FIN 516: Final Exam Questions and Complete Answers

Document Content and Description Below

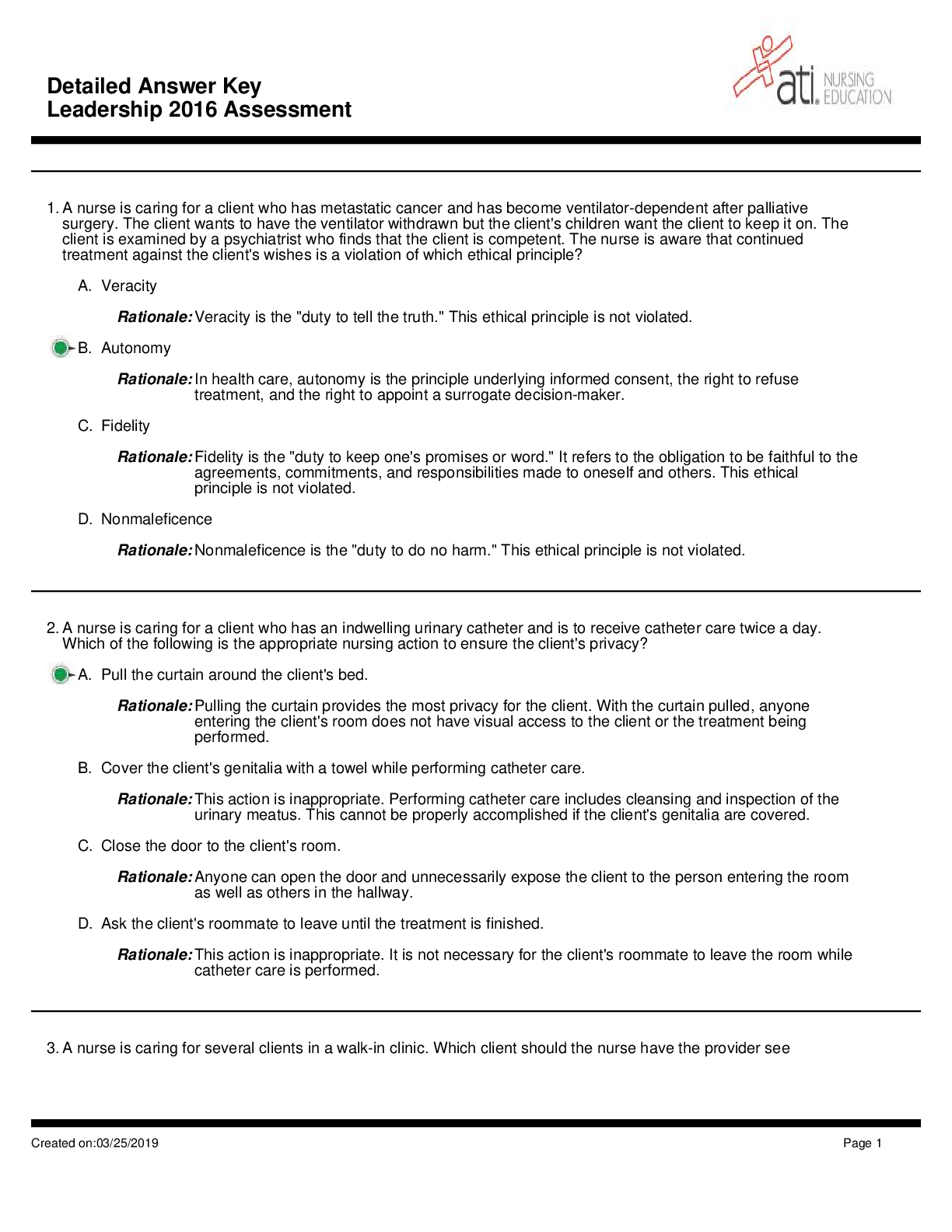

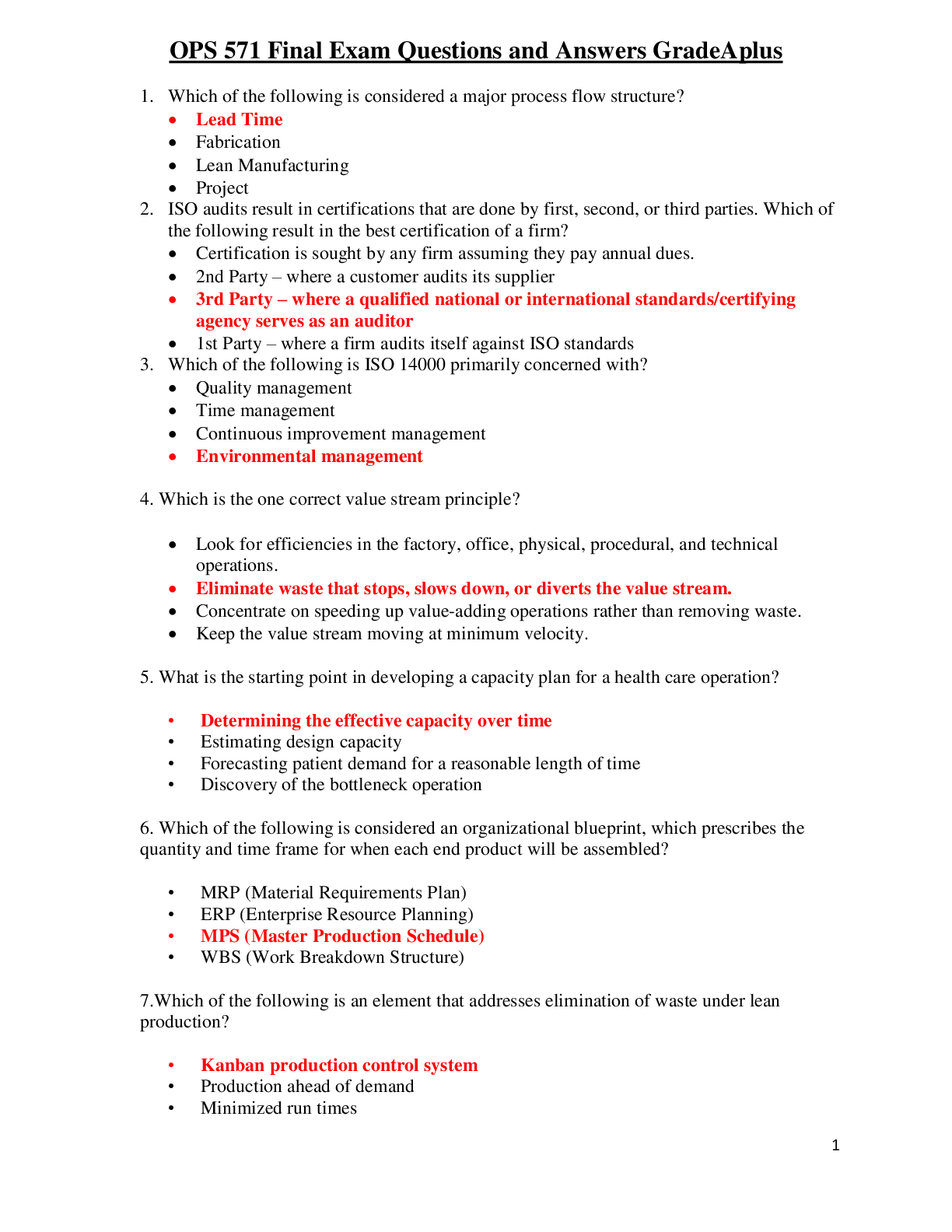

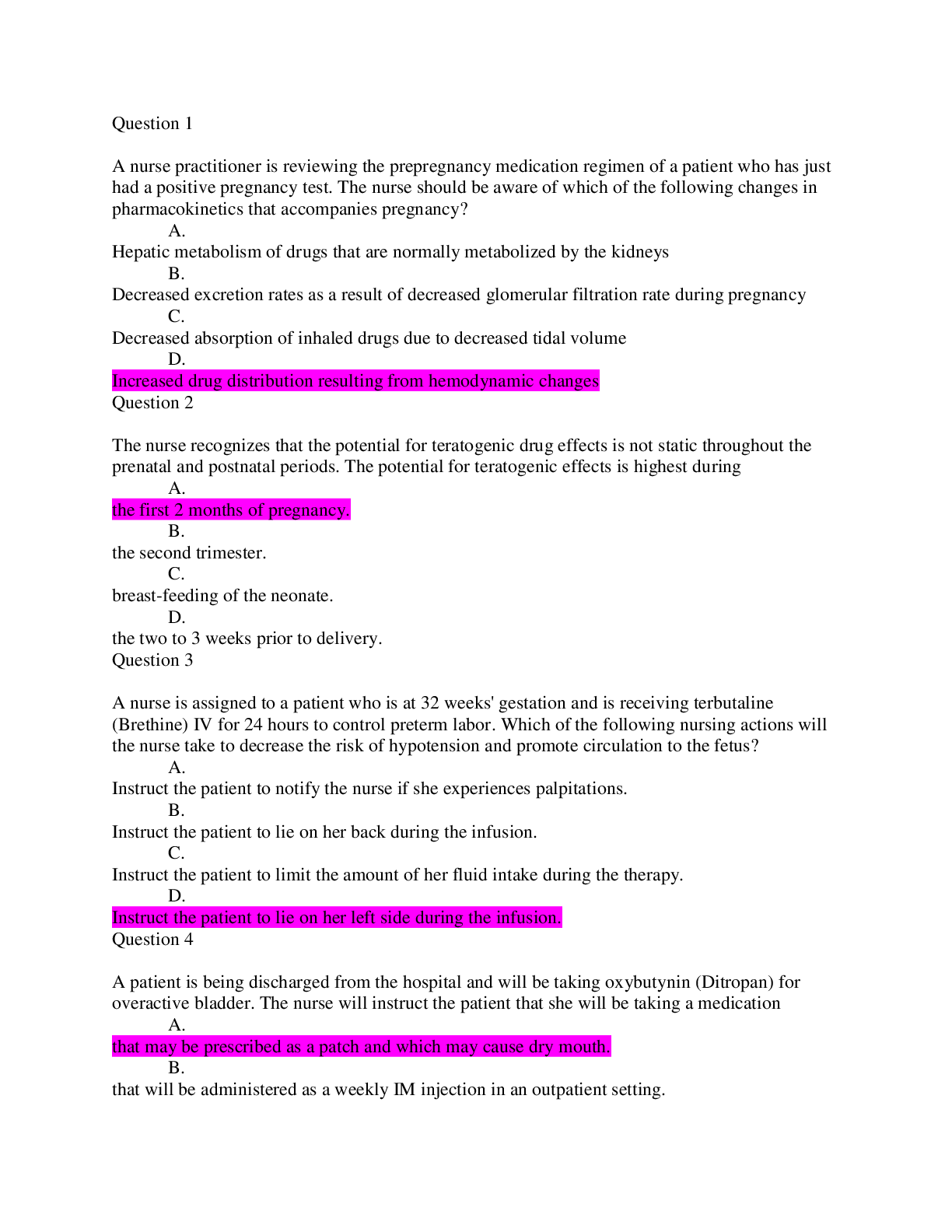

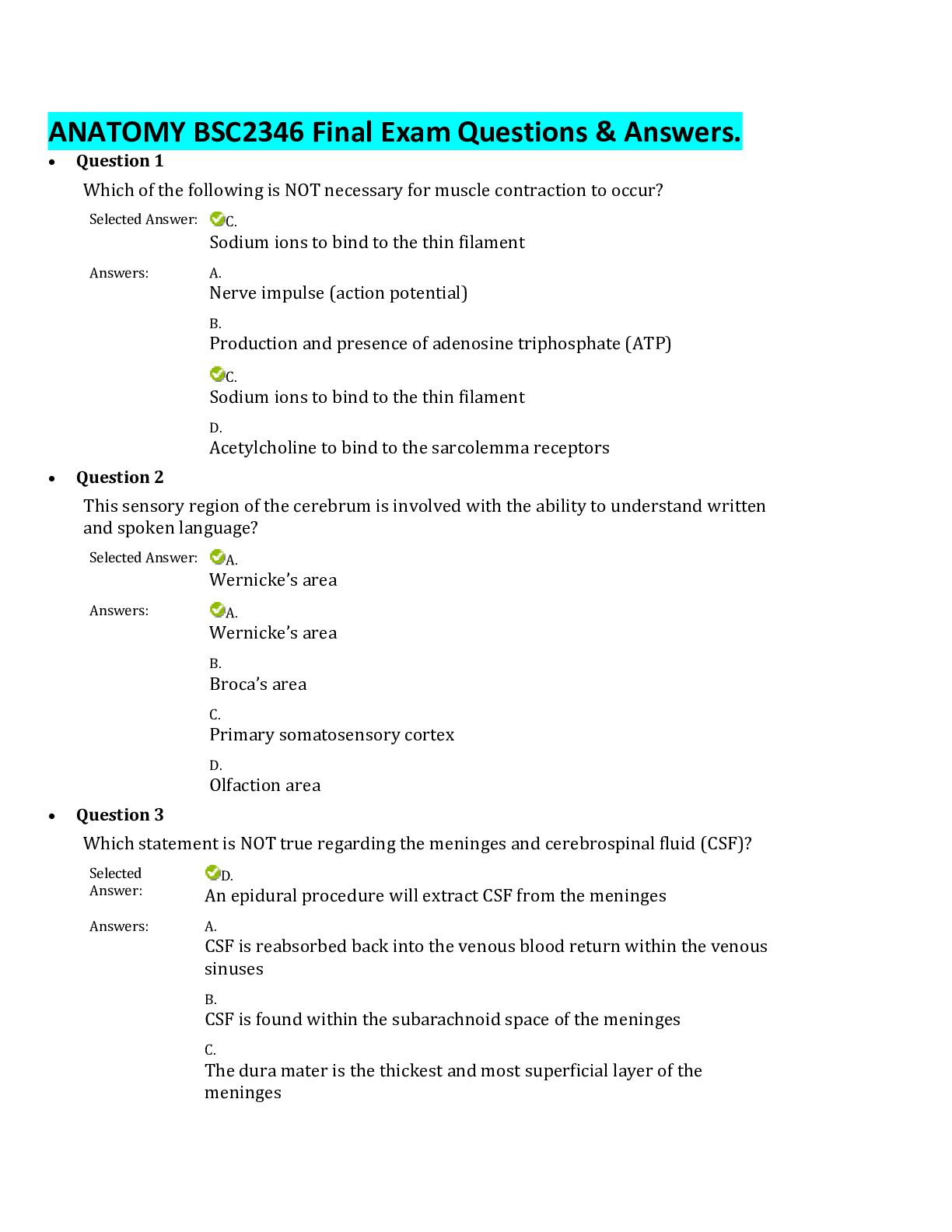

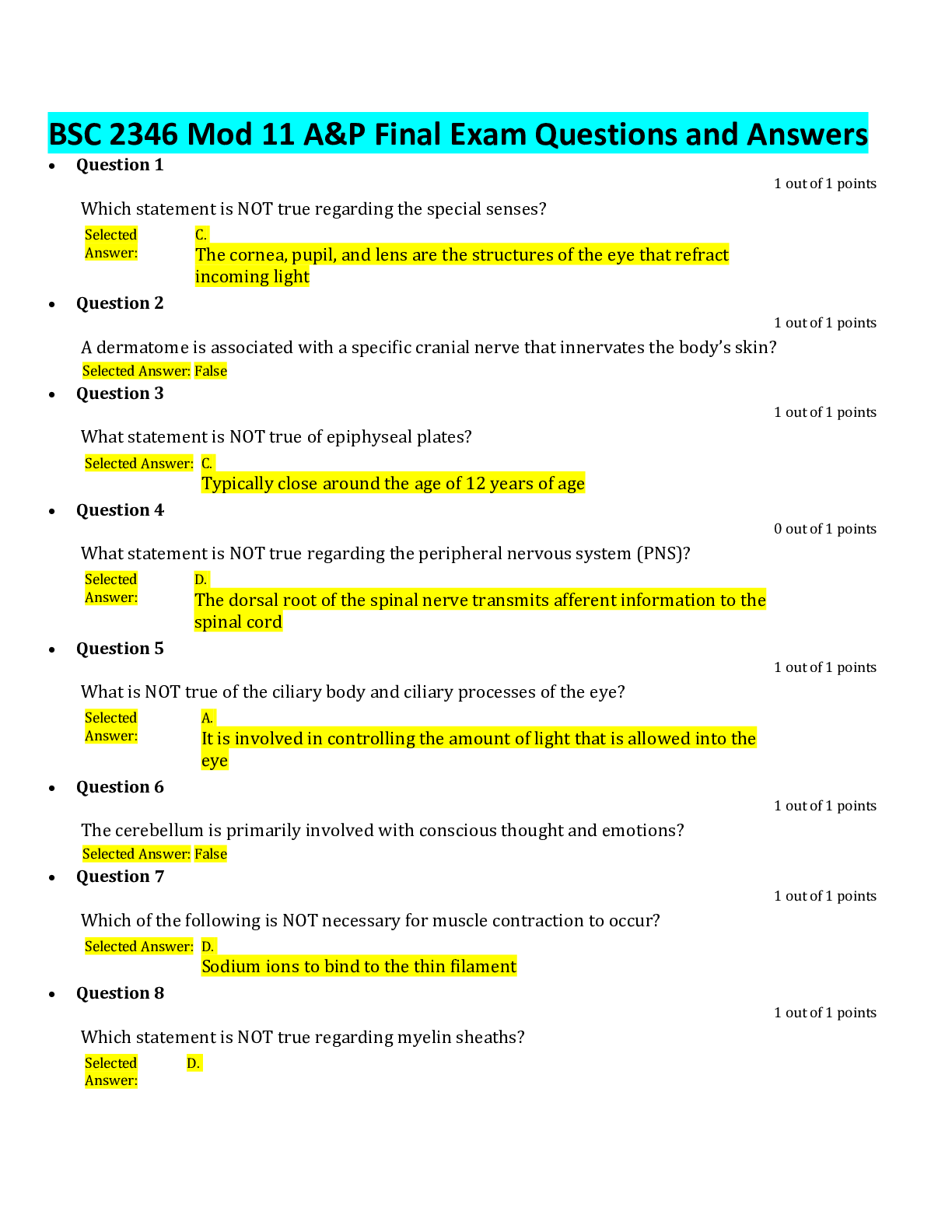

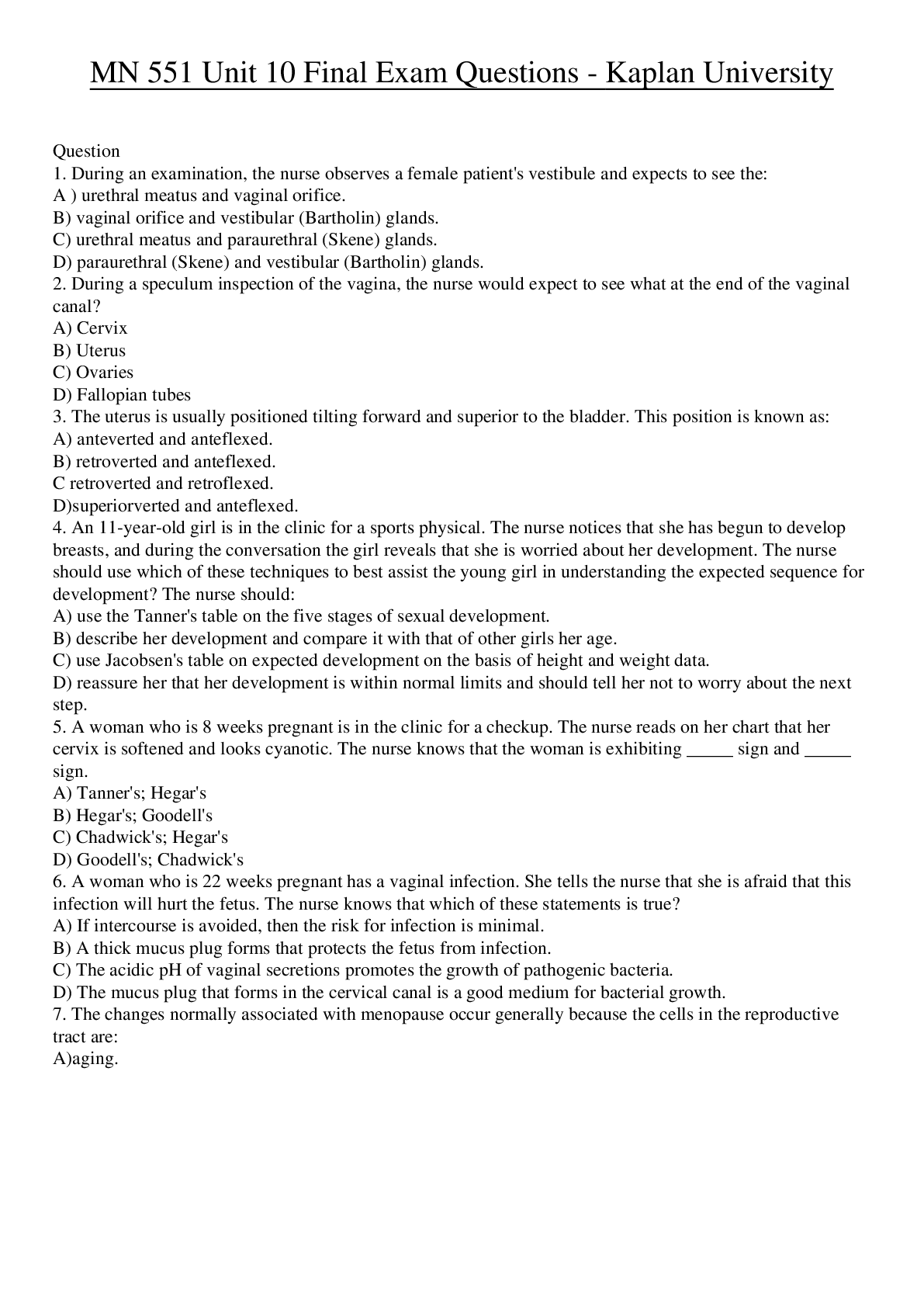

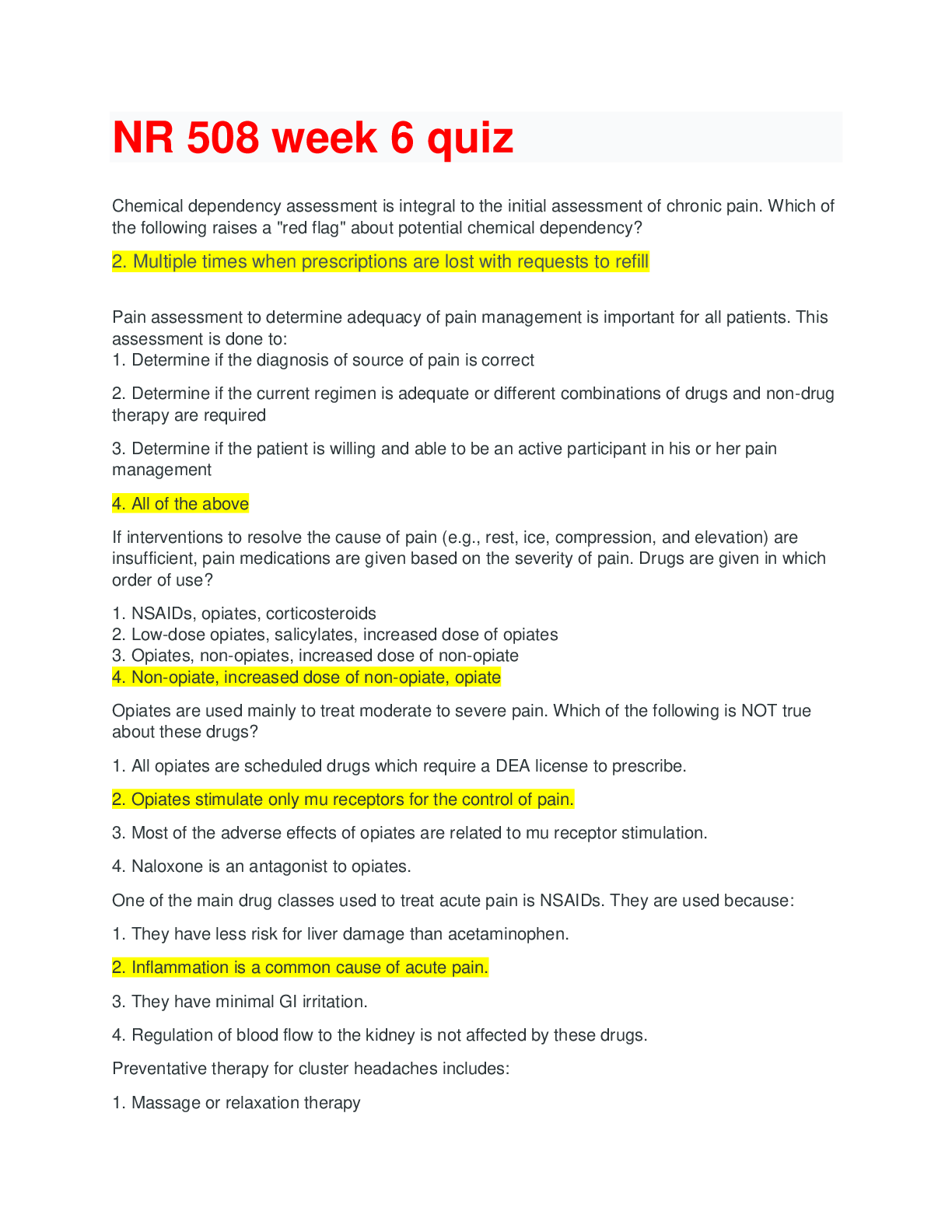

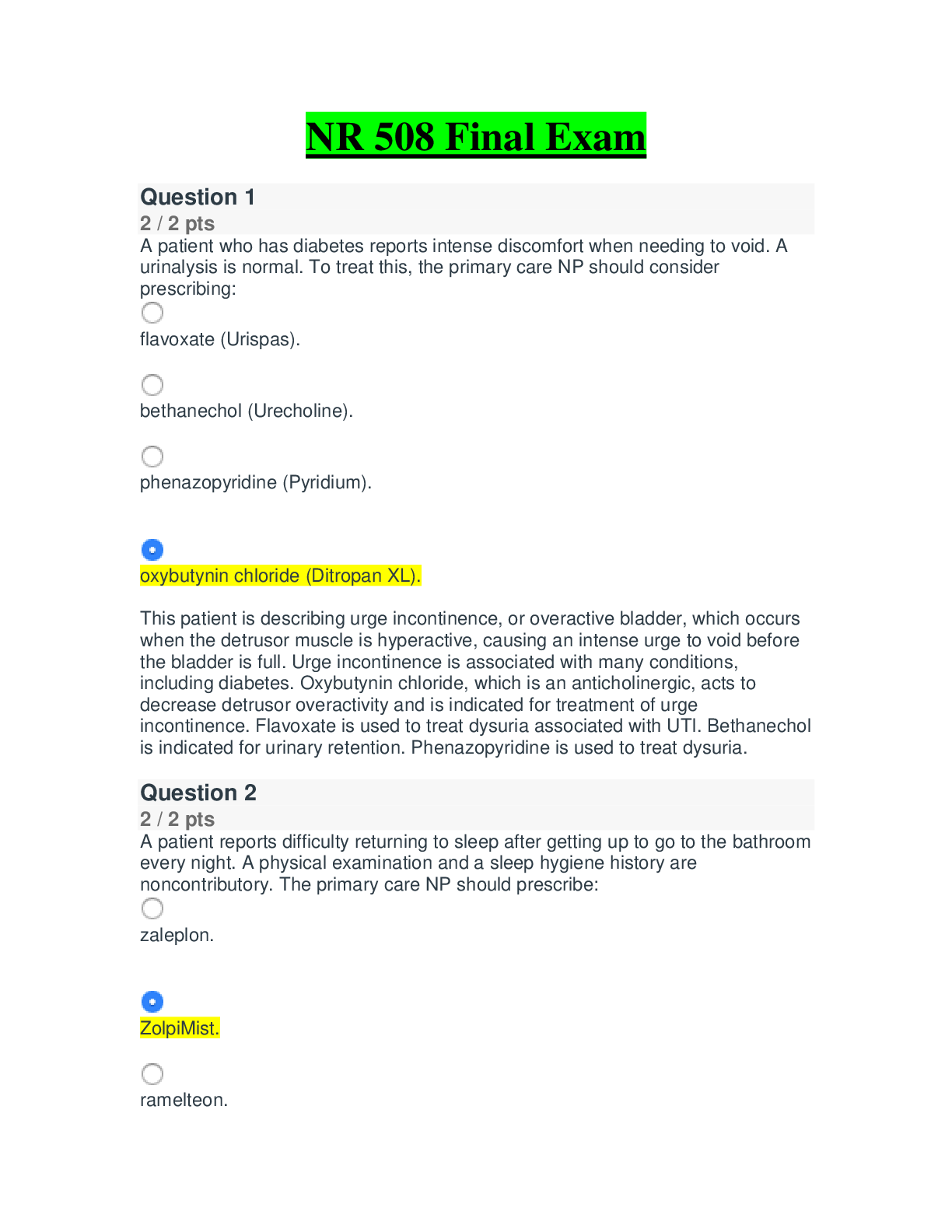

1. (TCO B) Which of the following statements concerning the MM extension with growth is NOT CORRECT? (a) The tax shields should be discounted at the unlevered cost of equity.] (b) The value of a gr... owing tax shield is greater than the value of a constant tax shield. (c) For a given D/S, the levered cost of equity is greater than the levered cost of equity under