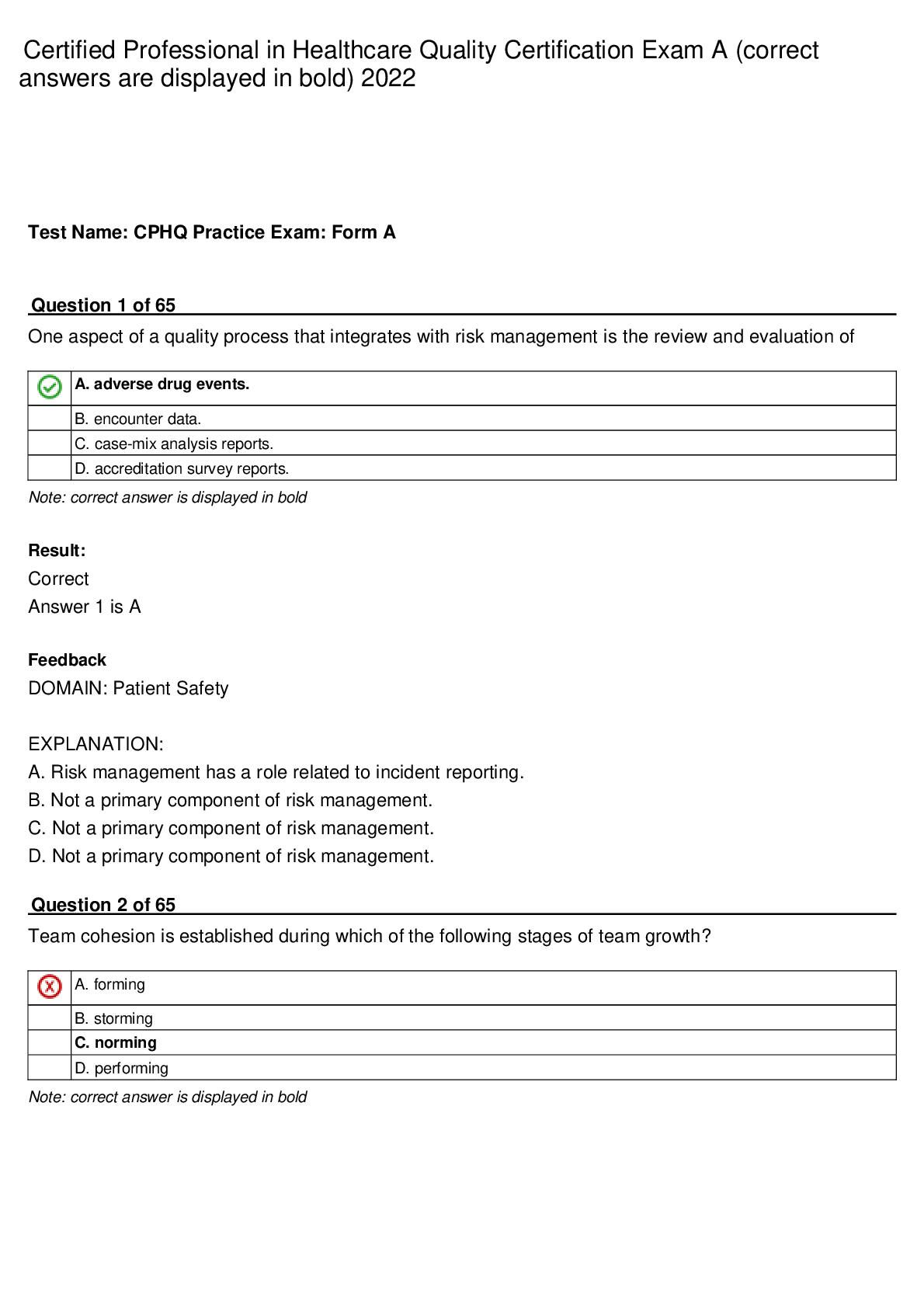

Financial Accounting > QUESTIONS & ANSWERS > University of Phoenix ACC 548 Final Exam Answers(Score An A) (All)

University of Phoenix ACC 548 Final Exam Answers(Score An A)

