Accounting > TEST BANK > Test Bank Accounting for Government and Nonprofit Organizations by Patton (All)

Test Bank Accounting for Government and Nonprofit Organizations by Patton

Document Content and Description Below

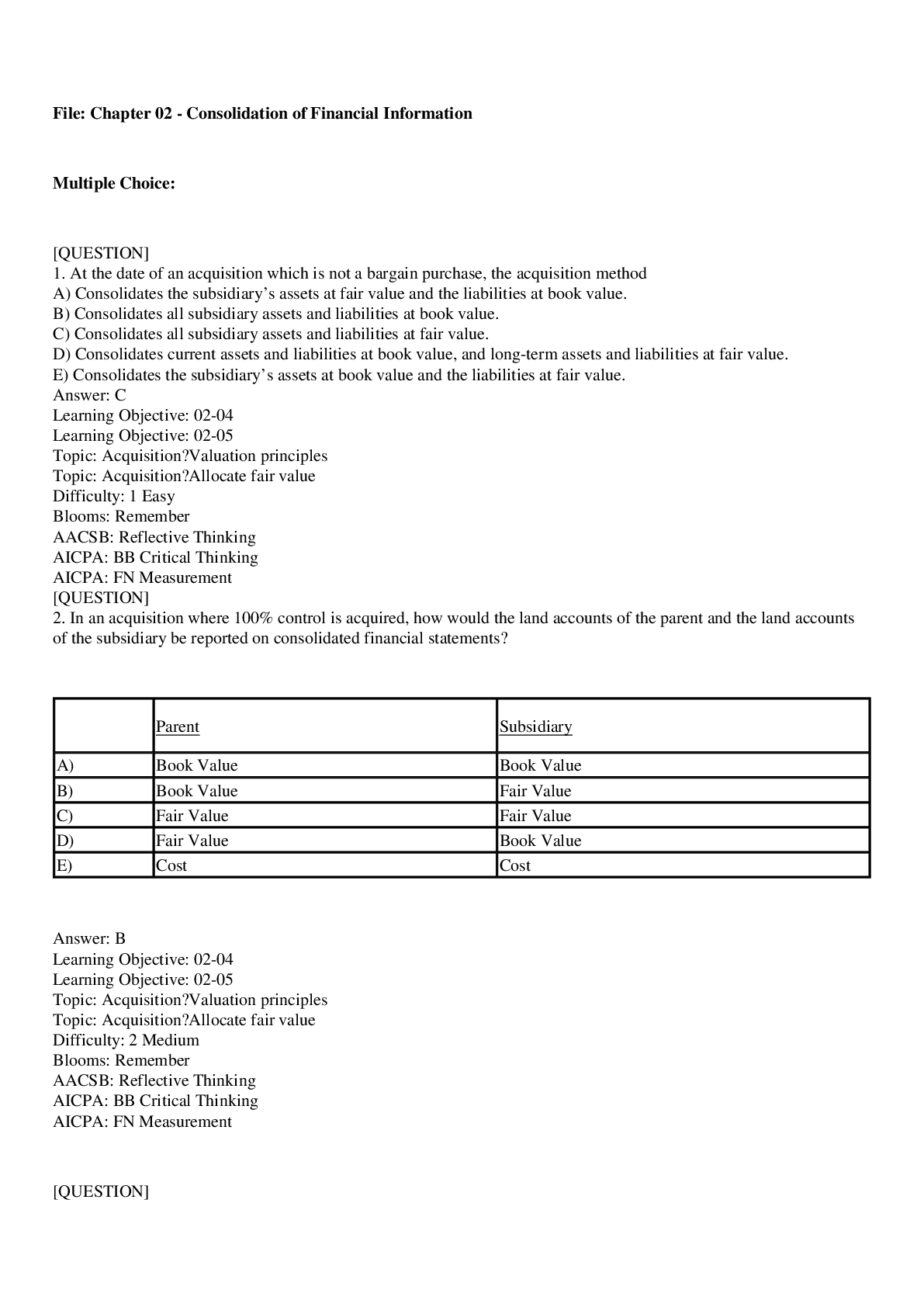

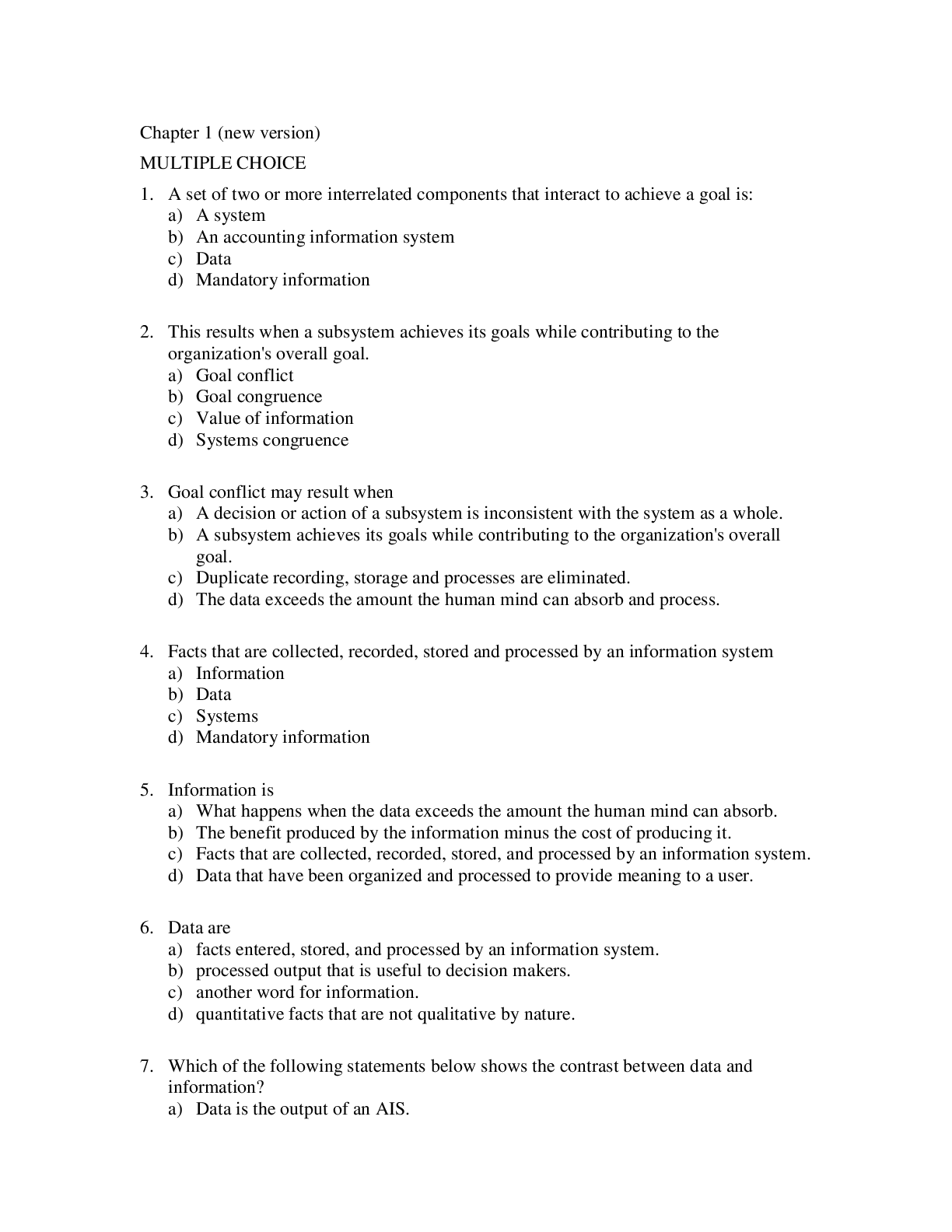

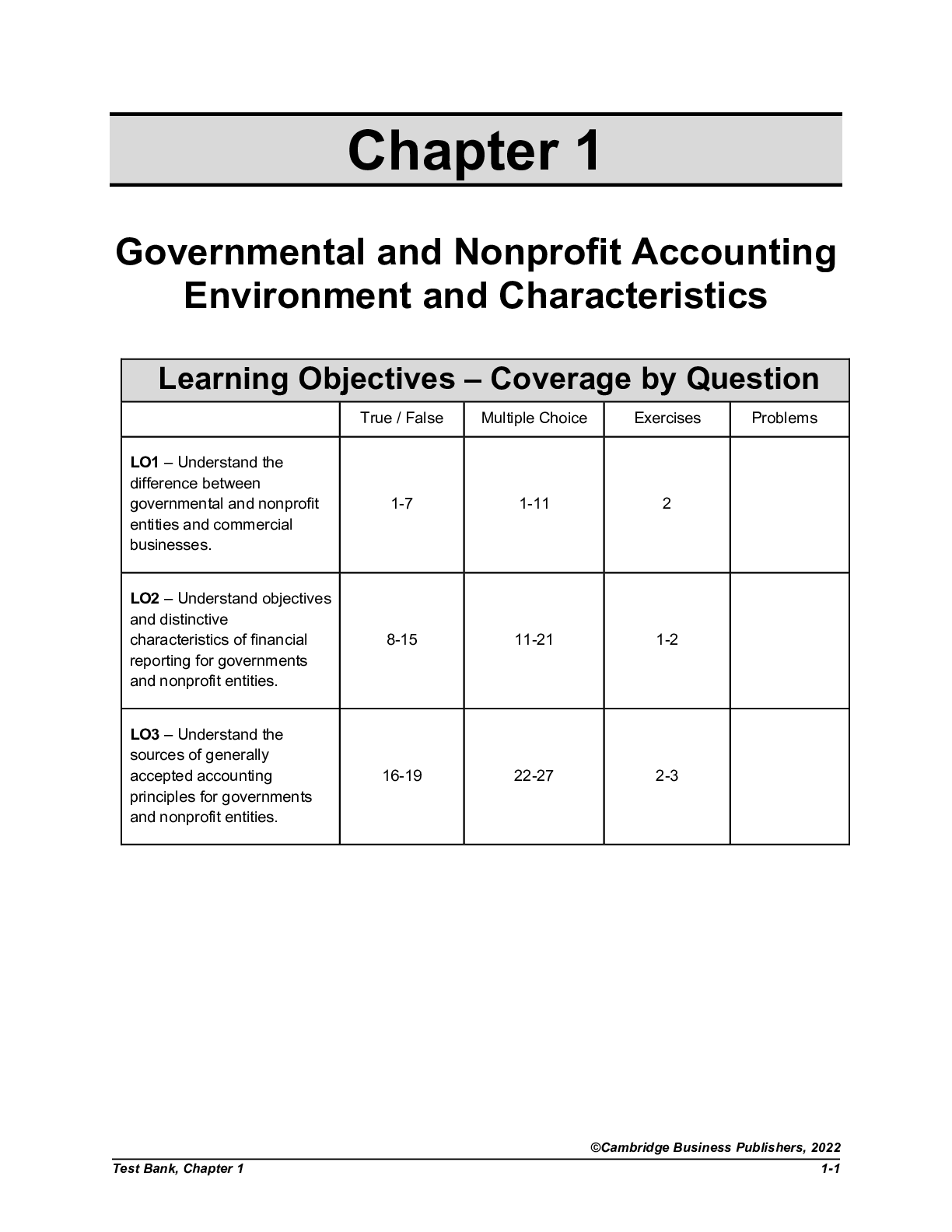

Chapter 1 Governmental and Nonprofit Accounting Environment and Characteristics Learning Objectives – Coverage by Question True / False Multiple Choice Exercises Problems LO1 – Understand... the difference between governmental and nonprofit entities and commercial businesses. 1-7 1-10 2 LO2 – Understand objectives and distinctive characteristics of financial reporting for governments and nonprofit entities. 8-15 10-16 1-2 LO3 – Understand the sources of generally accepted accounting principles for governments and nonprofit entities. 16-19 17-21 2-3 Chapter 1: Governmental and Nonprofit Accounting Environment and Characteristics True / False Topic: Governmental and Nonprofit Organizations LO: 1 1. An entity is likely to be a governmental entity if a controlling majority of its governing body is appointed by governmental officials. Answer: True Rationale: Entities created by governments by statute or under nonprofit laws are governmental if their officers are popularly elected, or a controlling majority of their governing body is appointed or approved by governmental officials. Topic: Governmental and Nonprofit Organizations LO: 1 2. Characteristics that distinguish nonprofits from business enterprises include nonprofits receiving significant contributions from resource providers without an expectation of receive an equivalent return and the lack of a profit motive. Answer: True Rationale: Businesses seldom receive charitable contributions and exist to make profits to enhance the wealth of their owners. Nonprofits receive significant charitable contribution and are not in business to make a profit. Topic: Operating Environment LO: 1 3. A purpose of a government is to provide services to its constituents. Answer: True Rationale: Business enterprises exist to enhance the wealth of its owners, but a government exist to provide services to its constituents. Topic: Operating Environment LO: 1 4. A purpose of a nonprofit is to provide services to its constituents. Answer: True Rationale: Business enterprises exist to enhance the wealth of its owners, but a nonprofit exists to provide services to its constituents. Topic: Operating Environment LO: 1 5. Governments receive most of their revenues through exchange transactions. Answer: False Rationale: Governments obtain most of their revenues from taxation. Topic: Operating Environment LO: 1 6. Unlike businesses enterprises, Governments and nonprofits acquire resources through taxes or donations. Transactions related to taxes and donations require special accounting standards. Answer: True Rationale: A reason for unique accounting standards for governments and nonprofits is that they obtain most of their revenues from nonexchange transactions, such as taxes and donations. Topic: Operating Environment LO: 