Finance > EXAM > BLOOMBERG MARKET CERTIFICATE REVIEW QUESTIONS AND ANSWERS (Complete) 100% Graded A (All)

BLOOMBERG MARKET CERTIFICATE REVIEW QUESTIONS AND ANSWERS (Complete) 100% Graded A

Document Content and Description Below

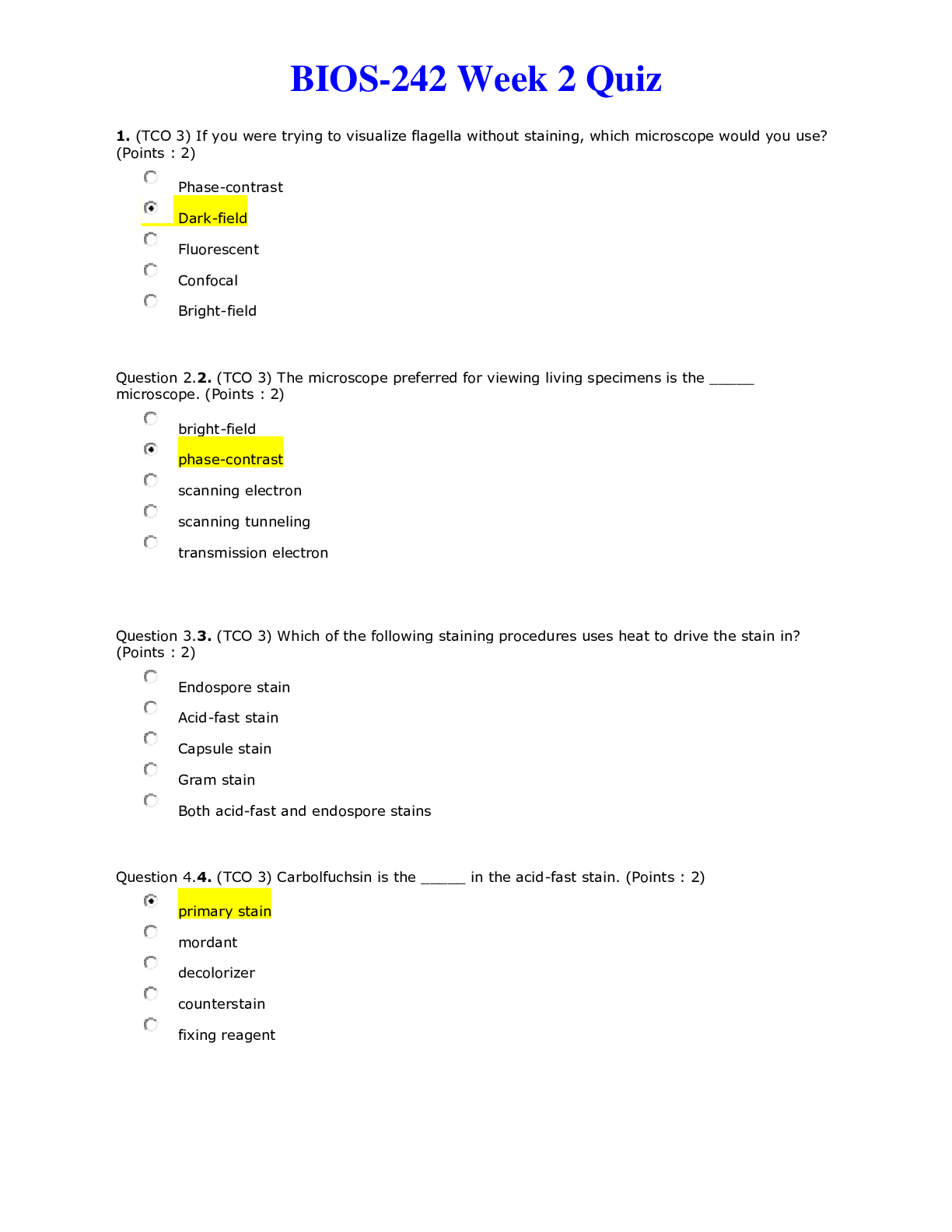

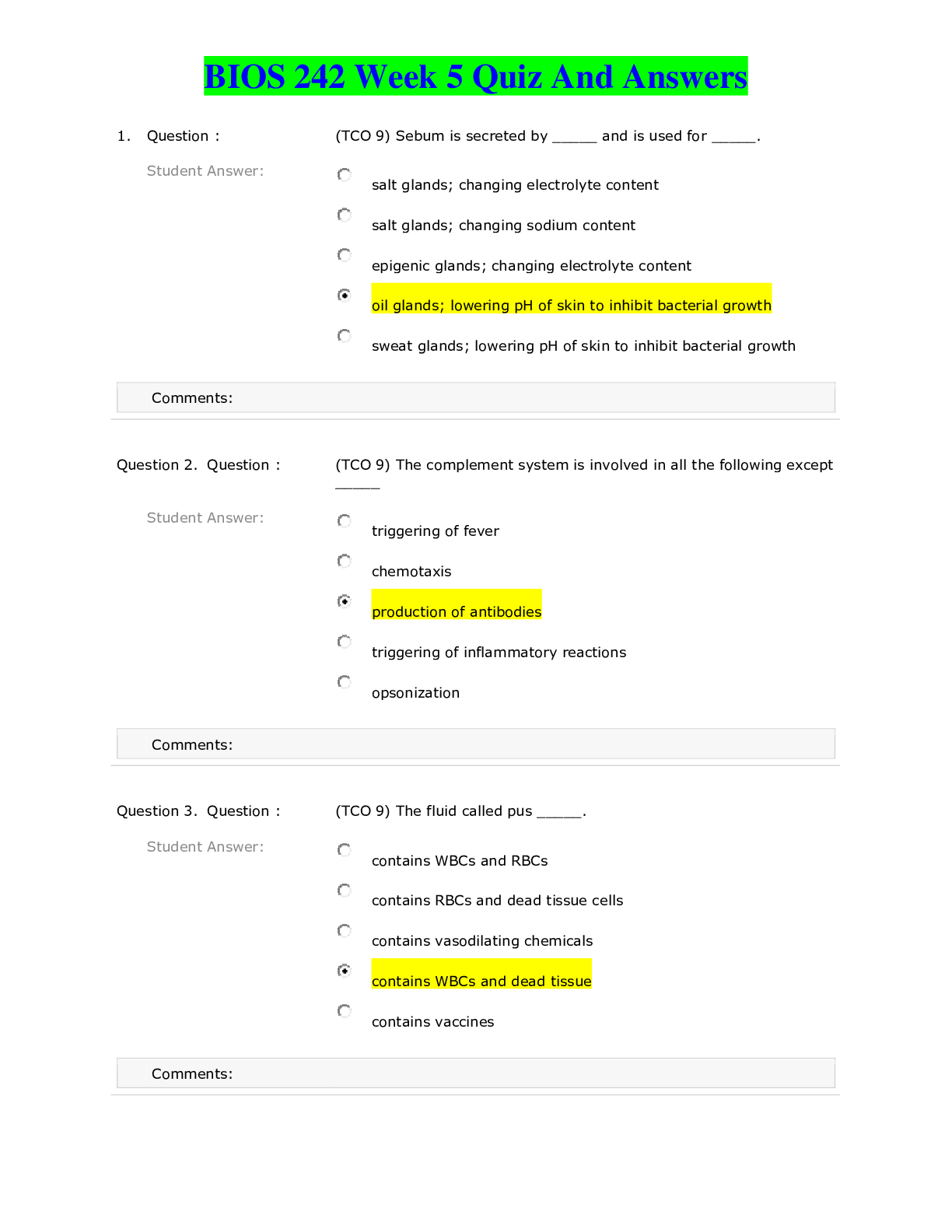

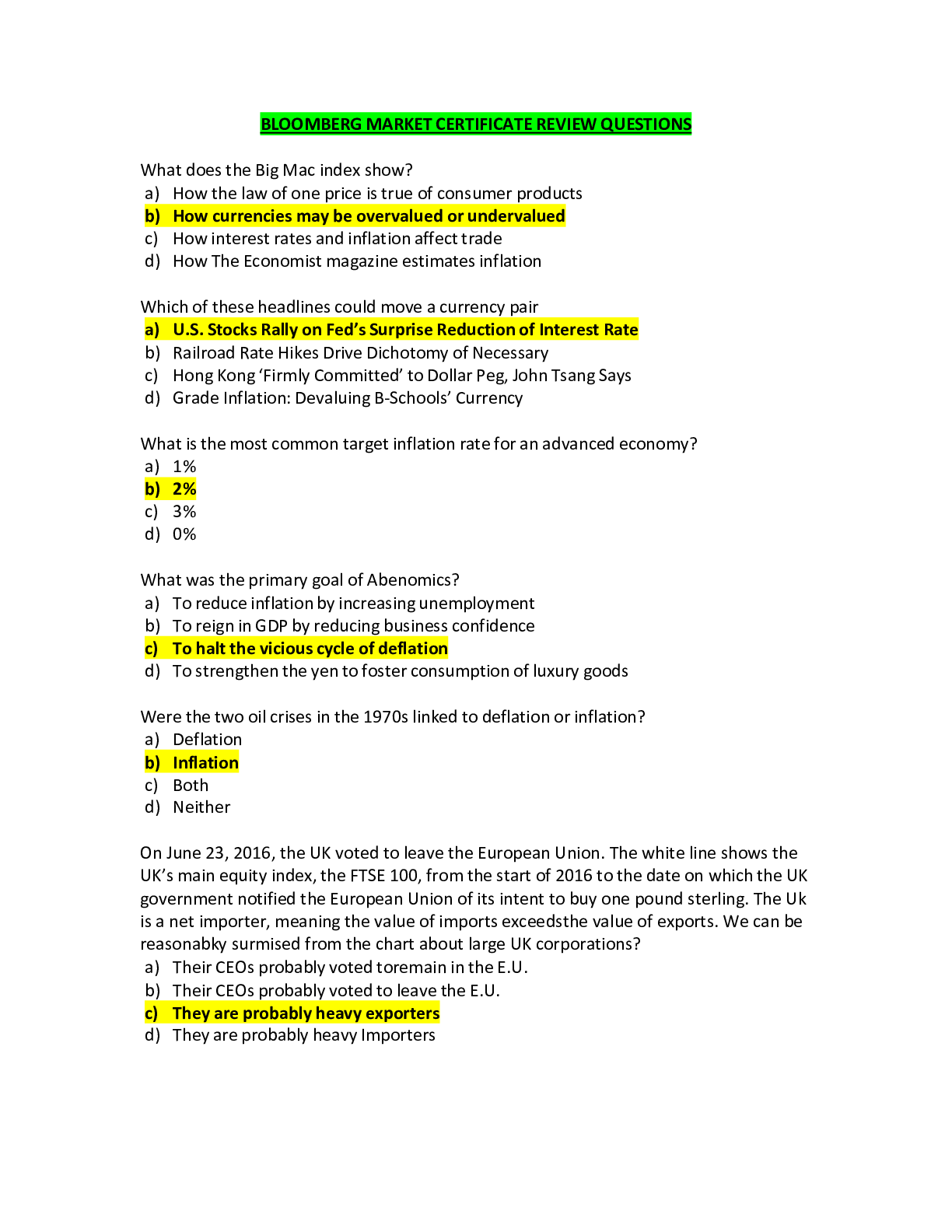

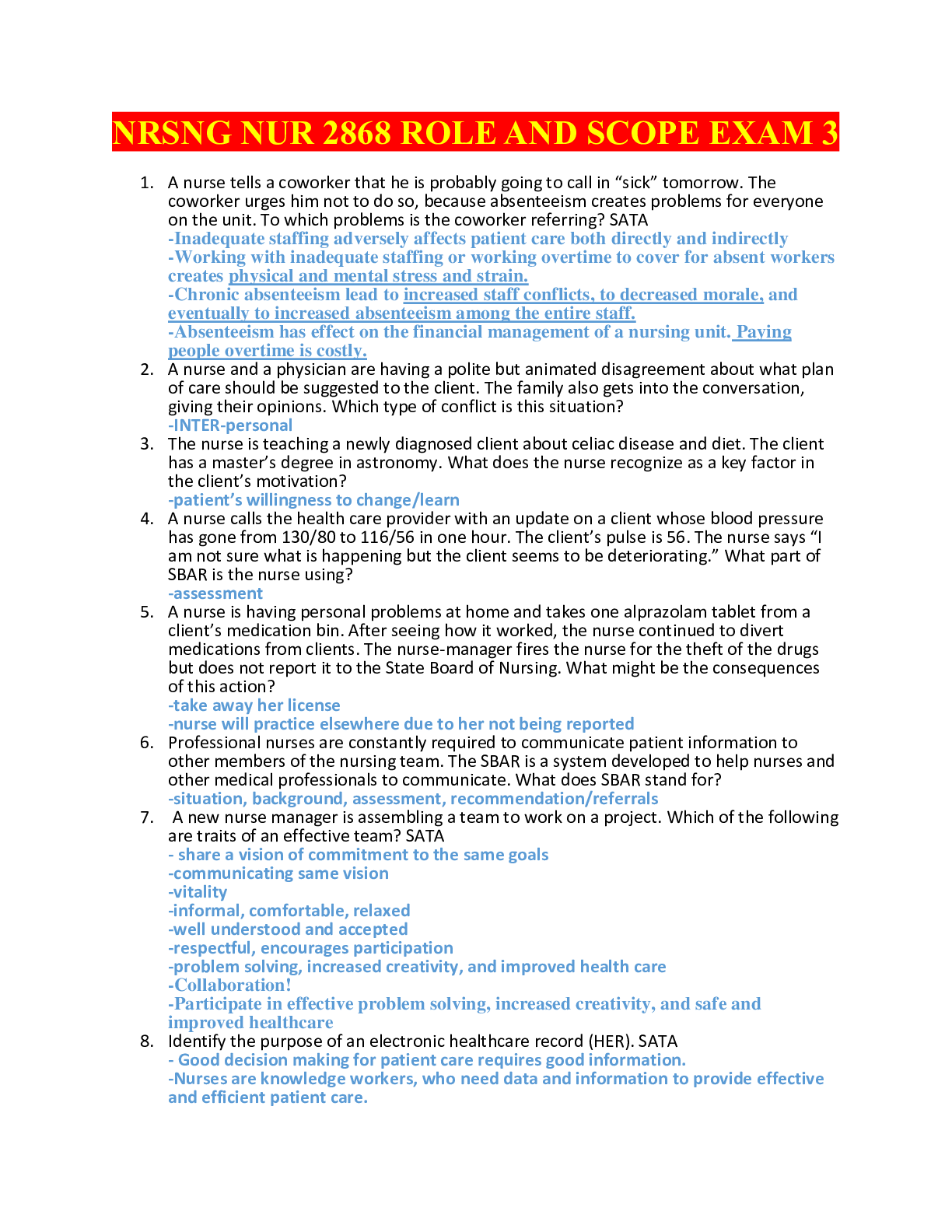

BLOOMBERG MARKET CERTIFICATE REVIEW QUESTIONS What does the Big Mac index show? a) How the law of one price is true of consumer products b) How currencies may be overvalued or undervalued c) How i... nterest rates and inflation affect trade d) How The Economist magazine estimates inflation Which of these headlines could move a currency pair a) U.S. Stocks Rally on Fed’s Surprise Reduction of Interest Rate b) Railroad Rate Hikes Drive Dichotomy of Necessary c) Hong Kong ‘Firmly Committed’ to Dollar Peg, John Tsang Says d) Grade Inflation: Devaluing B-Schools’ Currency What is the most common target inflation rate for an advanced economy? a) 1% b) 2% c) 3% d) 0% What was the primary goal of Abenomics? a) To reduce inflation by increasing unemployment b) To reign in GDP by reducing business confidence c) To halt the vicious cycle of deflation d) To strengthen the yen to foster consumption of luxury goods Were the two oil crises in the 1970s linked to deflation or inflation? a) Deflation b) Inflation c) Both d) Neither On June 23, 2016, the UK voted to leave the European Union. The white line shows the UK’s main equity index, the FTSE 100, from the start of 2016 to the date on which the UK government notified the European Union of its intent to buy one pound sterling. The Uk is a net importer, meaning the value of imports exceedsthe value of exports. We can be reasonabky surmised from the chart about large UK corporations? a) Their CEOs probably voted toremain in the E.U. b) Their CEOs probably voted to leave the E.U. c) They are probably heavy exporters d) They are probably heavy Importers In early 2016, the same Germany machinery company has interest from four prospective clients from engineering markets: Indonesia, Brazil, Russia, and South Africa. They all want to buy ten machines, but the factory can only produce ten in time. Therefore, the company has to choose only one client. Given the volatility of the domestic currencies of the four prospective clients, the CEO would like to choose the client which is least likely to cancel the order due to currency volatility. The invoice comes due on June 30, 2016. According to historical currency volatility alone, which prospective client would be least likely to cancel the order (see chart 1)? a) Indonesia b) Brazil c) Russia d) South Africa Imagine you are a Dutch diamond dealer who sources diamonds from South Africa. […] You check the forward rates on offer on the Bloomberg FRD function. You have two options. Exchange euros today at today’s exchange rate to pay him on million rands now, or lock in a forward agreement to convert euros to one million rands in one year’s time and share the forward agreement with him. If you were to do the forward instead of exchanging euros for rands today, approximately how much more or less would you end up with in a year? (see chart 2) a) EUR 4,717 more b) EUR 4,717 fewer c) ZAR 4,717 more d) ZAR 4,717 fewer Legendary investor Warren Buffet said: “Gold gets dug out of the ground…. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.” Based on this quotation, what quality of gold is he referring to? a) Its durability b) Its scarcity c) Its physical attractiveness d) Its storage costs Here is a chart showing both nominal GDP growth and real GDP growth for a country. Which of the following can be a true statement at the time the chart was captured? a) The country has inflation. The top line is nominal growth and the bottom line is real growth. b) The country has inflation. The bottom line is nominal growth and the top line is real growth. c) The country has deflation. The top line is nominal growth and the bottom line is real growth. d) The country has deflation. The bottom line is nominal growth and the top line is real growth. Which of the following lines is the best leading economic indicator? a) PMI b) Nonfarm payrolls c) Real GDP growth d) U.S. auto sales The “misery index” is often cited in the media as a way to measure consumer pain. It is defined as the inflation rate plus the unemployment rate. Identify the country with the highest “misery index.” a) Argentina b) India c) France d) Italy What tipically happens to nonfarm payrolls, the PMI indicator, and housing starts at the onset of a recession in the United States? a) Nonfarm payrolls go UP, the PMI indicator goes DOWN, the housing starts goes DOWN b) Nonfarm payrolls go DOWN, the PMI indicator goes DOWN, the housing starts goes DOWN c) Nonfarm payrolls go DOWN, the PMI indicator goes UP, the housing starts goes UP d) Nonfarm payrolls go UP, the PMI indicator goes UP, the housing starts goes UP Which of the following qualities of economic indicators do investors prize the most? a) Rigor b) Sample size c) Timeliness of release d) Government sponsorship Why is the release of GDP statistics less interesting to investors than the release of other economic indicators? a) Because governments consistently alter their GDP measurement methods b) Because the formula for GDP includes not only private investment but also other irrelevant factors c) Because GDP is not official government data d) Because GDP statistics are released well after other economic indicators Which of the following important U.S. economic indicators is only available on a quarterly basis? a) Nonfarm payrolls b) CPI c) GDP d) PMI Which economic indicator is most directly linked to unemployment? a) Nonfarm payrolls b) CPI c) GDP d) PMI These charts show data for four countries as of early 2016. For each country, the purple line denotes historic real GDP growth. The white line denotes the consensus estimated real GDP growth. The red line denotes the most pessimistic analyst forecast. The green line denotes the most optimistic analyst forecast. For which country is the most controversy among the analyst community about 2016 growth? (see chart 3) a) Albania b) Dominican Republic c) Russia d) Germany What is the main reason that investment banks create estimates of economic indicators? a) To determine in which countries the banks should operate b) To increase real GDP growth by exporting their intellectual property to foreign investors c) To hold governments accountable for management of their economies d) To know when specific economic data points are a positive or negative surprise Which of the following is the biggest pitfall of economic indicators? a) They do not take into account seasonality b) They are not sufficiently timely to make investment decisions c) They only serve as proxies for economic activities d) They do not consistently presage turning points Here is a chart displaying estimates of the initial jobless claims indicator, one of the main unemployment statistics in the US. It measures the number of new applicants for unemployment benefits. What was the level of the analyst with the most optimistic outlook? (see chart 4) a) 260 b) 274 c) 277 d) 290 Which of the following countries represent 1.3% of total activity traded US debt? (see chart 5) a) Taiwan b) Canada c) Russia d) India What quality of US government bonds causes investors to buy them when market volatility rises? a) US government bonds are denominated in dollars b) US government bonds