Financial Accounting > QUESTIONS & ANSWERS > ACCT 4510 Advanced Financial Accounting - Douglas College- Assignment Chapter 11. Score: 100/100 Poi (All)

ACCT 4510 Advanced Financial Accounting - Douglas College- Assignment Chapter 11. Score: 100/100 Points

Document Content and Description Below

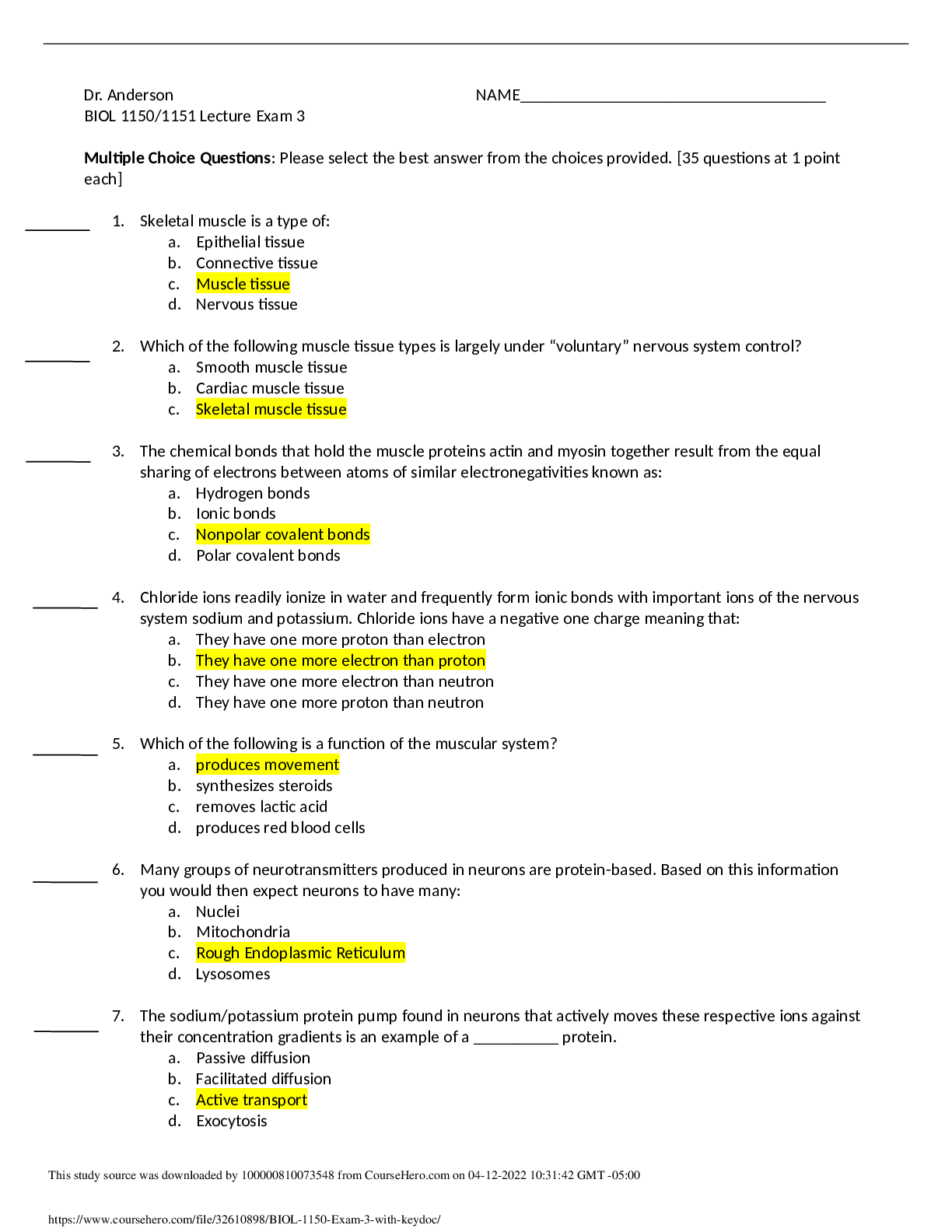

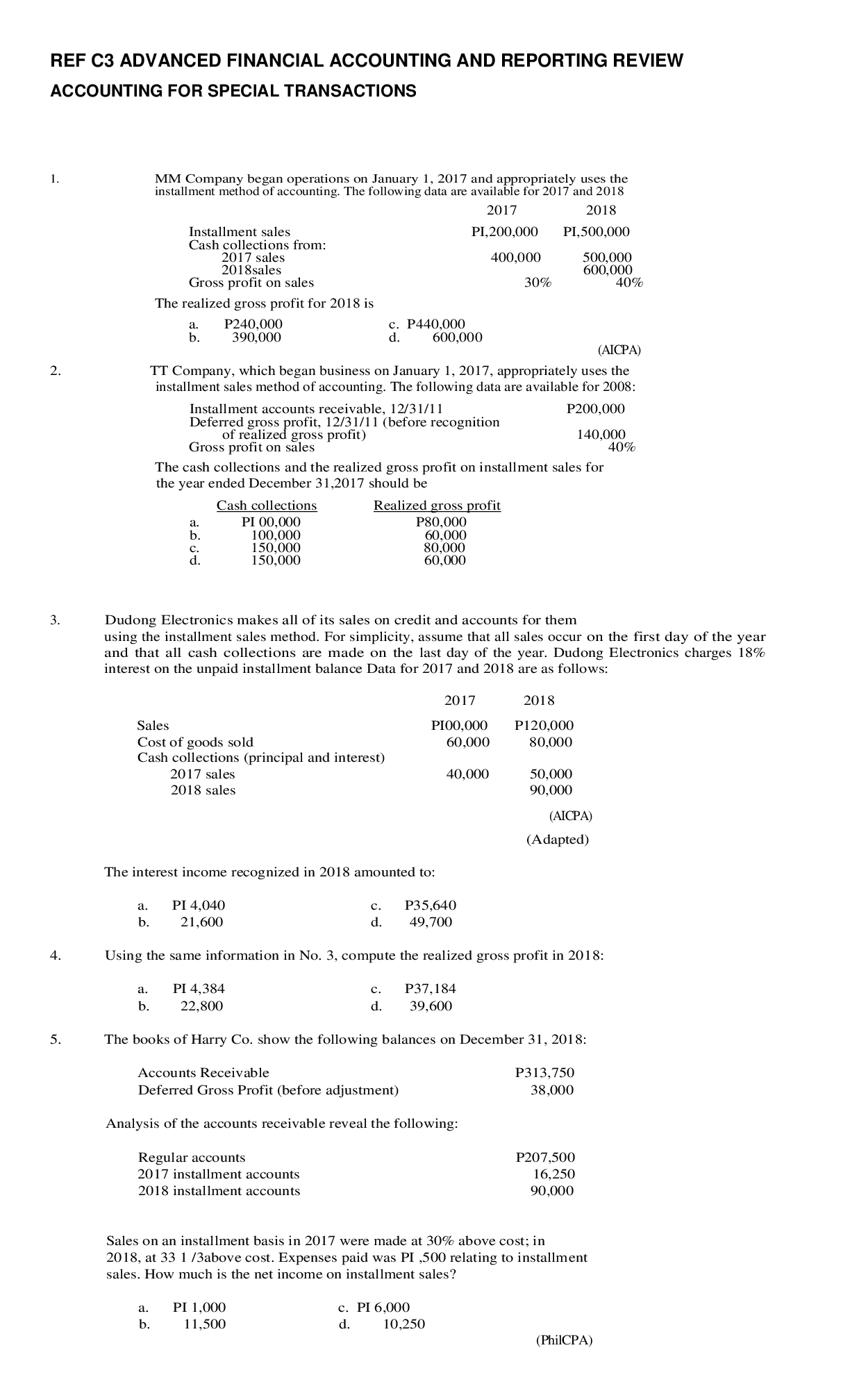

ACCT 4510 Advanced Financial Accounting - Douglas College- Assignment Chapter 11. Score: 100/100 Points On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the ou... tstanding ordinary shares of Sandora Corp. of Flint, Michigan. Sandora’s comparative statement of financial position and Year 2 income statement are as follows: STATEMENT OF FINANCIAL POSITION At December 31 Year 2 Year 1 Plant and equipment (net) US$ 6,600,000 US$ 7,300,000 Inventory 5,700,000 6,300,000 Accounts receivable 6,100,000 4,700,000 Cash 780,000 900,000 US$ 19,180,000 US$ 19,200,000 Ordinary shares US$ 5,000,000 US$ 5,000,000 Retained earnings 7,480,000 7,000,000 Bonds payable—due Dec. 31, Year 6 4,800,000 4,800,000 Current liabilities 1,900,000 2,400,000 US$ 19,180,000 US$ 19,200,000 INCOME STATEMENT For the year ended December 31, Year 2 Sales US$ 30,000,000 Cost of purchases 23,400,000 Change in inventory 600,000 Depreciation expense 700,000 Other expenses 3,800,000 28,500,000 Profit US$ 1,500,000 Additional Information Exchange rates Dec. 31, Year 1 US$1= C$1.10 Sep. 30, Year 2 US$1= C$1.07 Dec. 31, Year 2 US$1= C$1.05 Average for Year 2 US$1= C$1.08 Sandora declared and paid dividends on September 30, Year 2. The inventories on hand on December 31, Year 2, were purchased when