MM’s original (with tax) assumptions. (d) For a given D/S, the WACC is greater than the WACC under MM’s original (with tax) assumptions. (e) The total value of the firm is independent of the amount of debt it uses. Question 2.2. (TCO D) Which of the following statements is most correct? (a) In a private placement, securities are sold to private (individual) investors rather than to institutions. (b) Private placements occur most frequently with stocks, but bonds can also be sold in a private placement. (c) Private placements are convenient for issuers, but the convenience is offset by higher flotation costs. (d) The SEC requires that all private placements be handled by a registered investment banker. (e) Private placements can generally bring in funds faster than is the case with public offerings. (Points : 20) 2. (TCO D) Which of the following is generally NOT true and an advantage of going public? (a) Facilitates stockholder diversification. (b) Increases the liquidity of the firm's stock. (c) Makes it easier to obtain new equity capital. (d) Establishes a market value for the firm. (e) Makes it easier for owner-managers to engage in profitable self-dealings. Question 3.3. (TCO E) Buster’s Beverages is negotiating a lease on a new piece of equipment that would cost $100,000 if purchased. The equipment falls into the MACRS 3-year class, and it would be used for 3 years and then sold, because the firm plans to move to a new facility at that time. The estimated value of the equipment after 3 years is $30,000. If the borrow and purchase option is used, the cash flows would