1 7. Governmental and nonprofit accounting standards-setters tend to take a longer-term perspective in developing accounting measurements for certain of their transactions because they rarely go out of business. Answer: False Rationale: Governmental accounting standards-setters tend to take a longer-term perspective in developing accounting measurements for governments because governments rarely go out of business because of their power to tax and the types of services that governments provide. Nonprofits, however, are at risk of going out of business for many reasons, such as competition, inefficiencies, and changes in constituent needs. Topic: Users and Uses of Accounting Information LO: 2 8. Major external users of governmental and nonprofit entity financial reports are oversight bodies, service recipients, and owners. Answer: False Rationale: Although it is true that oversight bodies and service recipients are major external users of governmental and nonprofit entity financial reports, neither governments or nonprofits have owners. Instead, they are accountable to resource providers, such as taxpayers, donors, investors, and grant-providing organizations. Topic: Accounting and Financial Reporting Characteristics LO: 2 9. State and local governments and nonprofit entities are required to prepare fund-based reports for external financial reporting purposes. Answer: False Rationale: State and local governments prepare fund-based reports for external financial reporting purposes, but FASB does not require nonprofit entities to prepare fund-based reports although FASB does not preclude such reporting if the nonprofit entity complies with FASB’s financial reporting requirements. Topic: Accounting and Financial Reporting Characteristics LO: 2 10. The federal government, state and local governments, and nonprofit entities are required to prepare financial statements on the accrual basis for external financial reporting purposes. Answer: True Rationale: The financial statements of the federal government and nonprofit entities are prepared on the accrual basis of accounting. State and local governments use the accrual basis to prepare financial statements for their business-type activities and their government-wide financial statements. Topic: Accounting and Financial Reporting Characteristics LO: 2 11. All governments prepare fund financial statements for external financial reporting purposes. Answer: False Rationale: State and local governments prepare fund financial statements, but funds are not used in the federal financial statements. Topic: Accounting and Financial Reporting Characteristics LO: 2 12. The federal government and state and local governments use the modified accrual basis of accounting. Answer: False Rationale: State and local governments use the modified accrual basis of accounting to account for their basic government functions and the accrual basis of accounting to account for business-type activities and for their government-wide financial statements. The federal government, however, only uses the accrual basis of accounting for financial reporting purposes. Topic: Accounting and Financial Reporting Characteristics LO: 2 13. The FASAB establishes financial reporting standards for all governments. Answer: False Rationale: The Federal Accounting Standards Advisory Board (FASAB) sets financial reporting standards for the federal government, but the Governmental Accounting Standards Board (GASB) sets financial reporting standards for state and local governments. Topic: Accounting and Financial Reporting Characteristics LO: 2 14. The GASB establishes financial reporting standards for state and local governments and nonprofit entities. Answer: False Rationale: The GASB establishes financial reporting standards for state and local governments, but the FASB establishes financial reporting standards for nonprofit entities. Topic: Accounting and Financial Reporting Characteristics LO: 2 15. In their objectives of financial reporting, both the FASAB and GASB state that financial reporting should assist in the government’s duty to be publicly accountable. Answer: True Rationale: Public accountability is an important objective in both the FASAB and GASB’s Concepts Statements. Topic: Accounting Principles and Standards LO: 3 16. The FASB establishes financial reporting standards for all nongovernmental entities, including nonprofit colleges and universities and health care providers. Answer: True Rationale: The FASB establishes financial reporting standards for all nongovernmental entities, including nonprofits, such as nonprofit colleges and universities and nonprofit health care providers. Topic: Accounting Principles and Standards LO: 3 17. The financial reporting standards established by the FASAB, GASB, and FASB are considered to be generally accepted accounting principles by virtue of the authority accorded them by the General Accountability Office. Answer: False Rationale: The American Institute of Certified Public Accountants’ Code of Professional Conduct—not the General Accountability Office—provides the authoritative GAAP status for financial reporting standards promulgated by the FASAB, GASB, and FASB. Topic: GAAP Hierarchy LO: 3 18. GASB standards recognize only two categories of GAAP for state and local governments. The most authoritative source of GAAP is GASB Statements. Answer: True Rationale: GASB standards recognize only two categories of GAAP for state and local governments. Category A is the most authoritative source of GAAP and is comprised of GASB Statements and Interpretations. Category B is also authoritative and is comprised of GASB Technical Bulletins, GASB Implementation Guides, and AICPA literature cleared by the GASB. Topic: GAAP Hierarchy LO: 3 19. The FASB Codification is the single source of authoritative GAAP for nonprofit organizations. Answer: True Rationale: The FASB Codification is the single source of authoritative GAAP for nonprofit organizations. Any accounting literature—outside the FASB Codification—is nonauthoritative. Multiple Choice Topic: Operating Environment LO: 1 1. Which of the following is a distinguishing characteristic of a nonprofit organization? a. Its revenues do not exceed its expenses b. There is