Document Content and Description Below

1. Which of the following is not a procedure performed primarily for the purpose of expressing an opinion on the financial statements, but may bring possible illegal acts to the auditor’s attenti... on? A. Study and evaluation of internal accounting control B. Review of internal administrative control C. Tests of transactions D. Tests of balances 2. An auditor is testing sales transactions. One step is to trace a sample of debit entire from the accounts receivable subsidiary ledger back to the supporting sales invoices. What would be auditor intend to establish by this step? A. Sales invoices represent bona fide sales B. All sales have been recorded C. All sales invoices have been properly posted to customer accounts. D. Debit entries in the accounts receivable subsidiary ledger are properly supported by sales. 3. Which of the following would detect an understatement of a purchase discount? A. Verify footings and cross footings of purchases and disbursement records. B. Compare purchase invoice terms with disbursement records and checks C. Compare approved purchase orders to receiving report D. Verify the receipts of items ordered and invoiced 4. Audit evidence can come in different forms with different degrees of persuasiveness. Which of the following is the least persuasive type of evidence? A. Documents mailed by outsiders to the auditor B. Correspondence between auditor and vendors C. Sales invoices inspected by the auditor D. Computations made by the auditor 5. Which of the following best describes the independent auditor’s approach to obtaining satisfaction concerning depreciation expense in the income statement? Verify the mathematical accuracy of the amounts charged to income as a result of depreciation expense. A. Determine the method for computing depreciation expense and ascertain that it is in accordance with generally accepted accounting principles B. Reconcile the amount of depreciation expense to those amounts credited to accumulated depreciation accounts. C. Establish the basis for depreciable assets and verify the depreciation expense 6. Which of the following is not a factor affecting the independent auditor’s judgement as to the quantity, type, and content of audit working papers? A. The needs in the particular circumstances for supervision and review of the work performed by any assistants. B. The nature and condition of the client’s records and internal controls. C. The expertise of client personnel and their expected audit participation. D. The type of the financial statement s, schedules, or other information upon which the auditor is reporting. 7. Which of the following is not a principal objective of the auditor in the examination of revenues? https://www.coursAeh.ero.Tcoomv/efirliefy/7c5a5s1h52d1e1p/PoRsEitFeIdNdAuLri-nQg3pthdef/ year. B. To study and evaluate internal control, with particular emphasis on the use of accrual accounting to record revenue. C. To verify that earned revenue has been recorded, and recorded revenue has been earned. D. To identify and interpret significant trends and variations in the amounts of various categories of revenue. 8. Confirmation of individual accounts receivable balances directly with debtors will, of itself, normally provide evidence concerning the A. Collectibility of the balances confirmed B. Ownership of the balances confirmed C. Validity of the balances confirmed D. Internal control over balances confirmed 9. In connection with the audit of a current issue of long-term bonds payable, the auditors should A. Determine whether bondholders are persons other than owners, directors, or officers of the company issuing the bond. B. Calculate the effective interest rate to see if it is substantially the same as the rates for similar issues. C. Decide whether the bond issue was made without violating the law. D. Ascertain that the client has obtained the opinion of counsel on the legality of the issue. 10. The auditor can best verify a client’s bond sinking fund transactions and year-end balance by A. Recomputation of interest expense, interest payable, and amortization of bond discount or premium. B. Confirmation with individual holders of retired bonds. C. Confirmation with the bond trustee. D. Examination and count of the bonds retired during the year. 11. Which of the following is the best audit procedure for determining the existence of unrecorded liabilities? A. Examine confirmation requests returned by creditors whose accounts appear on a subsidiary trial balance of accounts payable. B. Examine a sample of cash disbursements in the period subsequent to year end. C. Examine a sample of invoices a few days prior to and subsequent to year end to ascertain whether they have been properly recorded. D. Examine unusual relationships between monthly accounts payable balances and recorded purchases. 12. Which of the following is the most important consideration of an auditor when examining the stockholder’s equity section of a client’s balance sheet? A. Changes in the capital stock account are verified by an independent stock transfer agent. B. Stock dividends and/or stock splits during the year under audit were approved by the stockholders. C. Stock dividends are capitalized at par or stated value on the dividend declaration date. D. Entries in the capital stock account can be traced to a resolution in the minutes of the board of directors’ meetings. 13. Which of the following best explains why accounts payable confirmation procedures are not always used? A. Inclusion of accounts payable balances on the liability certificate completed by the client allows the auditor to refrain from using confirmation procedures. B. Accounts payable generally are insignificant and can be audited by utilizing analytic review procedures. C. The auditor may feel certain that the creditors will press for payment. D. Reliable externally generated evidence supporting accounts payable balances is generally available for audit inspection on the client’s premises [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 07, 2020

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Dec 07, 2020

Downloads

0

Views

98

(1).png)