are stored in bank vaults c) US government bonds are underwritten by global taxpayers d) US government bonds are considered low risk? Why does the US have a strong reputation for creditworthiness? a) Because no country has a many taxable states as the United States b) Because America’s wealth means that it does not have to borrow c) Because it has the right to tax the wealthiest population on earth d) Because dollars are backed by the gold at Fort Knox What is one reason why foreign governments lend to the US government? a) To enhance diplomatic relations b) To build liquid FX reserves c) To benefit from the price and yield going up d) To pay for the US budget deficit What does one yellow bar depict in this debt distribution diagram? (see chart 6) a) Coupon repayment b) Principal repayment c) Yield repayment d) Distribution repayment Which one of the following actors benefits when interest rates go up? a) A company with a fixed-rate loan? b) A company about to secure a fixed-rate loan? c) An investor who already owns bonds d) An investor who is about to buy bonds Which percentage of GDP represented by government debt is an indicator that yields will spike? a) 50% b) 90% c) 150% d) There is no general rule What is true of both the UK and the US? a) Both countries print world reserve currencies b) Both countries are highly creditworthy c) Both currencies are used equally in the world FX markets d) Both countries are heavily reliant on long-term borrowing Which would you prefer? a) A 3% annual yield on an investment in 10-year US government bonds? b) A 4% annual yield on a credit risk-free 10-y government bond from the mythical country of Utopia c) A 2% annual yield on an investment in 10-y US government bonds d) A 3% annual yield on a credit risk-free government bond from the mythical country of Utopia. Which would you prefer? a) A 5% annual yield on an investment in 10-y US government bonds b) A 3% annual yield on a risk-free 10-y government bond from the mythical country of Utopia c) A 4% annual yield on an investment in 10-y US government bonds d) A 2% annual yield on a risk-free 10-y government bond from the mythical country of Utopia What is the primary reason for US government bond yields to ripple through the bond market? a) Bond prices move in lockstep in order for the yields to match government bond yields b) The large government bond market competes for investors’ attention via yields c) All governments mandate interest rates as part of their economic policy d) Non-government borrowers are slightly less safe and therefore must offer slightly lower yields A rise in which of the following measures would typically send a government bond price up? a) Creditworthiness b) Inflation c) Interest rates d) Government borrowing Which of the countries shown makes the greatest relative use of short-term government financing? (see chart 7) a) Australia b) Switzerland c) Norway d) Germany How do investors compare bonds? a) By comparing the total amounts of principal and interest outstanding b) By comparing the prices of single bonds c) By comparing the total amounts borrowed to the repayment amounts d) By comparing the yields of single bonds Which of the following is the strongest driver of inflation? a) Consumers deferring purchases in hopes of a better deal b) Wartime activities c) A rise in the price of gold d) High interest rates What was the output gap in 1973? (see chart 8) a) +3% b) +160 c) -3.2% d) -80 At the point in time shown, where is the country’s 10-y inflation expectation in relation to the central Bank’s inflation target? a) 2.0239% above b) c) 0.0239% above d) 0.4761 below Investors who fear rising inflation may buy Treasury Inflation Protected securities (TIPS). How do TIPS shield lenders from inflation? a) By disbursing gold bullion b) By offsetting the inflation with deflation c) By triggering an insurance payout d) By compensating investors for inflation What is the federal Reserve’s favorite inflation gauge? a) Core PCE b) GDP deflator c) CPI d) Household income What was likely the Fed interest rate policy? a) To maintain high interest rates b) To maintain low interest rates c) To hike interest rates d) To cut interest rates Why does the yield curve naturally slope upwards? a) To compensate lenders for the greater risk of short-term loans compared to long- term loans b) To compensate lenders for the greater risk of long-term loans compared to short- term loans c) To compensate borrowers for the greater risk of short-term loans compared to long- term loans d) To compensate borrowers for the greater risk of long-term loans compared to short- term loans Why did the corporate spread significantly widen during the 2008 market crash? a) Corporate bonds issuers go bankrupt more frequently than governments, as they do not have a tax base to fall back on in hard times b) Corporate bonds went up as investors rotated out of equities into all forms of safer bonds c) Corporations were viewed as safer than governments; therefore, the corporate bonds went up and the government bonds went down. d) A slowdown in economic activity led to fears of rising inflation What impact will a tightening of the corporate spread most likely have on a company? a) A tendency to restrict the borrowing capacity of the company b) A tendency to expand the borrowing capacity of the company c) A tendency to make borrowing more expensive d) A tendency to make the company more prone to bankruptcy What are the three main transmission mechanisms by which the yield curve affects the economy? a) Housing rental impact, corporate impact, consumer impact b) Global impact, consumer impact, trade impact c) Corporate impact, global impact, consumer impact d) Trade impact, corporate impact, housing rental impact What was the percentage of a) 2.421% b) 0.023% c) 2.398% d) 2.332% The purchase of which of the following products is most affected by interest rates? a) A yacht b) An automobile c) A house d) A safari What is the primary driver of the left-hand end of the yield curve? a) Inflation b) Central bank interest rates c) GDP growth estimates d) Bond trading Which yield curve is most likely linked to a booming economy? (see chart 9) a) A b) B c) C d) D What do you think the Federal Reserve did with interest rates in the month following the attacks of September 11, 2001 a) Steepened the interest rates b) Kept interest rates the same c) Increased interest rates d) Cut interest rates Why does the yield curve tend to invert shortly before recession? a) Recessions tend to send prices down and this includes the price of term premiums b) The fact that the yield curve inverted before many recessions in recent history is purely coincidental c) The term premium tends to be very positive before a recession due to impending interest rate hikes d) An inverted yield curve means that bond traders are predicting interest rate cuts, and interest rate cuts happen in response to a recession Why do companies do IPOs? a) When companies go bankrupt, they must delist b) Company management gets to ring the bell on the stock exchange floor c) Companies with revenue above a certain threshold must be publicly listed by law d) IPOs incentivize entrepreneurs to innovate as IPOs provide a way for entrepreneurs to monetize their work Why do company manager-owners smile when they ring the stock exchange bell at their IPO? a) Manager-owners receive their first stake in the company at an IPO b) Money raised from an IPO solely compensates manger-owners c) Manager-owners are freed of the burden of managing their