Finance > QUESTIONS & ANSWERS > CFA 51: FIXED INCOME SECURITIES: DEFINING ELEMENTS WITH CORRECT ANSWERS (All)

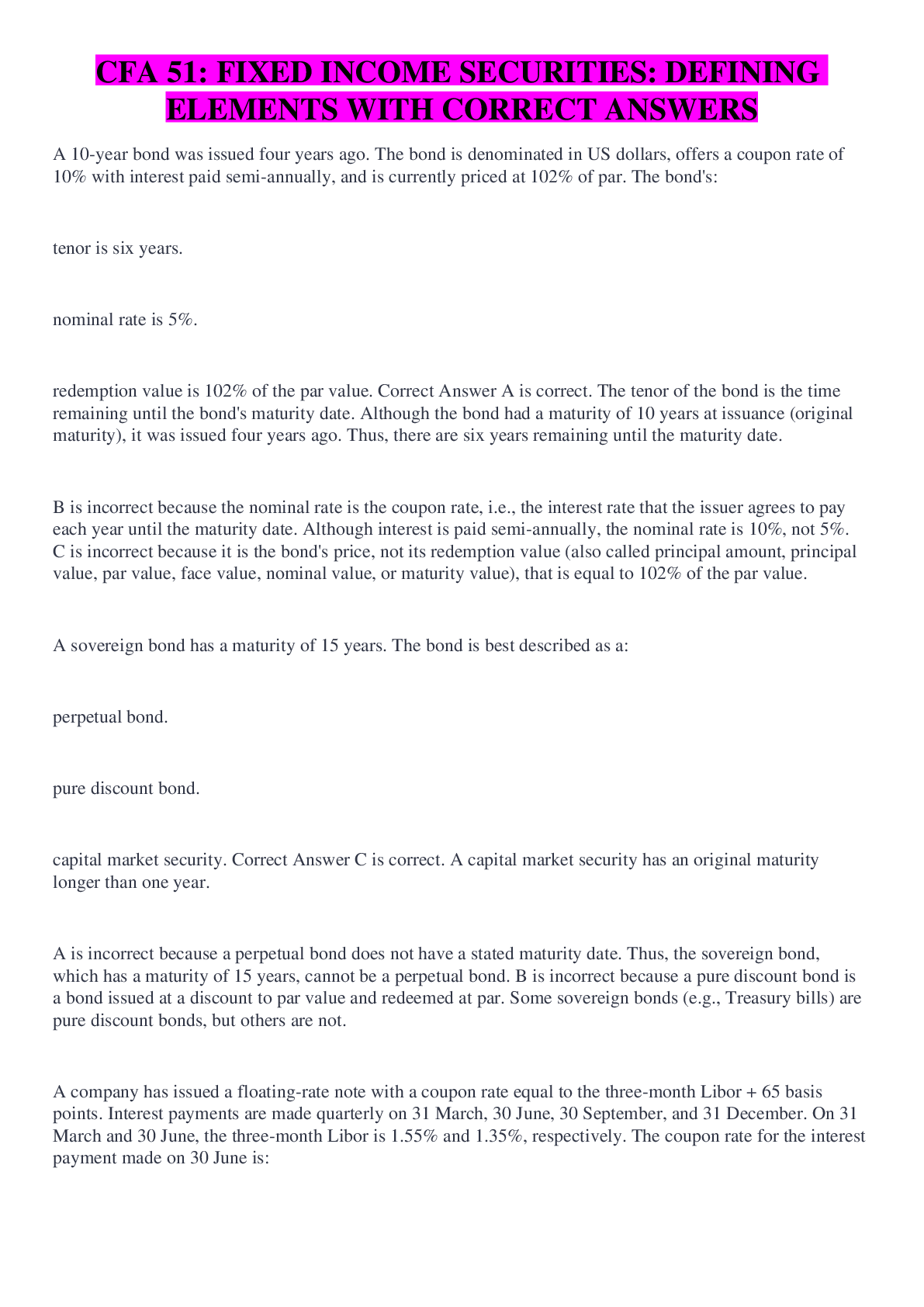

CFA 51: FIXED INCOME SECURITIES: DEFINING ELEMENTS WITH CORRECT ANSWERS

Document Content and Description Below

A 10-year bond was issued four years ago. The bond is denominated in US dollars, offers a coupon rate of 10% with interest paid semi-annually, and is currently priced at 102% of par. The bond's: te... nor is six years. nominal rate is 5%. redemption value is 102% of the par value. Correct Answer A is correct. The tenor of the bond is the time remaining until the bond's maturity date. Although the bond had a maturity of 10 years at issuance (original maturity), it was issued four years ago. Thus, there are six years remaining until the maturity date. B is incorrect because the nominal rate is the coupon rate, i.e., the interest rate that the issuer agrees to pay each year until the maturity date. Although interest is paid semi-annually, the nominal rate is 10%, not 5%. C is incorrect because it is the bond's price, not its redemption value (also called principal amount, principal value, par value, face value, nominal value, or maturity value), that is equal to 102% of the par value. A sovereign bond has a maturity of 15 years. The bond is best described as a: perpetual bond. pure discount bond. capital market security. Correct Answer C is correct. A capital market security has an original maturity longer than one year. A is incorrect because a perpetual bond does not have a stated maturity date. Thus, the sovereign bond, which has a maturity of 15 years, cannot be a perpetual bond. B is incorrect because a pure discount bond is a bond issued at a discount to par value and redeemed at par. Some sovereign bonds (e.g., Treasury bills) are pure discount bonds, but others are not. A company has issued a floating-rate note with a coupon rate equal to the three-month Libor + 65 basis points. Interest payments are made quarterly on 31 March, 30 June, 30 September, and 31 December. On 31 March and 30 June, the three-month Libor is 1.55% and 1.35%, respectively. The coupon rate for the interest payment made on 30 June is: 2.00%. [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$11.00

Document information

Connected school, study & course

About the document

Uploaded On

Nov 30, 2022

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Nov 30, 2022

Downloads

0

Views

37