an absence of ownership interests that can be sold, transferred, or redeemed c. It does not depreciate its capital assets d. It does not charge fees for any of its services Answer: B Rationale: Nonprofit organizations, unlike business enterprises, lack ownership interests. Therefore, they do not engage in ownership-type transactions, such as issuing stock and paying dividends. Topic: Operating Environment LO: 1 2. Which of the following activities is performed by state and local governments but not nonprofit organizations? a. Issuing federal tax-exempt debt b. Receiving grants c. Preparing budgets d. Providing services to constituents Answer: A Rationale: A unique characteristic of state and local governments is that they can issue debt whose interest is free of federal income tax. State and local governments and nonprofit organizations receive grants, prepare budgets, and provide services to constituents. Topic: Operating Environment LO: 1 3. Which of the following is a reason that governmental accounting is different from business accounting? a. Governments provide services. b. Governments are expected to have a long-life. c. Governments have budgets. d. Governments may have liabilities Answer: B Rationale: The long-life of governments, as compared to business enterprises, is a reason that governmental accounting is different. To illustrate, the GASB allows the difference between projected and actual earnings for pension investments to be reported as either as deferred inflows of resources or deferred outflows of resources and recognized as an expense over a five-year period rather than being reported immediately as an expense. This will be discussed in more detail in Chapter 8. Topic: Operating Environment LO: 1 4. Most of the revenues obtained by most governments come from: a. Taxes b. Sales of goods or services c. Borrowing d. All of the above. Answer: A Rationale: Governments obtain most of their revenues from various types of taxes. Of course, borrowing does not result in revenue. Although a few governments obtain a large portion of their revenues from the sale of goods or services—such as a government-owned utilities or hospitals—the largest source of revenues for states, cities, counties, and most other governments is taxes. Topic: Operating Environment LO: 1 5. Which of the following is a major source of resources for many nonprofits, but not for businesses or governments? a. Donor contributions b. Taxes c. Sales of goods to consumers d. Sale of stock Answer: A Rationale: Donor contributions are significant source of revenues for many nonprofits. Some governments receive donations, but generally, not to the extent of nonprofits. A government’s major source of revenue generally is various types of taxes. Businesses receive most of their revenue from the sale of goods or services. Topic: Operating Environment LO: 1 6. A nonprofit organization performs all of the following activities except a. Charging a fee for services provided b. Paying dividends to shareholders c. Purchasing long-lived (capital) assets d. Paying overtime to employees Answer: B Rationale: Nonprofit