company d) An IPO crystallizes the value of the manager-owners’ stake If all the shares went up by 5%, which share on the screen shown would have the biggest contribution to an upward movement in the Index? (see chart 10) a) General electric b) Goldman Sachs c) Apple d) Exxon Mobil In 1999, JG and KH published a book called ‘’Dow 36,000’’. At the time, the Dow Jones Industrial Average Index was just below 12,000. Which of the following is a potential substitute for the book title? a) The Total Market Cap of the Stock Market Will Go Down 36,000 points b) The Average Retirement Account of an Industrial Worker Will Triple c) The sum of the Market Caps of All 30 Dow Jones Members Will Triple d) The Sum of the Share Prices of All 30 Dow Jones Members Will Triple Here is a chart of the index value for S&P 500 and the UK’s main equity index, the FTSE 100, from the end of 2008 to early 2015. One index has clearly outperformed the other. Which one? a) S&P 500 Index b) FTSE 100 Index c) UK Index d) WEI Index What is the prime reason that Jenny’s discretionary income is more volatile than her salary? a) Her tax rate remains 30% b) Her mortgage pmts and necessities are fixed c) Her discretionary income and salary are equally volatile d) Her cost of living is affected by high inflation in the neighborhood A wedding planning company has a high fixed-cost base and a lot of debt. Who would you rather be? a) A shareholder in a booming economy b) A shareholder in a stagnant economy c) A bond holder in a booming economy d) A bond holder in a stagnant economy According to the chart, what would be the approximate return be on the S&P 500 from the through of March 2009 to the end of 2013, ignoring dividends? (see chart 11) a) 170% b) 100% c) 270% d) 200% Assume that an investor in the S&P 500 reinvests his dividends. According to the chart, what approximate return would this investor have reaped from the early 2009 through the endpoint of the chart? (see chart 12) a) 167% b) 200% c) 300% d) 100% Why are equities volatile? a) Due to the varying supply of and demand for IPOs b) Due to the residual nature of earnings c) Due to changing tax rates d) Due to low levels of borrowing Which of the following statement is true? a) When you buy an equity, your potential loss is unlimited and your max potential gain is 100% b) When you buy an equity, the most you can lose is 100% and your potential gain is unlimited c) When you buy an equity, you are promised a stream of fixed dividends d) When you buy a bond, you are promised the residual income of that company Which row of the budget planning table shows the amount to which she as shareholder would be entitled? (see chart 13) a) A b) B c) C d) D For which stock did the the bulk of the total return come from dividends? (see chart 14) a) Colgate-Palmolive b) Procter & Gamble c) Reckitt Benckiser d) Church and Dwight What does the release of earnings announcements have in common with the release of economic indicators? a) Both are typically released on a quarterly basis b) Both are typically published by corporations c) Both are estimated in advance by analysts d) Both are of broad interest to all investors For which company was Boeing the primary plane supplier in the last year? a) United Continental b) United Technologies c) Honeywell International d) China Eastern Airlines Which company is the most exposed to the ups and downs of the aircraft engine industry? a) Rolls-Royce b) General Electric c) United Tech Corp d) MTU Aero Engines Engines are the most expensive, heavy component on an aircraft and are designed with detailed specification. Which of the following would likely be the best theme for a Rolls- Royce analyst research note to help a portfolio manager decide between investing in RR or United Technologies? a) The impact of the price of oil on air travel b) Regulatory concerns for the Boeing-Airbus duopoly c) The competitive environment in the super-luxury car segment d) A comparison of the commercial prospects of new aircraft models You are building a financial model of a bifocal lens manufacturer. Which of the following is the best driver to use? a) Median age of society b) Mean museum visits per capita per year c) Mean cruises sales per household per year d) Total number of bridge and mahjong players Which of the following Bloomberg headlines would be of most interest to an aluminum trader in China? a) Next-Generation Vehicles to Show Shift From Steel to Aluminum b) China’s Aluminum Demand Weathers Real-Estate Slowdown So Far c) Coca-Cola Announces Plans to Recycle, Reuse Cans Sold in US d) Aluminum Falls on Boeing’s Announcement of Production Cuts When an analyst is looking at a company for the first time, which of the following four activities does he do first? a) Defines the industry or industries in which the company operates b) Sizes the market or markets in which the company sells c) Calculates the company’s market share or market shares d) Estimates the breakdown of the company’s cost base Here is a table from the Bloomberg Intelligence copper dashboard which shows the different end-users of the ‘red metal’. Which of the following Bloomberg headlines would likely be of most interest to a copper trader? a) Copper slides 7.7% to seven-month Low on US Construction Data b) China’s Construction Slowdown Dents Copper Consumption, Prices c) Infrastructure Spending to Lead Latin America’s Economic Growth d) European Industrial Orders Rose in May on Machinery, Transport Which of the following industry drivers should be of most interest to a prospective investor of 3M? (see chart 14) a) The move towards the paperless office b) The change in postal volumes c) The prevalence of surgical procedures d) The popularity of home improvement projects Company X was expected to have earnings per share of $0.52 for the upcoming quarter. On the day of the results, the company reported earnings per share of $0.83. What happened to the share price when the stock market opened? a) It went up b) It went down c) There is not enough information to tell d) It remained unchanged Which company is worth more, Coca-Cola or Pepsi? a) Coca-Cola because it has a higher market capitalization b) Pepsi because it has a higher capitalization c) Coca-Cola because it has a higher price per share d) Pepsi because it has a higher price per share Widget Co. has a market capitalization of $100M. It does a 10-for-1 split. It then does a 1-for-16 stock split. Finally, it does a 35-for-1 stock split. Nothing else changes. What’s the new market cap? a) $4.57M b) $100M c) $2.186M d) $1.8M What input do both absolute valuation and relative valuation typically require? a) Long-term forecasts b) Short-term forecasts c) Historic revenue data d) Historic earnings data Which of the following is most likely to be the most challenging part of this first step of the absolute valuation process? a) Making the assumptions upon which to project future performance b) Conducting the necessary mathematics c) Locating the required historic data within company releases and earnings statements d) Dividing the market cap by the number of shares What is a reason one discounts future cash flows as part of the absolute valuation process? a) Future profits are uncertain b) Deflation makes future cash flows worthless c) The company might do a share split which will diminish the value of one’s stake d) Investors prefer future pmts to pmts today What role does beta play in absolute valuation? a) It determines how risky a stock is in comparison to the overall stock market b) It sets the 