Finance > STUDY GUIDE > FINC 5000 Week 9 Final Exam Part B Answers (Webster University), Graded A Study Guide. (All)

FINC 5000 Week 9 Final Exam Part B Answers (Webster University), Graded A Study Guide.

Document Content and Description Below

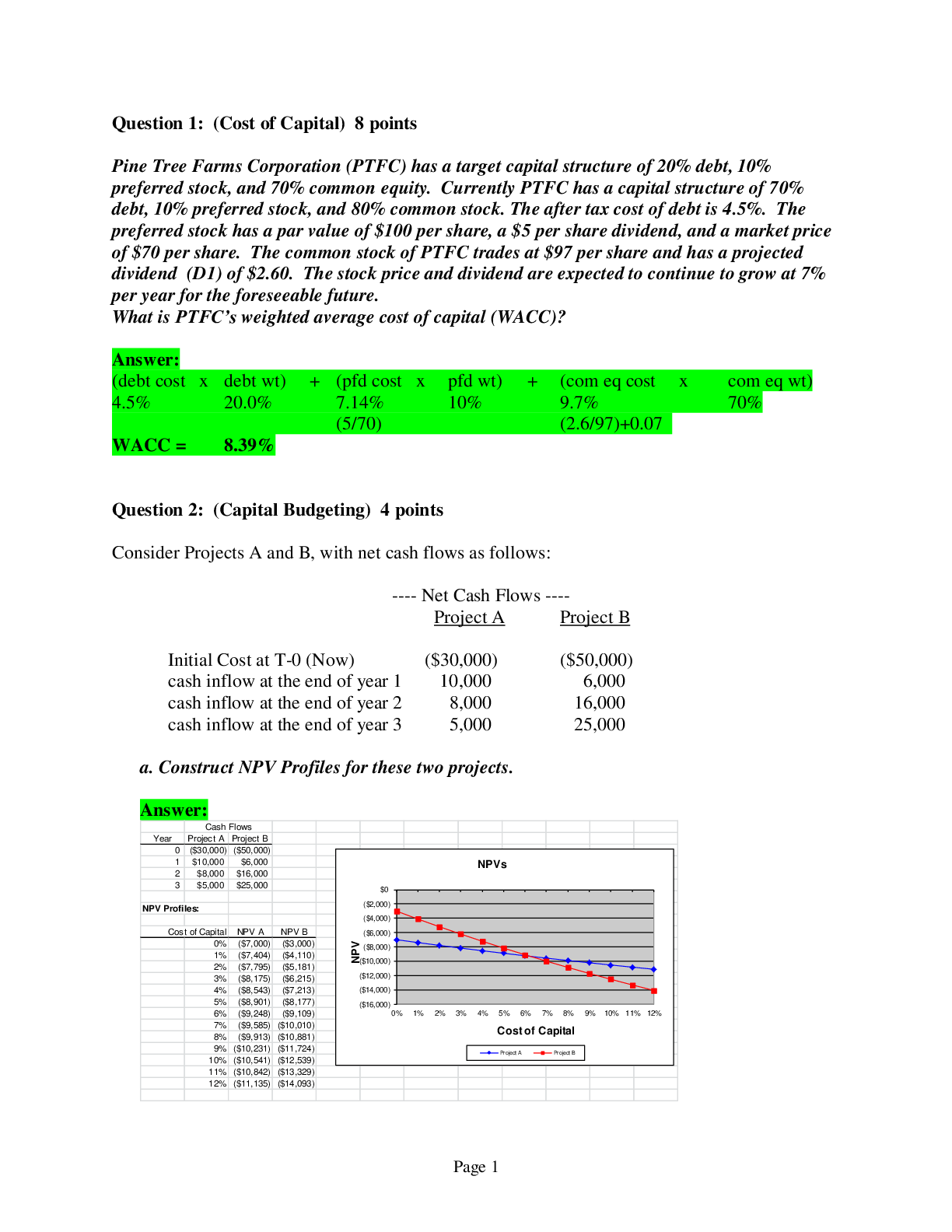

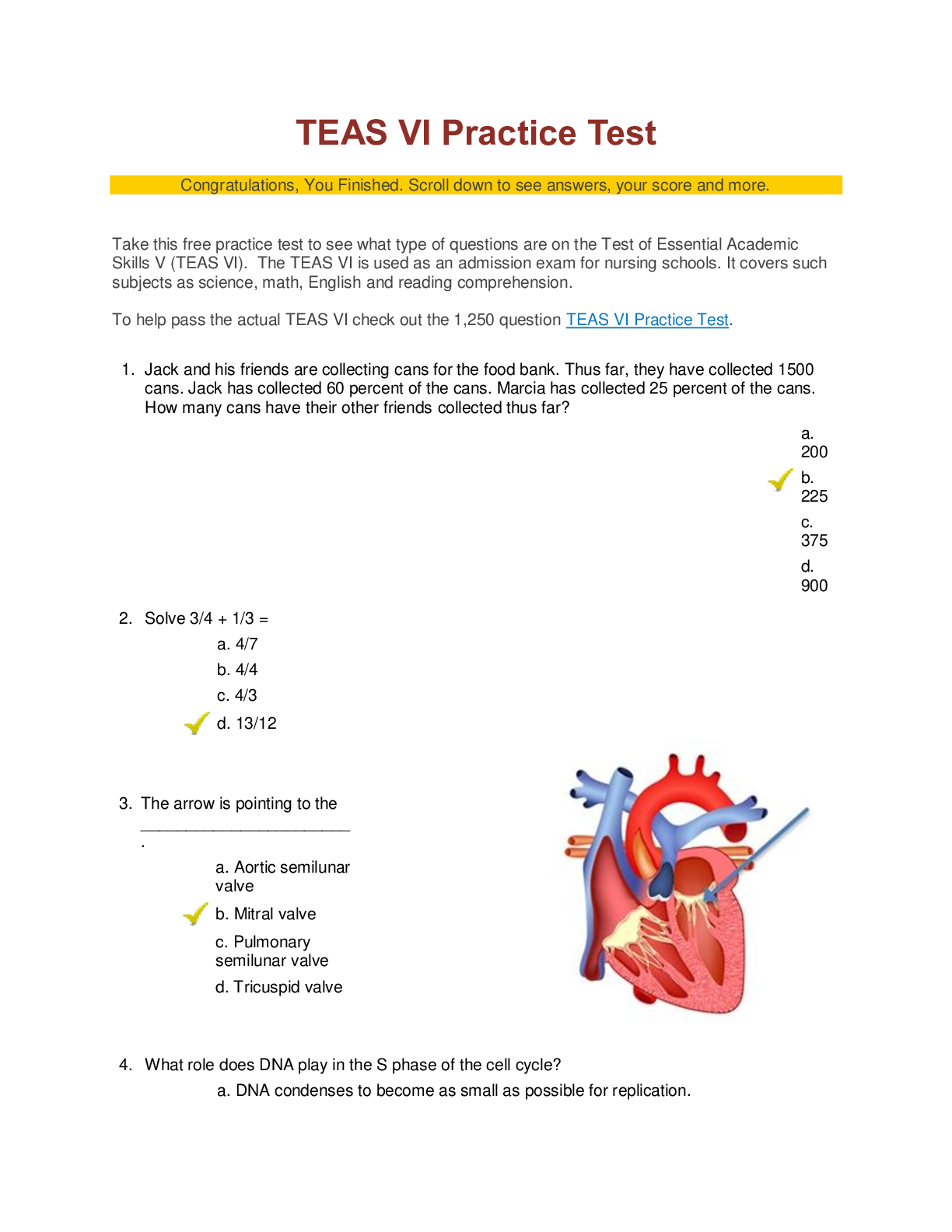

FINC 5000 Week 9 Final Exam Part B Answers (Webster University) Question 1: (Cost of Capital) 8 points Pine Tree Farms Corporation (PTFC) has a target capital structure of 20% debt, 10% p... referred stock, and 70% common equity. Currently PTFC has a capital structure of 70% debt, 10% preferred stock, and 80% common stock. The after tax cost of debt is 4.5%. The preferred stock has a par value of $100 per share, a $5 per share dividend, and a market price of $70 per share. The common stock of PTFC trades at $97 per share and has a projected dividend (D1) of $2.60. The stock price and dividend are expected to continue to grow at 7% per year for the foreseeable future. What is PTFC’s weighted average cost of capital (WACC)? Question 2: (Capital Budgeting) 4 points Consider Projects A and B, with net cash flows as follows: ---- Net Cash Flows ---- Project AProject B Initial Cost at T-0 (Now) ($30,000) ($50,000) cash inflow at the end of year 1 10,000 6,000 cash inflow at the end of year 2 8,000 16,000 cash inflow at the end of year 3 5,000 25,000 a. Construct NPV Profiles for these two projects. b. If the two projects were mutually exclusive, which would you accept if your firm’s cost of capital were 4%? Which would you accept