the exchange rate was US$1 = C$1.06. Required: (a) Assume that Sandora's functional currency is the Canadian dollar: (i) Calculate the Year 2 exchange gain (loss) that would result from the translation of Sandora's financial statements. (Input all amounts as positive value. Omit currency symbol in your response.) Exchange gain C$ 16,400 (ii) Translate the Year 2 financial statements into Canadian dollars. (Round the values in the "Rate" column to 2 decimal places. Exchange gain, if any, should be entered as positive value, and Exchange loss, if any, should be entered with a minus sign. Input all other amounts as positive values. Omit currency symbol in your response.) Income Statement-Year 2 US$ Rate C$ Sales 30,000,000 × 1.08 32,400,000 Cost of purchases 23,400,000 × 1.08 25,272,000 Change in inventory 600,000 888,000 Depreciation expense 700,000 × 1.10 770,000 This study source was downloaded by 100000857336479 from CourseHero.com on 04-02-2023 13:12:41 GMT -05:00 Other expenses 3,800,000 × 1.08 4,104,000 https://www.coursehero.com/file/66229445/Assignment-Chapter-11pdf/7/29/2020 Assignment Print View https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=1.&postSubmissionView=13252713937332272&wid=1325271379… 3/8 Exchange gain 16,400 28,500,000 31,017,600 Profit 1,500,000 1,382,400 Retained Earnings Statement-Year 2 US$ Rate C$ Bal. Jan 1 7,000,000 × 1.10 7,700000 Profit 1,500,000 1,382,400 8,500,000 9,082,400 Dividends 1,020,000 × 1.07 1,091,400 Bal. Dec 31 7,480,000 7,991, [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 12, 2023

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Apr 12, 2023

Downloads

0

Views

59