10-year bond yield as a baseline required rate of return c) It provides the expected slope of the share price chart into the future d) It sets the return on a stock market index as a baseline required rate of return Here is the capital structure of Microsoft. What part of the $42.03 share price (to the nearest dollar) is represented by cash? (see chart 15) a) $11 b) $9 c) $10 d) $8 How is enterprises value calculated? a) Enterprise value = market cap – cash + debt b) Enterprise value = market cap + cash – debt c) Enterprise value = market cap + cash + debt d) Enterprise value = market cap – cash – debt Which of the following stocks is most sensitive to the movement of the overall stock market? (see chart 16) a) Home Depot b) Intel c) Starbucks d) Amazon Which of the following assigns the same relative weightings to short-term and long-term outcomes as the absolute valuation process? a) A student deciding to attend medical school b) A yoga instructor avoiding junk food c) A government giving a tax break on electric car purchases d) A fishery exceeding fishing quotas Here is the WACC function for US company Pfizer. Calculations have been hidden. What is the WACC? a) 9.4% b) 8.2% c) 84.6% d) 2.8% A rise in which of the following inputs will increase on absolute valuation? a) Number of shares b) Beta c) Earnings estimates d) 10-y government bond How do earnings yields differ from bond yields? a) Earnings yields are expressed as percentage while bond yields are expressed as absolute values b) The earnings from equities are paid out in non-cash dividends while the coupons on bonds are paid out in cash c) Earnings yields are always higher than the bond yields due to the riskier nature of equities d) The cash flow from equities can continue indefinitely while the cash flow from bonds comes to an end At its peak at the end of 1999, Microsoft had a market cap of $600B. PC sales were booming and most PCs ran on Microsoft software. Revenue was growing 30% per year. The P/E ratio peaked at nearly 80.0x in 1999. What happened in the subsequent 15 years? (see chart 17) a) Earnings declined and this pushed the market cap down b) Earnings grew and this pushed the market cap up c) The decline in the P/E ratio canceled out the decline in earnings and this pushed the market cap up d) The decline in the P/E ratio more than offset earnings growth and this pushed the market cap down What is one possible weakness of this peer approach to valuation? a) It is a very laborious approach to valuation b) The estimated growth can be dramatically wrong c) It only focuses on the statistics of one company d) It does not account for industry context What may be a problem of comparing the P/E of a stock to the P/E of the overall market? a) The overall market may not be sufficiently broad for the purpose of comparison b) Given the number of stocks in the overall market, it is very time consuming to calculate the P/E of the market c) Most stock market indices exclude the effect of dividends d) A stock’s P/E ratio can remain above or below market average for extended periods Here is a chart of the Nasdaq Composite, the world’s main technology index. It peaked in the dotcom bubble on March 10, 2000. The P/E ratio later peaked above 500. In hindsight, widely agreed to have been a bubble. In March 2015, the index value for the first time since then surpassed the peak. Why might some investors at that point have argued ‘this time it’s different’? (see chart 18) a) In comparison, to low bond yields in early 2015, a 0.2% earnings yield on the Nasdaq looked fair more reasonable b) In comparison to low bond yields in early 2015, a 0.6% earnings yield on the Nasdaq looked far more reasonable c) Earnings grew substantially, meaning that the P/E ratio in early 2015 was only around 164.6x d) Earnings grew substantially, meaning that the P/E ratio in early 2015 was only around 30.3x The World Equity Index function shown contains two valuation metrics for the S&P 500. The Nike description page contains the same two valuation metrics. How does Nike’s valuation compare to that of the S&P 500? (see chart 19) a) Nike is less expensive than the S&P 500 on a P/E basis and more expensive on a dividend yield basis b) Nike is more expensive than the S&P 500 on a P/E basis and less expensive on a dividend yield basis c) Nike is less expensive than the S&P 500 on both a P/E and dividend yield basis d) Nike is more expensive than the S&P 500 on both the P/E and dividend yield basis If the earnings per share of a company is $1 and the earnings yield is 2%, what is the price per share? a) $50 b) $20 c) $200 d) $5 This chart shows a scatterplot with the x-axis being the estimated sales growth and the y-axis being the estimated P/E multiple. Given this data alone, which of the following companies may warrant further analysis by a portfolio manager looking to buy an insurance company for her portfolio? (see chart 20) a) Markel b) Allstate c) Erie Indemnity d) Chubb Chart 1 Chart 2 Chart 3 Chart 4 Chart 5 Chart 6 Chart 7 Chart 8 Chart 9 Chart 10 Chart 11 Chart 12 Chart 13 Chart 14 Chart 15 Chart 16 Chart 17 Chart 18 Chart 19 Chart 20 BMC Currencies – Currency Market Mechanics 1. Of the visible countries, which is the fourth biggest exporter and fourth biggest importer? a. Japan b. Germany c. US d. China 2. The Mexican peso declined vs the US $ by 37% during the so called tequila crisis. What exacerbating factor did Mexico’s’ Tequila Crisis have in common with the Argentine crisis of 2002 a. Both counties use the same currency: the peso b. Both countries had a large dollar denominated debt c. Both crises occurred in December, a holiday month d. Both crises happened in Latin America 3. How many New Zealand dollars can you buy with the 100 Australian dollar a. 0.92690 b. 1.0789 c. 92.690 d. 107.89 4. Alisson lives in America and retired. Its 2016 and the lady wants to travel the world. She wants to pick the country that had a weaken currency vs the US dollars. Where will she go? a. Norway b. UK c. Japan d. France 5. 4 Currency chart for Barbadian vs Jamaican dollar; Czech vs Polish; Nigerian vs Ghanaian and Hong Kong vs Macanese. Which one is pegged? a. BvJ b. CvP c. NvG d. HKvM 6. Which of the following Is not an example of failed peg? a. UK Sterlings vs Deutchs b. Mexican peso vs US in 1994 c. HK vs US in 1997 d. Argentine peso vs US in 2002 7. How many Danish crowns will buy 100 Japanese yen? a. 0.05360 b. 5.360 c. 18.656 d. 1865.6 Currencies – Currency Valuation 8. According to this Big Mac index screen, which of the following currencies is the most undervalued? a. US b. China c. Brazil d. Thailand 9. What generally happens when a central bank unexpectedly increases interest rate? a. The currency strengthens b. The currency weakens c. Currency strengthens d. Currency weakens, then strengthen 10. Which driver weakened the SF from 1 euro/SF to 0.83 Euro/SF a. A surprise change in inflation expectations b. A surprise change in valuation expections c. A surprise change in interest rate expectation d. A surprise change in trade 11. What does the Big Mac index show? a. How the law of one price is true of consumer products b. How currencies may be overvalued or undervalued c. How interest rate and inflation affect trade d. How the Economist magazine estimate inflation 12. What are the 3 main ST drivers of currency valuation? a. Surprise change in interest rate, inflation and gold b. Surprises changes in interest rate, inflation and trade c. Surprise change in unemployment, inflation and trade d. Surprise change in