Economics > QUESTIONS & ANSWERS > ECONOMICS 320. Test Bank for International Economics, 9e: CHAPTER 10 THE BALANCE OF PAYMENTS (ALREAD (All)

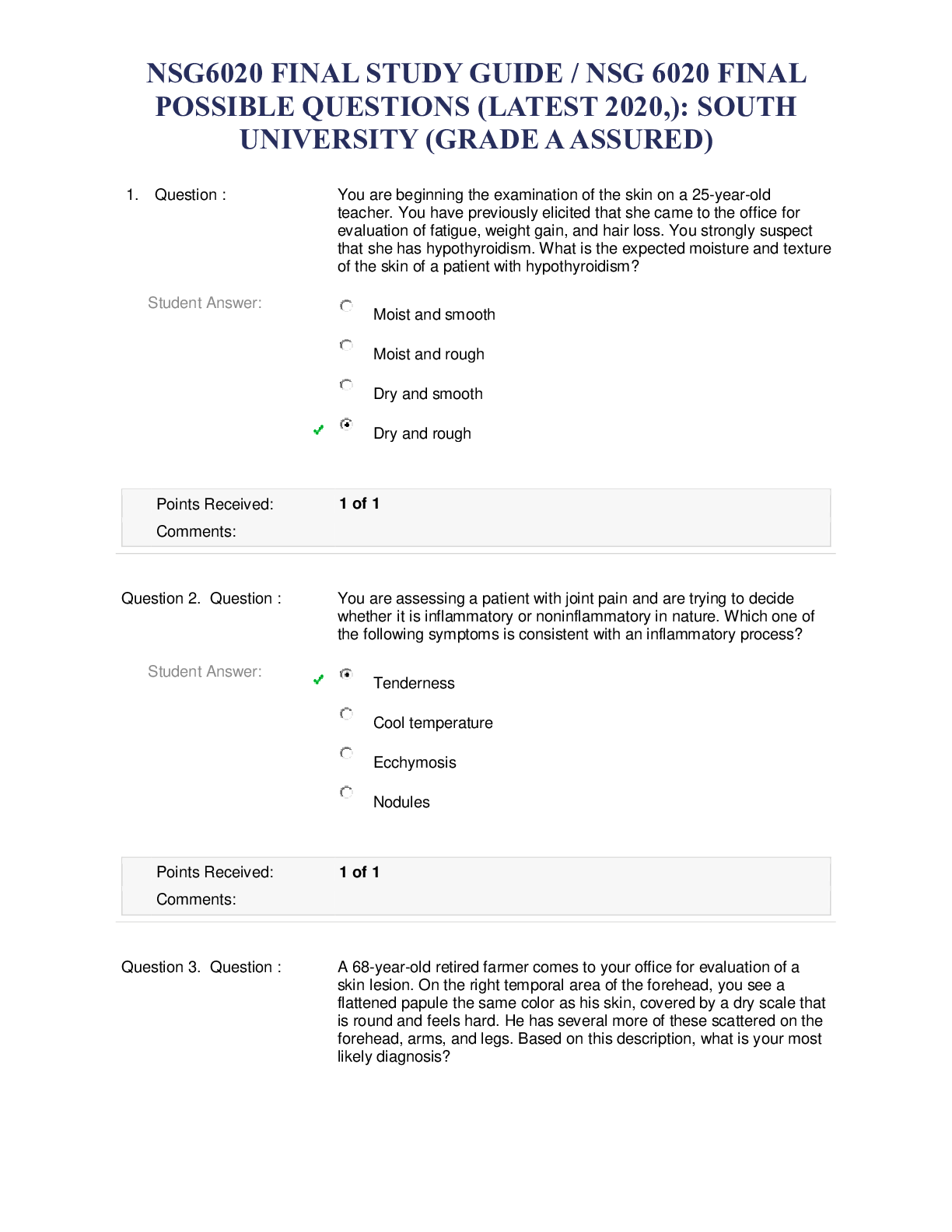

