Business > QUESTIONS & ANSWERS > You work with the pricing actuary at Cash for Claims, a large Property/Casualty insurer. (All)

You work with the pricing actuary at Cash for Claims, a large Property/Casualty insurer.

Document Content and Description Below

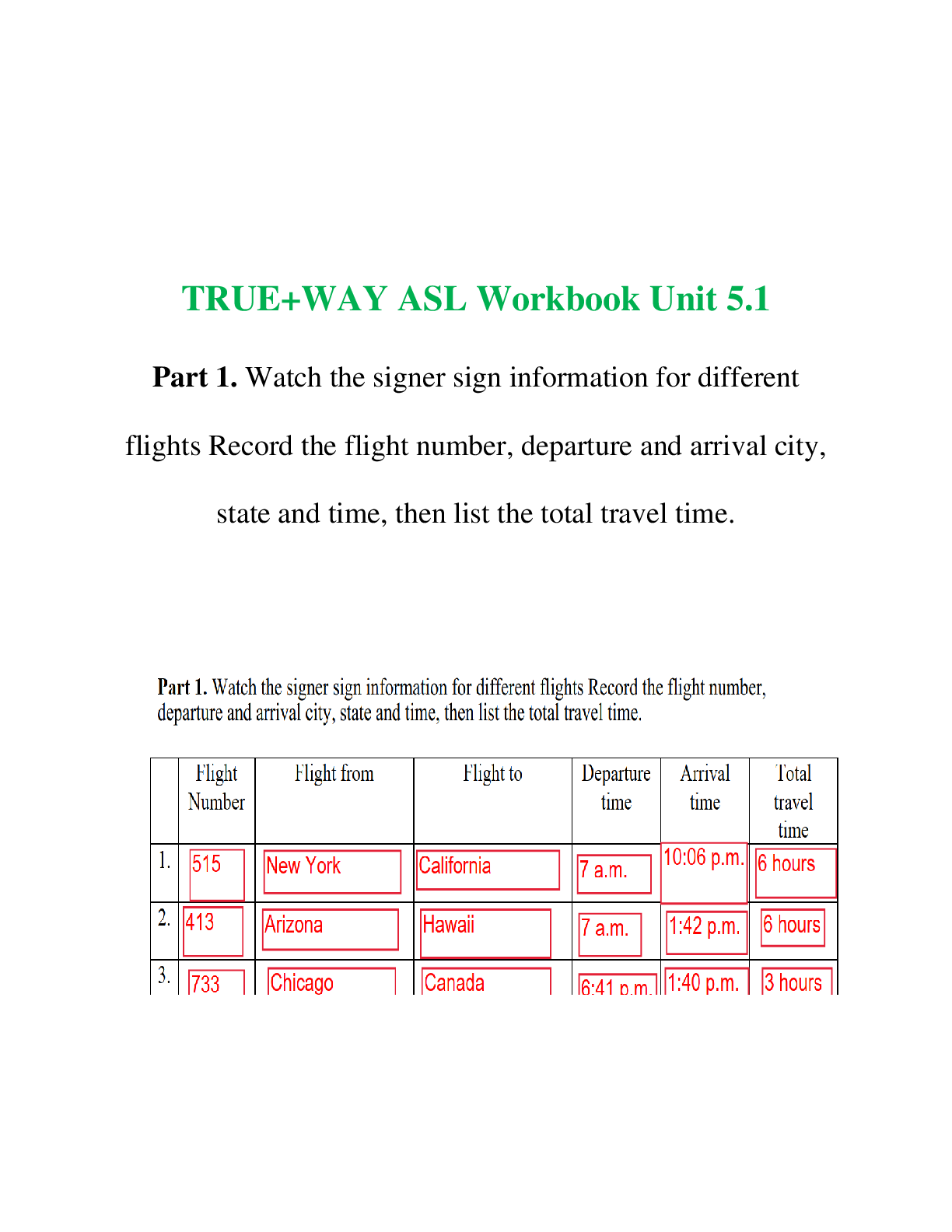

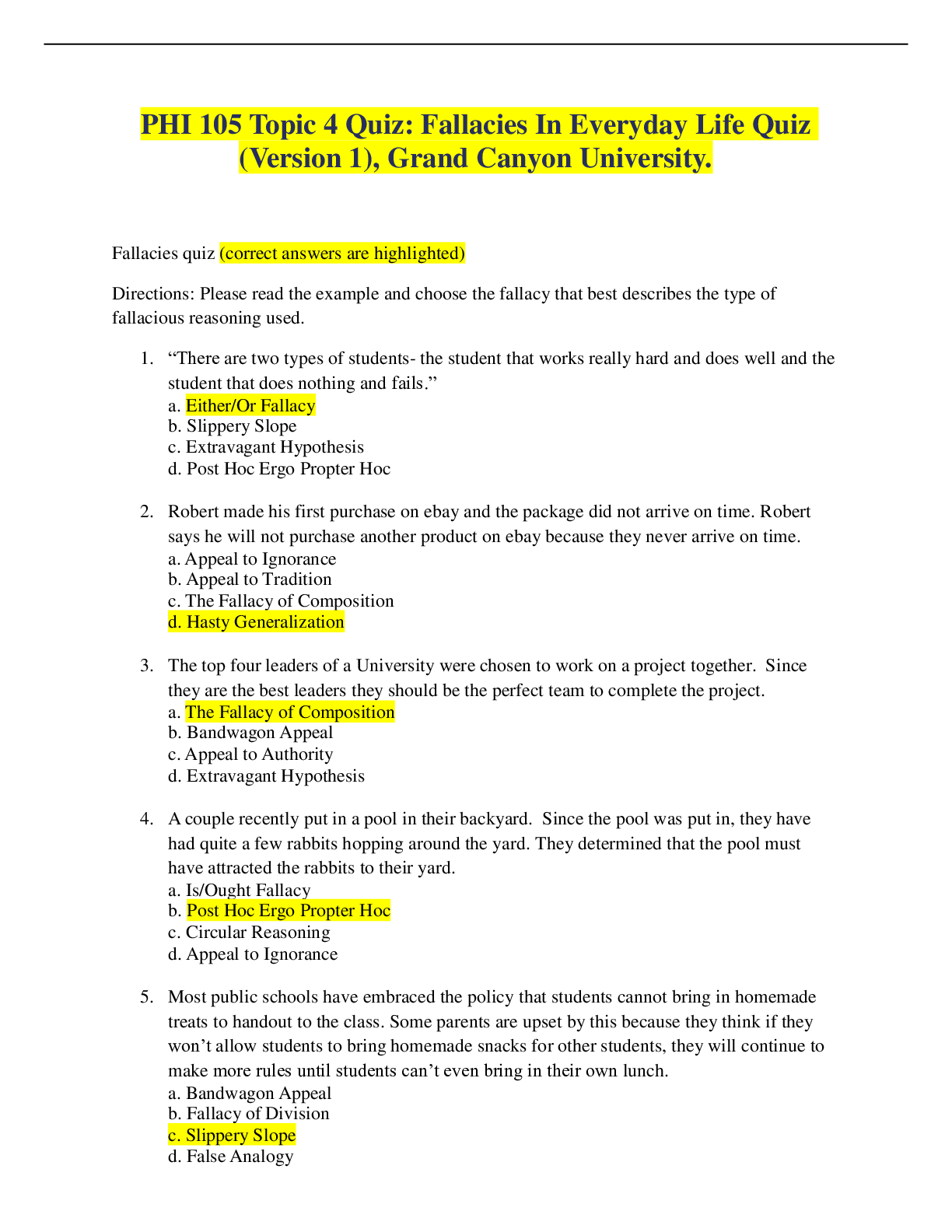

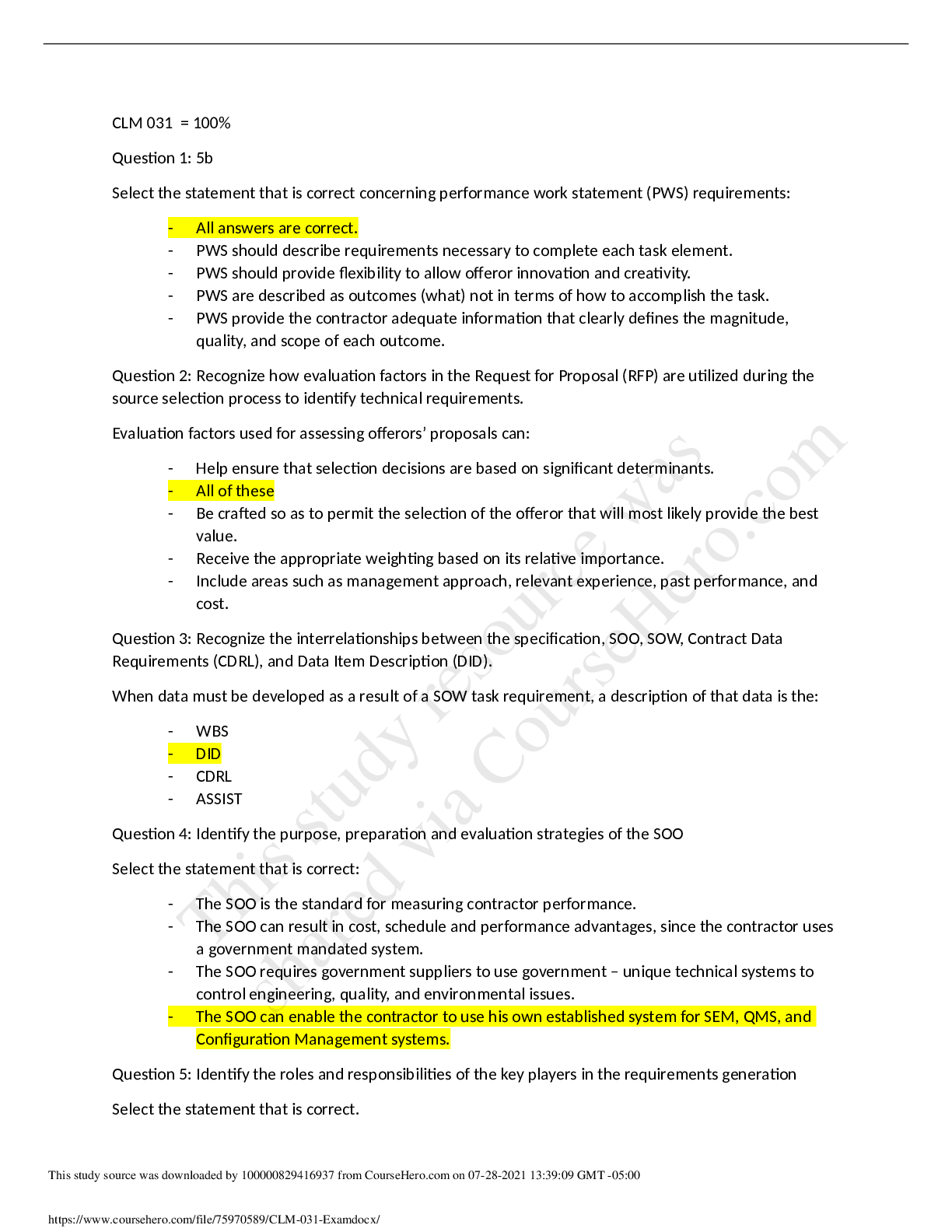

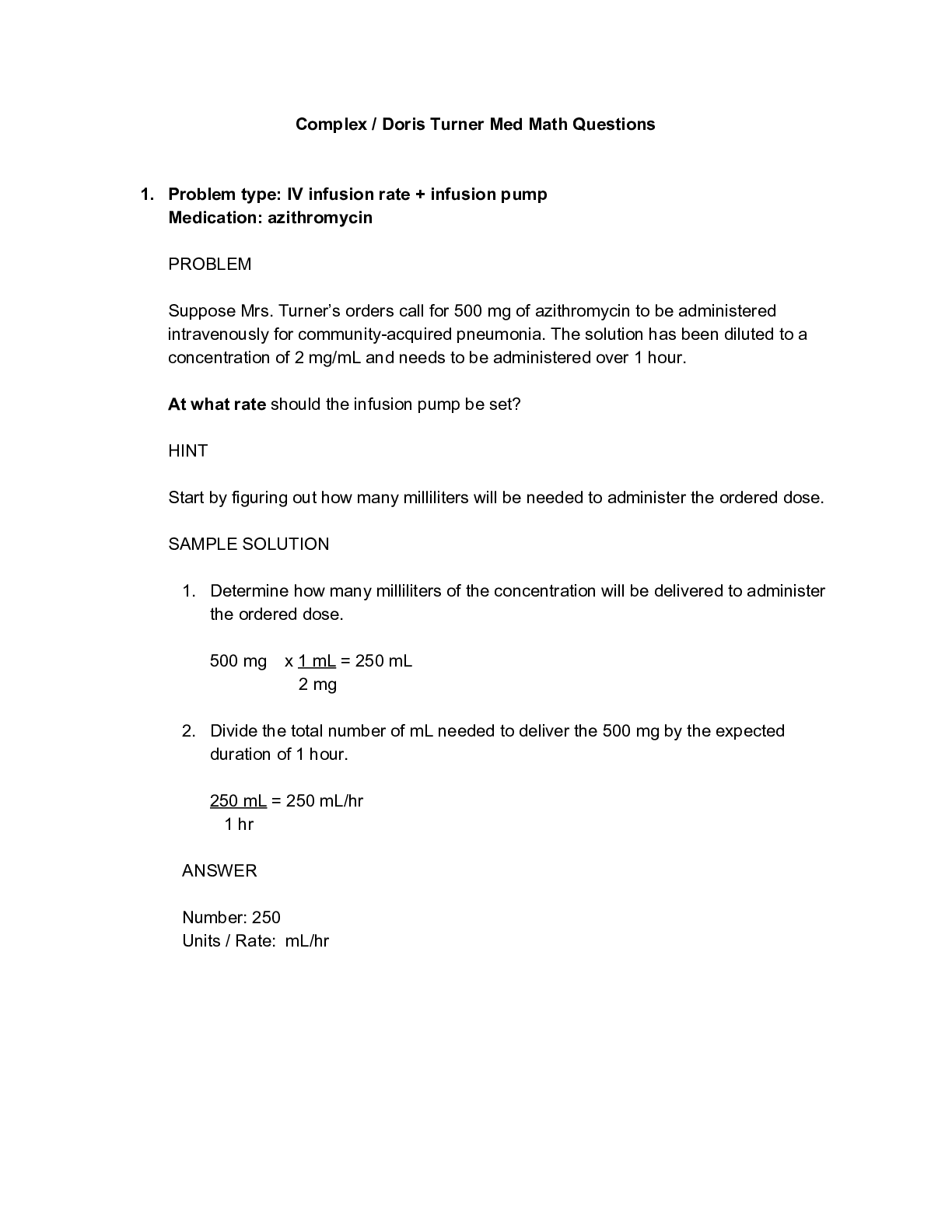

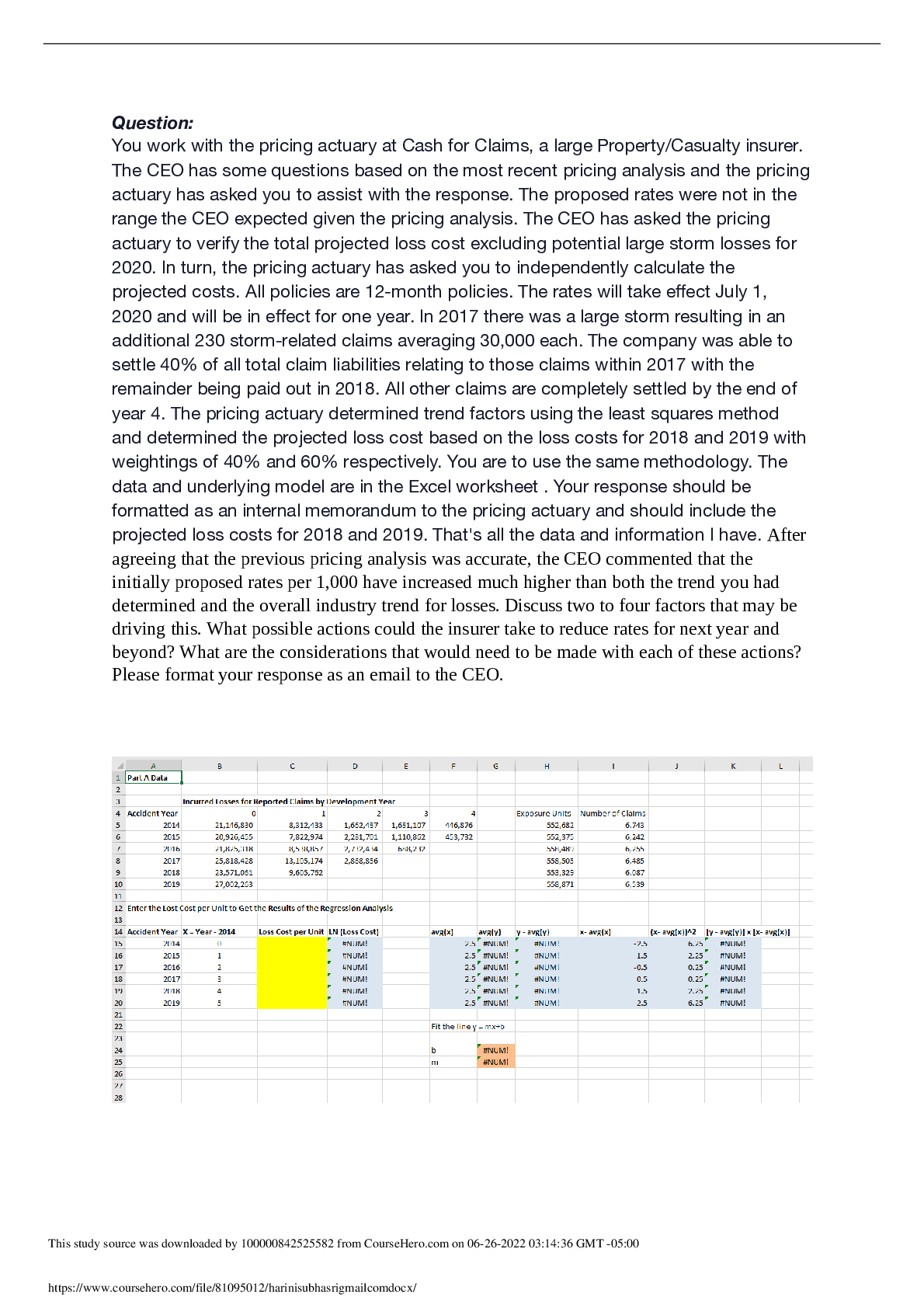