unemployment trade and gold 13. By what mechanism do interest rate affect currency values? a. Global Investors are attracted by higher bond yield in high interest rate countries b. Change in interest rate directly influence the value at which a currency is pegged c. High interest rate increase the value of house prices which make the currency safer d. Low interest rate always make a market more attractive for investors, which lifts the currency 14. Which of theses headlines could move a currency pair? a. US Stock rally on fed surprise reduction of D.R. b. Railroad rate hikes drive Dichotomy of necessary vs excessive c. HK’s Firmly committed to Dollar Peg, John Tsang says d. Grade Inflation: Devaluing B-School’s Currency Currencies – Central Banks and Currencies 15. What is the most common target inflation rate for an advanced economy? a. 1% b. 2% c. 3% d. 0% 16. What was the primary goal of Abenomics? a. To reduce inflation by increasing unemployment b. To help Shinzo Abe win the election of 2012 c. To halt the vicious cycle of deflation d. To Strengthen the yen to foster consumption of luxury goods 17. Vicious Deflationary Cycle. What step connects the lower left grey arrow to the upper right blue arrow? a. Workers expect prices to increase b. Workers demand pay increase c. Employment decrease d. Price declines 18. What was the Great depression in the US linked to inflation or deflation a. Inflation b. Deflation c. Both d. Neither Currencies – Currencies Risk 19. In 2016, the UK voted to leave EU. White line= UK main equity (FTSE 100); Orange Line - # of dollars it takes ot buy one pound sterling. The UK = Net importer. What can be the reasonably surmised from the chart about large UK Corporation? a. Their CEO probably voted to remain in the EU b. CEO probably voted to leave the EU c. They are probably heavy exporters d. They are probably heavy importers 20. Why is there a mirror image between the yen weakness and stock market strength on the chart shown? a. Rising Japanese interest rate both weakens the yen and left the stock market b. A declining yen will left inflation, which sis good for Japanese corporations c. Yen weakness favors the man exporting corporation within the index d. Stock market strength pushes Japanese’s investors to buy safe haven currencies 21. IN 2016, Germany Machinery Company has interest from 4 prospective clients from emerging markets: Brazil, Indonesia, Russia and South Africa. They want to to buy 10 machines. The company will bill them in euros but the CFO is worried that the client may cancel the order if the currency declines when the invoice comes. According to historical currency volatility alone, the client form which country would be most likely to pay his invoice. A. Indonesia B. Brazil C. Russia D. South Africa 22. What is the median estimate for the number of U.S. dollars per British sterling for calendar year 2015? a. 1.61 b. 1.63 c. 1.66 d. 1.75 23. What is the median estimate for the number of Japanese yen/euro for the calendar year 2020 a. 126 b. 132 c. 163 d. 115 24. What is the difference between the CItitgroup and JP Morgan Chase estimate for the US dollar/sterling currency pair for the end of Q1 of 2015 a. 0.16 pounds b. 0.16 euros c. 0.16 percent d. 0.16 dollars 25. You are a Dutch diamond dealer who sources diamonds from South Africa. You believe that the African continent is set to boom, and so you believe that the South African rand will strengthen against the world’s major currencies. Therefore, you are worried about your ability to afford South African diamonds in the future. A new mine is being dug in South Africa and you have agreed with the miner to buy 1 million South African rands' worth of diamonds a year from today. Therefore, you will need 1 million rands in cash in one year’s time. Currently, the exchange rate is 17.1261 rands to the euro. You believe that the rand will strengthen to 16 rand to the euro in one year’s time. You speak to some currency dealers and they let you know that they would agree today to convert your euros into rands in one year’s time at the rate of 18.654182. Assume that you converted some of your euros into 1 million rands at today’s prevailing rate and stored the rands in a safe. How many more or fewer euros would you have in one year’s time if you were to agree today to the forward agreement instead of simply purchasing the million rands today? a. EUR 4,783 More b. EUR 4783 less c. EUR 4110 more d. Eur 4110 less Explanation: Today, 1,000,000 rands will cost you (1,000,000 / 17.1261) = EUR 58,390. If you take the forward agreement, 1,000,000 rands would cost you (1,000,000 / 18.654182) = EUR 53,607. Therefore, if you took the forward agreement instead of changing the money today, you would have (EUR 58,390 – EUR 53,607) = EUR 4,783 more. 26. Why would Jack Welch suggest putting all company plants on barges? A. To respond to the changes in the currency market quickly B. To avoid using any domestic currencies C. To locate the cost base in the most favorable tax regimes D. To purchase materials for the plant more quickly 27. Samsung is based in South Korea and reports in South Korean won. Samsung sells its products around the world and the geographic breakdown of its 2015 revenues are in the first chart. The second chart shows how some major world currencies moved against the South Korean won through the course of 2015. Of the currencies shown, which currency movement held back Samsung's revenue growth the most? A. Yuan B. Dollar C. Real D. Euro 28. Legendary investor Warren Buffett said, “Gold gets dug out of the ground... Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.” Based on this quotation, what quality of gold is he referring to? A. Its durability B. Its scarcity C. Its physical attractiveness D. Its storage costs 29. Of the following options, what is the best way for investors to manage currency risk? A. By locking in forward rates for known foreign payments B. By investing in pegged currencies C. By investing purely in very large stocks in their home market D. By vacationing each year in a country with a weak currency FIXED Income: 1. What does it signify when the bars are green at the bottom? A. Deficit B. High revenue C. Growth D. Surplus 2. According to the table on the right, which country owns 2.9% of U.S. debt? A. Belgium B. Taiwan C. United Kingdom D. Switzerland 3. What quality of U.S. government bonds causes investors to buy them when market volatility rises? A. U.S. government bonds are denominated in dollars. B. U.S. government bonds are stored in bank vaults. C. U.S. government bonds are unwritten by global taxpayers. D. U.S. government bonds are considered low risk. 4. Why is fixed income called fixed income? A. Because bonds cannot rise in price over the life of a bond B. Because the repayment amounts and timings are fixed for ordinary bonds C. Because current and future owners of a bond get the same effective annual interest rate D. Because the price of the bond is fixed, given the safe haven nature of bonds 5. Which is the biggest?? A. World GDP B. World total stock market value C. World total bond market value D. World total currency reserve 6. What is one reason why foreign governments lend to the U.S. government? A. To enhance diplomatic relations B. To build liquid FX reserves C. To benefit from the price and yield going up D. To pay for the U.S. budget deficit 7. What does one yellow bar depict in this debt distribution diagram? A. Coupon repayment B. Principal repayment C. Yield repayment D. Distribution repayment 8. Which one of the following actors benefits when interest rates go up? A. A company with a fixed-rate loan B. A company about to secure a fixed-rate loan C. An investor who already owns bonds D. An investor who is about to buy bonds 9. When investors doubt the creditworthiness of a borrower, how do they alter their calculation of the bond yield to take into account these doubts? A. Investors do not alter the calculation. B. Investors exclude future repayments they think will not occur. C. Investors add the percent likelihood of bankruptcy to the yield. D. Investors decrease the price by the percent likelihood of bankruptcy. 