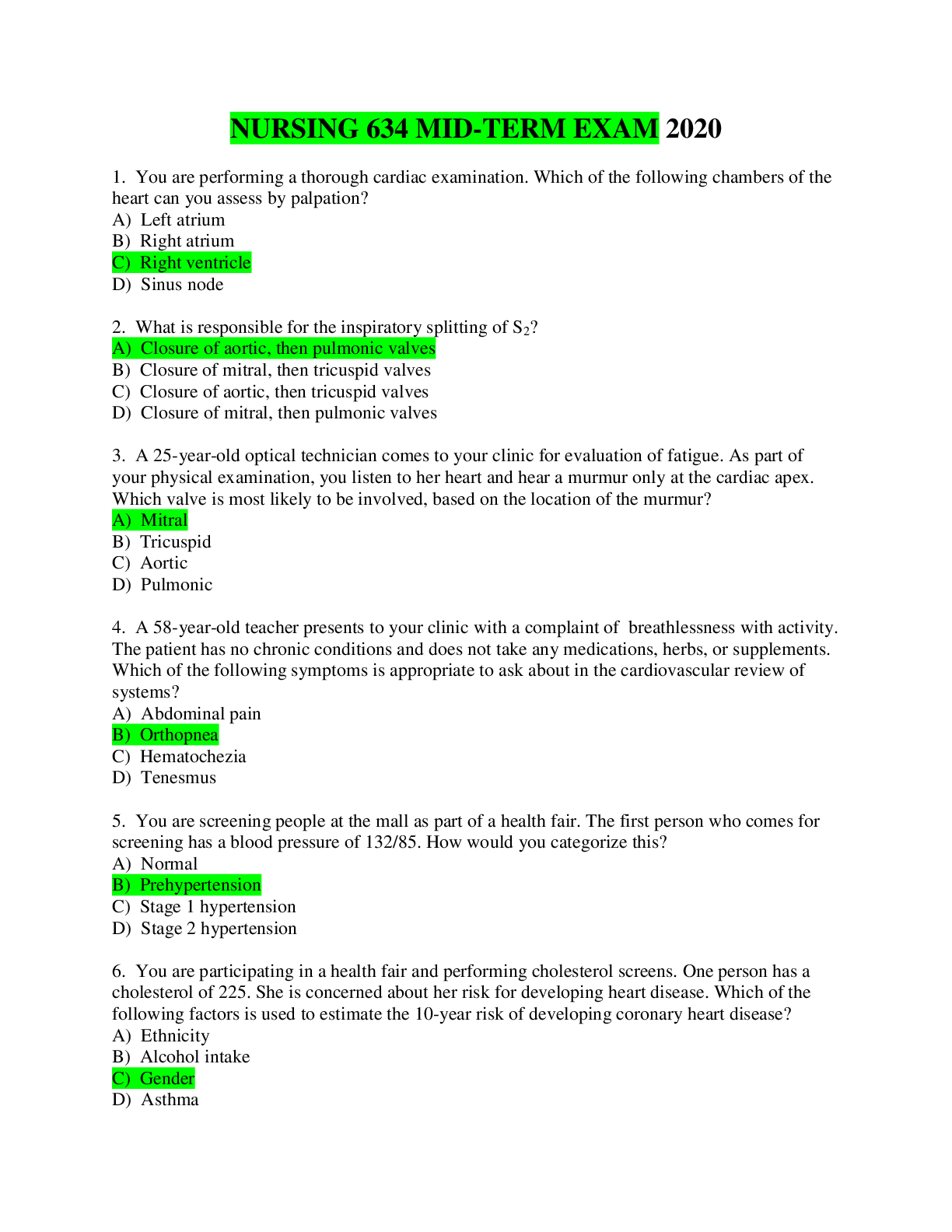

ECONOMICS 320. Test Bank for International Economics, 9e: CHAPTER 10 THE BALANCE OF PAYMENTS (ALREADY GRADED A)

