Business > QUESTIONS & ANSWERS > Strayer University - All Va Campuses > Finance 550 Final Exam Part 2 > Finance 550 Final Exam Part 2 (All)

Strayer University - All Va Campuses > Finance 550 Final Exam Part 2 > Finance 550 Final Exam Part 2

Document Content and Description Below

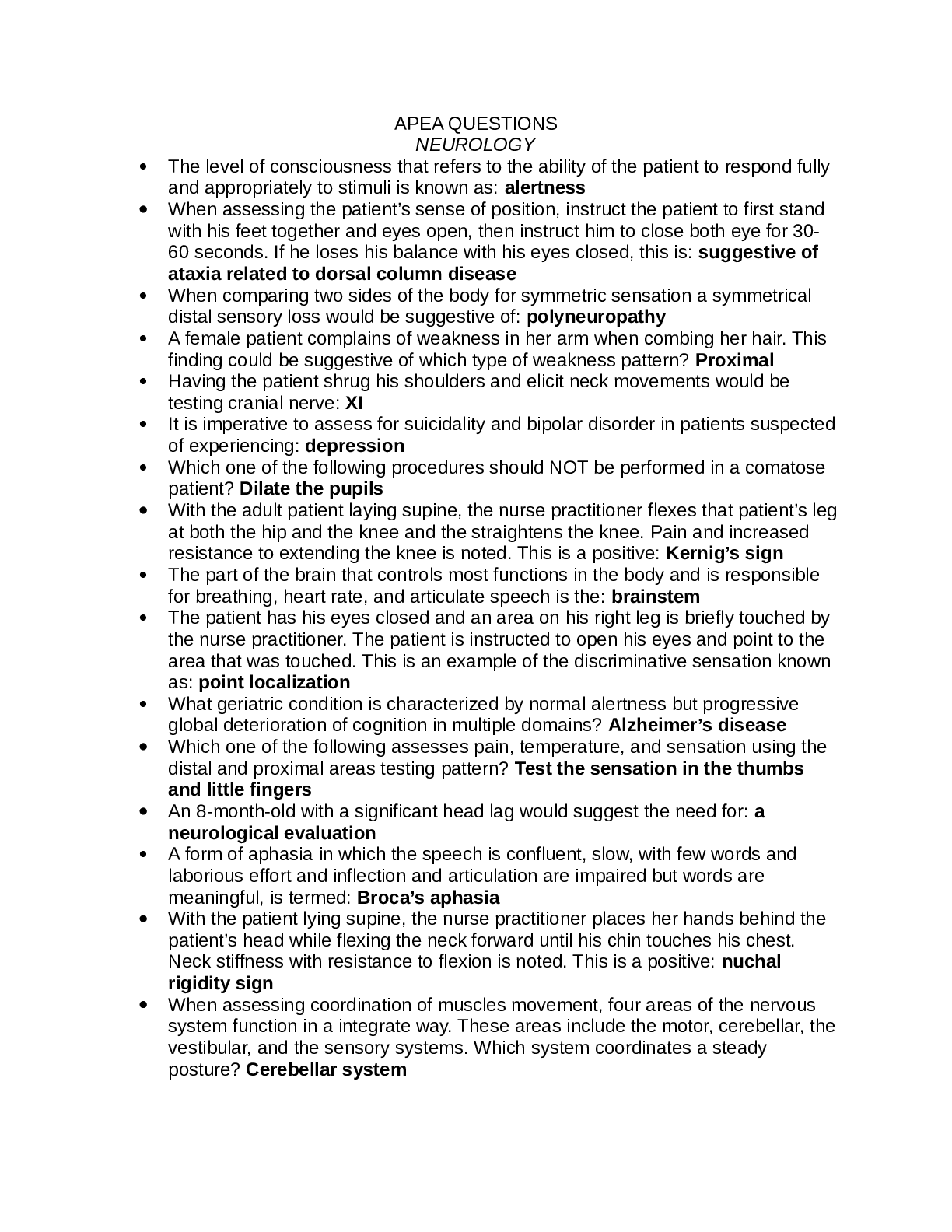

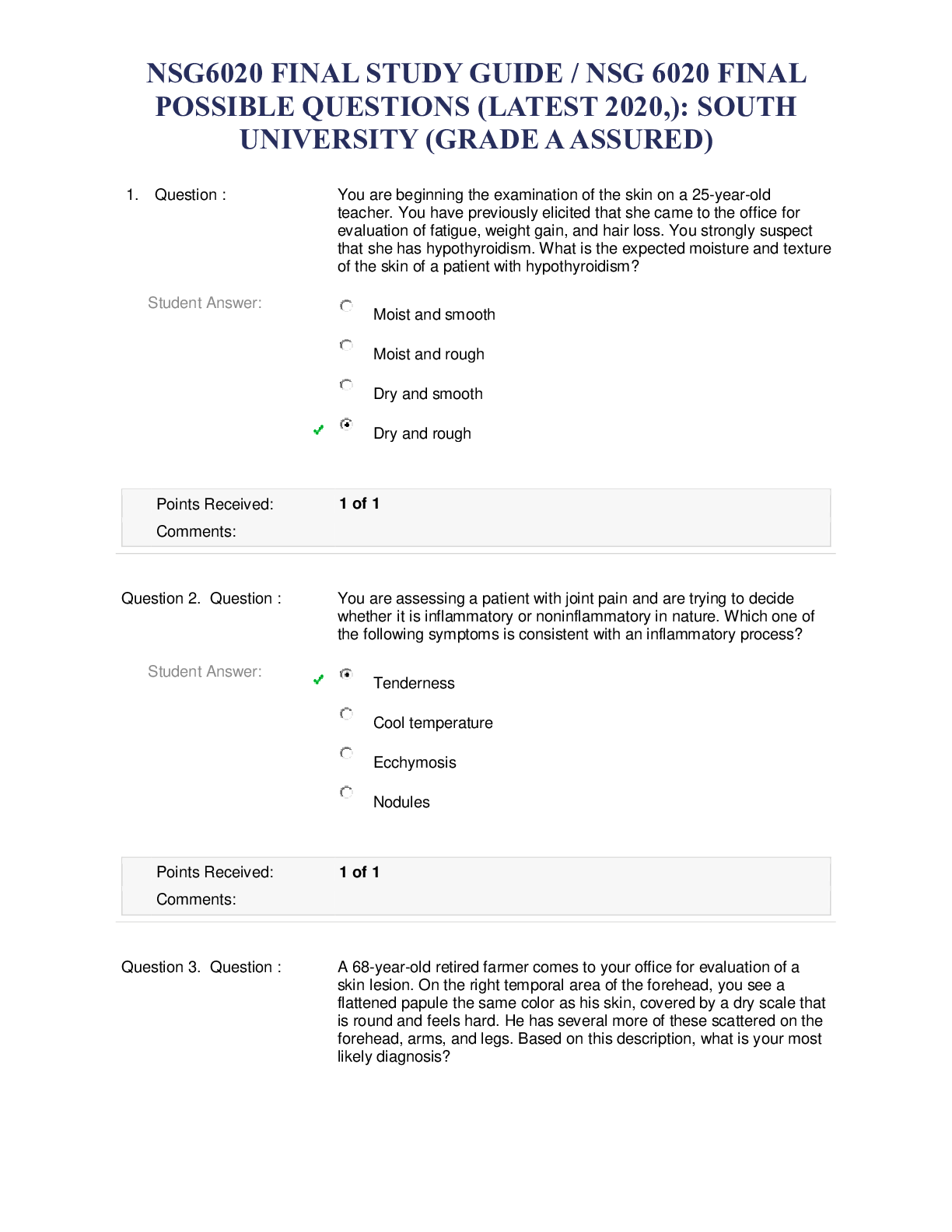

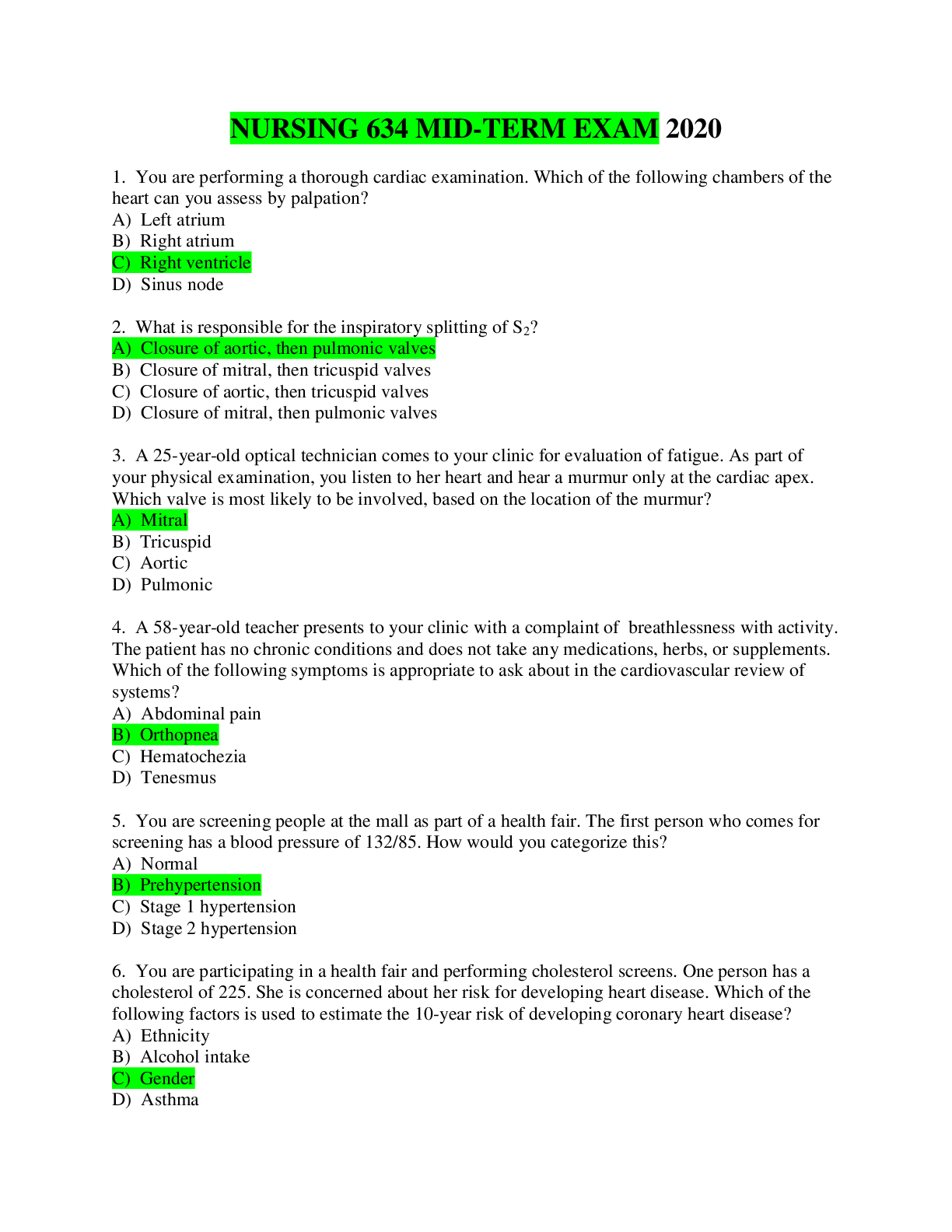

Fin 550 Final Exam Part 2 • Question 1 A stock currently sells for $75 per share. A put option on the stock with an exercise price $70 currently sells for $0.50. The put option is Answer ... • Question 2 4 out of 4 points Which of the following is consistent with put-call-spot parity? Answer • Question 3 4 out of 4 points An advantage of a forward contract over a futures contract is that Answer • Question 4 4 out of 4 points The cost of carry includes all of the following except Answer • Question 5 4 out of 4 points A call option in which the stock price is higher than the exercise price is said to be Answer • Question 6 4 out of 4 points The basis (Bt,T) at time t between the spot price (St) and a futures contract expiring at time T (Ft,T) is Answer • Question 7 4 out of 4 points The bond that maximizes the difference between the invoice price and the delivery price is referred to as the Answer • Question 8 4 out of 4 points An investor who wants a long position in a ____ must first place the order with a broker, who then passes it on to the trading pit or electronic network. Details of the order are then passed on to the exchange clearinghouse. Answer • Question 9 4 out of 4 points When F0,T > E(ST) it is known as Answer • Question 10 4 out of 4 points According to the cost of carry model the relationship between the spot (S0) and futures price (F0,T) is Answer • Question 11 4 out of 4 points A vertical spread involves buying and selling call options in the same stock with Answer • Question 12 0 out of 4 points In a money spread, an investor would Answer • Question 13 4 out of 4 points In the Black-Scholes option pricing model, an increase in time to expiration (T) will cause Answer • Question 14 4 out of 4 points The Black-Scholes model assumes that stock price movements can be described by Answer • Question 15 0 out of 4 points Which of the following is not a variable required to determine an option's value in the Black-Scholes valuation model? Answer • Question 16 4 out of 4 points Investment companies or mutual funds that continue to sell and repurchase shares after their initial public offerings are referred to as Answer • Question 17 4 out of 4 points Investing in emerging markets can be viewed as a global application of Answer • Question 18 4 out of 4 points The Securities Act of 1933 Answer • Question 19 4 out of 4 points Which of the following are guiding principles for ethical behavior in the asset management industry as put forward by the CFA Center for Financial Market Integrity? Answer • Question 20 4 out of 4 points An investment vehicle that acts like a mutual fund of hedge funds, and allows investors access to managers that might otherwise be unavailable is known as Answer [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 18, 2020

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Apr 18, 2020

Downloads

0

Views

38

.png)