Search for

Filter By

Rating

Price in $

Search for Courses, Exams, Books, TEST BANKS, Assignments, notes...

Showing All results

Sort by

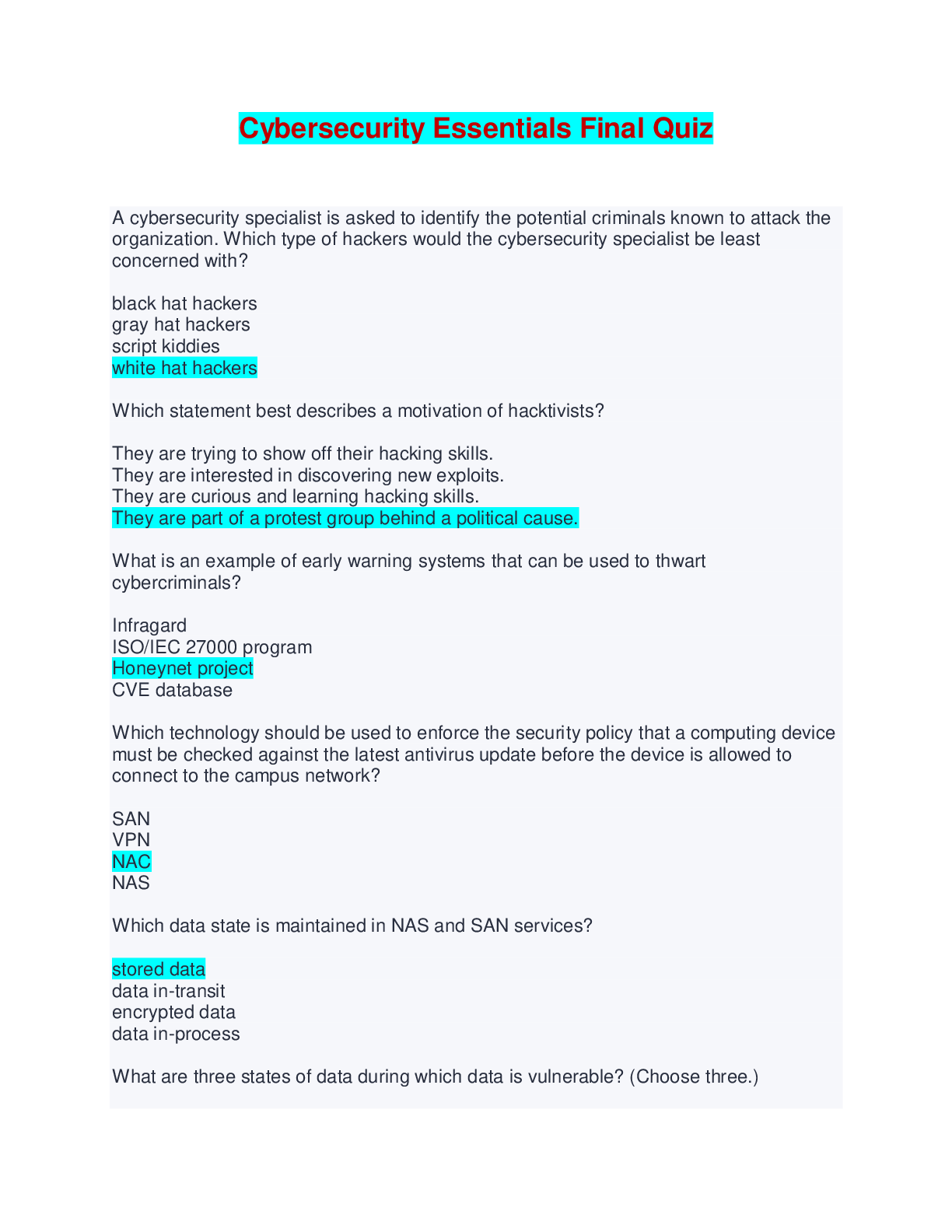

Computer Science > EXAM > Cybersecurity Essentials Final Quiz | Questions with complete solutions

