Accounting > QUESTIONS & ANSWERS > San Francisco State University - ACCOUNTING 301ch23 STATEMENT OF CASH FLOWS (All)

San Francisco State University - ACCOUNTING 301ch23 STATEMENT OF CASH FLOWS

Document Content and Description Below

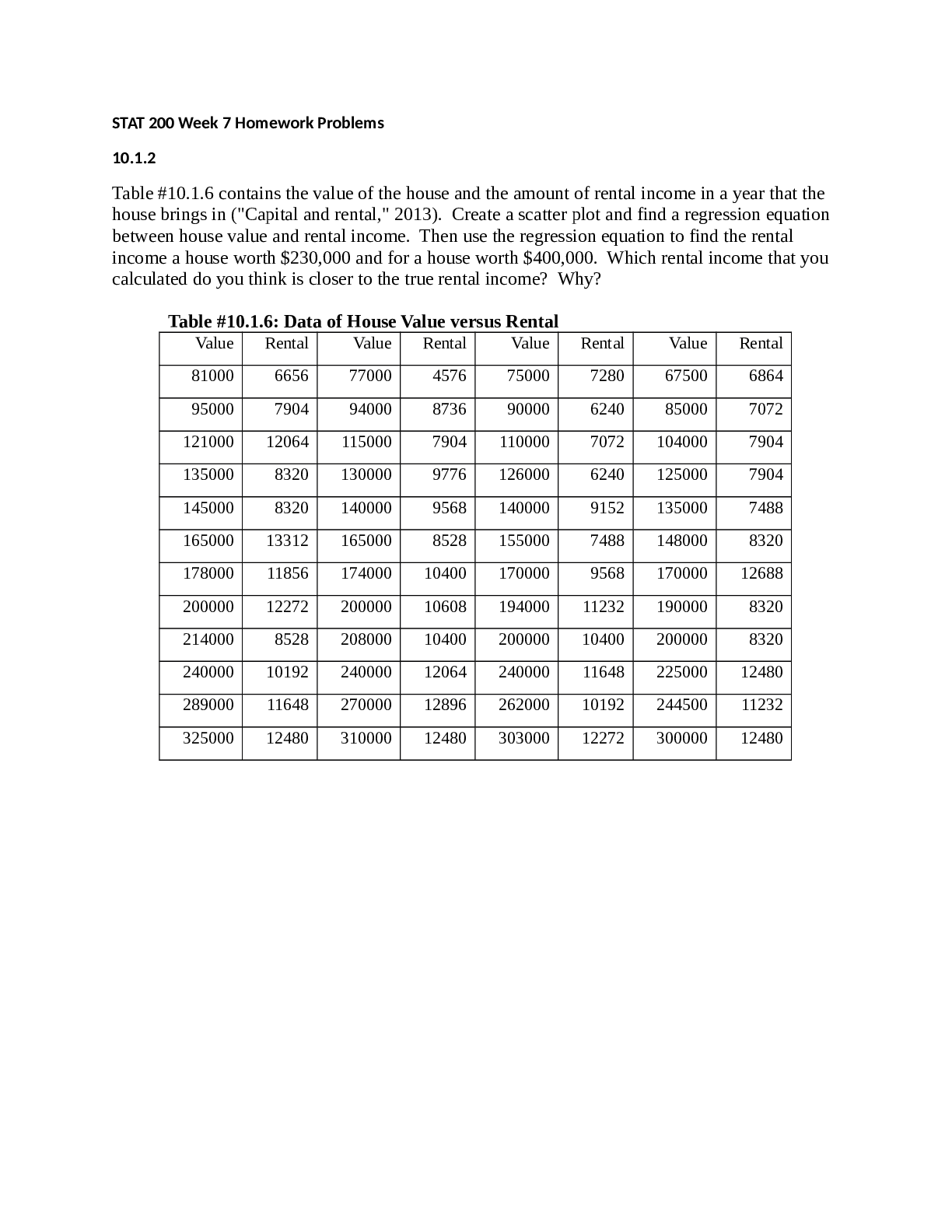

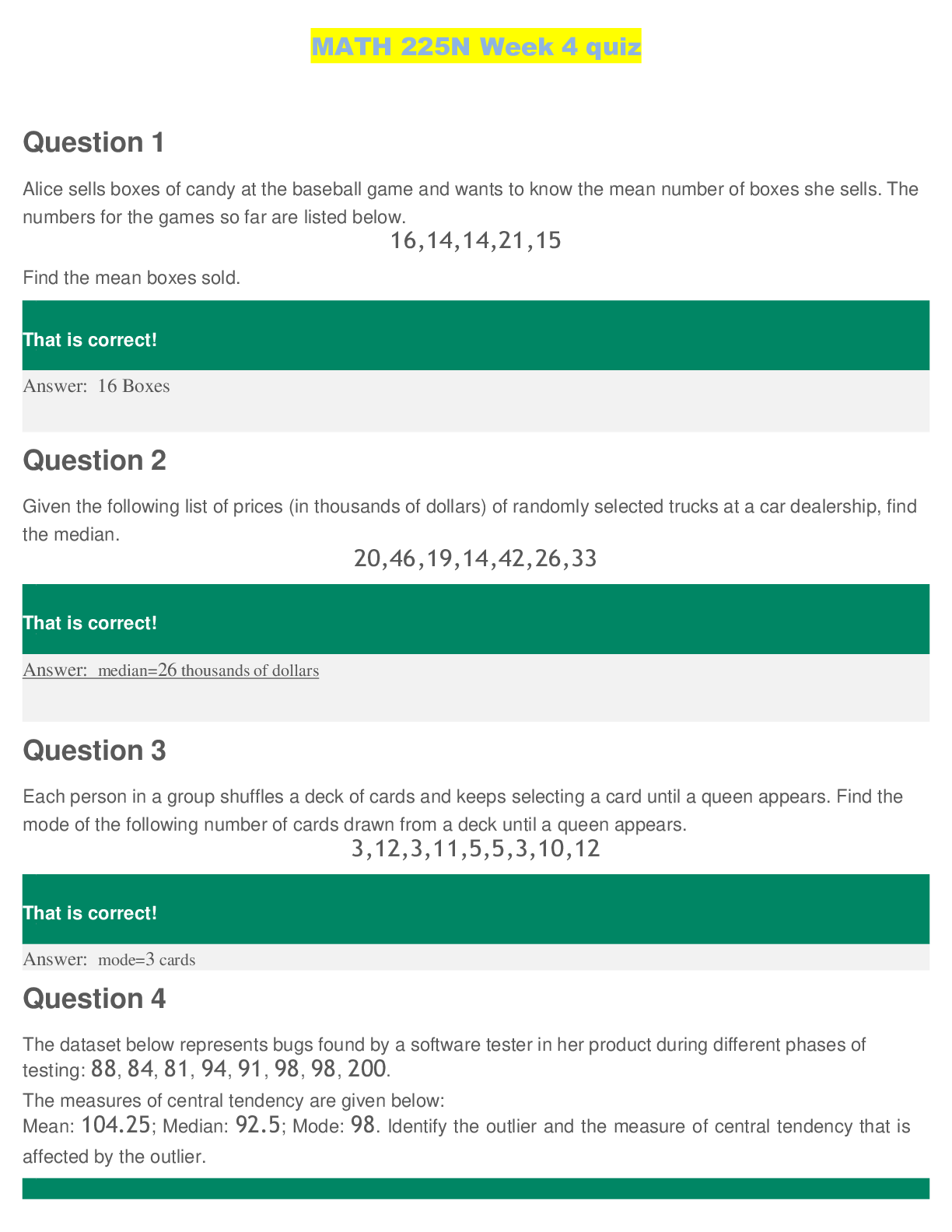

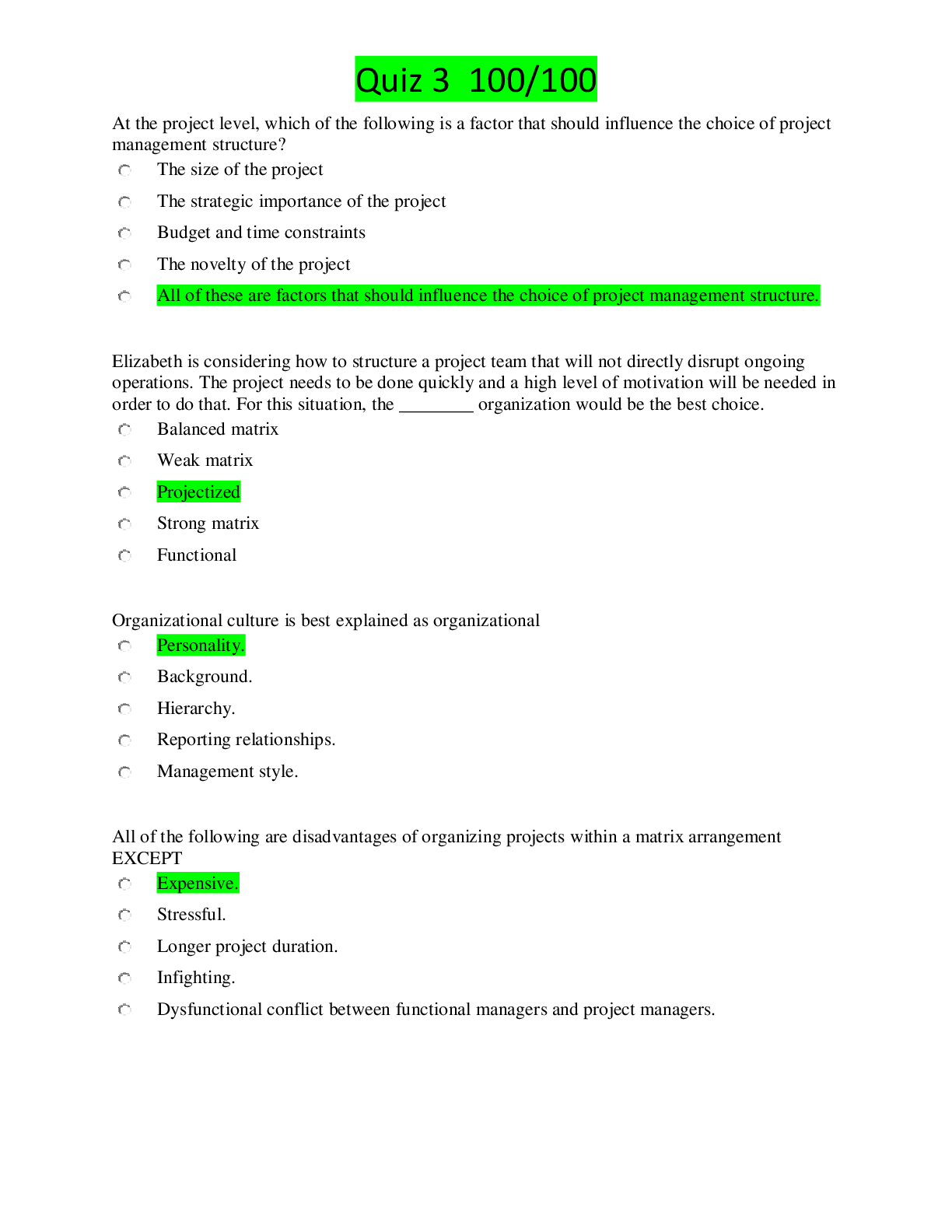

CHAPTER 23STATEMENT OF CASH FLOWS IFRS questions are available at the end of this chapter. TRUE-FALSE—Conceptual Answer No. Description F 1. Primary purpose of the statement of cash flows. T 2.... Information provided by statement of cash flows. T 3. Classification of operating activities. F 4. First step in cash flow statement preparation. T 5. Reconciling beginning and ending cash balances. F 6. FASB’s recommended method. T 7. Decrease in accounts receivable and cash-basis revenues. F 8. Decrease in prepaid expenses. F 9. Net income and net cash flow from operating activities. T 10. Converting net income to net cash flow from operating activities. F 11. Income from equity method investment. T 12. Computing cash receipts from customers. F 13. Computing cash payments for operating expenses. F 14. Reporting cash receipts/disbursements in direct method. T 15. Indirect method adjustments. F 16. Amortization of bond premium. T 17. Purchases and sales of trading securities. T 