Finance > QUESTIONS & ANSWERS > FIN515 Managerial Finance Final-Exam Complete questions and Answer 2020 docs (All)

FIN515 Managerial Finance Final-Exam Complete questions and Answer 2020 docs

Document Content and Description Below

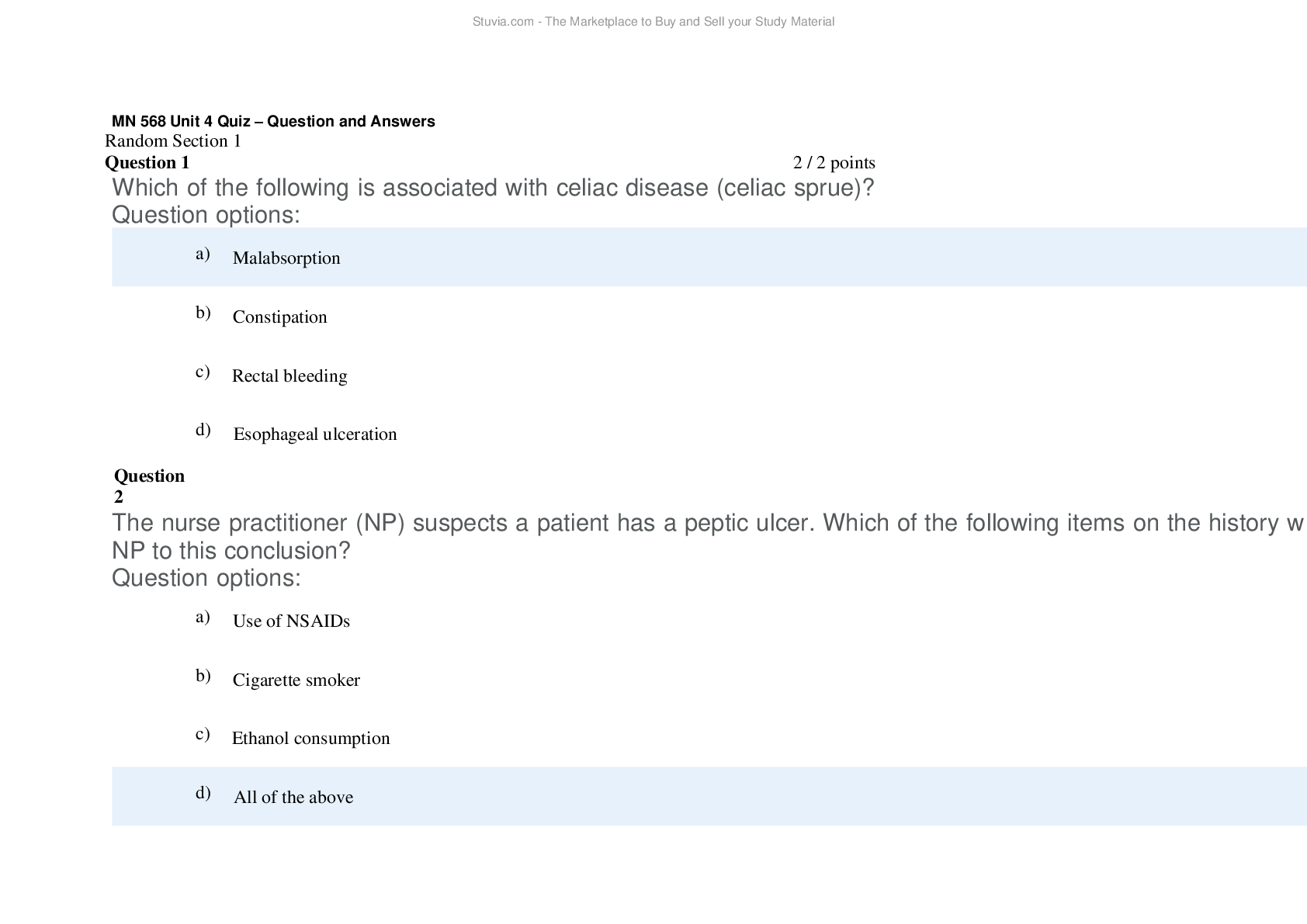

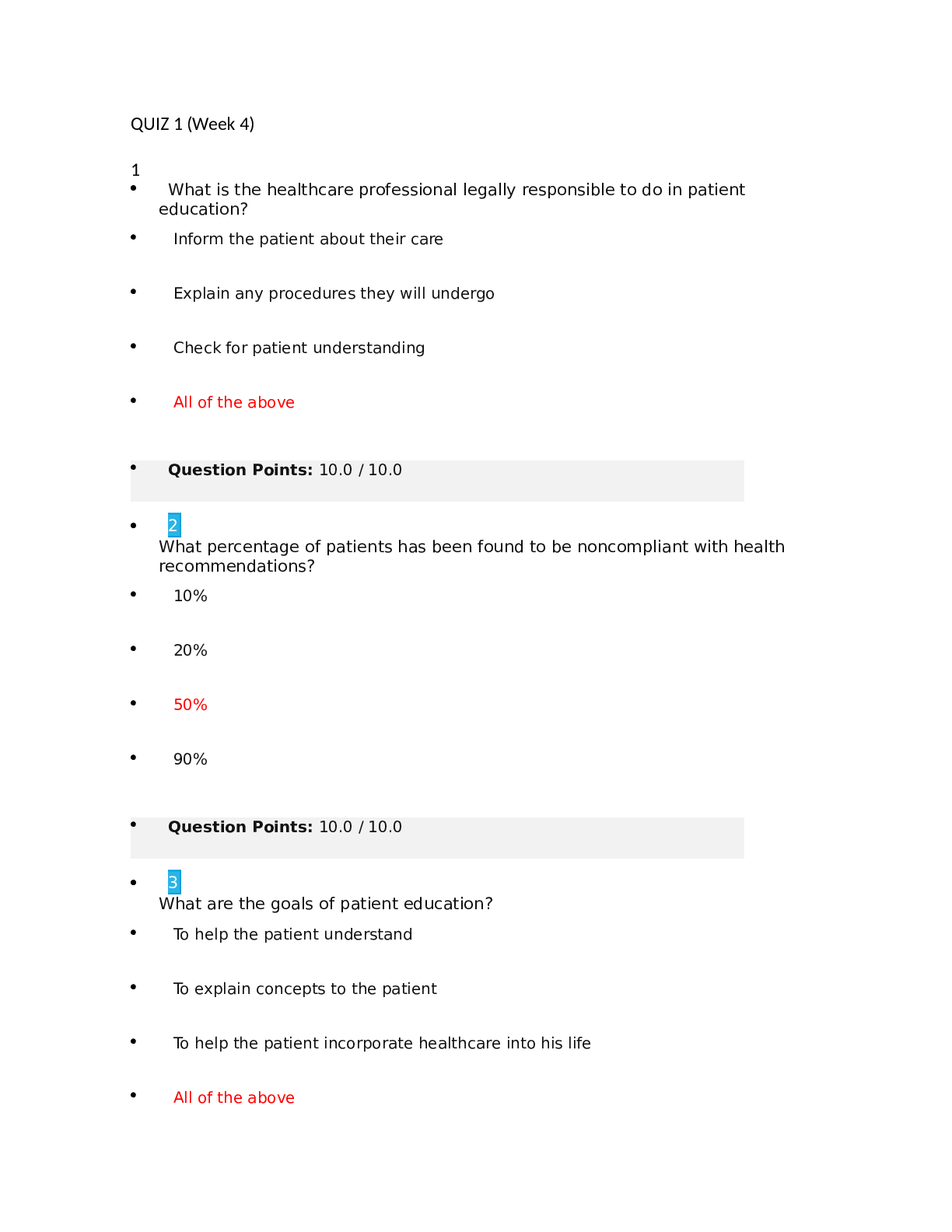

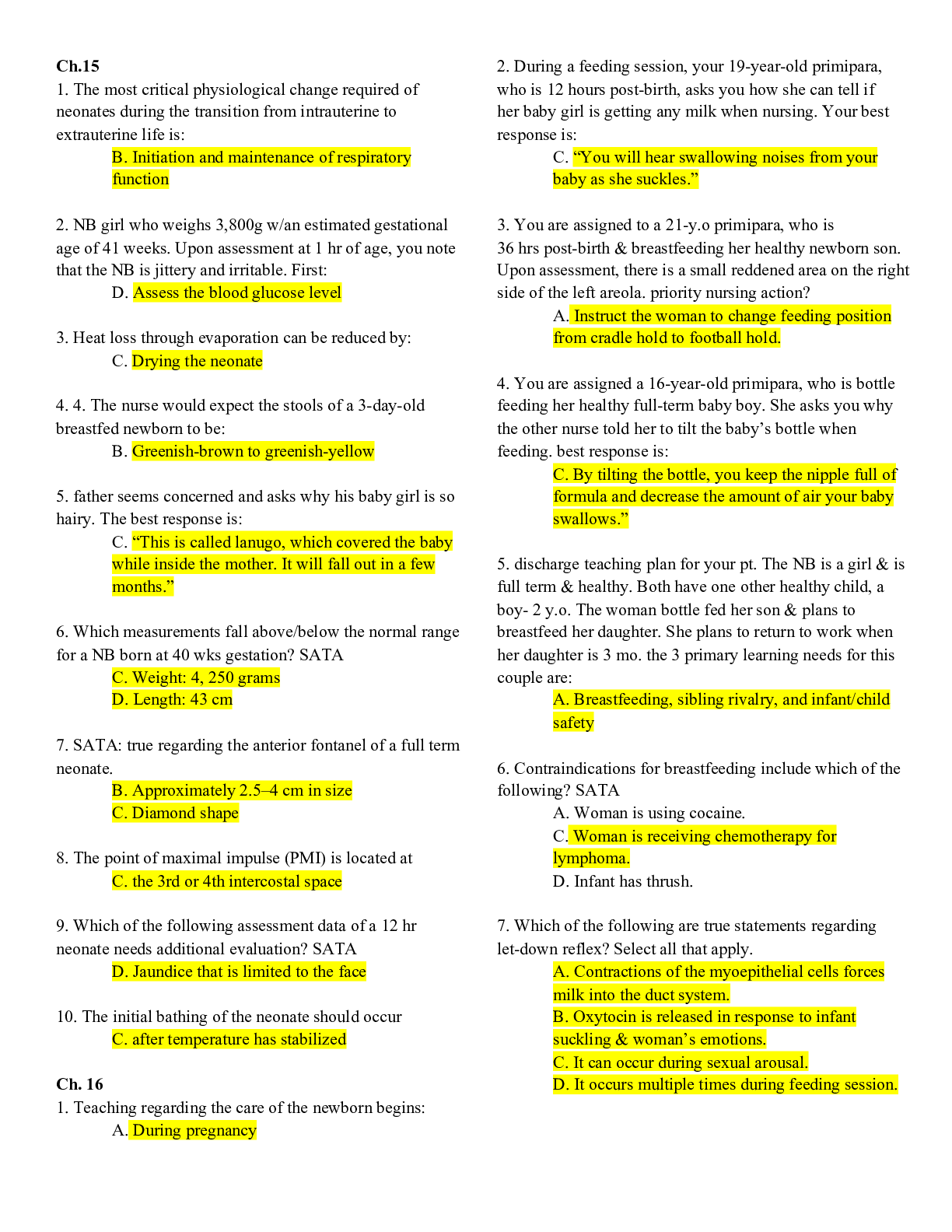

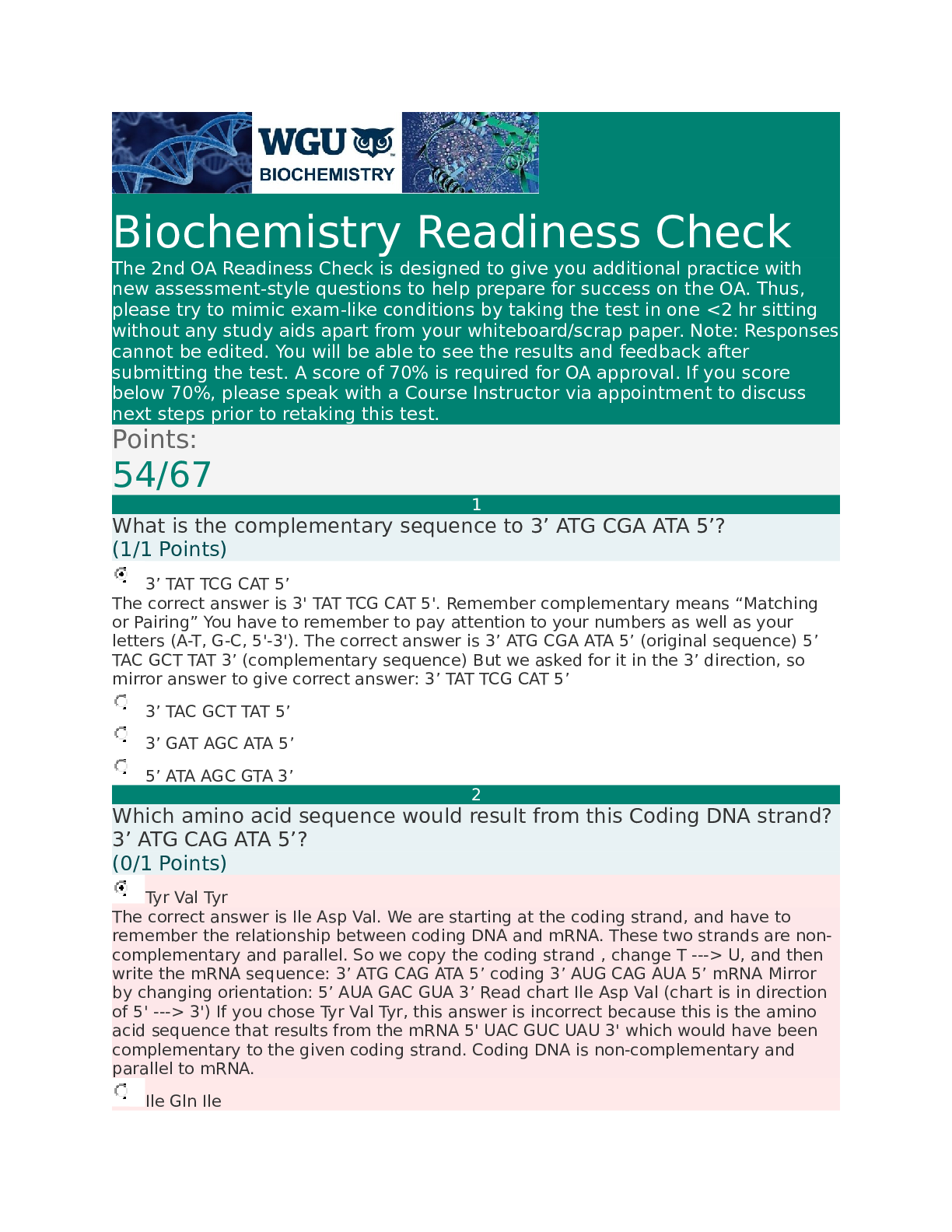

FIN515 Managerial Finance Final-Exam Complete questions and Answer 2020 docs 1. (TCO A) In the United States, which of the following types of organization has the greatest revenue in total? a. Sole pr... oprietorship b. C corporation c. S corporation d. Limited partnership Question 2. (TCO A) Which of the following statements is NOT correct? (Points : 5) Question 3. (TCO A) Sole proprietorships have all of the following advantages except ? a. easy to set up. b. single taxation of income. c. limited liability. d. ownership and control are not separated. Question 4. (TCO B) Which of the following would cause the present value of an annuity to decrease? a. Reducing the number of payments. b. Increasing the number of payments. c. Decreasing the