organizations, unlike business enterprises, lack ownership interests. Therefore, they do not engage in ownership-type transactions, such as issuing stock and paying dividends. Topic: Governmental and Nonprofit Organizations LO: 1 7. The GASB establishes financial reporting standards for state and local governmental entities. An entity created by a government possessing one or more of the following characteristics should follow GASB standards: a. The power to enact and levy a tax. b. The power to directly issue debt, for which its interest is exempt from federal taxation. c. The potential that another government could unilaterally dissolve the entity and assume their assets and liabilities. d. Any of the above. e. Only a and b. Answer: D Rationale: The GASB Codification, Section 1000, paragraph .801 explains that any of the above characteristics indicate that an organization created by a government should be considered a government for financial reporting purposes. Topic: Governmental and Nonprofit Organizations LO: 1 8. An activity that is unique to governments is a. Budgeting b. Cash management c. Levying taxes d. Advertising Answer: C Rationale: Most organizations engage in budgeting, cash management, and advertising. Governments have the unique ability to levy taxes. Topic: Operating Environment LO: 1 9. Nonprofit organizations obtain their revenues primarily from a. Issuance of bonds b. Contributions from donors c. Taxes on personal property d. Taxes on real property Answer: B Rationale: Donor contributions are significant source of revenues for many nonprofits. The issuance of bonds results in a liability. Nonprofits do not levy taxes on personal or real property. Topic: Accounting and Financial Reporting Characteristics LO: 1, 2 10. External governmental financial reporting focuses on which of the following? a. Calculating profit or loss b. Protecting investors from fraud c. Demonstrating accountability d. Reporting to management Answer: C Rationale: Public accountability is an important objective in both the FASAB and GASB’s Concept Statements Topic: Accounting and Financial Reporting Characteristics LO: 2 11. Which basis of accounting is used for the basic governmental functions of state and local governments? a. Cash basis of accounting b. Modified accrual basis of accounting c. Accrual basis of accounting d. Regulatory basis of accounting Answer: B Rationale: The basis of accounting that governments use for their basic functions is the modified accrual basis of accounting. These functions are reported in governmental-type funds, which are discussed in more detail beginning in Chapter 2. Topic: Accounting and Financial Reporting Characteristics LO: 2 12. Which of the following entities must use fund accounting for external financial reporting purposes? a. Businesses b. Nonprofit organizations c. State and local governments d. Federal government e. All of the above Answer: C Rationale: The GASB requires both government-wide and fund-based reporting for external financial reporting purposes. Topic: Accounting and Financial Reporting Characteristics LO: 2 13. Which of the following