Financial Accounting > TEST BANK > South-Western Federal Taxation 2022, Corporations, Partnerships, Estates and Trusts, 45th Edition by (All)

South-Western Federal Taxation 2022, Corporations, Partnerships, Estates and Trusts, 45th Edition by Raabe Test Bank

Document Content and Description Below

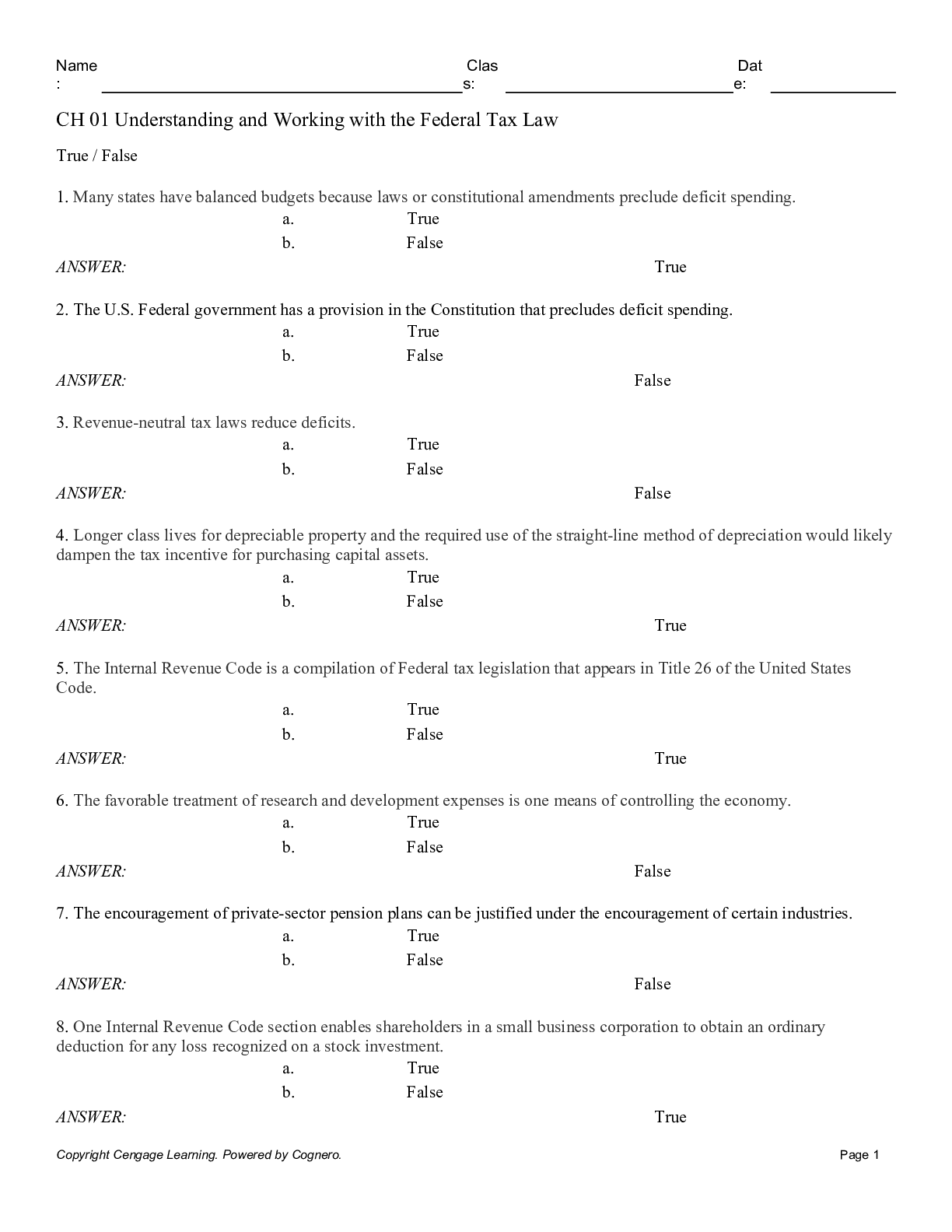

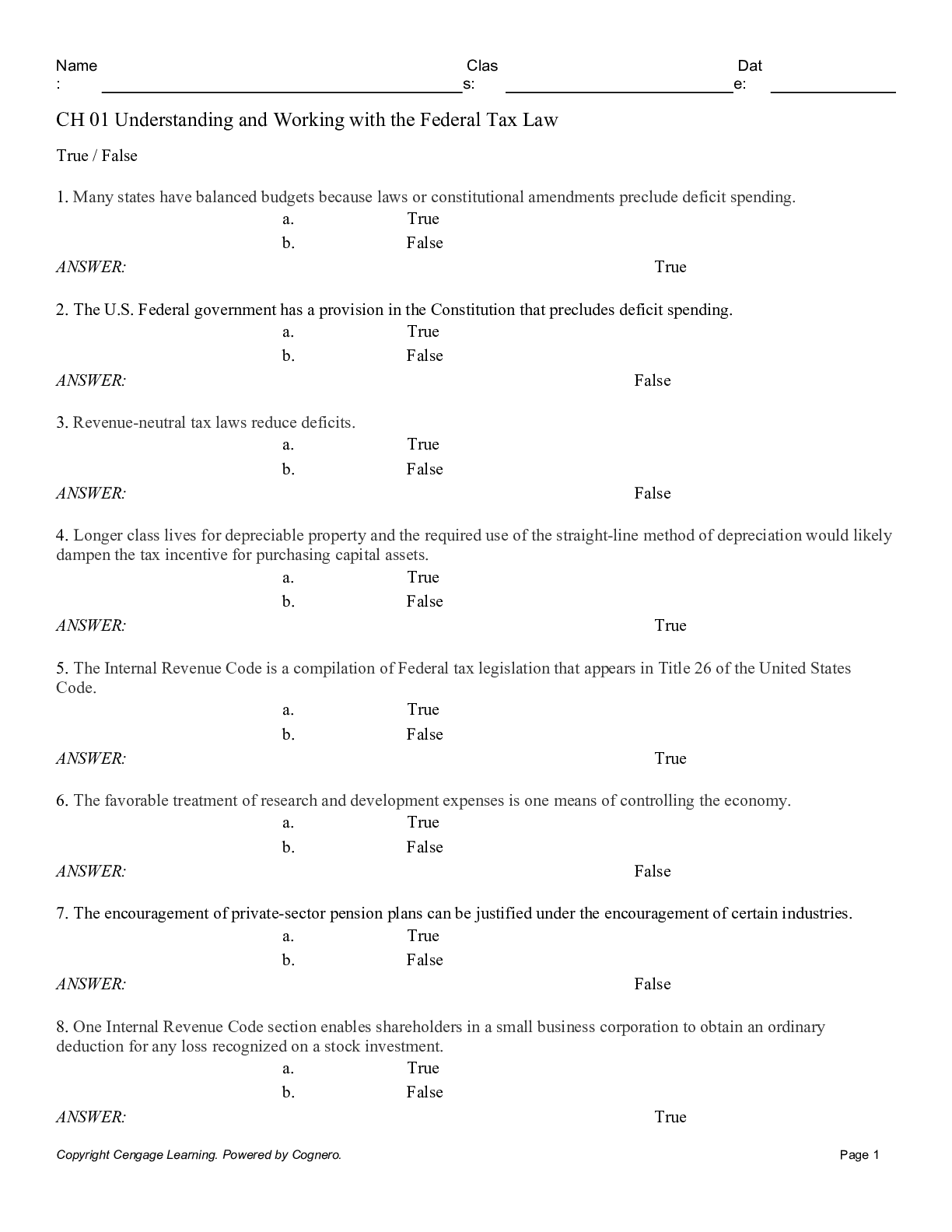

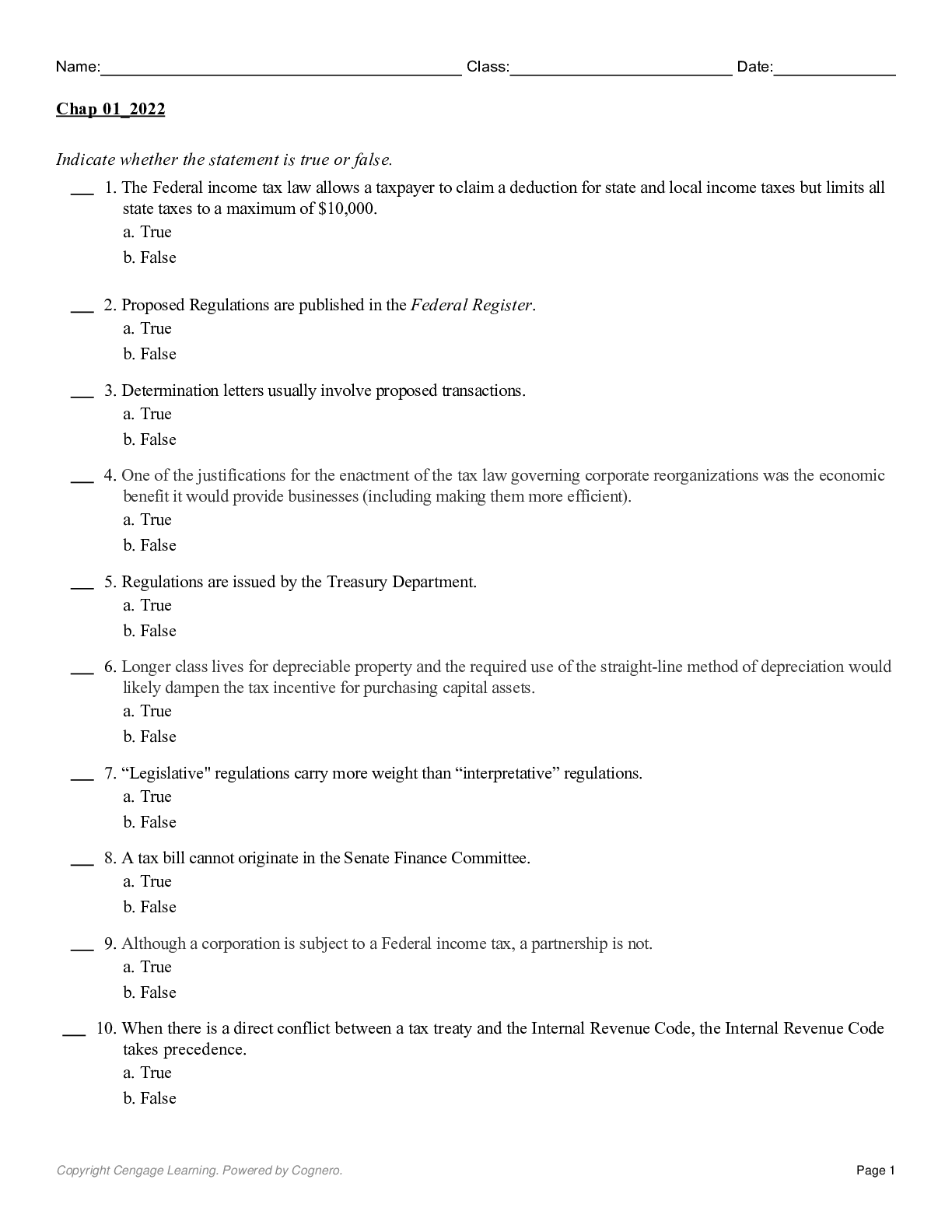

Test Bank for South-Western Federal Taxation 2022, Corporations, Partnerships, Estates and Trusts, 45th Edition, 45e by William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman, Jr. TEST B... ANK ISBN-13: 9780357519417 FULL CHAPTERS INCLUDED Part 1: Introduction to Taxation and Business Entities Chapter 1: Understanding and Working with the Federal Tax Law The Big Picture: Importance of Tax Research 1-1: The Whys of the Tax Law 1-2: Summary 1-3: Reconciling Accounting Concepts 1-4: Working with the Tax Law-Tax Sources 1-5: Working with the Tax Law-Locating and Using Tax Sources 1-6: Working with the Tax Law-Tax Research 1-7: Working with the Tax Law-Tax Planning 1-8: Taxation on the CPA Examination Chapter 2: the Deduction for Qualified Business Income for Noncorporate Taxpayers The Big Picture: Entrepreneurial Pursuits 2-1: Tax Treatment of Various Business Forms 2-2: The Tax Cuts and Jobs Act (TCJA) of 2017 and Entity Tax Rates 2-3: The Deduction for Qualified Business Income 2-4: Tax Planning Refocus on the Big Picture: Entrepreneurial Pursuits Part 2: Corporations Chapter 3: Corporations: Introduction and Operating Rules The Big Picture: a Half-Baked Idea? 3-1: An Introduction to the Income Taxation of Corporations 3-2: Determining the Corporate