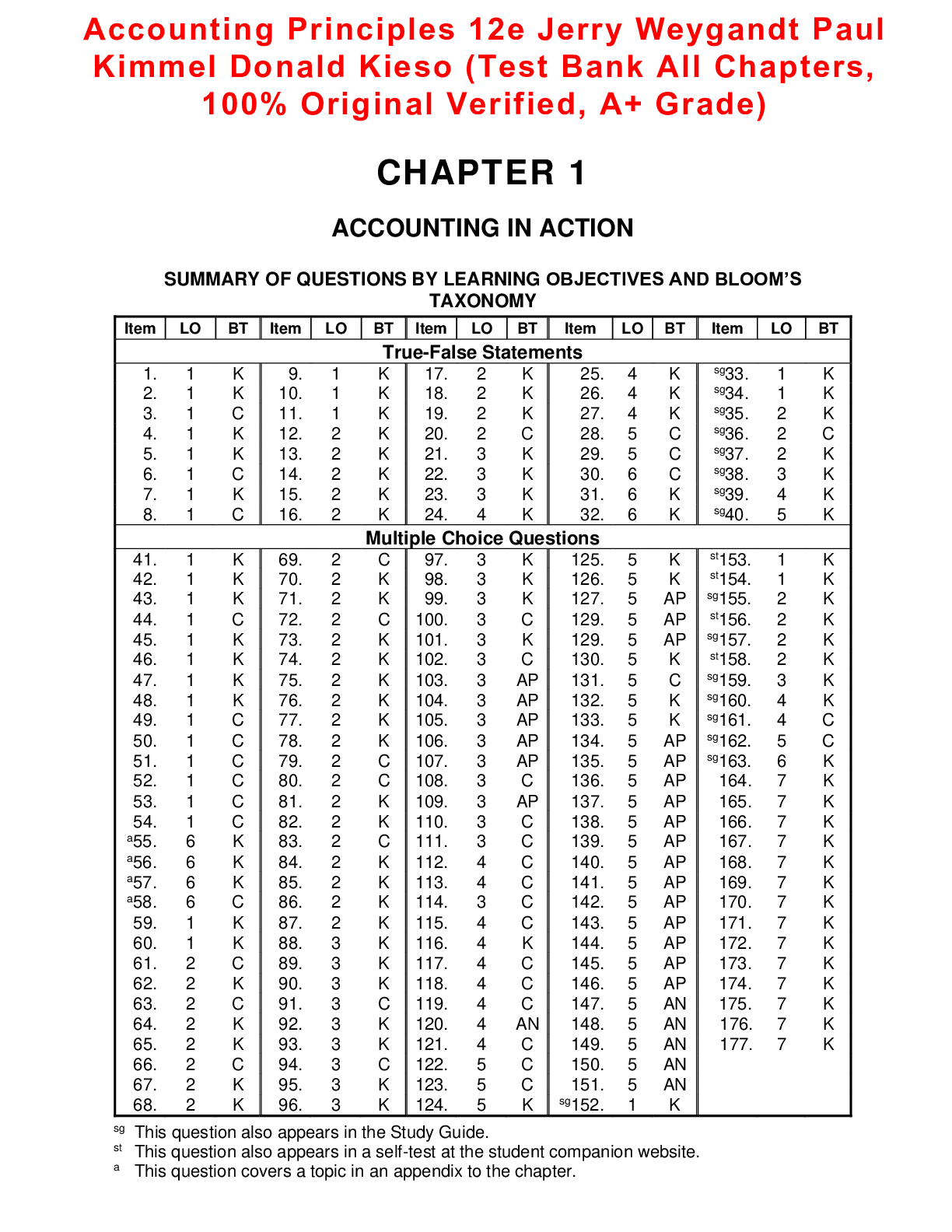

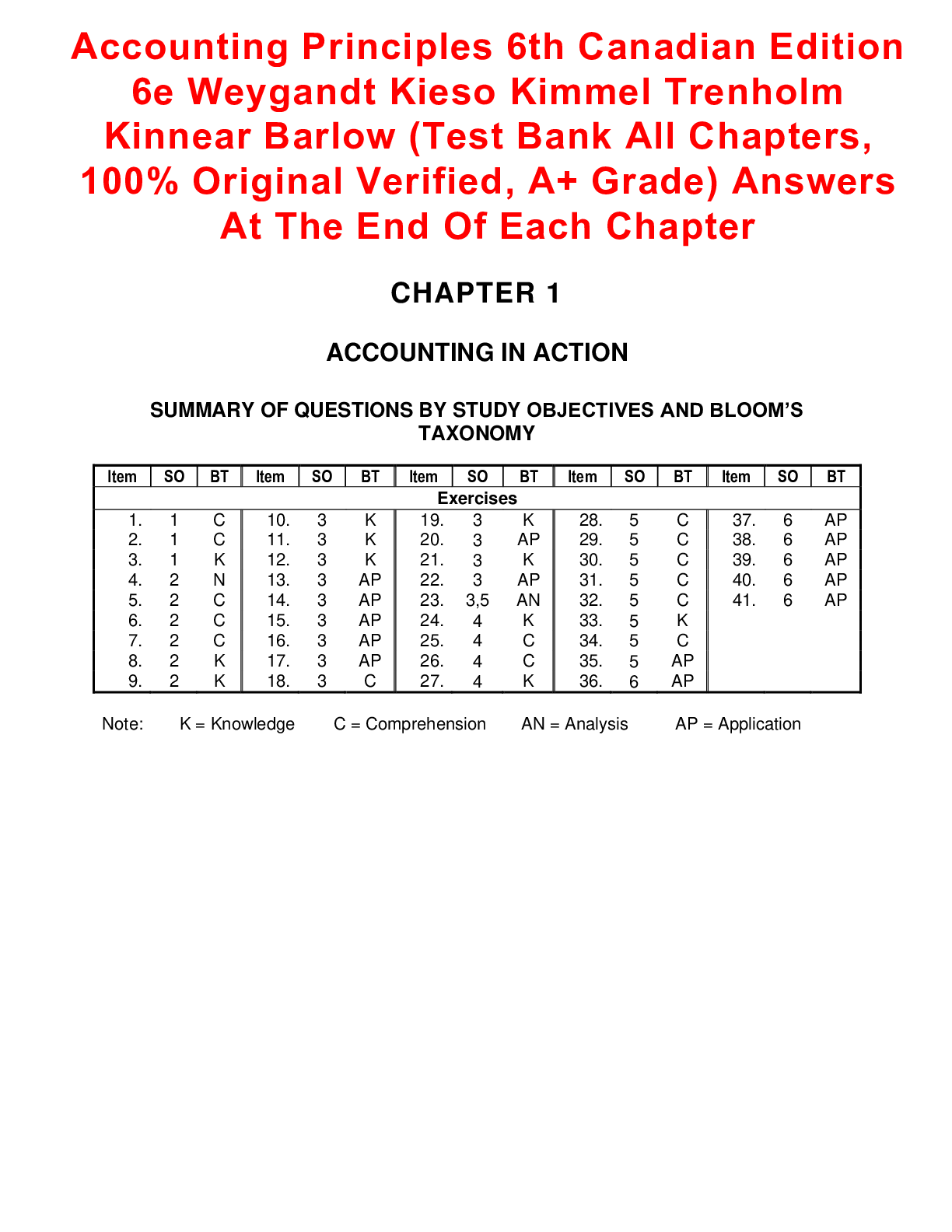

Financial Accounting > TEST BANK > CHAPTER 10 PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS: Test Bank for Accounting Princip (All)

CHAPTER 10 PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS: Test Bank for Accounting Principles, Eleventh Edition: This document/TEST BANK Contains 313 Questions With Answers, Worked Solutions and Essay Explanations.

Document Content and Description Below