Finance > QUESTIONS & ANSWERS > FIN111 FINAL EXAM TEST BANK (All)

FIN111 FINAL EXAM TEST BANK

Document Content and Description Below

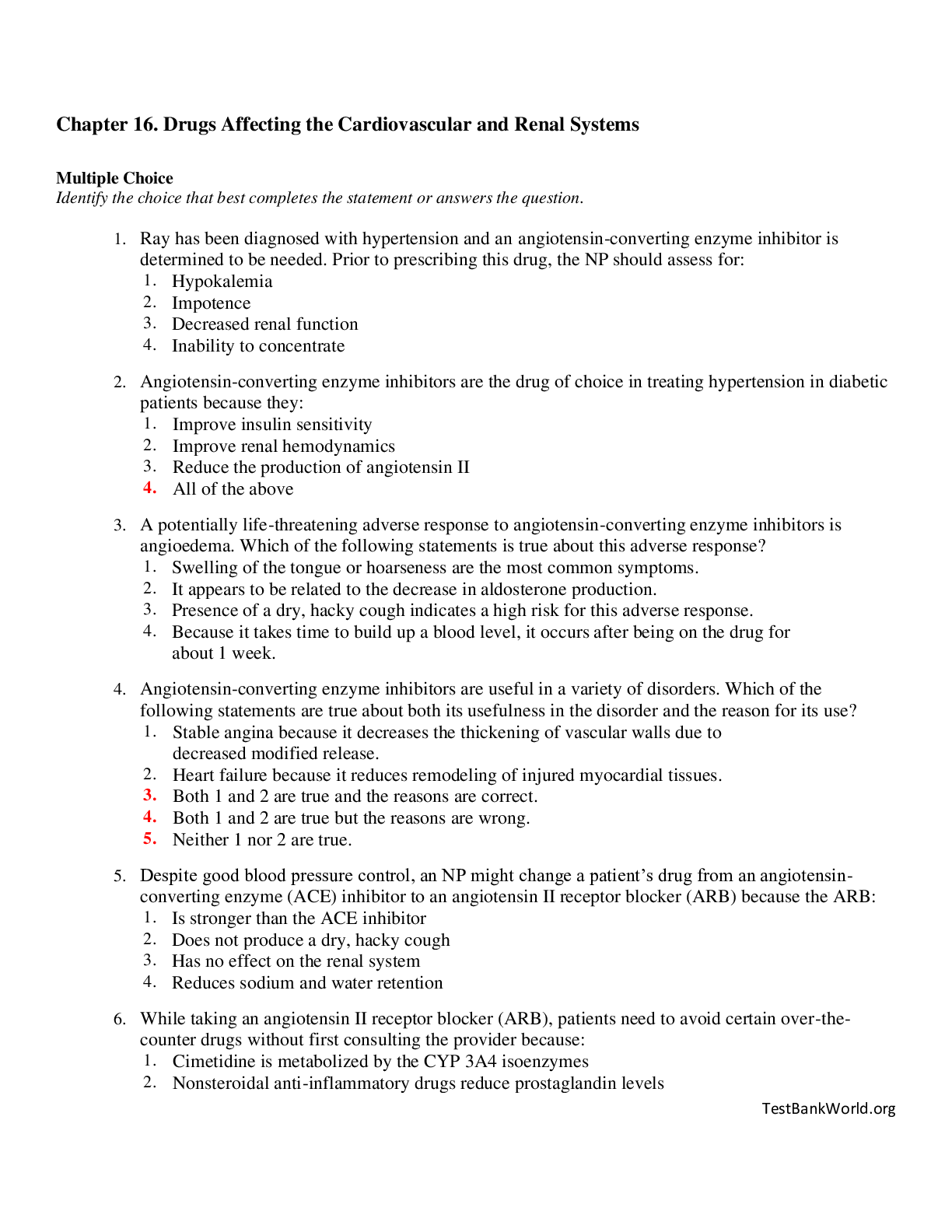

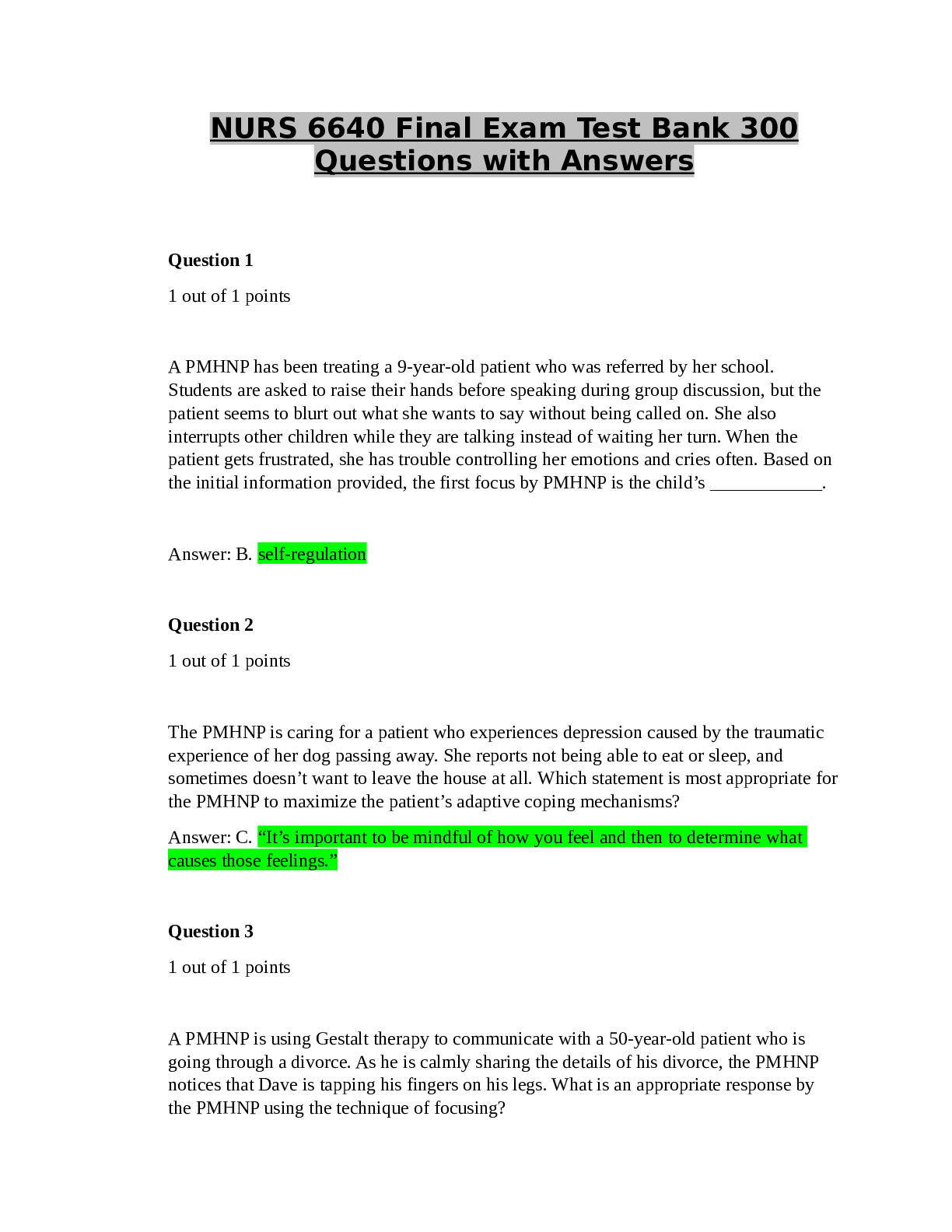

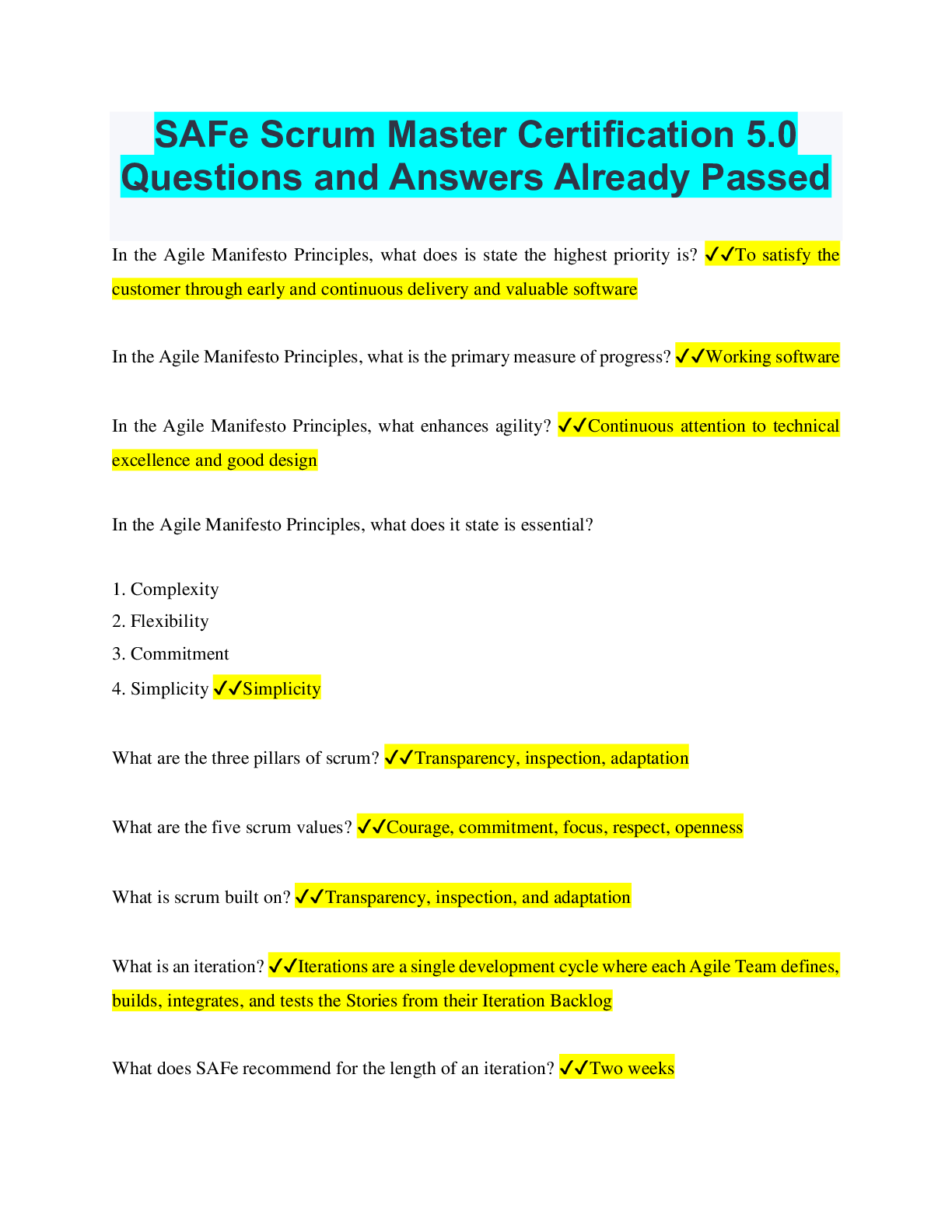

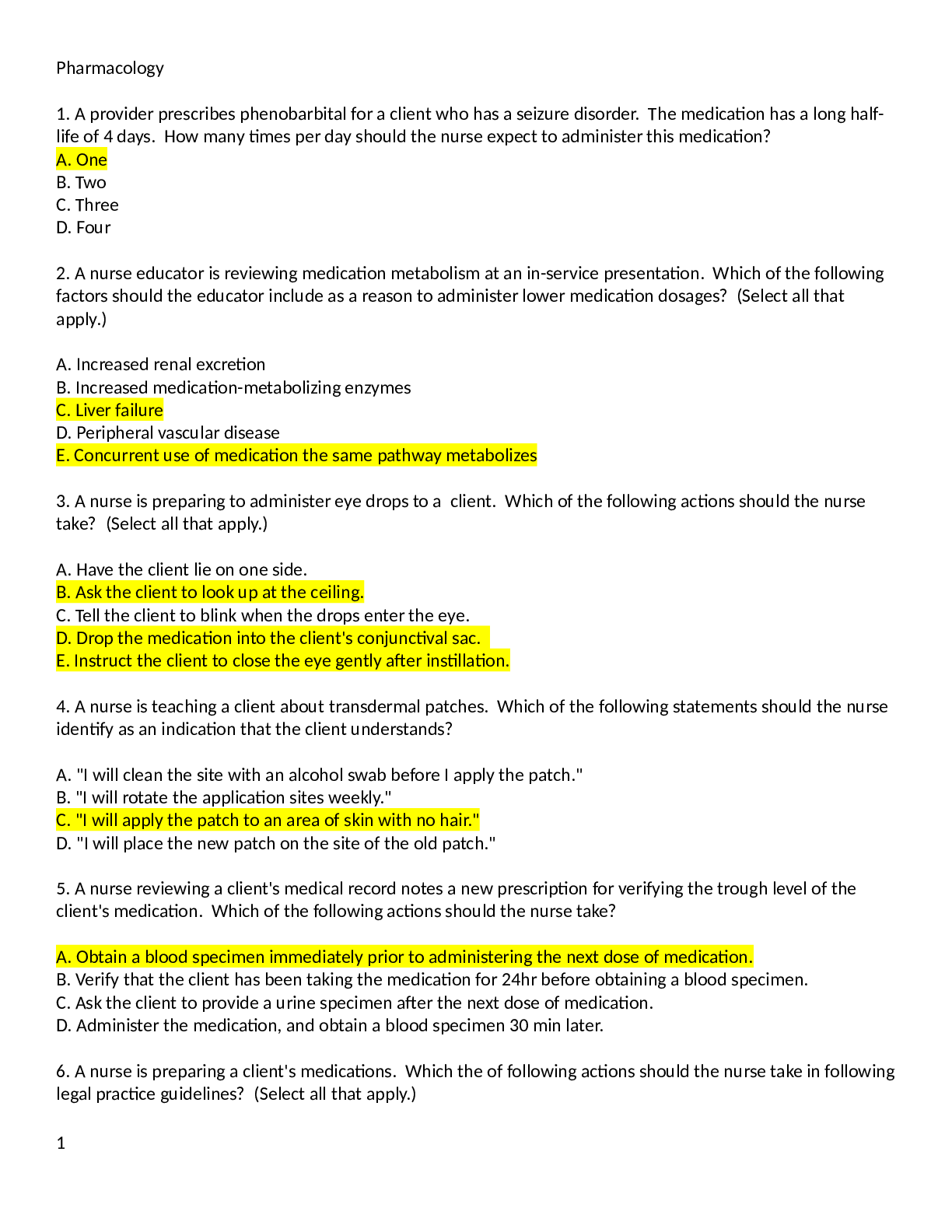

FIN111 FINAL EXAM TEST BANK 1. Which of the following financial institutions does NOT accept deposits? *a. Finance company b. Credit union c. Building company d. Commercial bank 2. Building societi... es and credit unions traditionally focus on ____________ whereas finance companies have activities in ___________. a. consumer loans; business loans b. business loans; consumer loans *c. consumer loans; consumer and business loans d. government securities; corporate bonds. Building societies provide long-term residential loans (for consumers) and credit unions provide shortterm consumer loans. Finance companies are more diversified as they offer loans to consumers and businesses. They compete with banks for business loans. 3. Which of the following statements is NOT correct? *a. Credit unions are not allowed to accept deposits from retail investors. b. Credit unions and building societies are supervised by APRA. c. Finance companies are not allowed to accept deposits. d. Finance companies are supervised by ASIC. 4. Building societies, credit unions and finance companies ___________ than banks. a. are subject to more regulation *b. are far more numerous c. are larger in scale d. are growing at a higher pace 5. The major assets of building societies are a. mortgage-backed securities. b. investment securities. *c. residential mortgages. d. cash and liquid assets. 