10. As a general rule, what percentage of debt to GDP will make a government’s bond yields spike? A. 50% B. 90% C. 150% D. There is no general rule. 11. What is true of both the U.K. and the U.S.? A. Both countries print world reserve currencies. B. Both countries are highly creditworthy. C. Both currencies are used equally in the world FX markets. D. Both are heavily reliant on long-term borrowing. 12. Which would you prefer? A. A 3% annual yield on an investment in 10-year U.S. government bonds B. A 4% annual yield on a risk-free 10-year government bond from the mythical country of Utopia C. A 2% annual yield on an investment in 10-year U.S. government bonds D. A 3% annual yield on a risk-free 10-year government bond from the mythical country of Utopia 13. Which would you prefer? A. A 5% annual yield on an investment in 10-year U.S. government bonds B. A 3% annual yield on a risk-free 10-year government bond from the mythical country of Utopia C. A 4% annual yield on an investment in 10-year U.S. government bonds D. A 2% annual yield on a risk-free 10-year government bond from the mythical country of Utopia 14. What is the primary reason for U.S. government bond yields to ripple through the bond market? A. Bond prices move in lockstep in order for the yields to match government bond yields. B. The large government bond market competes for investors’ attention via yields. C. All governments mandate interest rates as part of their economic policy. D. Non-government borrowers are slightly less safe and therefore must offer slightly lower yields. 15. A rise in which of the following measures would typically send a government bond price up? A. Creditworthiness B. Inflation C. Interest rates D. Government borrowing 16. Which of the countries shown makes the greatest relative use of short-term government financing? A. Australia B. Switzerland C. Norway D. Germany 17. How do investors compare bonds? A. By comparing the total amounts of principal and interest outstanding B. By comparing the prices of single bonds C. By comparing the total amounts borrowed to the repayment amounts D. By comparing the yields 18. Which of the following is the strongest driver of inflation? A. Consumers deferring purchases in hopes of a better deal B. Wartime activities C. A rise in the price of gold D. High interest rates 19. This chart shows the output gap in the U.S. as of the end of 1973. What was likely the Fed interest rate policy at the end of 1973? A. To maintain high interest rates and be vigilant about inflation B. To maintain low interest rates and be vigilant about inflation C. To maintain high interest rates and be vigilant about deflation D. To maintain low interest rates and be vigilant about deflation 20. Here is a chart from the ILBE function displaying U.S. 10-year inflation expectations as of early 2016. At the point in time shown, where is the country's 10-year inflation expectation in relation to the Central Bank's inflation target? A. 1.5733% above B. 0.5733% above C. 0.4267% below D. 1.4267% below 21. Investors who fear rising inflation may buy Treasury Inflation Protected Securities (TIPS). How do TIPS shield lenders from inflation? A. By disbursing gold bullion B. By offsetting the inflation with deflation C. By triggering an insurance payout D. By compensating investors for inflation 22. What is the Federal Reserve's favorite inflation gauge? A. Core PCE B. GDP deflator C. CPI D. Household income 23. Here is the output gap in the U.S. in early 1975. What was likely the Fed interest rate policy? A. To maintain high interest rates B. To maintain low interest rates C. To hike interest rates D. To cut interest rates 24. Why does the yield curve naturally slope upwards? A. To offer investors increased bond prices over time as represented by the rising line B. To compensate lenders for the greater risk of long-term loans compared to short-term loans C. To pay investors for the risk of deflation D. To attract bond traders who typically prefer long-term bonds 25. Why did the corporate spread significantly widen during the 2008 market crash? A. Corporate bond issuers go bankrupt more frequently than governments, as they do not have a tax base to fall back on in hard times. B. Corporate bonds went up as investors rotated out of equities into all forms of safer bonds. C. Corporations were viewed as safer than governments; therefore, the corporate bonds went up and the government bonds went down. D. A slowdown in economic activity led to fears of rising inflation. 26. What impact will a tightening of the corporate spread most likely have on a company? A. A tendency to restrict the borrowing capacity of the company B. A tendency to expand the borrowing capacity of the company C. A tendency to make borrowing more expensive D. A tendency to make the company more prone to bankruptcy 27. The U.S. yield curve affects which of the following entities? A. All large companies worldwide and the U.S. government B. All large U.S. companies and all governments worldwide C. All large companies and all governments worldwide D. All large U.S. companies and the U.S. government 28. What is the 10-year to 3-month term premium of the following yield curve? A. 2.421% B. 0.023% C. 2.398% D. 2.332% 29. Which of these purchases is most likely to be affected by interest rates? A. A safari B. A yacht C. An automobile D. An undergraduate university degree 30. What is the primary driver of the left-hand end of the yield curve? A. Inflation B. Central bank interest rates C. GDP growth estimates D. Bond trading 31. Which yield curve is most likely linked to a booming economy? A. A B. B C. C D. D 32. The two yield curves in the chart are from September 10, 2001 (yellow line) and from October 10, 2001 (green line). What do you think the Federal Reserve did with interest rates in the month following the terrorist attacks of September 11, 2001? A. Steepened the interest rates B. Kept interest rates the same C. Increased interest rates D. Cut interest rates 33. Why does the yield curve tend to invert shortly before a recession? A. Recessions tend to send prices down and this includes the price of term premiums. B. The fact that the yield curve inverted before many recessions in recent history is purely coincidental. C. The term premium tends to be very positive before a recession due to impending interest rate hikes. D. An inverted yield curve means that bond traders are predicting interest rate cuts, and interest rate cuts happen in response to a recession. Equity 1. Why do companies do IPOs? A. When companies go bankrupt, they must delist. B. Company management gets to ring the bell on the stock exchange floor. C. Companies with revenue above a certain threshold must be publicly listed by law. D. IPOs incentivize entrepreneurs to innovate as it provides a way for them to monetize their work. 2. Why do company manager-owners smile when they ring the stock exchange bell at their IPO? A. Manager-owners receive their first stake in the company at an IPO. B. Money raised from an IPO solely compensates manager-owners. C. Manager-owners are freed of the burden of managing their company. D. An IPO crystallizes the value of the manager-owners' stake. 