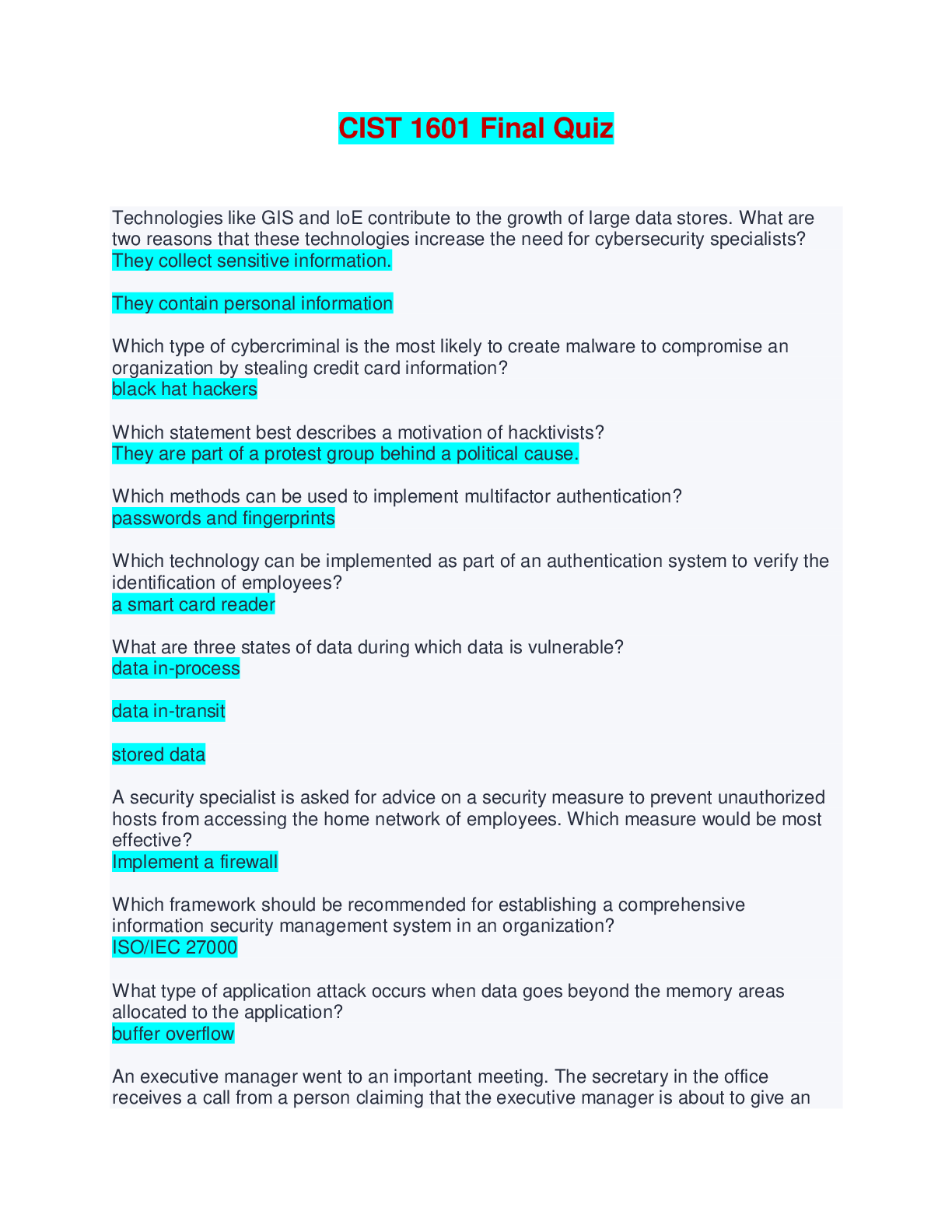

Computer Science > EXAM > CIST 1601 Final Quiz | Questions with 100% Correct Answers