entities must report at both fund-level and entity-wide level? a. Businesses b. Nonprofit organizations c. State and local governments d. Federal government e. All of the above Answer: C Rationale: The GASB requires both government-wide and fund-based reporting for external financial reporting purposes. Topic: Accounting and Financial Reporting Characteristics LO: 2 14. Which of the following entities must report at the entity-wide level? a. Businesses b. Nonprofit organizations c. State and local governments d. Federal government e. All of the above Answer: E Rationale: The FASAB, FASB, and GASB require financial reporting for the entity as a whole. Topic: Users and Uses of Accounting Information LO: 2 15. The major external users of governmental financial reports include: a. Taxpayers. b. Stockholders. c. Bond-rating agencies. d. Both a and b. e. Both a and c. Answer: E Rationale: The major external users of governmental financial reports are resources providers, oversight bodies, and service recipients. Resource providers include taxpayers, grant-providing organizations, investors, and bond-rating agencies. Topic: Accounting and Financial Reporting Characteristics LO: 2 16. To what extent do organizations that report based on fund accounting also report on the entity as a whole? a. Organizations that are required to report based on fund accounting are not required to report on the entity as a whole b. Organizations that choose to report on the entity as a whole are not permitted to prepare reports based on fund accounting for internal purposes c. Organizations that are required to report based on fund accounting are required to also report on the entity as a whole d. Organizations that are required to report based fund accounting have the option to also report on the entity as a whole Answer: C Rationale: State and local government are required to report based on fund accounting and also are required to report on the entity as a whole. No other organization is required to report by fund. Nonprofits must report on the entity as a whole but may also may use fund-based reporting although they are not required to do so. Topic: Accounting Principles and Standards LO: 3 17. For which types of organizations is the FASB responsible for establishing accounting and financial reporting standards? a. Business enterprises and nonprofit organizations, including nonprofit colleges, universities and health care providers b. Business enterprises; nonprofit organizations; and all colleges, universities and health care providers, whether organized as nonprofit or governmental entities c. Business enterprises only d. All entities, except for those under the jurisdiction of the American Institute of CPAs Answer: A Rationale: The AICPA’s’ Code of Professional Conduct states that the FASB establishes financial reporting standards for business enterprises and nonprofit organizations. Topic: Accounting Principles and Standards LO: 3 18. For which types of organizations is the GASB responsible for establishing accounting and financial reporting standards? a. All state, local, and Federal organizations