Income Tax liability 3-3: Procedural Matters 3-4: Tax Planning Refocus on the Big Picture: Cooked to Perfection Chapter 4: Corporations: Organization and Capital Structure The Big Picture: the Vehicle for Business Growth Is the Corporate Form 4-1: Organization of and Transfers to controlled Corporations 4-2: Capital Structure of a Corporation 4-3: Investor Losses 4-4: Gain from Qualified Small Business Stock 4-5: Tax Planning Refocus on the Big Picture: The Vehicle for Business Growth Is the Corporate Form Chapter 5: Corporations: Earnings & Profits and Dividend Distributions The Big Picture: Taxing Corporate Distributions 5-1: Corporate Distributions-Overview 5-2: Earnings and Profits (E & P)-§ 312 5-3: Dividends 5-4: Tax Planning Refocus on the Big Picture: Taxing Corporate Distributions Chapter 6: Corporations: Redemptions and Liquidations The Big Picture: Family Corporations and Stock Redemptions 6-1: Stock Redemptions-In General 6-2: Stock Redemptions-Sale or Exchange Treatment 6-3: Stock Redemptions-Effect on the Corporation 6-4: Stock Redemptions-Preferred Stock Bailouts 6-5: Liquidations-In General 6-6: Liquidations-Effect on the Distributing corporation 6-7: Liquidations-Effect on the Shareholder 6-8: Liquidations-Parent-Subsidiary Situations 6-9: Tax Planning Refocus on the Big Picture: A Family Attribution Waive Is a Valuable Tool in Succession Planning Chapter 7: Corporations: Reorganizations The Big Picture: Structuring Acquisitions 7-1: Corporate Reorganizations 7-2: Types of Tax-Free Reorganizations 7-3: Judicial Doctrines 7-4: Tax Attribute Carryovers 7-5: Tax Planning Refocus on the Big Picture: Structuring Acquisitions Chapter 8: Consolidated Tax Returns