CGFM Exam 1- Study Guide latest updated

Document Content and Description Below

AGA - ANSWER-Association of Government Accountants CEAR - ANSWER-Certificate of Excellence in Accountability Reporting CFO - ANSWER-Chief Financial Officer CGFM - ANSWER-Certified Government ... Financial Manager ERP - ANSWER-Enterprise Resource Planning FASAB - ANSWER-Federal Accounting Standards Advisory Board FASB - ANSWER-Financial Accounting Standards Board FSIO - ANSWER-Financial Systems Integration Office (within GSA) GAAP - ANSWER-Generally Accepted Accounting Principles GAO - ANSWER-Government Accountibility Office GASB - ANSWER-Government Accounting Standards Board GPRA - ANSWER-Government Performance and Results Act OMB - ANSWER-Office of Management and Budget PAR - ANSWER-Performance and Accountability Report SEA - ANSWER-Service Efforts and Accomplishments Accountability - ANSWER-Principle that in a democracy, government operates at the consent of the people. Therefore it must answer to the people for its actions and results, including the taking and using of the people's resources. Allotments - ANSWER-In the federal government, an agency's distribution of apportioned budgetary authority to various components within the agency. After the executive agency receives its apportionment, it allots budgetary authority to specific components within the agency. Anti-Deficiency Act - ANSWER-At the federal level, a law stating that officials can be fined and/or jailed if they obligate the government to spend funds beyond the legally authorized purpose, time, or amount. Apportionmnets - ANSWER-Definitions may vary at different levels of government. At the federal level, OMB's approval to use a protion of the legislatively approved budgetary authority. Appropriated Budget - ANSWER-Budget that has been passed by the legistlative branch; has effect of law. Appropriation - ANSWER-A legistlative enactment (law, statute or ordinance) that creates spending authority; the legal authority to incur expenses and spend money. Attestation engagements - ANSWER-Engagement primarily concerned with examining or performing agreed upon procedures on a subject matter, or an assertion about a subject matter, and reporting on the results. The subject matter may be financial or nonfinancial and can be part of a financial audit or performance audit. Possible subjects include reporting on an entity's internal controls, compliance with law or performance measures. Authorization - ANSWER-Legislative enactment that approves programs; prescribes what activities an agency may pursue if funding is available. Block grants - ANSWER-Intergovernmental provision of resources for broadly defined purposes. Contrasts with category grants. Capital Budget - ANSWER-Forecasts and controls spending for "big ticket" items that are acquired and used over a period of several years, such as construction projects and major equipment purchases. Used at state and local levels. Capital lease - ANSWER-Capital leases is a lease fo real property that meets defined criteria requiring the government to report the property as it purchased long term debt Cash-flow budget - ANSWER-Forecasts the timing as well as amount of cash flows for the year. Used to project required cash levels. Category grants - ANSWER-Intergovernmental provision of resources to be used for activities in a specific category of purpose. May be further classified as discretionary grants or formula grants. Contrasts with block grants. Central Management Agencies - ANSWER-Government agencies that provide central management services to other components. Example would be a state government hr office (that serves all state agencies) or the OMB at the federal level. CEAR - ANSWER-An AGA program that helps federal agencies and their components to produce effective, high-quality Performance and Accountability Reports Certificate of Participation - ANSWER-Form of shared government financing. In a typical form, several financial institutions share in a loan arrangement with a government entity. Charter - ANSWER-Local government version of a constitution. States may provide for the establishment of local governments through charters checks and balances - ANSWER-Process by which one branch of government (legislative, executiv or judicial) can constrain actions of the other branches. Flows from separation of powers. CFO Act - ANSWER-1990 law that, among other provisions, requires the federal government's major executive branch agencies to have a CFO. Prescribes duties and reporting requirements, and requires audited financial statements Commissions - ANSWER-Government components established by law, statuted or ordinance. May be permanent or temporary. Because they are established by law, may have greater autonomy and authority than government components that are administratively established. Ex. Federal Communication Commision Components - ANSWER-Organized units of government such as agencies, offices and departments. Found in all branches of government at all levels. Conflict of interest - ANSWER-Arises when one has personal interest in matters relating to official duties or activities. Such conflicts can destroy objectivity and independence and prevent the exercise of due care Consumption Taxes - ANSWER-Broad category of tax that includes sales, use, excise and value-added taxes Continuity of Operations - ANSWER-Refers to the efforts to ensure the organization can sustain essential operations regardless of planned or unplanned incidents or disruptions. Covenant (bond) - ANSWER-Legal requirements pertaining to a specific bond issue. Typically define the maturity date, revenue stream that will be used to repay the debt, interest rate and repayment schedule. May require a sinking fund and may specify conditions that must be met before new debt can be issued. Credit-rating agencies - ANSWER-Independent organizations that assess the credit worthiness of debt. Three major rating agenciew are Standard & Poors, Moody's Investor Service and Fitches rating Data mining - ANSWER-Using special, computer-based techniques such as filters and algorithms to extract meaningful information from large bodies of data Debt - ANSWER-Money owed by the entity to individual or organizational creditors, ususally as a result of planned short- or long-term borrowing to finance government objectives Dedicated tax - ANSWER-Taxes levied to finance a specific activity. Proceeds are deposited into an account restricted to that activity. Also referred to as earmarked or restricted taxes. Deficit - ANSWER-Occurs when government expenditures for a specific fiscal period exceed revenues and/or financial resource inflows. Diligence - ANSWER-Pursuing an event, action or assignment to a timely and sufficient end or close Discrestionary grants - ANSWER-Form of category grant. Transfers funds between governments for a specific purpose; whether a grant is awarded and the amount of the award depend on discretion of the entity providing the funds Donations - ANSWER-Voluntary contributions that confer no rights or benefits on the giver Due care - ANSWER-To discharge professional responsibilities with competence and diligence, to the best of one's ability, and with the same level of ability and skill as others in similar positions. It also means to act in the best interest of those served. Earmarking - ANSWER-Variation on use of special funds. Revenue from specific taxes or other sources is set aside for specific activities. One example is the earmarking of gasoline taxes for highway improvements Enterprise Resoure Planning System - ANSWER-Major "end-to-end" computer system that links many functions and departments. Used to simplify and streamline financial management, and to integrate operation with financial management Estate tax - ANSWER-Form of wealth tax. Levied on the estate of the deceased person before assets are distributed to heirs Ethics - ANSWER-A set of moral principles and values; the principles of conduct governing an individual or a (professional) group. A complex system of discipline that civilized societies impose on themselves through laws, customs, standards, social etiquette and other rules to govern moral conduct Excise tax - ANSWER-Form of consumption tax. Levied on the consumption of a particular type of good or participation in a certain type of activity. Whereas general sales taxes are broad-based, excise taxes are more narrowly targeted. Executive orders - ANSWER-Orders issued by the president, governor, or a local government's chief executive that do not violate laws or statutes and have substantial impact on policy and procedures of government. They carry less weight than laws because the legislature or next chief executive may overturn the previous order Fair - ANSWER-Free from self-interest, prejudice or favoritism. Implies an elimination of one's own feelings, prejudices and desires so as to acheive a proper balance of conflicting interests. FASAB - ANSWER-Defines GAAP for entities of the federal government; this includes the national government as a whole plus distinct components. Federalism - ANSWER-Principle that government authority and responsibility is shared among different levels of government. (In practice, people often use the term 'federal' when referring to the national level of government) FASB - ANSWER-Defines GAAP for private sector entities. Occasionally, GASB and FASAB make FASB standards applicable to national, state or local government Financial Management System - ANSWER-Organized means for the collection, processing, transmission and dissemination of financial information. Includes policies and procedures and trained personnel as well as any applicable computer hardware and software Financial Statement Audit - ANSWER-Examination of financial statements, accomplished by an independent auditor. Results in an opinon on whether the financial statements are presented fairly in accordance with GAAP or another comprehensive basis of accounting Financial Reports - ANSWER-External reports that depict financial position and financial results of operations of the entity Formula grants - ANSWER-Form of category grants. The amount of the inter-governmental transfer is based on a formula contained in law or regulation, which determines the total amount recipients will receive if basic eligibility requirements are satisfied Forensic auditing - ANSWER-"Forensic" implies that the results will be admissable as legal evidence. Forensic auditing combines the skills of auditors and accountants with investigative techniques, useful for both detection and prevention of fraud General Assembly - ANSWER-Name often applied to the legislative branch at the state level General obligation bonds - ANSWER-Form of government debt that is backed by the full faith and credit of the government. Contrasts with revenue bonds General-purpose government - ANSWER-Entities at the national, state or local level that provide a broad range of services GASB - ANSWER-Defines GAAP for state and local government entities Government Corporationgs - ANSWER-Quasi-government entities formed to support businesslike functions where most, if not all, operating expenses are expected to be covered through revenues and fees, rather than from appropriated budget authority Government Performance and Results Act (GPRA) - ANSWER-U.S. law passed in 1993; requires federal agencies to create long-term strategic plans. The strategic plans are followed by annual performance plans (currnetly performance budgets), performance measures and performance reports Grants - ANSWER-Funds transferred from one level of government to another for specific or broad purposes Impartial - ANSWER-Lack of favoritism. The absence of favor or prejudice. Not partial or biased. Treating or affecting all equally. Income tax - ANSWER-Tax based on income and levied on individuals or corporations. Used most often at national and state levels, though some states allow local governments to impose income taxes. Independence - ANSWER-Free from relationships that may impair, or appear to impair, one's ability to act with objectivity. Independence is the quality of being free of any obligation to particular parties or interests. Inheritance Tax - ANSWER-Form of wealth tax. Levied on the person receiving the bequest Initiative - ANSWER-Process that enables citizents to present their view of a problem and a proposed solution, rather then depending on a solution devised and enacted by the legislative branch. Allows direct citizen action to affect laws. Intangibles tax - ANSWER-Form of wealth tax. Applied to intangible assets such as stocks and bonds, savings accounts, trademearks and accounts receivable (in the case of a business). [Show More]