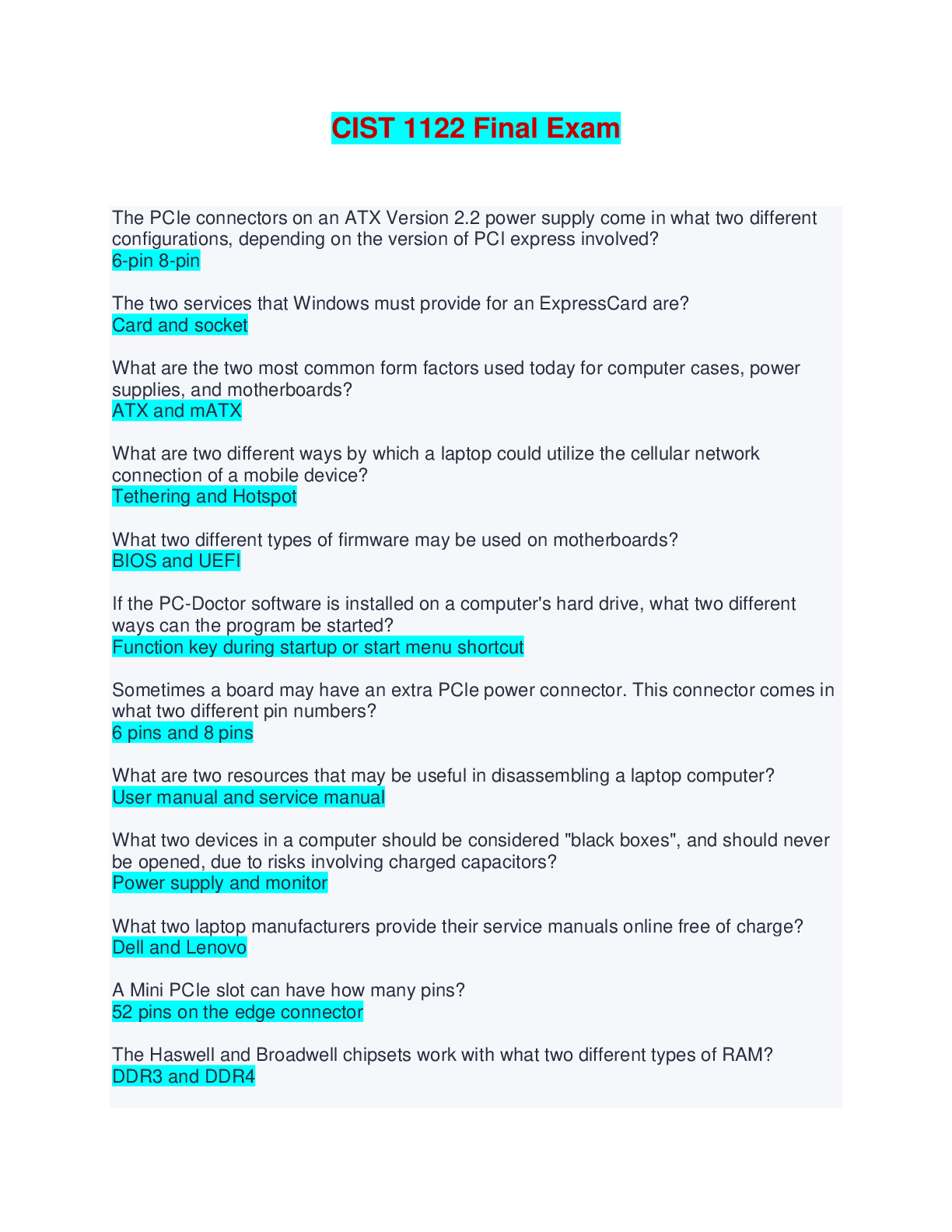

Computer Science > EXAM > CIST 1122 Final Exam | Questions and Answers

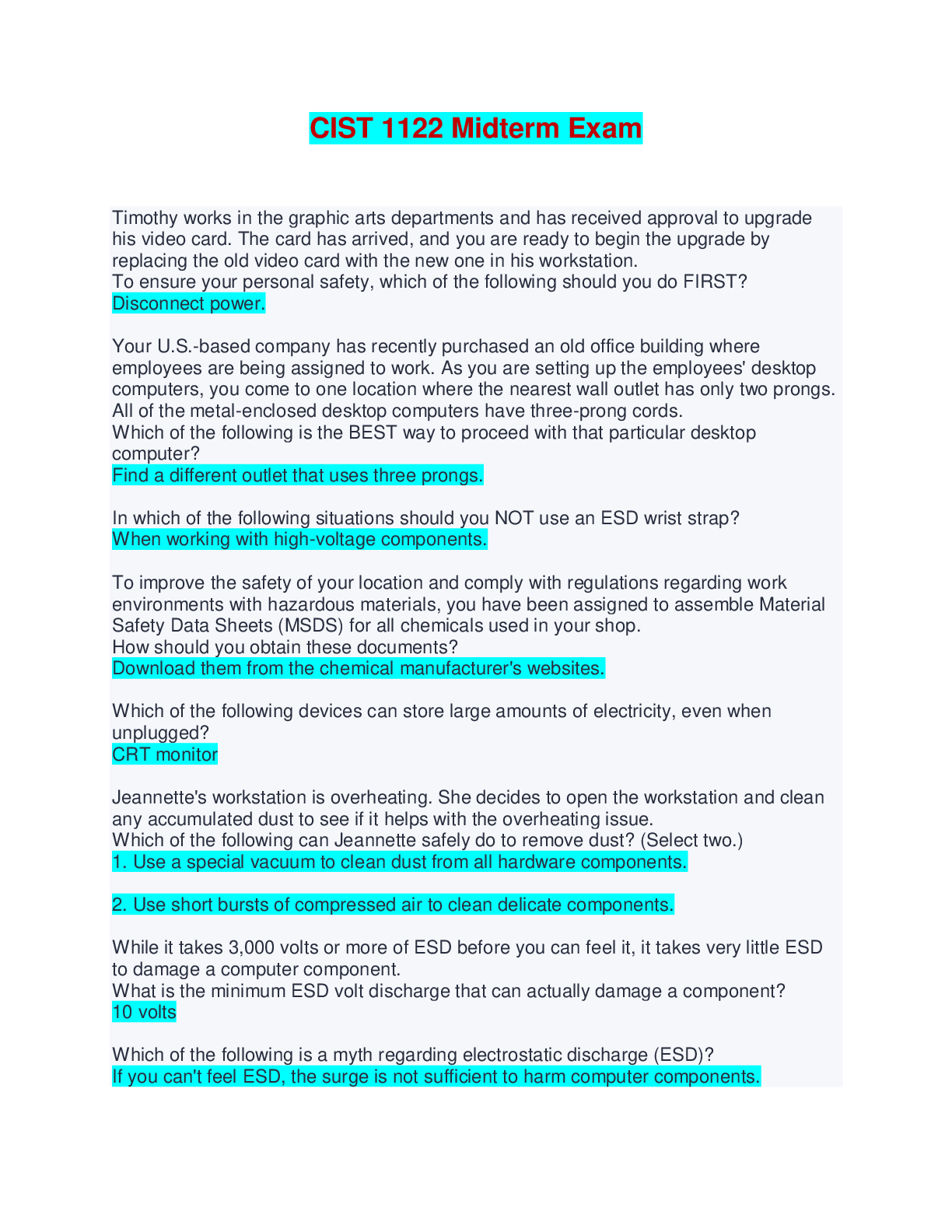

Computer Science > EXAM > CIST 1122 Midterm Exam | Questions with complete solutions

Supply Chain Management > EXAM > Supply Chain Exam 2 (Chapter 16) | Questions and Answers

Supply Chain Management > EXAM > Supply Chain Exam 2 (Chapter 11) | Questions with Verified Answers