Document Content and Description Below

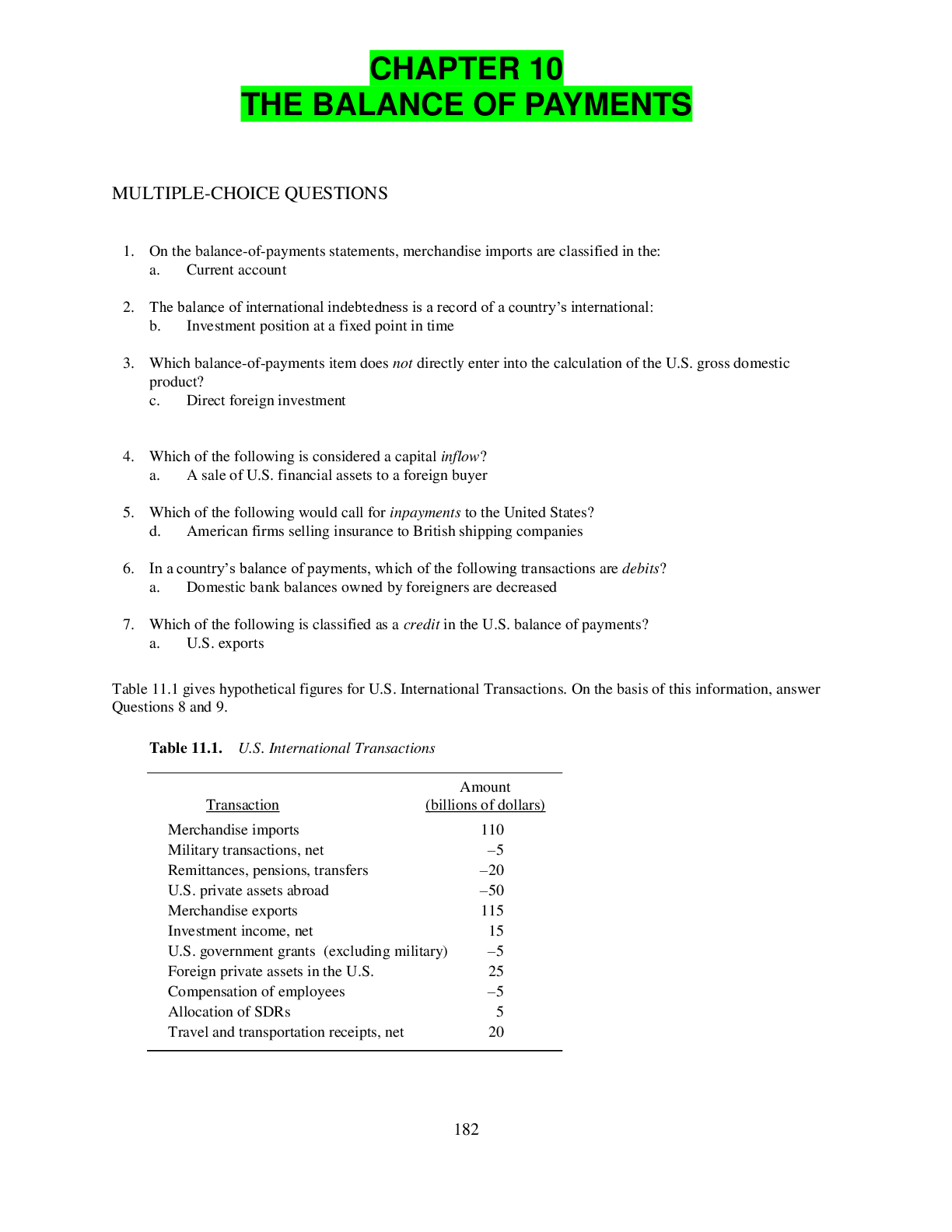

CHAPTER 10 THE BALANCE OF PAYMENTS MULTIPLE-CHOICE QUESTIONS 1. On the balance-of-payments statements, merchandise imports are classified in the: 2. The balance of international indebtedness is ... a record of a country’s international: 3. Which balance-of-payments item does not directly enter into the calculation of the U.S. gross domestic product? 4. Which of the following is considered a capital inflow? 5. Which of the following would call for inpayments to the United States? 6. In a country’s balance of payments, which of the following transactions are debits? 7. Which of the following is classified as a credit in the U.S. balance of payments? Table 11.1 gives hypothetical figures for U.S. International Transactions. On the basis of this information, answer Questions 8 and 9. Table 11.1. U.S. International Transactions Amount Transaction (billions of dollars) Merchandise imports 110 Military transactions, net –5 Remittances, pensions, transfers –20 U.S. private assets abroad –50 Merchandise exports 115 Investment income, net 15 U.S. government grants (excluding military) –5 Foreign private assets in the U.S. 25 Compensation of employees –5 Allocation of SDRs 5 Travel and transportation receipts, net 20 8. Based on the information provided in Table 11.1, the goods and services balance equals: 9. Based on the information provided in Table 11.1, the current account balance equals: 10. Unlike the balance of payments, the balance of international indebtedness indicates the international: 11. Which of the following indicates the international investment position of a country at a given moment in time? 12. Concerning the U.S. balance of payments, which account is defined in essentially the same way as the net export of goods and services, which comprises part of the country’s gross domestic product? 13. If an American receives dividends from the shares of stock she or he owns in Toyota, Inc., a Japanese firm, the transaction would be recorded on the U.S. balance of payments as a: 14. If the United States government sells military hardware to Saudi Arabia, the transaction would be recorded on the U.S. balance of payments as a: 15. The U.S. balance of trade is determined by: 16. U.S. military aid granted to foreign countries is entered in the: 17. If the U.S. faces a balance-of-payments deficit on the current account, it must run a surplus on: 18. The current account of the U.S. balance of payments does not include: 19. The U.S. has a balance of trade deficit when its: 20. The value to American residents of income earned from overseas investments shows up in which account in the U.S. balance of payments? a. Using the data of Table 11.2, answer Question 21. Table 11.2. International Investment Position of the United States U.S. assets abroad U.S. government assets $800 billion U.S. private assets $200 billion Foreign assets in the U.S. Foreign official assets $600 billion Foreign private assets $300 billion 21. Consider Table 11.2. The U.S. balance of international indebtedness suggests that the United States is a net: 22. For the first time since World War I, in 1985 the United States became a net international: 23. A country that is a net international debtor initially experiences: 24. Credit (+) items in the balance of payments correspond to anything that: 25. Debt (–) items in the balance of payments correspond to anything that: 26. When all of the debit or credit items in the balance of payments are combined: 27. In the balance of payments, the statistical discrepancy is used to: 28. All of the following are credit items in the balance of payments, except: 29. All of the following are debit items in the balance of payments, except: 30. The role of __________ is to direct one nation’s savings into another nation’s investments. 31. When a country realizes a deficit on its current account: 32. Reducing a current account deficit requires a country to: 33. Reducing a current account deficit requires a country to: 34. Reducing a current account surplus requires a country to: 35. Concerning a country’s business cycle, rapid growth of production and employment is commonly associated with: 36. The burden of a current account deficit would be the least if a nation uses what it borrows to finance: 37. Concerning a country’s business cycle, __________ is commonly associated with large or growing current account deficits: 38. According to researchers at the Federal Reserve, the loss of jobs associated with a deficit in the current account tends to be: TRUE-FALSE QUESTIONS Table 11.3 shows hypothetical transactions, in billions of U.S. dollars, that