6. Which of the following statements is NOT correct? The sale of mortgages to a third party by a building society is ___________ for the building society. a. a source of liquidity *b. a source of interest income c. an opportunity to gain noninterest income d. an opportunity to make additional mortgage loans 7. The major class of assets for building societies is a. investment securities. b. cash and liquid assets. c. retained earnings. *d. loans and advances. Retained earnings are not assets but equity. Because the traditional business of building societies are long term residential loans, loans and advances dominate the assets. 8. Traditionally building societies invest mainly in __________ and fund them with _______. a. long-term residential mortgages; investment securities *b. long-term residential mortgages; short-term consumer savings deposits c. long-term residential mortgages; commercial paper d. short-term consumer loans; commercial paper 9. Which of the following statements is NOT correct? Building societies a. have the opportunity to transform into banks. b. have merged among themselves to face increased competition. c. have decreased in number. *d. have kept the same line of products since their creation. Building societies have diversified their activities, which now include deposit accounts, credit cards, investment savings accounts, mortgages, business loans and Internet banking services. 10. Which of the following is NOT a comparative advantage of building societies over banks? a. Perceived as more customer focused. b. Better presence in small rural communities. *c. Subject to less regulation. d. Well established specialisation in residential loans. 11. When interest rates increase the building, societies record ________ in the interest costs on their short-term liabilities and ____________ in the interest income of the fixed rate longterm residential loans. a. an increase; an increase b. no change; an increase *c. an increase; no change d. a decrease; no change The short-term liabilities reprice at maturity, which happens frequently due to the short maturity, hence the increase in costs. The long-term loans with fixed interest rate cannot change interest rate until maturity. As the maturity is long, the repricing does not happen often and therefore the building society cannot benefit from an increase in interest income. 12. Which of the following statements is NOT correct? Credit unions a. are co-operatives, which are owned and operated by their members. b. are authorised deposit-taking institutions (ADIs). c. are organised as clubs whose members pool their savings and loan them to one another. *d. mainly invest in long-term residential loans. Credit unions invest in short-term consumer loans. 13. Credit unions’ assets primarily consist of a. investment securities. *b. loans to members. c. cash and liquid assets. d. property, plant and equipment. 14. Credit union capital predominantly consists of *a. retained profits. b. reserves. c. ordinary shares. d. cash and liquid assets. Credit unions are cooperatives and therefore do not issue shares to the public. The main component of capital is therefore profits, the funds generated by the net income of the company. Cash and liquid assets cannot be capital as they are assets. 