The Big Picture: a Corporation Contemplates a Merger 8-1: The Consolidated Return Rules 8-2: Assessing Consolidated Return Status 8-3: Electing Consolidated Return Status 8-4: Stock Basis of Subsidiary 8-5: Consolidated Taxable Income 8-6: Tax Planning Refocus on the Big Picture: Should the Affiliated Group File a Consolidated Return? Chapter 9: Taxation of International Transactions The Big Picture: Going International 9-1: Overview of International Taxation 9-2: Tax Treaties 9-3: Sourcing of Income and Deductions 9-4: Foreign Currency Gain/Loss 9-5: U.S. Persons with Offshore Income 9-6: U.S. Taxation of Nonresident Aliens and Foreign Corporations 9-7: Reporting Requirements 9-8: Tax Planning Refocus on the Big Picture: Going International Part 3: Flow-Through Entities Chapter 10: Partnerships: Formation, Operation, and Basis The Big Picture: Why Use a Partnership, Anyway? 10-1: Overview of Partnership Taxation 10-2: Formation of a Partnership: Tax Effects 10-3: Partnership Operations and Reporting 10-4: Partner Calculations and Reporting 10-5: Other Taxes on Partnership Income 10-6: Tax Planning Refocus on the Big Picture: Why Use a Partnership, Anyway? Chapter 11: Partnerships: Distributions, Transfer of Interests, and Terminations The Big Picture: the Life Cycle of a Partnership 11-1: Distributions from a Partnership 11-2: Section 736-Liquidating Distributions to Retiring or Deceased Partners 11-3: Sale of a Partnership Interest 11-4: Other Dispositions of Partnership Interests 11-5: Section 754-Optional Adjustments to Property Basis 11-6: Other Issues 11-7: Tax Planning Refocus on the Big Picture: The Life Cycle of a Partnership Chapter 12: S Corporations The Big