if your firm’s cost of capital were 8%? Question 3: (Capital Budgeting) 2 points Calculate the IRR of the following project: Year Cash Flow 0 ($55,000) 1 $21,000 2 $23,000 3 $25,000 Question 4: (Capital Budgeting) 2 points Calculate the Modified Internal Rate of Return (MIRR) of the project in Question 3, assuming your firm’s cost of capital is 7%. Question 5: (Capital Structure) 4 points Firms R and S are similar firms in the same industry. Firms R and S have the same profit margin and total asset turnover when compared. However, Firm R's capital structure is 70% debt, 30% equity, and Firm S's capital structure is 30% debt, 70% equity. Given the above conditions, which firm will experience the highest return on equity (ROE)? Why? Question 6: (Capital Structure) 4 points A consultant has collected the following information regarding Hobbit Manufacturing: Operating income (EBIT) $600 million, Debt $0, Interest expense $0, Tax rate 35%, Cost of equity 7%, WACC 7% . The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends . Hobbit can borrow money at a pre-tax rate of 5%. The consultant believes that if the company moves to a capital structure consisting of 30% debt and 70% equity (based on market values), which would require taking on debt in the amount of $1,779.47 million, that the cost of equity will increase to 8% and the pre-tax cost of debt will remain at 6%, but the value of the firm will rise. Is the consultant correct? If the company makes this change, what will be the increase in total market value for the firm? Question 7: (Forecasting) 8 points Jolly Joe's Novelties, Inc. had the financial data shown below last year. Jolly Joe's has just invented a new toy which they expect will cause sales to double from $100,000 to $180,000, increasing net income to $12,000. From experience the company knows that when sales changes, all current assets plus accounts payable and accrued expenses change at the same percentage rate, and the company feels they can handle the increase without adding any fixed assets. a. Will Jolly Joe's need any new outside funding if they pay no dividends? b. If so, how much will be needed? Question 8: (Working Capital Management) 4 points Suppose it takes Jolly Joe’s Novelties, Inc. 5 days to build and sell toys (on average). Also suppose it takes the firm’s customers 35 days, on average, to pay for the toys after they have purchased them on credit. Finally, suppose the firm is able to delay paying for the materials it uses in the manufacturing process for 30 days. Given these conditions, how long is Jolly Joe’s cash conversion cycle? Question 9: (Working Capital Management) 4 points If Jolly Joe’s buys $100 worth of supplies on credit with terms 3/10 n30 and pays the bill on the 28th day after the purchase: a. What is the approximate, or “nominal,” cost of trade credit as an annual rate? b. What is the exact cost of trade credit as an annual rate? [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 21, 2019

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Sep 21, 2019

Downloads

0

Views

73

.png)

SOUTH UNIVERSITY (GRADED A STUDY GUIDE).png)