Supply Chain Management > EXAM > Supply Chain Exam 2 (Chapter 9) | Q & A with 100% Correct Answers

Supply Chain Management > EXAM > Supply Chain Exam 2 (Chapter 8) | Q & A (Complete Solutions)

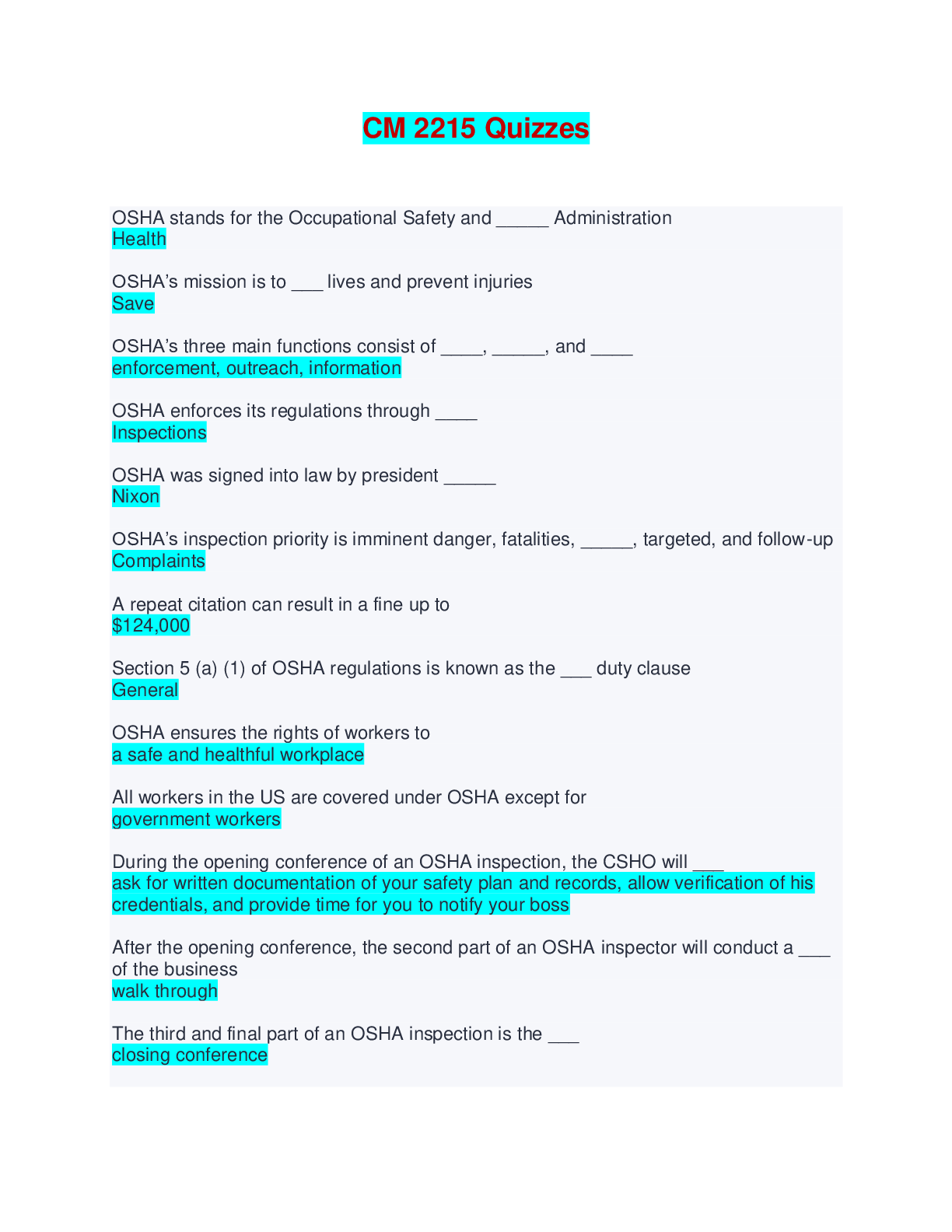

