Finance > QUESTIONS & ANSWERS > FINC 302-Practice questions for Chapter 17: Dividends and Payout Policy ALL ANSWERS CORRECT,100% SCO (All)

FINC 302-Practice questions for Chapter 17: Dividends and Payout Policy ALL ANSWERS CORRECT,100% SCORE

Document Content and Description Below

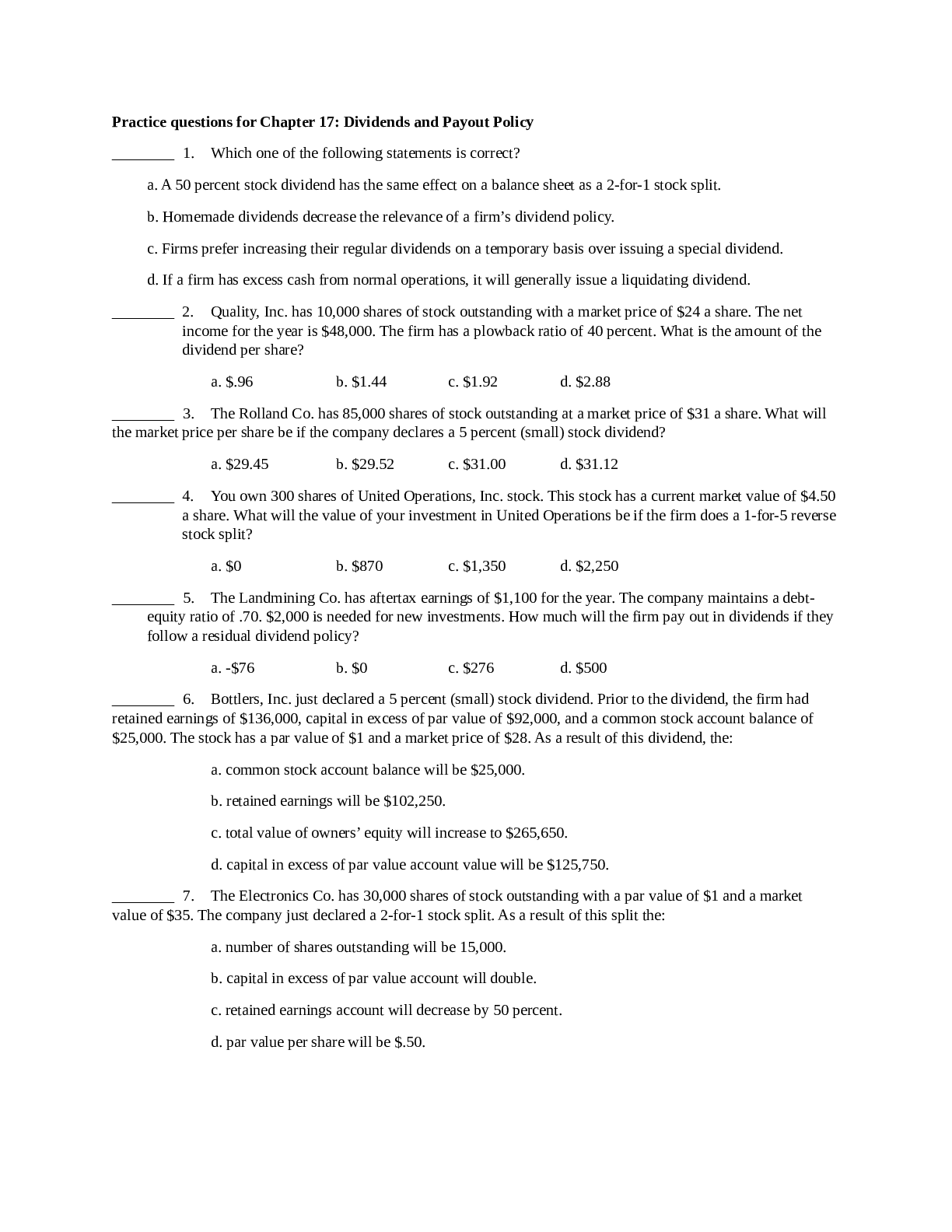

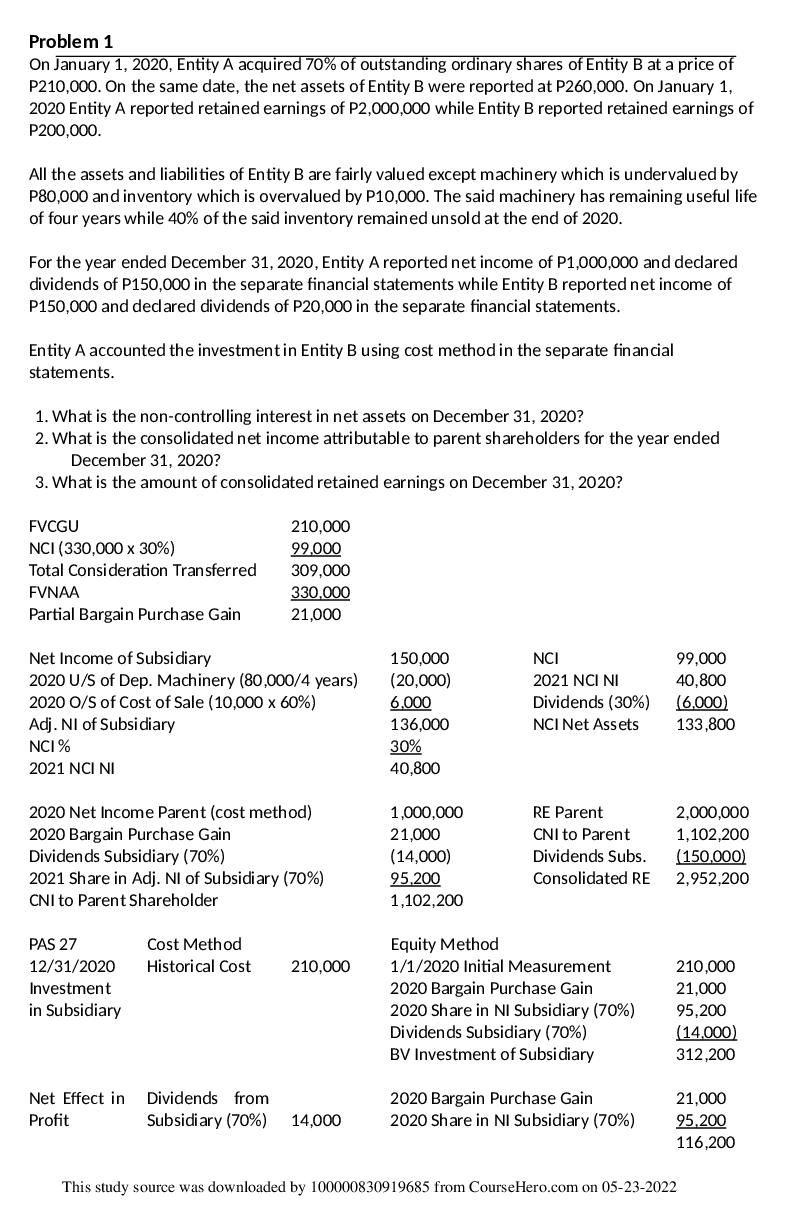

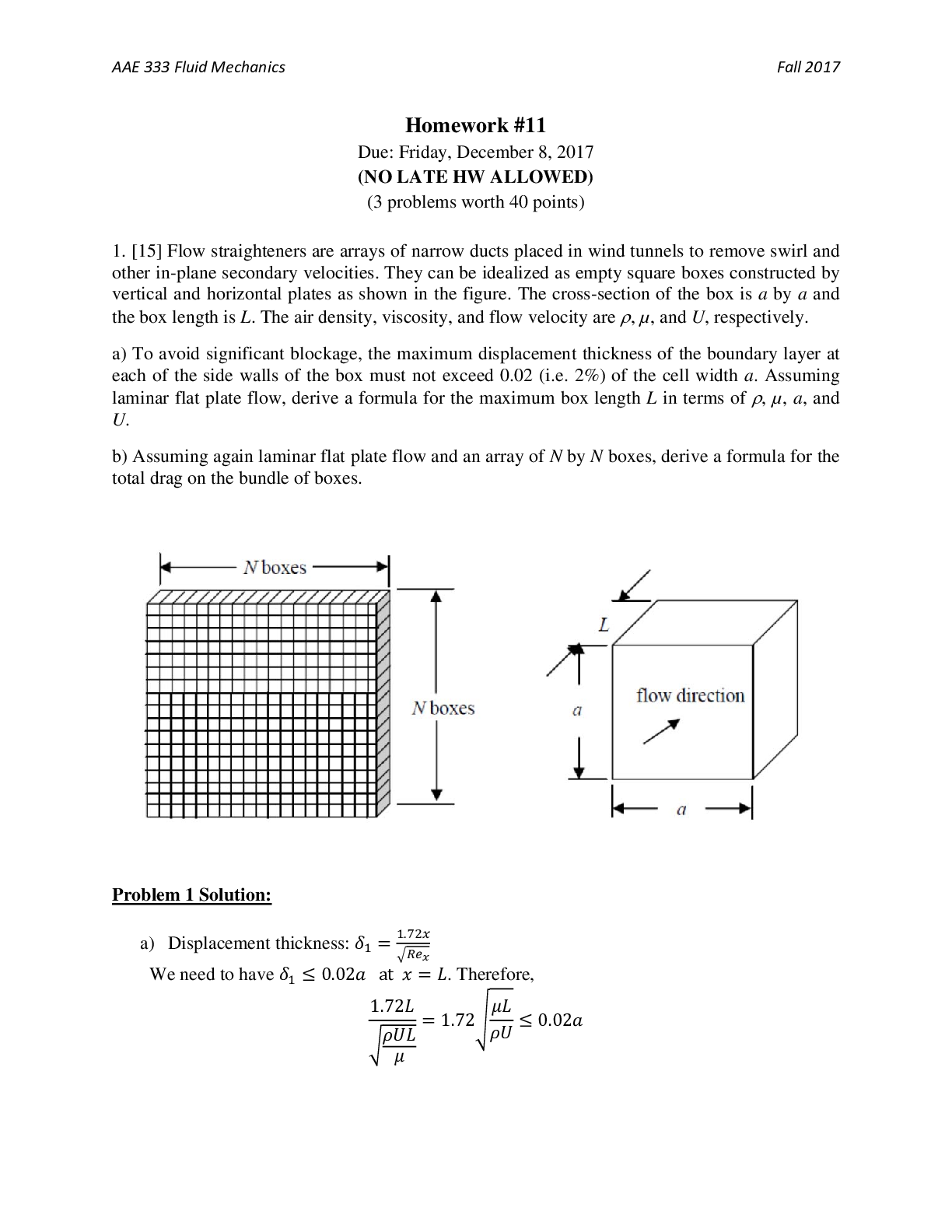

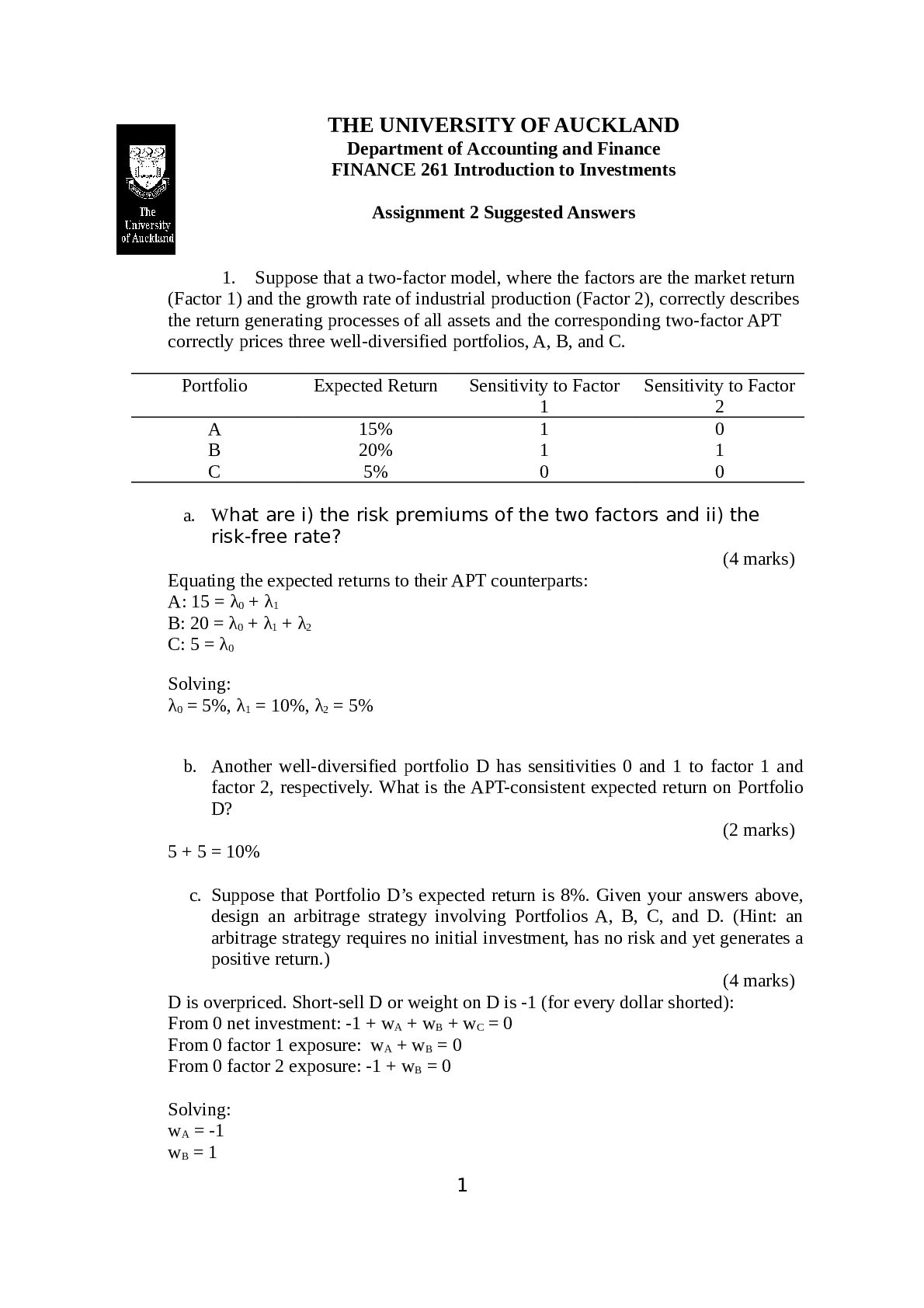

Practice questions for Chapter 17: Dividends and Payout Policy ________ 1. Which one of the following statements is correct? a. A 50 percent stock dividend has the same effect on a balance sheet as ... a 2-for-1 stock split. b. Homemade dividends decrease the relevance of a firm’s dividend policy. c. Firms prefer increasing their regular dividends on a temporary basis over issuing a special dividend. d. If a firm has excess cash from normal operations, it will generally issue a liquidating dividend. ________ 2. Quality, Inc. has 10,000 shares of stock outstanding with a market price of $24 a share. The net income for the year is $48,000. The firm has a plowback ratio of 40 percent. What is the amount of the dividend per