to create even payments every period – 1. 2. FV=0, coupon rate=0 3. Also assumes reinvestments at the yield of annuity payments 4. Used in mortgages and insurance and retirement products iv. Notes: bonds with shorter maturities usually, depending on type f note This study source was downloaded by 100000831777157 from CourseHero.com on 07-16-2022 00:04:38 GMT -05:00 https://www.coursehero.com/file/99286907/Wall-Street-Prep-Fixed-Income-and-Debtdocx/ 1. ie. corporate bonds with 20 year can be a note, but U [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 16, 2022

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Jul 16, 2022

Downloads

0

Views

46

.png)

.png)