18. Disclosing noncash investing and financing activities. F 19. Use of cash flow worksheet. T 20. Reporting stock dividends on worksheet. MULTIPLE CHOICE—Conceptual Answer No. Description c 21. Objective of the statement of cash flows. c 22. Primary purpose of the statement of cash flows. c S23. Answers provided by the statement of cash flows. b S24. First step in cash flow statement preparation. d 25. Definition of cash equivalents. d 26. Cash flow effect of a short-term nontrade note payable. c P27. Classifying items as investing activities. b P28. Classification of a financing activity. b S29. Reporting amortization of bond premium. c S30. Converting accrual based expense to cash basis. c S31. Reporting revenues and expenses on a cash basis. c 32. Cash flow effects of major repairs on machinery. b 33. Adjustment to income for inventory increase. c 34. Adjustment under the direct and indirect methods. c 35. Adjustment to cost of goods sold under the direct method. a 36. Adjustment for an increase in accounts payable. a 37. Adjustment for a decrease in prepaid insurance. b 38. Direct method vs. indirect method.Test Bank for Intermediate Accounting, Sixteenth Edition c 39. Direct method vs. indirect method. 23 - 2Statement of Cash Flows MULTIPLE CHOICE—Conceptual (cont.) Answer No. Description c 40. Addition to net income under indirect method. b 41. Deduction from net income under indirect method. b 42. Statement of cash flows information. b 43. The effect of an inventory increase on cash flows from operating activities. b 44. Cash flow effects of a stock dividend. b 45. Effect of a change in dividends payable. d 46. Effect of cash dividend declaration on operating cash flows. d 47. Adjustment for equity method investment income. a 48. Reporting unusual transactions. d 49. Events not shown on statement of cash flows. c S50. Reporting significant noncash transactions. P These questions also appear in the Problem-Solving Survival Guide. S These questions also appear in the Study Guide. MULTIPLE CHOICE—Computational Answer No. Description a 51. Determine net cash flow from operating activities. c 52. Determine net cash flow from investing activities. b 53. Determine cash received from customers (direct method). d 54. Determine taxes paid (direct method). c 55. Determine net cash flow from financing activities. c 56. Compute net cash used in financing activities. c 57. Sale of fixed assets at a gain/cash flow effects. b 58. Analysis of plant asset account/cash flow presentation. c 59. Sale of equipment at a gain/cash flow effects. c 60. Determine depreciation expense for the year. b 61. Determine depreciation expense for the year. a 62. Calculate equipment purchased during the year. c 63. Calculate cost of equipment sold. a 64. Determine book value of equipment at end of year. b 65. Determine ending balance of accounts payable. c 66. Determine ending balance of retained earnings. d 67. Determine ending balance of capital stock. b 68. Determine the amount of a cash dividend. d 69. Reporting a stock dividend. c 70. Compute proceeds from issuance of bonds payable. a 71. Compute net cash provided by operating activities. a 72. Determine net income for period. a 73. Compute net cash provided by operating activities. a 74. Compute net cash provided by operating activities. a 75. Compute cash flow from investing activities. c 76. Compute cash flow from financing activities. d 77. Compute cash provided by operating activities. c 78. Compute cash provided by investing activities. a 79. Compute cash used by financing activities. a 80. Compute net cash provided by operating activities. a 81. Compute net cash provided by operating activities [Show More]

Last updated: 1 year ago

Preview 1 out of 78 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$7.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 13, 2021

Number of pages

78

Written in

Additional information

This document has been written for:

Uploaded

Apr 13, 2021

Downloads

0

Views

35