b. All state and local governmental organizations, except for state and local governmental colleges, universities, health care providers, and utilities c. All state and local governmental organizations, including government-sponsored colleges, universities, health care providers, and utilities d. All governmental and not-for-profit organizations Answer: C Rationale: The AICPA’s Code of Professional Conduct states that the GASB establishes financial reporting standards for state and local governments. Topic: Accounting Principles and Standards LO: 3 19. Which entity establishes financial accounting standards and principles for the federal government? a. FASB b. GASB c. FASAB d. None of the above. Answer: C Rationale: The AICPA’s Code of Professional Conduct states that the FASAB establishes financial reporting standards for the federal government. Topic: GAAP Hierarchy LO: 3 20. Which of the following is the most authoritative source of accounting standards for cities and counties? a. Current practices widely used by nonprofit entities b. GASB Statements c. AICPA Industry Audit Guides d. GASB Implementation Guides e. GASB Technical Bulletins Answer: B Rationale: GASB Statements are Category A in the GASB GAAP hierarchy—the most authoritative level of the GAAP hierarchy. Topic: GAAP Hierarchy LO: 3 21. Which of the following is the most authoritative source of accounting standards for nonprofits? a. Current practices widely used by not-for-profit entities b. FASB Codification c. FASB Statements d. GASB Codification Answer: B Rationale: The FASB has a single source or category for authoritative nongovernmental GAAP—the FASB Codification. Exercises Topic: Fund Accounting LO: 2 1. Discuss the nature and purpose of "fund accounting." Answer: Fund accounting is the practice under which an organization segregates its assets, liabilities, and net assets into separate accounting entities, called "funds," based on legal restrictions, donor-imposed restrictions, or other regulations. Entities use separate funds to account for the acquisition and disposition of resources whose use is restricted in some manner to specific purposes. Each fund has a set of self-balancing accounts. That is, the total assets of a particular fund must equal the total of its liabilities and fund balance (or net assets or net position). The accounting records of a particular fund must identify the unique resources of that fund and the claims on those resources, as distinguished from all other funds. Financial statements are prepared at the fund level by state and local governments. Topic: Accounting and Financial Reporting Characteristics LO: 1, 2, 3 2. Listed below are some identifying characteristics of organizations. Indicate with a check mark in the appropriate column(s) those characteristics that apply to each type of organization. Some characteristics may apply to more than one type of organization. Characteristic Type of Organization State and Local Business Nonprofit Government Has a need for accounting Operates according to a legal budget Has equity shareholders Receives voluntary contributions Levies and enforces