Question: You work with the pricing actuary at Cash for Claims, a large Property/Casualty insurer. The CEO has some questions based on the most recent pricing analysis and the pricing actuary has ... asked you to assist with the response. The proposed rates were not in the range the CEO expected given the pricing analysis. The CEO has asked the pricing actuary to verify the total projected loss cost excluding potential large storm losses for 2020. In turn, the pricing actuary has asked you to independently calculate the projected costs. All policies are 12-month policies. The rates will take effect July 1, 2020 and will be in effect for one year. In 2017 there was a large storm resulting in an additional 230 storm-related claims averaging 30,000 each. The company was able to settle 40% of all total claim liabilities relating to those claims within 2017 with the remainder being paid out in 2018. All other claims are completely settled by the end of year 4. The pricing actuary determined trend factors using the least squares method and determined the projected loss cost based on the loss costs for 2018 and 2019 with weightings of 40% and 60% respectively. You are to use the same methodology. The data and underlying model are in the Excel worksheet . Your response should be formatted as an internal memorandum to the pricing actuary and should include the projected loss costs for 2018 and 2019. That's all the data and information I have. After agreeing that the previous pricing analysis was accurate, the CEO commented that the initially proposed rates per 1,000 have increased much higher than both the trend you had determined and the overall industry trend for losses. Discuss two to four factors that may be driving this. What possible actions could the insurer take to reduce rates for next year and beyond? What are the considerations that would need to be made with each of these actions? Please format your response as an email to the CEO. [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$6.00

Document information

Connected school, study & course

About the document

Uploaded On

Jan 13, 2023

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Jan 13, 2023

Downloads

0

Views

10