Last updated: 1 year ago

Preview 1 out of 87 pages

Reviews( 0 )

Recommended For You

*NURSING> EXAM > ATI PN MENTAL HEALTH 2020/21- STUDY GUIDE TO GRADE ‘A’ (All)

ATI PN MENTAL HEALTH 2020/21- STUDY GUIDE TO GRADE ‘A’

ATI PN MENTAL HEALTH 2020/21- STUDY GUIDE TO GRADE ‘A’

By Daphine , Uploaded: Jul 21, 2022

$15

Health Care> EXAM > Ethics for Health Professions HCA-200 Final Exam Questions with Answers 100% Correct (All)

Ethics for Health Professions HCA-200 Final Exam Questions with Answers 100% Correct

Ethics for Health Professions (HCA- 200) Final Examination Part 1: Multiple Choice (1 points each) ● Identify the choice that best completes the statement or answers the question. ● Clearly circ...

By Quiz Merchant , Uploaded: Apr 19, 2021

$9

*NURSING> EXAM > ENPC Test Questions & Answers (All)

ENPC Test Questions & Answers

ENPC Test Questions & Answers-An unresponsive 2-year-old child was found by his mother with a bottle labeled "Elavil 50 mg" by his side. Which piece of information is important to obtain from his moth...

By PROF , Uploaded: Apr 25, 2024

$9.5

Religious Studies> EXAM > CWV TOPIC 2 QUIZ. QUESTIONS AND ANSWERS LATEST UPDATED. (Score 100%) (All)

CWV TOPIC 2 QUIZ. QUESTIONS AND ANSWERS LATEST UPDATED. (Score 100%)