took place during a year. Answer the next seven questions on the basis of this information. Table 11.3. International Transactions of the United States Amount Transaction (billions of dollars) Allocation of SDRs 10 Changes in U.S. assets abroad 100 Statistical discrepancy –15 Merchandise imports –400 Payments on foreign assets in U.S. –20 Remittances, pensions, transfers –60 Travel and transportation receipts, net 30 Military transactions, net –10 Investment income, net 100 Merchandise exports 350 U.S. government grants (excluding military) –20 Changes in foreign assets in the U.S. 190 Other services, net 80 Receipts on U.S. investments abroad 30 Compensation of employees –10 1. Consider Table 11.3. The merchandise-trade balance registered a deficit of $50 billion. 2. Consider Table 11.3. The services balance registered a surplus of $100 billion. 3. Consider Table 11.3. The goods-and-services balance registered a surplus of $50 billion. 4. Consider Table 11.3. The unilateral-transfers balance registered a deficit of $40 billion. 5. Consider Table 11.3. The current-account balance registered a surplus of $30 billion. 6. Consider Table 11.3. The “net exports” component of the U.S. gross domestic product registered $–110 billion. 7. Consider Table 11.3. The payments data suggest that the United States was a “net demander” of $30 billion from the rest of the world. 8. The balance of payments refers to the stock of trade and investment transactions that exists at a particular point in time. 9. Referring to the balance-of-payments statement, an international transaction refers to the exchange of goods, services, and assets between residents of one country and those abroad. 10. The balance of payments includes international transactions of households and businesses, but not government. 11. Because the balance of payments utilizes double-entry accounting, merchandise exports will always be in balance with merchandise imports. 12. On the U.S. balance-of-payments statement, the following transactions are credits, leading to the receipt of dollars from foreigners: merchandise exports, transportation receipts, income received from investments abroad, and investments in the United States by foreign residents. 13. On the U.S. balance of payments, the following transactions are debits, leading to payments to foreigners: merchandise imports, travel expenditures, gifts to foreign residents, and overseas investments by U.S. residents. 14. The “goods and services” account of the balance of payments shows the monetary value of international flows associated with transactions in goods, services, and unilateral transfers. 15. An increase in import restrictions by the U.S. government tends to promote a merchandise-trade surplus. 16. Services transactions on Canada’s balance-of-payments statement would include Canadian ships transporting lumber to Japan, foreign tourists spending money in Canada, and Canadian engineers designing bridges in China. 17. On the balance-of-payments statement, dividend and interest income are classified as capital-account transactions. 18. A surplus on Germany’s goods-and-services balance indicates that Germany has sold more goods and services to foreigners than it has bought from them over a one-year period. 19. The merchandise-trade account on the balance-of-payments statement is defined the same way as “net exports” which constitutes part of the nation’s gross domestic product. 20. A positive balance on the goods-and-services account of the balance of payments indicates an excess of exports over imports which must be added to the nation’s gross domestic product. 21. For the United States, merchandise trade has generally constituted the largest portion of its goods-and-services account. 22. Unilateral transfers refer to two-sided transactions, reflecting the movement of goods and services in one direction with corresponding payments in the other direction. 23. Unilateral transfers consist of private-sector transfers, such as church contributions to alleviate starvation in Africa, as well as governmental transfers, such as foreign aid. 24. Current-account transactions include direct foreign investment, purchases of foreign government securities, and commercial bank loans made abroad. 25. On the U.S. balance-of-payments statement, a capital inflow would occur if a Swiss resident purchases the securities of the U.S. government. 26. If Toyota Inc. of Japan builds an automobile assembly plant in the United States, the Japanese capital account would register an outflow. 27. If Bank of America receives repayment for a loan it made to a Mexican firm, the U.S. capital account would register an inflow. 