be the following: (Year 1) -2,400; (Year 2) -3,800; (Year 3) -1,400; (Year 4) -79,600; all of these cash outflows would be at the beginning of the respective years. Alternatively, the firm could lease the equipment for 3 years, with annual lease payments of $29,000 per year, payable at the beginning of each year. The firm is in the 20% tax bracket. If it borrows and purchases, it could obtain a 3-year simple interest loan, to purchase the equipment at a before-tax interest rate of 10%. If there is a positive net advantage to leasing, the firm will lease the equipment. Otherwise, it will buy it. What is the NAL? (a) $5,736 (b) $6,023 (c) $6,324 (d) $6,640 (e) $6,972 (Points : 20) Life of equipment: 3 Tax rate: 20% Loan amount = equipment cost:$100,000 Maintenance costs: $3,000 Interest rate, simple: 10.0% Salvage value: $30,000 Lease Pmt: $29,000 Loan Analysis: 0 1 2 3 Totals MACRS factor 0.33 0.45 0.15 0.93 Depreciation 33,000 45,000 15,000 93,000 Loan repayment -100,000 Interest -10,000 -10,000 -10,000 Int tax saving (Interest T)) 2,000 2,000 2,000 Maintenance -3,000 -3,000 -3,000 Maint. tax saving (Maint. T) 600 600 600 Depr'n tax saving (Deprn T) 6 ,600 9 ,000 3,000 Net operating CF -2,400 -3,800 -1,400 -105,000 Salvage value before taxes 30,000 Book value (Cost − Total dep'rn) 7,000 Taxable salvage value 23,000 Tax on salvage value -4,600 Salvage value after taxes 25,400 Total Net CF - 2 ,400 -3 ,800 -1 ,400 -79,600 PV cost at I(1 − T) = 8.00% -70,308 Lease Analysis: 0 1 2 3 Lease payment -29,000 -29,000 -29,000 Tax saving on pmt 5 ,800 5 ,800 5 ,800 0 Net cost