CWV TOPIC 2 QUIZ QUESTIONS AND ANSWERS LATEST UPDATED

By ELIANA , Uploaded: Aug 01, 2022

$9

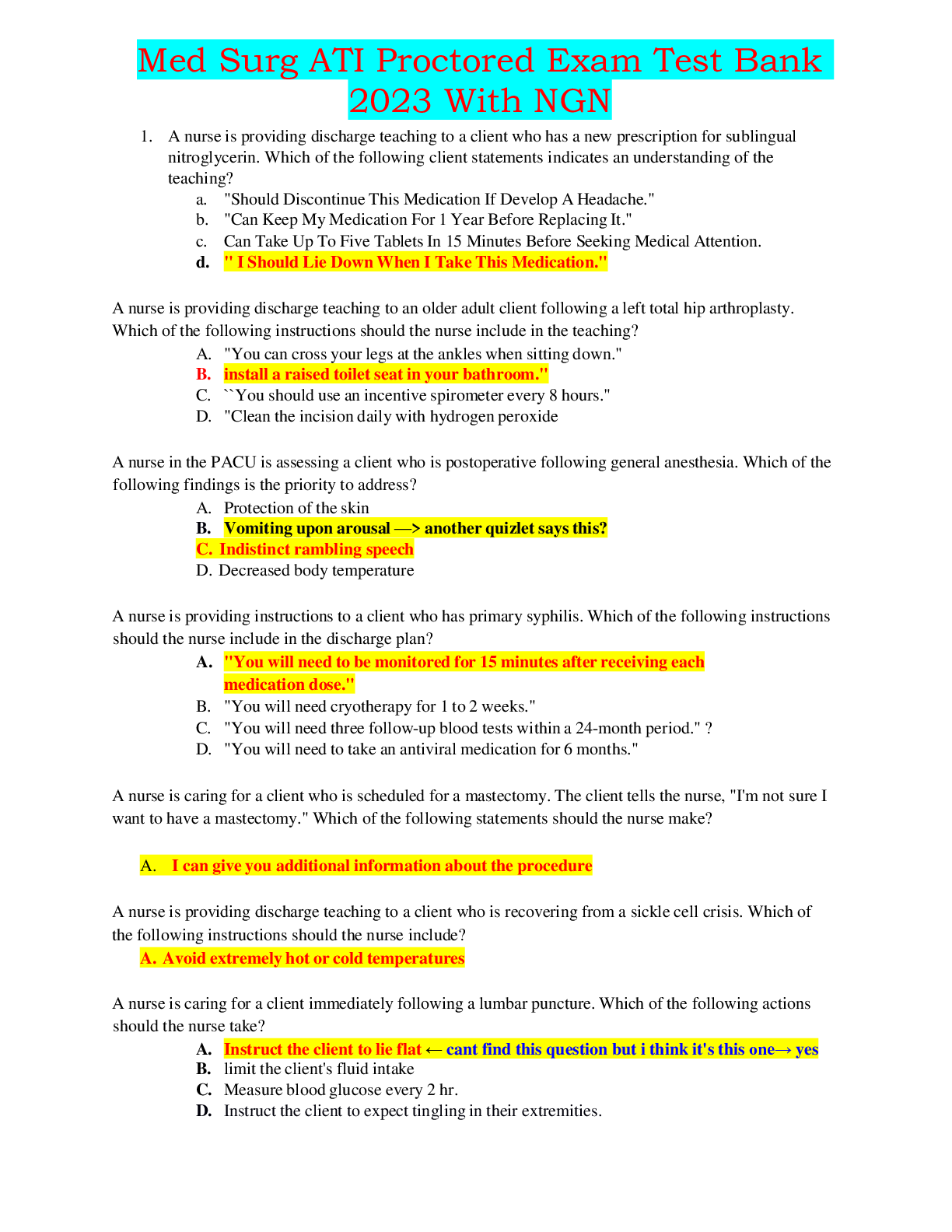

ATI MED SURG PROCTORED> EXAM > Med Surg ATI Proctored Exam Test Bank 2023/2024 With NGN (All)

Med Surg ATI Proctored Exam Test Bank 2023/2024 With NGN

Med Surg ATI Proctored Exam Test Bank 2023/2024 With NGN Med Surg ATI Proctored Exam Test Bank 2023/2024 With NGN Med Surg ATI Proctored Exam Test Bank 2023/2024 With NGN Med Surg ATI Proctored E...

