Financial Accounting > QUESTIONS & ANSWERS > ACCOUNTING 12345REVIEWER-IN-IA1-1-MYC. ALL ANSWERS CORRECT,100% SCORE (All)

ACCOUNTING 12345REVIEWER-IN-IA1-1-MYC. ALL ANSWERS CORRECT,100% SCORE

Document Content and Description Below

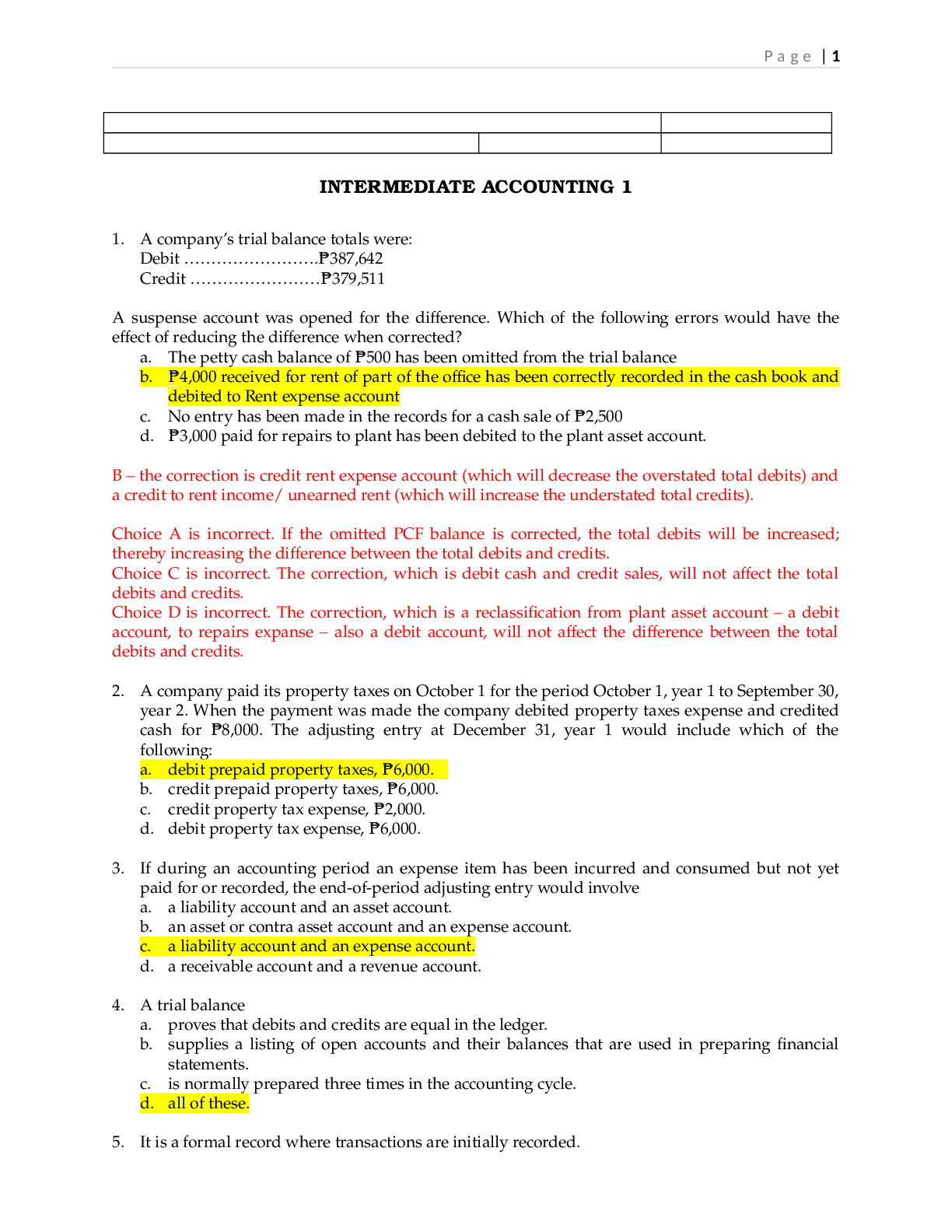

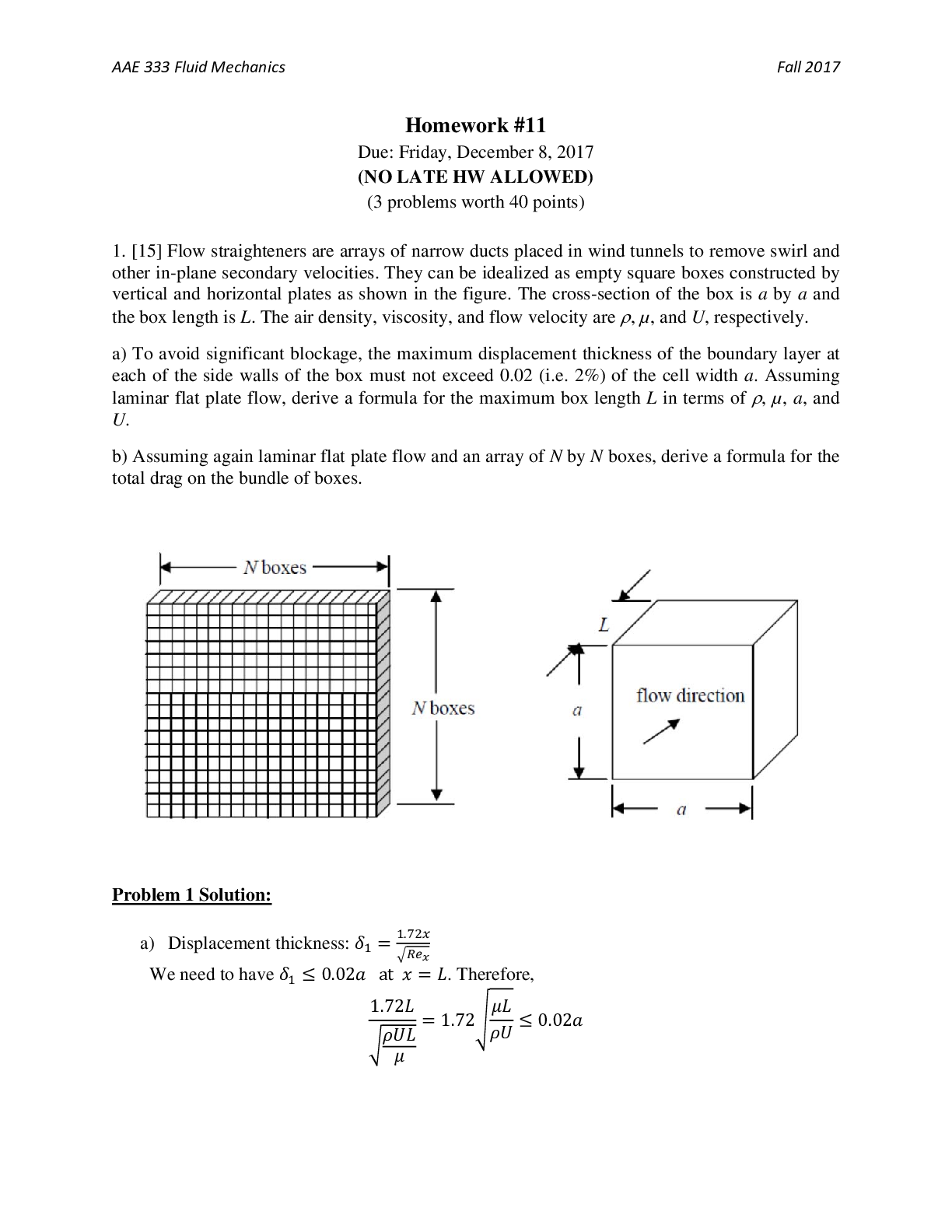

INTERMEDIATE ACCOUNTING 1 1. A company’s trial balance totals were: Debit …………………….₱387,642 Credit ……………………₱379,511 A suspense account was opened for the diff... erence. Which of the following errors would have the effect of reducing the difference when corrected? a. The petty cash balance of ₱500 has been omitted from the trial balance b. ₱4,000 received for rent of part of the office has been correctly recorded in the cash book and debited to Rent expense account c. No entry has been made in the records for a cash sale of ₱2,500 d. ₱3,000 paid for repairs to plant has been debited to the plant asset account. B – the correction is credit rent expense account (which will decrease the overstated total debits) and a credit to rent income/ unearned rent (which will increase the understated total credits). Choice A is incorrect. If the omitted PCF balance is corrected, the total debits will be increased; thereby increasing the difference between the total debits and credits. Choice C is incorrect. The correction, which is debit cash and credit sales, will not affect the total debits and credits. Choice D is incorrect. The correction, which is a reclassification from plant asset account – a debit account, to repairs expanse – also a debit account, will not affect the difference between the total debits and credits. 