15. Which of the following statements is NOT correct? Members of a credit union *a. are members of the credit union for life. b. can have access to the products offered by the credit union. c. have the right to vote. d. pay a small joining fee. 16. Which of the following statements is NOT correct? Members of a credit union a. are usually from the same profession, the same association or the same residence. b. can become directors of the credit union. *c. provide the capital required for the credit union to comply with the capital regulation. d. have one vote each irrespective of the amount of business they have with the credit union. Although credit unions are subject to the same capital regulation as banks they cannot meet the need for capital by issuing ordinary shares as they are not a public company but a cooperative. The capital is mainly generated by the profits that are retained. 17. Credit unions a. are not subject to capital regulation. b. can issue ordinary shares to meet their required capital. *c. carry more capital relative to their risk-weighted assets than banks. d. can include shareholders’ equity in the regulatory capital. 18. The CUFSS a. is the regulator of credit unions. *b. is an organisation that provides support to credit unions in financial distress. c. is the association that defends the interests of the credit unions when negotiating with the government or the regulator. d. is the registry of all members of the Australian credit unions. CUFSS stands for Credit union Financial Support Scheme. It collects contributions from credit unions and uses these resources to help the credit unions in financial difficulty. It is an insurance pool. 19. Which of the following statements is NOT correct? a. Credit unions are supervised by APRA. b. To use the services of a credit union a customer must be a member. *c. Credit unions are not subject to capital regulation. d. The total value of assets in credit unions in Australia is increasing. Like any other ADI, credit unions are supervised by APRA. Membership is compulsory for doing business with a credit union due to its status of cooperative. Not only credit unions are subject to the same capital regulation as any other ADIs but credit unions voluntarily carry more capital relative to their risk-weighted assets than banks. 20. Finance companies are NOT ADIs in that *a. they do not accept deposits from the public to obtain funds. b. they are not supervised by APRA. c. they make loans to consumers and businesses. d. they carry shareholders’ equity. ADI stands for authorized deposit taking institutions. Finance companies do not take deposits and therefore are NOT ADIs. Credit unions and building companies are not banks but nevertheless are ADIs. 21. Finance companies obtain most of their funds in large amounts by a. collecting many small deposits. b. issuing shares. *c. borrowing from banks or issuing securities in the markets. d. all of the above [Show More]

Last updated: 1 year ago

Preview 1 out of 61 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 18, 2022

Number of pages

61

Written in

Additional information

This document has been written for:

Uploaded

Jul 18, 2022

Downloads

0

Views

171

.png)