By EXAMHUB SOLUTIONS , Uploaded: Apr 15, 2024

$30.5

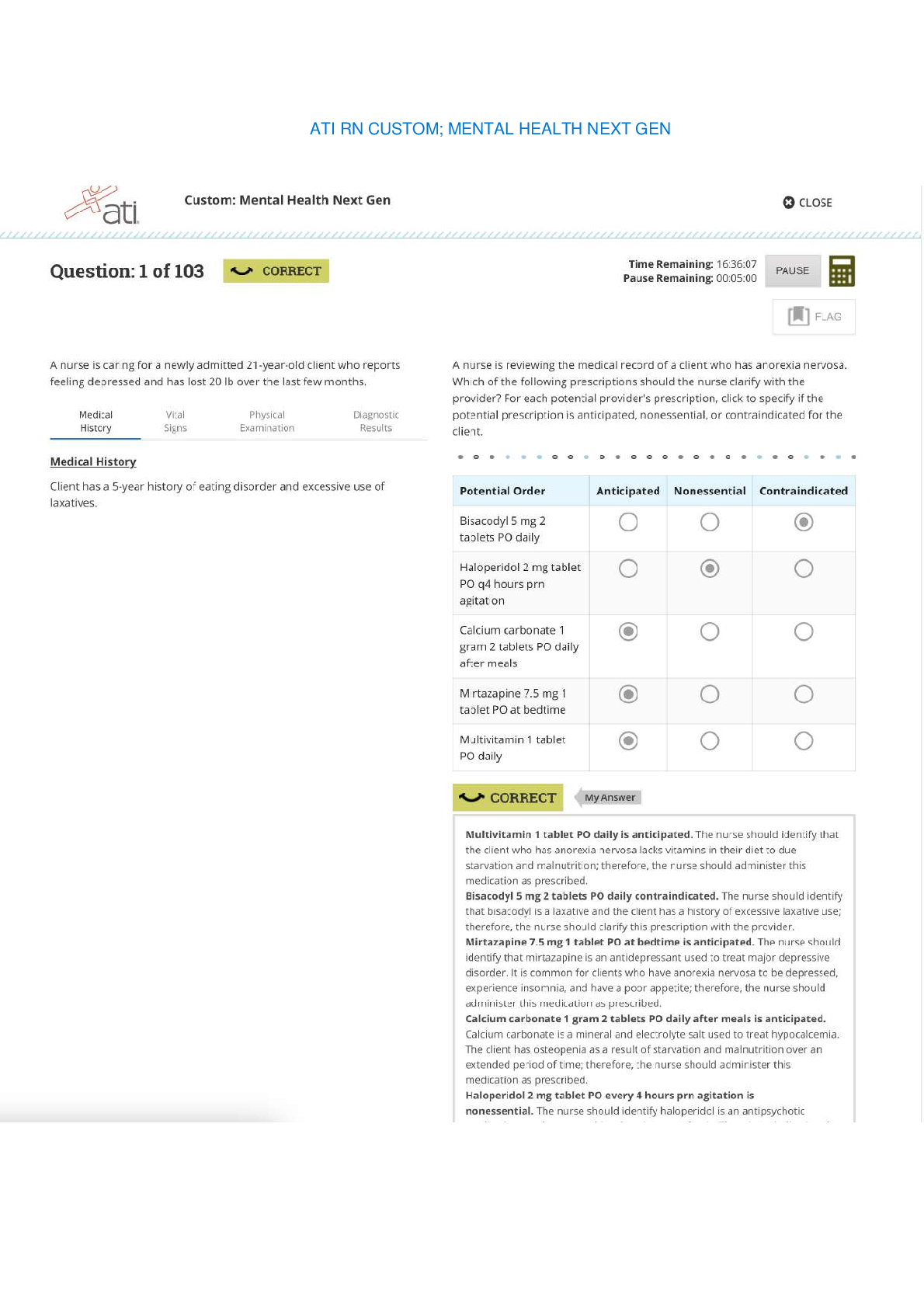

NURSING.> EXAM > ATI RN CUSTOM; MENTAL HEALTH NEXT GEN (All)

ATI RN CUSTOM; MENTAL HEALTH NEXT GEN

ATI RN CUSTOM; MENTAL HEALTH NEXT GEN ATI RN CUSTOM; MENTAL HEALTH NEXT GEN ATI RN CUSTOM; MENTAL HEALTH NEXT GEN ATI RN CUSTOM; MENTAL HEALTH NEXT GEN ATI RN CUSTOM; MENTAL HEALTH NEXT GE...