3. Here are 22 of the 30 members of the Dow Jones Industrial Average Index as of late March 2015. If all the shares went up by 5%, which share on the screen shown would have the biggest contribution to an upward movement in the Index? A. General Electric B. Goldman Sachs C. Apple D. Exxon Mobil 4. In 1999, James Glassman and Kevin Hassett published a book called “Dow 36,000.” At the time, the Dow Jones Industrial Average Index was just under 12,000. Which of the following is a potential substitute for the book title? A. "The Total Market Cap of the Stock Market Will Go Down 36,000 Points" B. "The Average Retirement Account of an Industrial Worker Will Triple" C. "The Sum of the Market Caps of All 30 Dow Jones Members Will Triple" D. "The Sum of the Share Prices of All 30 Dow Jones Members Will Triple 5. Here is a chart of the index value for the S&P 500 and the United Kingdom’s main equity index, the FTSE 100, from the end of 2008 to early 2015. One has clearly outperformed the other. Over this period, there was a technology boom and an oil crash. Here are pie charts showing the early 2015 index compositions by industry for both the S&P 500 and the FTSE 100. Which index outperformed? A. The S&P 500 Index B. The FTSE 100 Index C. The U.K. Index D. The WEI Index 6. What is the prime reason that Jenny's discretionary income is more volatile than her salary? A. Her tax rate remains 30%. B. Her mortgage payments and necessities are fixed. C. Her discretionary income and salary are equally volatile. D. Her cost of living is affected by high inflation in the neighborhood. 7. A wedding planning company has a high fixed-cost base and a lot of debt. Who would you rather be? A. A shareholder in a booming economy B. A shareholder in a stagnant economy C. A bond holder in a booming economy D. A bond holder in a stagnant economy 8. The S&P 500 stood at 1848 at the end of 2013. According to the chart, what would the approximate return be on the S&P 500 from the trough of March of 2009 to the end of 2013, ignoring dividends? A. 170% B. 100% C. 270% D. 200% 9. The brown line stood at 2639 at the end of 2013. According to the chart, what would the approximate return be on the S&P 500 including dividends from the trough level in March 2009 of 945 to the end of 2013? A. 217% B. 179% C. 317% D. 279% 10. Why are equities volatile? A. Due to the varying supply of and demand for IPOs B. Due to the residual nature of earnings C. Due to changing tax rates D. Due to low levels of borrowing 11. Which of the following statements is true? A. When you buy an equity, your potential loss is unlimited and your maximum potential gain is 100%. B. When you buy an equity, the most you can lose is 100% and your potential gain is unlimited. C. When you buy an equity, you are promised a stream of fixed dividends. D. When you buy a bond, you are promised the residual income of that company. 12. In the example highlighting the differences between bond holders and shareholders, surgeon Jenny is the shareholder. Which row of the budget planning table shows the amount to which she as a shareholder is entitled? A. A B. B C. C D. D 13. You buy the stock of four consumer goods companies at the end of 2004 and hold them until August 2010. Here are the TRA (Total Return) charts from Bloomberg for all four stocks. The "Buy Price" in the top left-hand corner is the price you paid for each stock. The price of the stock in August 2010 is noted in the chart's legend. The legend also states the Dividend Adjusted Value of the stock in 2010, the value of the reinvested dividends over the holding period. For which stock did the bulk of the total return come from dividends? A. Colgate-Palmolive B. Procter & Gamble C. Reckitt Benckiser D. Church & Dwight 14. What does the release of earnings announcements have in common with the release of economic indicators? A. Both are typically released on a quarterly basis. B. Both are typically published by corporations. C. Both are estimated in advance by analysts. D. Both are of broad interest to all investors. 15. The number at the bottom right of each supplier's box shows the portion of Boeing's total costs in the last year which go to that supplier. The number at the bottom right of each customer's box shows the portion of the customer's capital expenditure (money spent on high value purchases) in the last year which goes to Boeing. For which company shown was Boeing the primary plane supplier in the last year? A. United Continental B. United Technologies C. Honeywell International D. China Eastern Airlines 16. Which company is most exposed to the ups and downs of the aircraft engine industry? A. Rolls-Royce B. General Electric C. United Tech Corp D. MTU Aero Engines 17. Engines are the most expensive, heavy component on an aircraft and are designed with detailed specifications. Which of the following would likely be the best theme for a Rolls-Royce analyst research note to help a portfolio manager decide between investing in Rolls-Royce or United Technologies? A. The impact of the price of oil on air travel B. Regulatory concerns for the Boeing-Airbus duopoly C. The competitive environment in the super-luxury car segment D. A comparison of the commercial prospects of new aircraft models 18. You are building a financial model of a bifocal lens manufacturer. Which of the following is the best driver to use? A. Median age of society B. Mean museum visits per capita per year C. Mean cruise sales per household per year D. Total number of bridge and mahjong players 19. Here is a table from the Bloomberg Intelligence aluminum dashboard which shows the different end-uses of aluminum in China. Which of the following Bloomberg headlines would be of most interest to an aluminum trader in China? A. Next-Generation Vehicles to Show Shift From Steel to Aluminum B. China's Aluminum Demand Weathers Real-Estate Slowdown So Far C. Coca-Cola Announces Plans to Recycle, Reuse Cans Sold in U.S. D. Aluminum Falls on Boeing's Announcement of Production Cuts 20. When an analyst is looking at a company for the first time, which of the following four activities does he do first? A. Define the industry or industries in which the company operates B. Size the market or markets in which the company sells C. Calculate the company's market share or shares D. Estimate the breakdown of the company's cost base 21. Here is a table from the Bloomberg Intelligence copper dashboard which shows the different endusers of the “red metal.” Which of the following Bloomberg headlines would likely be of most interest to a copper trader? A. Copper Slides 7.7% to Seven-Month Low on U.S. Construction Data B. China's Construction Slowdown Dents Copper Consumption, Prices C. Infrastructure Spending to Lead Asia’s Economic Growth D. European industrial orders rose in May on Machinery, Tranport 22. Here is a breakdown of post-it note inventor 3M's revenue by industry. Which of the following industry drivers should be of most interest to a prospective investor of 3M? A. The move towards the paperless office B. The change in postal volumes C. The prevalence of surgical procedures D. The popularity of home improvement projects 23. Company X was expected to have earnings per share of $0.52 for the upcoming quarter. On the day of the results, the company reported earnings per share of $0.83. What happened to the share price when the stock market opened? A. It went up. B. It went down. C. There is not enough information to tell. D. It remained unchanged. 