FIN 571 WEEK 4

Document Content and Description Below

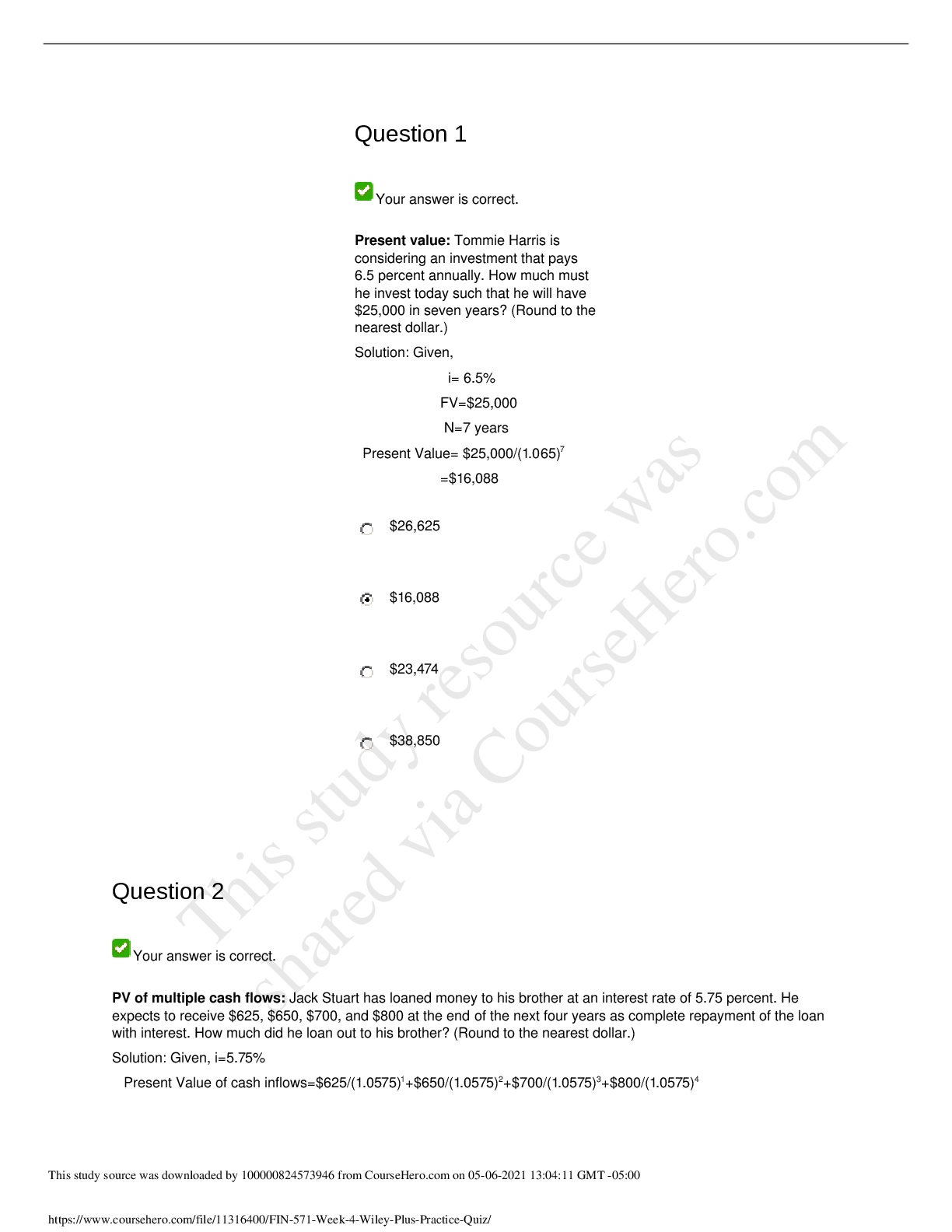

Present Value: Tommie Harris is considering an investment that pays 6.5 percent annually. How much must he invest today such that he will have $25,000 in seven years? (Round to the nearest dollar.) P... V of multiple Cash Flows: Jack Stuart has loaned money to his brother at an interest rate of 5.75 percent. He expects to receive $625, $650, $700, and $800 at the end of the next four years as complete repayment of the loan with interest. How much did he loan out to his brother? PV of Multiple Cash Flows: Hassan Ali has made an investment that will pay him $11,455, $16,376, and $19,812 at the end of the next three years. His investment was to fetch him a return of 14 percent. What is the present value of these cash flows? PV of multiple cash flows: Pam Gregg is expecting cash flows of $50,000, $75,000, $125,000, and $250,000 from an inheritance over the next four years. If she can earn 11 percent on any investment that she makes, what is the present value of her inheritance? Present value of an annuity: Transit Insurance Company has made an investment in another company that will guarantee it a cash flow of $37,250 each year for the next five years. If the company uses a discount rate of 15 percent on its investments, what is the present value of this investment? Future value of an annuity: Carlos Menendez is planning to invest $3,500 every year for the next six years in an investment paying 12 percent annually. What will be the amount he will have at the end of the six years? Bond Price: Briar Corp is issuing a 10-year bond with a coupon rate of 7 percent. The interest rate for similar bonds is currently 9 percent. Assuming annual payments, what is the present value of the bond? [Show More]

Last updated: 1 year ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Also available in bundle (1)

FIN 571 WEEK 1-5

Planning models that are more sophisticated than the percent of sales method have Firms that achieve higher growth rates without seeking external financing Triumph Company has total assets worth $6,...

By Bestsolver 3 years ago

$27.5

5

Reviews( 0 )

$10.50

Document information

Connected school, study & course

About the document

Uploaded On

May 06, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

May 06, 2021

Downloads

0

Views

45

.png)