By EXAMHUB SOLUTIONS , Uploaded: Apr 05, 2024

$45.5

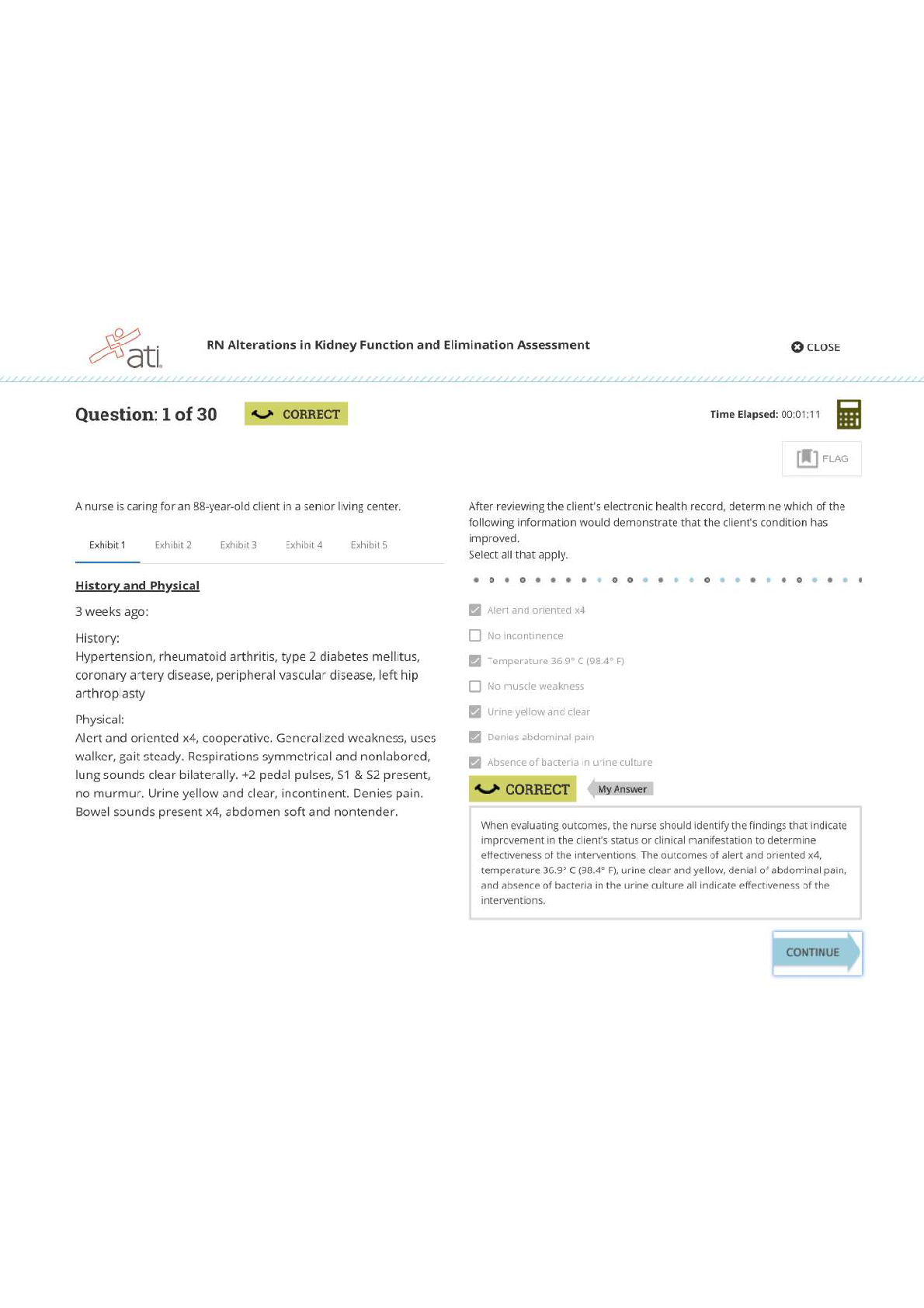

ATI Med Surg> EXAM > RN ATI MED SURG ALTERATIONS IN KIDNEY FUNCTION AND ELIMINATION ASSESSMENT. (All)

RN ATI MED SURG ALTERATIONS IN KIDNEY FUNCTION AND ELIMINATION ASSESSMENT.

RN ATI MED SURG ALTERATIONS IN KIDNEY FUNCTION AND ELIMINATION ASSESSMENT. RN ATI MED SURG ALTERATIONS IN KIDNEY FUNCTION AND ELIMINATION ASSESSMENT. RN ATI MED SURG ALTERATIONS IN KIDNEY FUNCTI...

