Business > SOLUTIONS MANUAL > Pearson's Federal Taxation 2024 Corporations, Partnerships, Estates & Trusts 37th Edition By Mitchel (All)

Pearson's Federal Taxation 2024 Corporations, Partnerships, Estates & Trusts 37th Edition By Mitchell Franklin, Luke Richardson (Solution Manual Latest Edition 2023-24, Grade A+, 100%

Document Content and Description Below

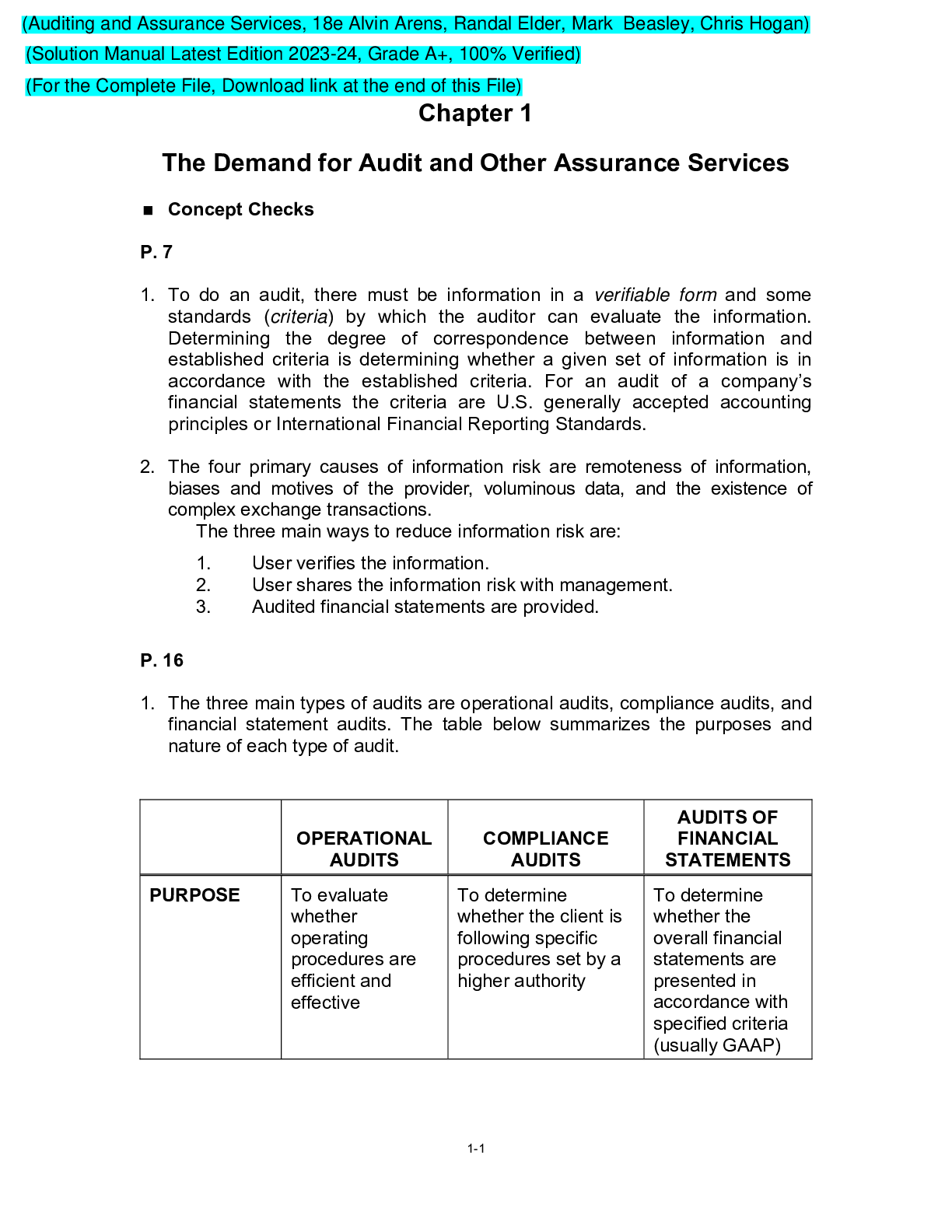

Tax Research Corporate Formations and Capital Structure The Corporate Income Tax Corporate Nonliquidating Distributions Other Corporate Tax Levies Corporate Liquidating Distributions Corporate A... cquisitions and Reorganizations Consolidated Tax Returns Partnership Formation and Operation Special Partnership Issues S Corporations The Gift Tax The Estate Tax Income Taxation of Trusts and Estates Administrative Procedures Tax Research Corporate Formations and Capital Structure The Corporate Income Tax Corporate Nonliquidating Distributions Other Corporate Tax Levies Corporate Liquidating Distributions Corporate Acquisitions and Reorganizations Consolidated Tax Returns Partnership Formation and Operation Special Partnership Issues S Corporations The Gift Tax The Estate Tax Income Taxation of Trusts and Estates Administrative Procedures [Show More]

Last updated: 2 weeks ago

Preview 1 out of 889 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 24, 2023

Number of pages

889

Written in

Additional information

This document has been written for:

Uploaded

Aug 24, 2023

Downloads

0

Views

93

, 2e by Stephen Lovett.png)