24. Which company is worth more, Coca-Cola or Pepsi?À A. Coca-Cola because it has a higher market capitalization B. Pepsi because it has a higher market capitalization C. Coca-Cola because it has a higher price per share D. Pepsi because it has a higher price per share 25. Widget Co has a market capitalization of $100M. It does a 10-for-1 stock split. It then does a 1-for-16 reverse stock split. Finally, it does a 35- for-1 stock split. Nothing else changes. What’s the new market cap? A. $4.57M B. $100M C. $2,186M D. $1.8M 26. What input do both absolute valuation and relative valuation require? A. Long-term forecasts B. Short-term forecasts C. Historic revenue data D. Historic earnings data 27. Which of the following is most likely to be the most challenging part of this first step of the absolute valuation process? A. Making the assumptions upon which to project future performance B. Conducting the necessary mathematics C. Locating the required historic data within company releases and earnings statements D. Dividing the market cap by the number of shares 28. What is a reason one discounts future cashflows as part of the absolute valuation process? A. Future profits are uncertain B. Deflation makes future cashflows worthless. C. The company might do a share split which will diminish the value of your stake. D. Investors prefer future payments to payments today. 29. What role does beta play in absolute valuation? A. It determines how risky a stock is in comparison to the overall stock market B. It sets the 10-year bond yield as a baseline required rate of return. C. It provides the expected slope of the share price chart into the future. D. It sets the return on a stock market index as a baseline required rate of return. 30. What part of the $42.03 share price (to the nearest dollar) is represented by cash? A. $11 B. $9 C. $10 D. $8 31. How is enterprise value calculated? A. Enterprise value = market cap – cash + debt B. Enterprise value = market cap + cash – debt C. Enterprise value = market cap + cash + debt D. Enterprise value = market cap – cash – debt 32. Which of the following stocks is most sensitive to the movement of the overall stock market? A. Home Depot B. Intel C. Starbucks D. Amazon 33. Which of the following ascribes the same relative weightings to short-term and long-term outcomes as the absolute valuation process? A. A student deciding to attend medical school B. A yoga instructor avoiding junk food C. A government giving a tax break on electric car purchases D. A fishery exceeding fishing quotas 34. Here is the WACC function for U.S. drug company Pfizer. The WACC calculation has been hidden. What is the WACC? A. 9.4% B. 8.2% C. 84.6% D. 2.8% 35. A rise in which of the following inputs will increase an absolute valuation? A. Number of shares B. Beta C. Earnings estimates D. 10-year government bond yield 36. How do earnings yields differ from bond yields? A. The earnings yield from equities is expressed as a percentage while the yields on bonds are expressed as absolute values. B. The earnings from equities are paid out in non-cash dividends while the coupons on bonds are paid out in cash. C. The earnings yields from equities are always higher than the yields on bonds due to the riskier nature of equities. D. The cashflow from equities can continue forever while the cashflow from most bonds comes to an end. 37. At its peak at the end of 1999, Microsoft had a market cap of $600B. It was the Apple of its day as PC sales were booming and most ran Microsoft software. Revenue was growing 30% per year. The P/E ratio peaked at 70.0x. Looking at this chart, what happened in the subsequent 15 years? A. Earnings declined and this pushed the market cap down. B. Earnings grew and this pushed the market cap up. C. The decline in the P/E ratio canceled out the decline in earnings and this pushed the market cap up. D. The decline in the P/E ratio more than offset earnings growth and this pushed the market cap down. 38. What is one possible weakness of this peer approach to valuation? A. It is a very laborious approach to valuation. B. The estimated growth can be dramatically wrong. C. It only focuses on the statistics of one company. D. It does not account for industry context 39. Let’s compare McDonald’s to the market. Here we can see that the S&P 500’s P/E ratio is 18.5x.McDonald’s has a price to earnings ratio of 19.3x, meaning that it trades roughly “in line” with the U.S. market. Investors will look at how the P/E of the company has trended in comparison to the P/E of the market. Any material deviation may pique investors’ interest. Here we can see that since the late 1980s, the P/E of McDonald’s has moved loosely in line with the P/E of the market. What may be a problem of comparing the P/E of a stock to the P/E of the overall market? A. The overall market may not be sufficiently broad for the purpose of comparison. B. Given the number of stocks in the overall market, it is very time consuming to calculate the P/E of the market. C. The overall stock market index performance excludes the effect of dividends. D. A stock’s P/E ratio can remain above or below market average for extended periods. 40. Here is a chart of the Nasdaq Composite, the world’s main technology index. It peaked in the dotcom bubble on March 10, 2000. The P/E ratio later peaked above 500. In hindsight, this is widely agreed to have been a bubble. In March 2015, the index value for the first time since then surpassed the peak. Why might some investors at that point have argued “this time it’s different”? A. Given low bond yields in the wake of the financial crisis, a 0.2% earnings yield on the Nasdaq now looks far more reasonable. B. Given low bond yields in the wake of the financial crisis, a 0.6% earnings yield on the Nasdaq now looks far more reasonable. C. Earnings grew substantially, meaning that the P/E ratio in early 2015 was only around 164.6x. D. Earnings grew substantially, meaning that the P/E ratio in early 2015 was only around 30.3x. 41. The World Equity Index function show contains two valuation metrics for the S&P 500. The Nike description page contains the same two valuation metrics. How does Nike's valuation compare to that of the S&P 500? A. Nike is less expensive than the S&P 500 on a P/E basis and more expensive on a dividend yield basis. B. Nike is more expensive than the S&P 500 on a P/E basis and less expensive on a dividend yield basis. C. Nike is less expensive than the S&P 500 on both a P/E and dividend yield basis. D. Nike is more expensive than the S&P 500 on both a P/E and dividend yield basis. 42. If the earnings per share of a company is $1 and the earnings yield is 2%, what is the price per share? A. $50.00 B. $20.00 C. $200.00 D. $5.00 43. This chart shows a scatterplot with the x-axis being the estimated sales growth and the y-axis being the estimated P/E multiple. Given this data alone, which of the following companies may warrant further analysis by a portfolio manager looking to buy an insurance company for her portfolio? A. Markel B. Allstate C. Erie Indemnity D. Chubb [Show More]

Last updated: 1 year ago

Preview 1 out of 44 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 20, 2021

Number of pages

44

Written in

Additional information

This document has been written for:

Uploaded

Mar 20, 2021

Downloads

0

Views

142

.png)