By EXAMHUB SOLUTIONS , Uploaded: Apr 10, 2024

$28.5

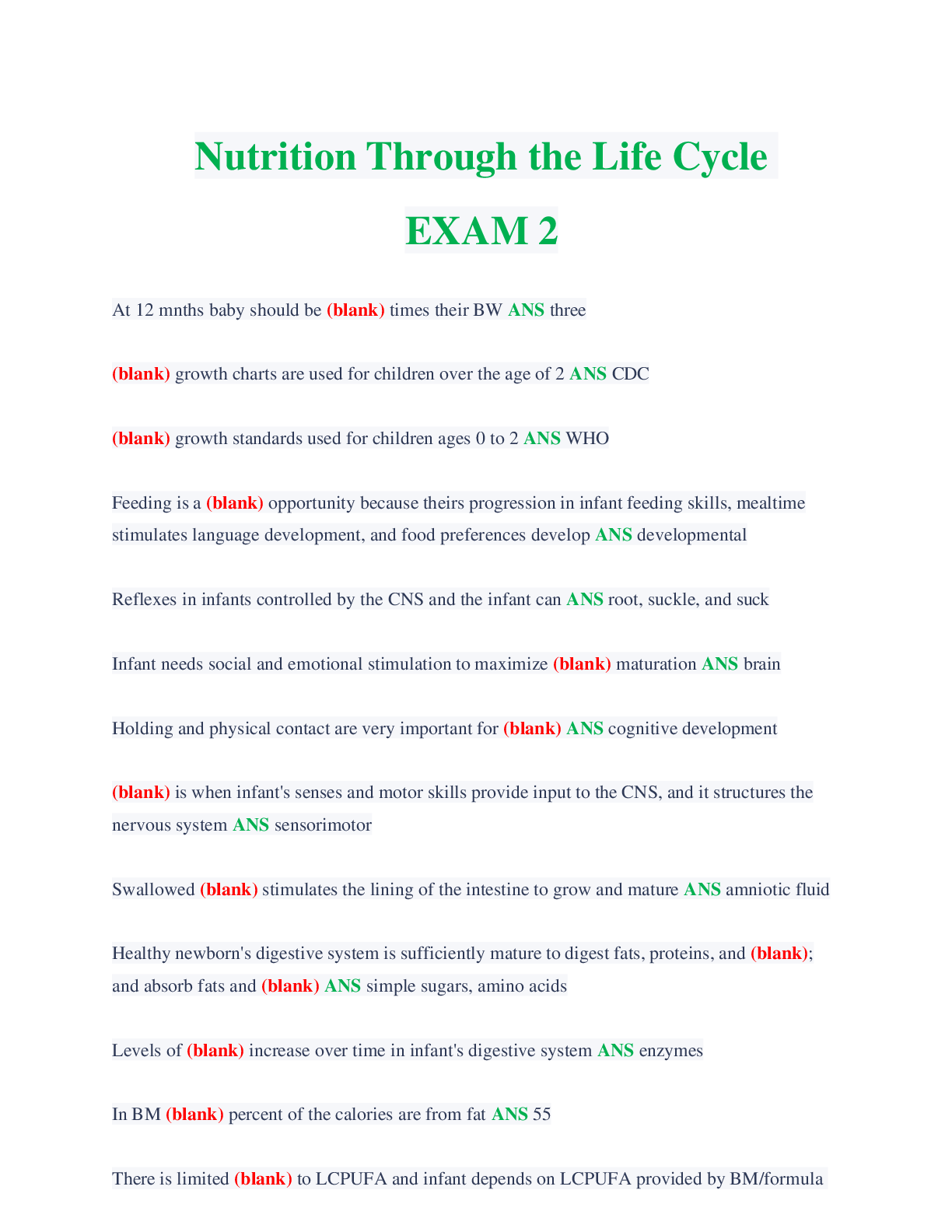

Nutrition> EXAM > Nutrition Through the Life Cycle EXAM 2. 50 Questions & Answers. (Score 100%) (All)

Nutrition Through the Life Cycle EXAM 2. 50 Questions & Answers. (Score 100%)

Nutrition Through the Life Cycle EXAM 2 Latest

By Academic mines , Uploaded: Apr 27, 2023

$10

*NURSING> EXAM > NGR 6172 Pharm Midterm Exam- Questions and Answers. Score 98% (All)

NGR 6172 Pharm Midterm Exam- Questions and Answers. Score 98%

NGR 6172 Pharm Midterm Exam- Questions and Answers GRADED A-1). A patient who takes daily doses of aspirin is scheduled for surgery next week. The nurse should advise the patient to: a. continue to...

By PROF , Uploaded: Feb 01, 2022

$11

Philosophy> EXAM > PHL 200 Intro to Ethics Unit 3 - Score 100% (All)

PHL 200 Intro to Ethics Unit 3 - Score 100%

PHL 200 Intro to Ethics Unit 3 For a utilitarian, which consideration is most important? Why is utilitarianism an objectivist or relativist theory? Which of the following considerations is important f...

By Ajay25 , Uploaded: Jan 04, 2022

$8

Document information

Connected school, study & course

About the document

Uploaded On

Jan 13, 2023

Number of pages

87

Written in

Additional information

This document has been written for:

Uploaded

Jan 13, 2023

Downloads

0

Views

42