collection of taxes Uses accrual basis of accounting Uses modified accrual basis of accounting Financial reporting includes fund reporting Subject to FASB standards Subject to GASB standards Financial reporting focuses on entity as a whole Answer: Characteristic Type of Organization State and Local Business Nonprofit Government Has a need for accounting Operates according to a legal budget Has equity shareholders Receives voluntary contributions Levies and enforces collection of taxes Uses accrual basis of accounting Uses modified accrual basis of accounting Financial reporting includes fund reporting Subject to FASB standards Subject to GASB standards Financial reporting focuses on entity as a whole Topic: GAAP Hierarchy LO: 3 3. A large private bus company in Empire City went bankrupt. At Empire City's request, the state legislature established a legally separate public benefit corporation named Metro City Bus. In the law establishing Metro City Bus, Empire City was authorized to appoint Metro's entire governing body, and Metro was authorized to issue tax-exempt debt to assume the assets of the private bus company. When Metro City Bus began to prepare its financial statements, two questions were raised. Was Metro City Bus a government? And if it were a government, how should it prepare its cash flow statement? Research showed that, when the bus company was a private organization, it followed FASB standards, which required cash flow statements to be prepared using a particular format. However, GASB Statement No. 9 did not approve the use of FASB standards, and instead required governmental enterprises to prepare cash flow statements using a different format. An article published in a leading practitioner accounting journal suggested that all business-type activities, private or governmental, ought to adopt FASB standards. Required: a. Discuss whether Metro City Bus is or is not a governmental entity. What are the specific factors in this situation that cause Metro to be one or the other? b. Discuss whether Metro City Bus should prepare its cash flow statements using the FASB format or the GASB format. What are the factors that affect your conclusion? Answer: a. Metro City Bus is a governmental entity because it was established by law as a public corporation. Also, its governing board is appointed by government officials and it has the power to issue tax exempt debt. b. Metro City Bus must prepare its cash flow statements using the format prescribed by the GASB. GASB Statements rank highest in the hierarchy of generally accepted accounting principles for state and local governments. Because the GASB issued a specific Statement for preparing cash flow statements (GASB Statement No. 9), that Statement must be followed rather than the FASB statement on cash flows. The article published in a leading practitioner accounting journal has no standing in this situation. [Show More]

Last updated: 1 year ago

Preview 1 out of pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2021

Number of pages

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2021

Downloads

0

Views

3

.png)