interest rate. d. Decreasing the liquidity of the payments. Question 5. (TCO B) In a TVM calculation, if incoming cash flows are positive, outgoing cash flows must be a. positive. b. negative. c. either positive or negative. It really doesn’t matter. d. stated in time units that are different from the time units in which the interest rates are stated. Question 6. Which of the following statements is correct? (Points : 5) . Question 7. (TCO G) The Chadmark Corporation's budgeted monthly sales are $3,000. In the first month, 40% of its customers pay and take the 2% discount. The remaining 60% pay in the month following the sale and don't receive a discount. Chadmark's bad debts are very small and are excluded from this analysis. Purchases for next month's sales are constant each month at $1,500. Other payments for wages, rent, and taxes are constant at $700 per month. Construct a single month's cash budget with the information given. What is the average cash gain or (loss) during a typical month for the Chadmark Corporation? 8. If you were a manager of a company, which of the three right side components of the DuPont Identity would you want to increase and which would you want to decrease, other things being equal? Give a specific example for how to do that for each of the three. 9. (TCO B) Leak Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments). Year: 1 2 Free cash flow: -$50 $100 10. A stock pays an annual dividend of $2.50 and that dividend is not expected to change. Similar stocks pay a return of 10%. What is P0? 11. A stock has just paid a dividend and has declared an annual dividend of $2.00 to be paid one year from today. The dividend is expected to grow at a 5% annual rate. The return on equity for similar stocks is 12%. What is P0? 12. A bond has 5 years to maturity and has a YTM of 8%. Its par value is $1,000. Its semiannual coupons are $50. What is the bonds current market price? 13. A bond currently sells for $1,000 and has a par of $1,000. It was issued two years ago and had a maturity of 10 years. The coupon rate is 7% and the interest payments are made semiannually. What is its YTM? 1000 = 35 * 1/y * ( 1- 1/(1 + y)^16) + 1000 /( 1+y)^16 Using Excel Formula To compute the yield to maturity using excel , we can use the function 14. A company has 10 million shares outstanding trading for $7 per share. It also has $300 million in outstanding debt. If its equity cost of capital is 15%, and its debt cost of capital is 9%, and its effective corporate tax rate is 40%, what is its weighted average cost of capital? 15. Name and describe the three functions of managerial finance. For each, give an example other than those used in the text and lecture. 16. Explain thoroughly how stock portfolios affect the risk to an investor. 17. What is the Cash Conversion Cycle (CCC)? Name the components of the CCC and explain why the CCC is important to business. 18. A company has the opportunity to do any of the projects for which the net cash flows per year are shown below. The company has a cost of capital of 12%. Which should the company do and why? You must use at least two capital budgeting methods. Show your work. Year A B C 0 -300 -100 -300 1 100 -50 100 2 100 100 100 3 100 100 100 4 100 100 100 5 100 100 100 6 100 100 100 7 -100 -200 0 [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 19, 2021

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Mar 19, 2021

Downloads

0

Views

37