Picture: Deductibility of Losses and the Choice of Business Entity 12-1: Choice of Business Entity 12-2: Qualifying for S Corporation Status 12-3: Operational Rules 12-4: Tax Planning Refocus on the Big Picture: Using a Pass-Through Entity to Achieve Deductibility of Losses Part 4: Advanced Tax Practice Considerations Chapter 13: Comparative Forms of Doing Business The Big Picture: Selection of a Tax Entity Form 13-1: Forms of Doing Business 13-2: Nontax Factors 13-3: Single Versus Double Taxation 13-4: Controlling the Entity Tax 13-5: Conduit Versus Entity Treatment 13-6: FICA, Self-Employment Taxes, and NIIT 13-7: Disposition of a Business or an Ownership Interest 13-8: Converting to Other Entity Types 13-9: Overall Comparison of Forms of Doing business 13-10: Tax Planning Refocus on the Big Picture: Selection of a Tax Entity Form Chapter 14: Taxes in the Financial Statements The Big Picture: Taxes in the Financial Statements 14-1: Accounting for Income Taxes-Basic Principles 14-2: Capturing, Measuring, and Recording Tax Expense-The Provision Process 14-3: Tax Disclosures in the Financial Statements 14-4: Special Issues 14-5: Benchmarking 14-6: Tax Planning Refocus on the Big Picture: Taxes in the Financial Statements Chapter 15: Exempt Entities The Big Picture: Effect of a For-Profit Business on a Tax-Exempt Entity 15-1: Types of Exempt Organizations 15-2: Characteristics of Exempt Entities 15-3: Taxes on Exempt Entities 15-4: Private Foundations 15-5: Unrelated Business Income Tax 15-6: Reporting Requirements 15-7: Tax Planning Refocus on the Big Picture: Effect of a For-Profit Business on a Tax-Exempt Entity Chapter 16: Multistate Corporate Taxation The Big Picture: