International Business > QUESTIONS & ANSWERS > International Business _ BSBA-1 Chapter 9: THE FOREIGN EXCHANGE MARKET (All)

International Business _ BSBA-1 Chapter 9: THE FOREIGN EXCHANGE MARKET

Document Content and Description Below

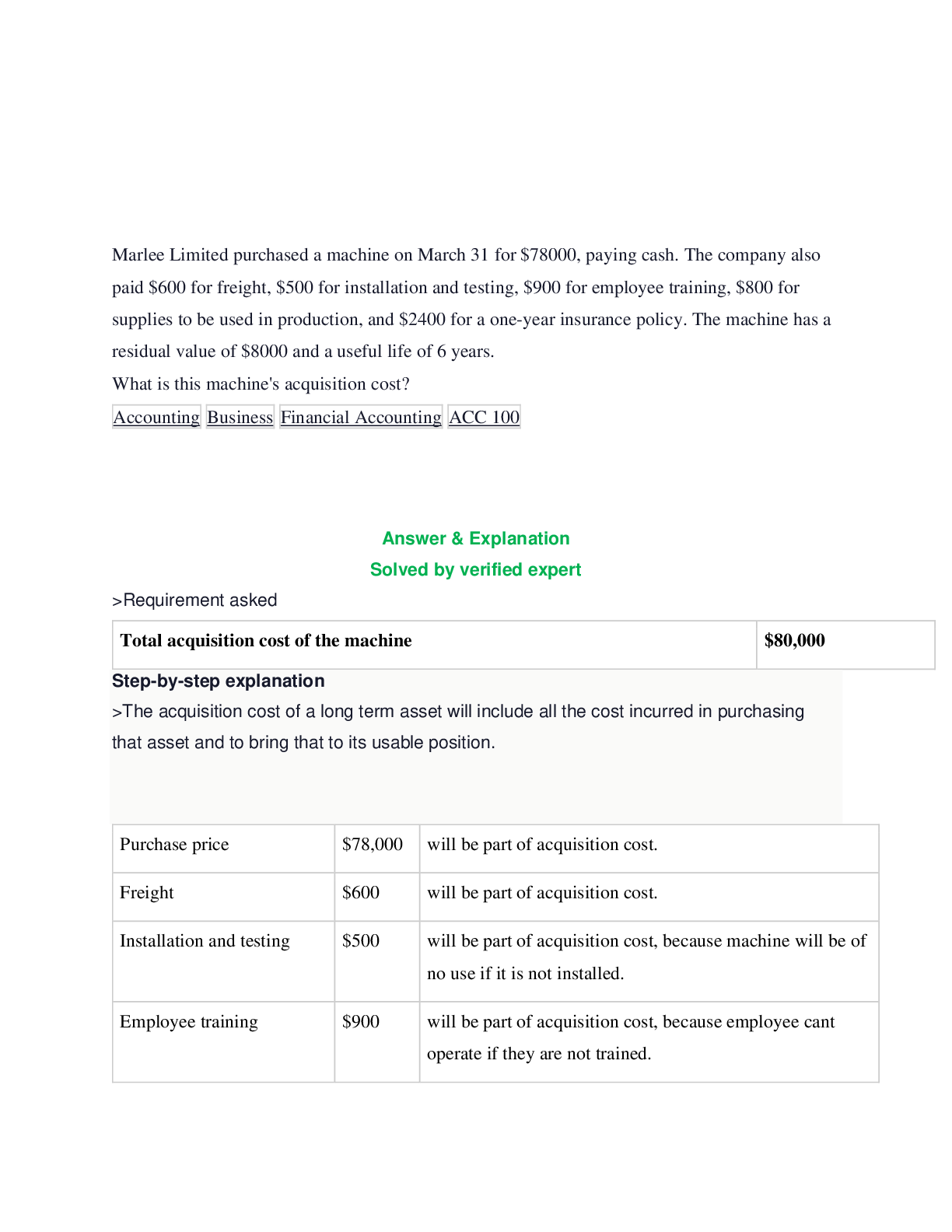

BSBA-1 Chapter 9: THE FOREIGN EXCHANGE MARKET Critical Thinking 1.the interest rate on South Korean government securities with one-year maturity is 4 percent and the expected inflation rate for th... e coming year is 2 percent. The interest rate in U.S. government securities which one-year maturity is 7 percent, and the expected rate of inflation is 5 percent. The current spot exchange rate for Korean won is 1 dollar= W 1,200. Forecast the spot exchange rate one year from today. Explain the logic of your answer. 3. Reread the Management Focus feature on Volkswagen in this chapter, then answer the following questions: a.) Why do you think management at Volkswagen decided to hedge only 30 percent of their foreign currency exposure in 2003? What would have happened if they had hedged 70 percent? Of their exposure? b.) Why do you think the value of the U.S. dollar declined against that of the Euro in 2003? c.) Apart from hedging through the foreign exchange market, what else can Volkswagen do to reduce its exposure to future declines in the value of the U.S. dollar against the euro? CLOSING CASE Hyundai and Kia Case Discussion Questions 1. Explain how the rise in the value of the Korean currency, the won, against the dollar impacts upon the competitiveness of Hyundai and Kia’s exports to the United States? 2. Hyundai and Kia are both expanding their presence in the United States. How does this hedge against adverse currency movements? What other reasons might these companies have for investing in the United States? What are the drawback of such a strategy? 3. If Hyundai expects the value of the won to strengthen appreciably against the U.S. dollar over the next decade, should it still expand its presence in the United State? 4. In 2008 the Korean won depreciated 28 percent against the United States dollar. Does this imply that Hyundai and Kia were wrong to invest in the United States? How does this explain the relative strength of car sales from Hyundai and Kia in the U.S. market during early 2009? [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$9.50

Document information

Connected school, study & course

About the document

Uploaded On

Apr 29, 2023

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Apr 29, 2023

Downloads

0

Views

36