of lease -23 ,200 -23 ,200 -23 ,200 0 PV cost of leasing at I(1 − T) -64,572 NAL = $5,736 3. (TCO E) Dakota Trucking Company (DTC) is evaluating a potential lease for a truck with a 4-year life that costs $40,000 and falls into the MACRS 3-year class. If the firm borrows and buys the truck, the loan rate would be 10%, and the loan would be amortized over the truck's 4-year life. The loan payments would be made at the end of each year. The truck will be used for 4 years, at the end of which time it will be sold at an estimated residual value of $10,000. If DTC buys the truck, its after tax cash flows would be the following: (Year 1) - 6,339; (Year 2) -4,764; (Year 3)-9,943; (Year 4) -5,640; all occurring at the end of respective years. The lease terms, call for a $10,000 lease payment (4 payments total) at the beginning of each year. DTC's tax rate is 40%. Should the firm lease or buy? (a) $849 (b) $896 (c) $945 (d) $997 (e) $1,047 Life of equipment: 4 Tax rate: 40% Loan amount = equipment cost:$40,000 Maintenance costs: $1,000 Interest rate: 10.0% Salvage value: $10,000 Lease Pmt: $10,000 Loan amortization for cash payment and interest expense: Payment: N = 4, I/YR = 10, PV = 40000, FV = 0. PMT = -$12,618.83 Year Beg. Bal. PMT Interest Principal Ending Bal. 1 40,000 12,619 4,000 8,619 31,381 2 31,381 12,619 3,138 9,481 21,900 3 21,900 12,619 2,190 10,429 11,472 4 11,472 12,619 1,147 11,472 0 Loan Analysis: 0 1 2 3 4 MACRS factor 0.33 0.45 0.15 0.07 Depreciation 13,200 18,000 6,000 2,800 Loan Pmt -12,619 -12,619 -12,619 -12,619 Int tax saving (Int. from table T)) 1,600 1,255 876 459 Maintenance -1,000 -1,000 -1,000 -1,000 Maint. tax saving (Maint. T) 400 400 400 400 Depr'n tax saving (Deprn T) 5 ,280 7 ,200 2 ,400 1,120 Net operating CF -6,339 -4,764 -9,943 -11,640 Salvage value 10,000 Tax on residual -4,000 Net residual val 6,000 Total Net CF -6 ,339 -4 ,764 -9 ,943 -5,640 PV cost of buying at I(1 – T) = 6.00% -23,035 Lease Analysis: 0 1 2 3 4 Lease payment -10,000 -10,000 -10,000 -10,000 0 Tax saving on pmt 4 ,000 4 ,000 4 ,000 4 ,000 0 Net cost of lease -6 ,000 -6 ,000 -6 ,000 -6 ,000 0 PV cost of leasing at I(1 – T) -22,038 NAL = $997 [Show More]

Last updated: 1 year ago

Preview 1 out of 10 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 14, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Apr 14, 2021

Downloads

0

Views

38

(1).png)