Financial Accounting > QUESTIONS & ANSWERS > ACCT 201A Exam II Review KEY with CORRECT ANSWERS (All)

ACCT 201A Exam II Review KEY with CORRECT ANSWERS

Document Content and Description Below

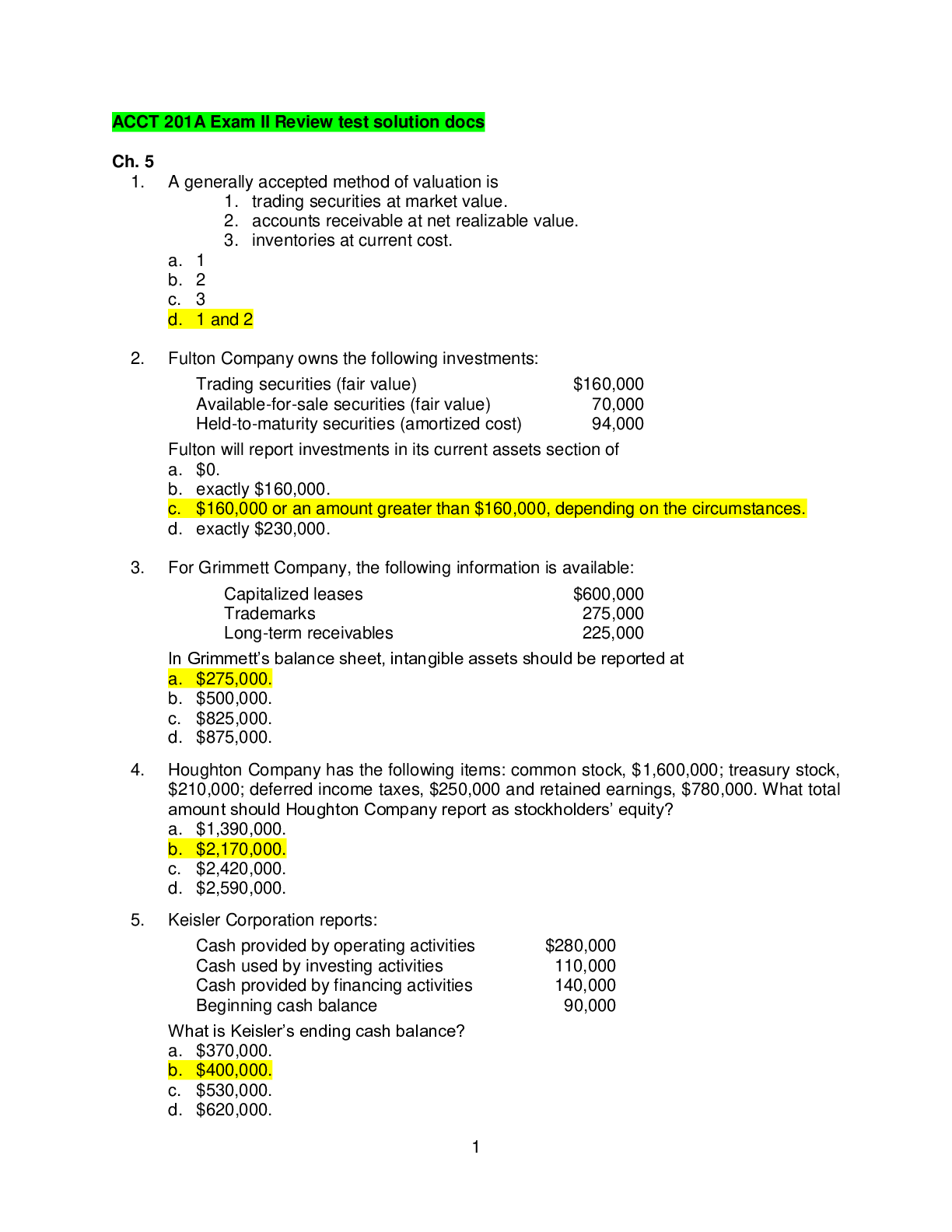

ACCT 201A Exam II Review KEY Ch. 5 1. A generally accepted method of valuation is 1. trading securities at market value. 2. accounts receivable at net realizable value. 3. inventories at current ... cost. a. 1 b. 2 c. 3 d. 1 and 2 Ans: D, LO: 2, Bloom: K, Difficulty: Moderate, Min: 2, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None 2. Fulton Company owns the following investments: Trading securities (fair value) $160,000 Available-for-sale securities (fair value) 70,000 Held-to-maturity securities (amortized cost) 94,000 Fulton will report investments in its current assets section of a. $0. b. exactly $160,000. c. $160,000 or an amount greater than $160,000, depending on the circumstances. d. exactly $230,000. Ans: C, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None 3. For Grimmett Company, the following information is available: Capitalized leases $600,000 Trademarks 275,000 Long-term receivables 225,000 In Grimmett’s balance sheet, intangible assets should be reported at a. $275,000. b. $500,000. c. $825,000. d. $875,000. Ans: A, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None 1 4. Houghton Company has the following items: common stock, $1,600,000; treasury stock, $210,000; deferred income taxes, $250,000 and retained earnings, $780,000. What total amount should Houghton Company report as stockholders’ equity? a. $1,390,000. b. $2,170,000. c. $2,420,000. d. $2,590,000. Ans: B, LO: 2, Bloom: AP, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None $1,600,000 – $210,000 + $780,000 = $2,170,000. 5. Keisler Corporation reports: Cash provided by operating activities $280,000 Cash used by investing activities 110,000 Cash provided by financing activities 140,000 Beginning cash balance 90,000 What is Keisler’s ending cash balance? a. $370,000. b. $400,000. c. $530,000. d. $620,000. Ans: B, LO: 4, Bloom: AP, Difficulty: Easy, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None $90,000 + $280,000 – $110,000 + $140,000 = $400,000. 6. During 2017 the DLD Company had a net income of $85,000. In addition, selectedaccounts showed the following changes: Accounts Receivable $3,000 increase Accounts Payable 1,000 increase Buildings 4,000 decrease Depreciation Expense 1,500 increase Bonds Payable 8,000 increase What was the amount of cash provided by operating activities? a. $84,500 b. $85,000 c. $86,500 d. $94,500 Ans: A, LO: 4, Bloom: AP, Difficulty: Moderate, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None $85,000 – $3,000 + $1,000 + $1,500 = $84,500. 2 7. Harding Corporation reports the following information: Net income $530,000 Depreciation expense 140,000 Increase in accounts receivable 60,000 Harding should report cash provided by operating activities of a. $330,000. b. $450,000. c. $610,000. d. $730,000. Ans: C, LO: 5, Bloom: AP, Difficulty: Moderate, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Prob. Solving, IMA: Reporting, IFRS: None $530,000 + $140,000 – $60,000 = $610,000. 8. Packard Corporation reports the following information: Net cash provided by operating activities $335,000 Average current liabilities 150,000 Average long-term liabilities 100,000 Dividends declared 60,000 Capital expenditures 110,000 Payments of debt 35,000 Packard’s cash deb [Show More]

Last updated: 1 year ago

Preview 1 out of 47 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 04, 2022

Number of pages

47

Written in

Additional information

This document has been written for:

Uploaded

Sep 04, 2022

Downloads

0

Views

70

.png)