share? a. $.96 b. $1.44 c. $1.92 d. $2.88 ________ 3. The Rolland Co. has 85,000 shares of stock outstanding at a market price of $31 a share. What will the market price per share be if the company declares a 5 percent (small) stock dividend? a. $29.45 b. $29.52 c. $31.00 d. $31.12 ________ 4. You own 300 shares of United Operations, Inc. stock. This stock has a current market value of $4.50 a share. What will the value of your investment in United Operations be if the firm does a 1-for-5 reverse stock split? a. $0 b. $870 c. $1,350 d. $2,250 ________ 5. The Landmining Co. has aftertax earnings of $1,100 for the year. The company maintains a debtequity ratio of .70. $2,000 is needed for new investments. How much will the firm pay out in dividends if they follow a residual dividend policy? a. -$76 b. $0 c. $276 d. $500 ________ 6. Bottlers, Inc. just declared a 5 percent (small) stock dividend. Prior to the dividend, the firm had retained earnings of $136,000, capital in excess of par value of $92,000, and a common stock account balance of $25,000. The stock has a par value of $1 and a market price of $28. As a result of this dividend, the: a. common stock account balance will be $25,000. b. retained earnings will be $102,250. c. total value of owners’ equity will increase to $265,650. d. capital in excess of par value account value will be $125,750. ________ 7. The Electronics Co. has 30,000 shares of stock outstanding with a par value of $1 and a market value of $35. The company just declared a 2-for-1 stock split. As a result of this split the: a. number of shares outstanding will be 15,000. b. capital in excess of par value account will double. c. retained earnings account will decrease by 50 percent. d. par value per share will be $.50.________ 8. The common stock of Publishing, Inc. has a par value of $1 and a market value of $34. The balance sheet shows a common stock account balance of $150,000, paid in surplus of $356,000, and retained earnings of $202,000. If the firm declares a 50 percent (large) stock dividend, the new: a. common stock account balance will be $75,000. b. par value per share will be $.50. c. retained earnings account will be $202,000. d. paid in surplus account will be $356,000. ________ 9. You currently own 100 shares of Monolo, Inc. stock with a total market value of $2,000. The company has plans for a 2-for-5 reverse stock split. After the stock split you will own ____ shares with a market price of _____ per share, all else equal. a. 40; $8.00 b. 40; $50.00 c. 250; $8.00 d. 250; $50.00 ________ 10. Waddell Industries has 35,000 shares of stock outstanding with a market price per share of $52. The net aftertax earnings of the firm are $74,000. The firm has just declared a 3-for-2 stock split. By how much will the earnings per share change due to the stock split? a. -$0.70 b. -$.035 c. $1.06 d. $1.14 Answers to the practice questions of Chapter17 1. b 2. d [$48,000 (1 − .4)] / 10,000 = $2.88 3. b ($31 85,000) / (85,000 1.05) = $29.52 4. c (300 1 / 5) ($4.50 5 / 1) = $1,350 5. b $1,100 (1 / 1.7 $2,000) = -$76.47; In this situation the funds needed for the project exceed the funds available and no dividends will be paid. 6. d Amount of new shares from stock dividend = 25,000 × .05 = 1,250; Capital in excess of par value account = $92,000 + [($28 − 1) × 1,250] = $125,750 7. d Par value per share = $1 × (1 / 2) = $ [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 26, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Apr 26, 2021

Downloads

0

Views

27

.png)

.png)