2. A company paid its property taxes on October 1 for the period October 1, year 1 to September 30, year 2. When the payment was made the company debited property taxes expense and credited cash for ₱8,000. The adjusting entry at December 31, year 1 would include which of the following: a. debit prepaid property taxes, ₱6,000. b. credit prepaid property taxes, ₱6,000. c. credit property tax expense, ₱2,000. d. debit property tax expense, ₱6,000. 3. If during an accounting period an expense item has been incurred and consumed but not yet paid for or recorded, the end-of-period adjusting entry would involve a. a liability account and an asset account. b. an asset or contra asset account and an expense account. c. a liability account and an expense account. d. a receivable account and a revenue account. 4. A trial balance a. proves that debits and credits are equal in the ledger. b. supplies a listing of open accounts and their balances that are used in preparing financial statements. c. is normally prepared three times in the accounting cycle. d. all of these. 5. It is a formal record where transactions are initially recorded.P a g e | 2 a. Journal entries c. Master file b. Ledger d. Journal 6. It is the basic storage of information in accounting. a. Journal entry c. Debit or Credit b. T-account d. Account 7. Which of the following is a recordable event or item? a. Changes in managerial policy b. The value of human resources c. Changes in personnel d. None of these 8. Errors revealed by a trial balance are a. those errors resulting from transposition but not transplacement. b. those errors resulting from either transposition or transplacement. c. transplacement and transposition errors on both sides of a journal entry. d. those errors which that have caused the total debits and total credits to be unequal. 9. Adjusting entries are necessary to 1. obtain a proper matching of revenue and expense. 2. achieve an accurate statement of assets and equities. 3. adjust assets and liabilities to their fair value. a. 1 c. 3 b. 2 d. 1 and 2 10. Factors that shape an accounting information system include the a. nature of the business c. volume of data to be handled. b. size of the firm d. all of these. 11. An accrued revenue can best be described as an amount a. collected and currently matched with expenses. b. collected and not currently matched with expenses. c. not collected and currently matched with expenses. d. not collected and not currently matched with expenses. 12. At the end of the current year, the prepaid insurance account showed a debit the balance of ₱5,000; the balance at the beginning of the year was ₱6,000, and during the year the insurance premiums paid amounted to ₱8,000. Assuming insurance premium payments are initially entered in the prepaid insurance account ,the adjusting entry at the end of the year would include: a. debit prepaid insurance ₱9,000 b. credit prepaid insurance ₱1,000 c. debit insurance expense ₱7,000 d. debit insurance expense ₱9,000 13. When an item of revenue is collected and recorded in advance, it is normally called a(n) ___________ revenue. a. accrued c. unearned b. prepaid d. cashP a g e | [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 15, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

May 15, 2021

Downloads

0

Views

36

.png)

.png)