Safety Management > EXAM > CM 2215 Quizzes | Questions with 100% Correct Answers

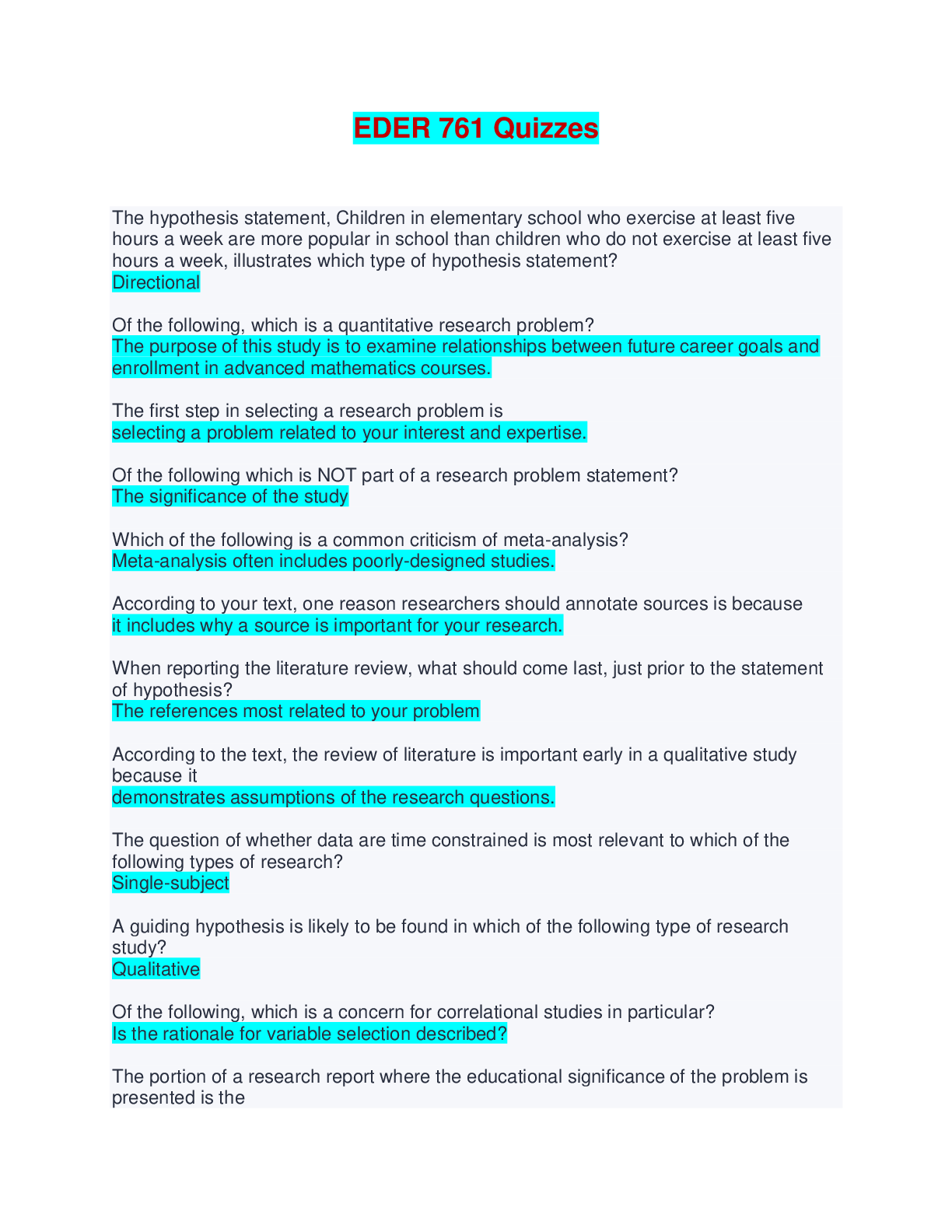

Business Research > EXAM > EDER 761 Quizzes | Questions with Verified Answers