Making a Multistate Location Decision 16-1: Corporate State Income Taxation 16-2: Apportionment and Allocation of Income 16-3: The Unitary Theory 16-4: Taxation of S Corporations 16-5: Taxation of Partnerships and LLCs 16-6: Other State and Local Taxes 16-7: Tax Planning Refocus on the Big Picture: Making a Multistate Location Decision Chapter 17: Tax Practice and Ethics The Big Picture: a Tax Adviser’s Dilemma 17-1: Tax Administration 17-2: The Tax Profession and Tax Ethics 17-3: Tax Planning Refocus on the Big Picture: A Tax Adviser’s Dilemma Part 5: Family Tax Planning Chapter 18: the Federal Gift and Estate Taxes The Big Picture: an Eventful and Final Year 18-1: Transfer Taxes-In General 18-2: The Federal Gift Tax 18-3: The Federal Estate Tax 18-4: The Generation-Skipping Transfer Tax 18-5: Tax Planning Refocus on the Big Picture: An Eventful and Final Year Chapter 19: Family Tax Planning The Big Picture: Lifetime Giving-The Good and the Bad 19-1: Valuation Concepts 19-2: Income Tax Concepts 19-3: Gift Planning 19-4: Estate Planning Refocus on the Big Picture: Lifetime Giving-The Good and the Bad Chapter 20: Income Taxation of Trusts and Estates The Big Picture: Setting Up a Trust to Protect a Family 20-1: Fiduciary Income Taxation 20-2: Nature of Trust and Estate Taxation 20-3: Taxable Income of Trusts and Estates 20-4: Taxation of Beneficiaries 20-5: Grantor Trusts 20-6: Procedural Matters 20-7: Tax Planning [Show More]

Last updated: 1 year ago

Preview 1 out of 707 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 07, 2022

Number of pages

707

Written in

Additional information

This document has been written for:

Uploaded

Dec 07, 2022

Downloads

0

Views

47