28. On the balance-of-payments statement, a capital inflow can be likened to the import of goods and services. 29. The capital account of the balance of payments includes private-sector transactions as well as official-settlements transactions of the home country’s central bank. 30. If the current account of the balance of payments registers a deficit, the capital account registers a surplus, and vice versa. 31. Concerning the balance of payments, a current-account surplus means an excess of exports over imports of goods, services, investment income, and unilateral transfers. 32. If a country realizes a current-account deficit in its balance of payments, it becomes a net supplier of funds to the rest of the world. 33. Concerning the balance of payments, a current-account deficit results in a worsening of a country’s net foreign investment position. 34. In the balance-of-payments statement, statistical discrepancy is treated as part of the merchandise trade account because merchandise transactions are generally the most frequent source of error. 35. Because a large number of international transactions fail to get recorded, statisticians insert a residual, known as statistical discrepancy, to ensure that total debits equal total credits. 36. Concerning the balance of payments, the goods-and-services balance is commonly referred to as the “trade balance” by the news media. 37. Since the 1970s, the merchandise trade account of the U.S. balance of payments has registered deficit. 38. Although the United States has realized merchandise trade deficits since the early 1970s, its goods-and-services balance has always registered surplus. 39. In the past two decades, the U.S. services balance has generally registered surplus. 40. The U.S. unilateral-transfers balance has consistently registered surplus in the past two decades. 41. Because the balance of payments is a record of the economic transactions of a country over a period of time, it is a “flow” concept. 42. The United States would be a “net creditor” if the value of U.S. assets abroad exceeded the value of foreign assets in the United States. 43. If a country consistently realizes a current-account surplus in its balance of payments, it likely will become a “net debtor” in its balance of international indebtedness. 44. By the mid-1980s, the United States had evolved from the status of a net-creditor nation to a net-debtor nation in its balance of international indebtedness. 45. The net-debtor status, that the United States achieved in its balance of international indebtedness by the mid-1980s, reflected the continuous current-account surplus that the United States attained in its balance of payments during the 1970s. 46. Although a net-debtor country may initially benefit from an inflow of savings from abroad, over the long run continued borrowing results in growing dividend payments to foreigners and a drain on the debtor country’s economic resources. 47. The official reserve assets of the United States consist of holdings of gold and foreign corporate securities. 48. That U.S. importers purchase bananas from Brazil constitutes a debit transaction on the U.S. balance of payments. 49. That German investors collect interest income on their holdings of U.S. Treasury bills constitutes a credit transaction on the U.S. balance of payments. 50. That U.S. charities donate funds to combat starvation in Africa constitutes a debit transaction on the U.S. balance of payments. 51. To reduce a current account deficit, a country should either decrease the budget deficit of its government or reduce investment spending relative to saving. 52. Most economists belief that in the 1980s, a massive outflow of capital caused a current account deficit for the United States. 53. A current account deficit for the United States necessarily reduces the standard of living for American households. 54. Rapid growth of production and employment is commonly associated with large or growing trade surpluses and current account surpluses. 55. Often, countries realizing rapid economic growth rates possess long-run current account deficits. 56. For the United States, a consequence of its current account deficit is a growing foreign ownership of the capital stock of the United States and a rising fraction of U.S. income that must be diverted abroad in the form of interest and dividends to foreigners. 57. Most economists contend that any reduction in the current account deficit is better achieved through increased national saving than through reduced domestic investment. [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 25, 2020

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Apr 25, 2020

Downloads

0

Views

51