Finance > QUESTIONS & ANSWERS > University Of Massachusetts, Lowell FINA 3010 – 207 & 209 Financial Management Exam I - Part 1 (Ta (All)

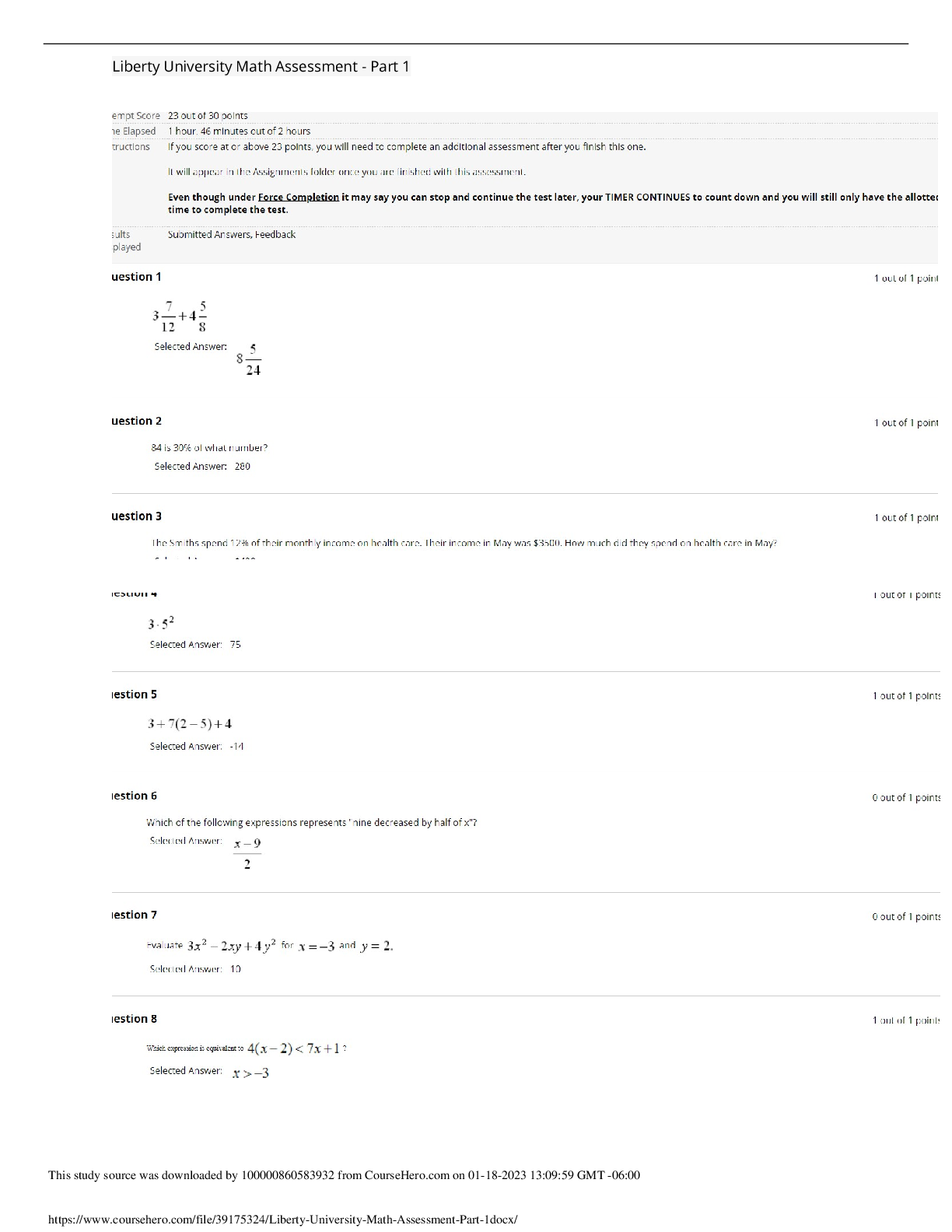

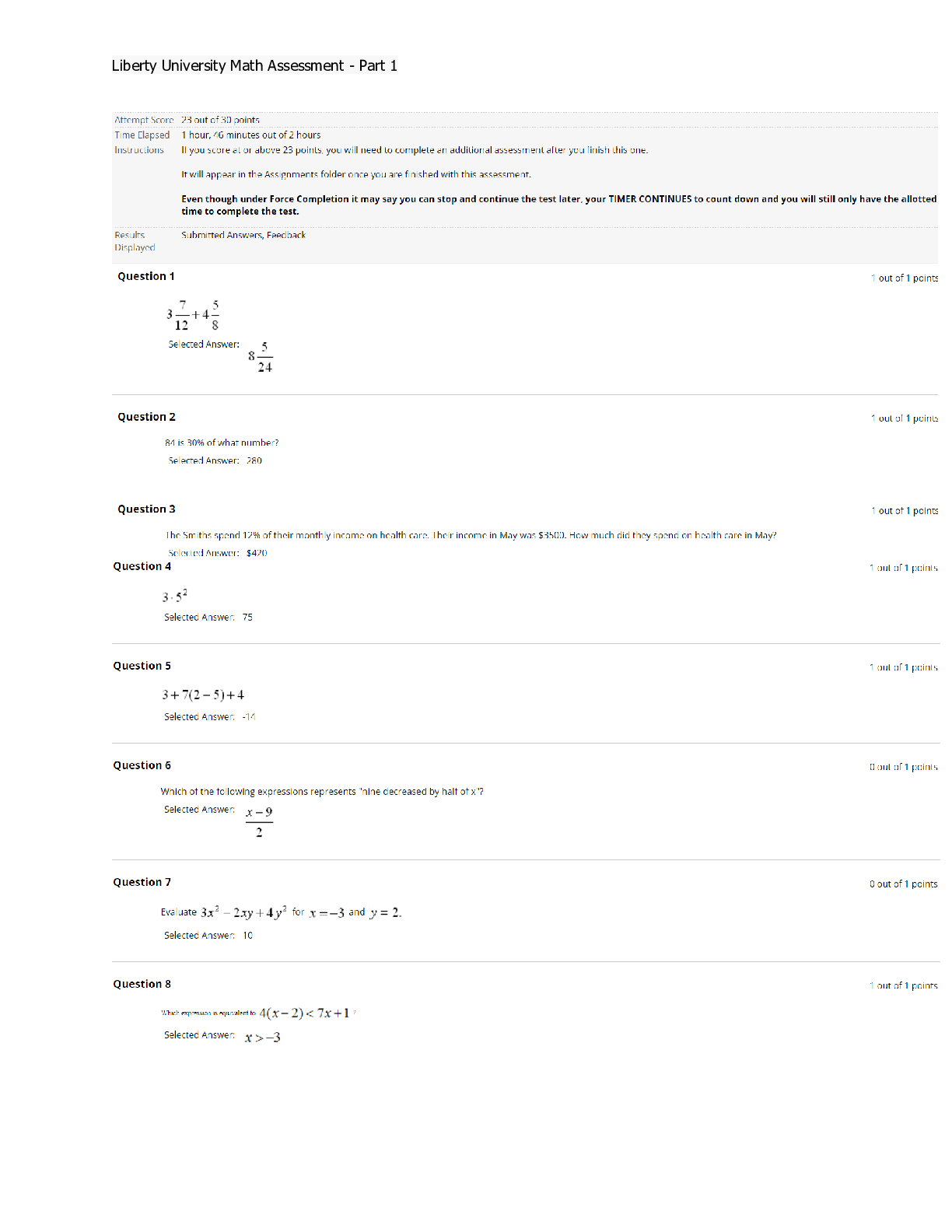

University Of Massachusetts, Lowell FINA 3010 – 207 & 209 Financial Management Exam I - Part 1 (Take Home Problems) • CHAPTER 3 FINANCIAL STATEMENT – CASH FLOW (25 Points)

Document Content and Description Below

University Of Massachusetts, Lowell FINA 3010 – 207 & 209 Financial Management Exam I - Part 1 (Take Home Problems) • CHAPTER 3 FINANCIAL STATEMENT – CASH FLOW (25 Points) • River Road I... nc. recently reported $185,250 of sales, $140,500 of operating costs other than depreciation, and $9,250 of depreciation. The company had $35,250 of outstanding bonds that carry a 6.75% interest rate, and its federal- plus-state income tax rate was 35%. In order to sustain its operations and thus generate future sales and cash flows, the firm was required to spend $15,250 to buy new fixed assets and to invest $6,850 in net operating working capital. What was the firm’s free cash flow? (5 POINTS) Answer: Sales $185,250 Operating costs 140,500 Depreciation 9,250 Operating income (EBIT) $ 35,500 FCF = EBIT * (1 - T) - ∆ NFA - ∆ CA + ∆ CL FCF = [EBIT(1 − T) + Deprec. and Amort.] – [Capital Expenditures + Net operating working capital] FCF = ($23,075.00 + $9,250 ) – ($15,250 + $6,850) Free cash flow FCF = $10,225 • Rhodes Company’s balance sheet showed total current assets of $12,500, all of which were required in operations. Its current liabilities consisted of $2,868 of accounts payable, $1,765 of 6% short-term notes payable to the bank, and $735 of accrued wages and taxes. What was its net operating working capital? (4 POINTS) Answer: Current Assets = $12,500 Excess cash = $0 Current liabilities – note payable = $2,868 + $735 NOWC = (current Assets – excess cash) – (current liabilities – note payable) NOWC = $12,500 – ($2,868 + $735) NOWC = $8,897 [Show More]

Last updated: 1 year ago

Preview 1 out of pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 06, 2021

Number of pages

Written in

Additional information

This document has been written for:

Uploaded

Mar 06, 2021

Downloads

0

Views

3

.png)

.png)

.png)