FIN 100 Sophia Final Milestone,100% CORRECT

Document Content and Description Below

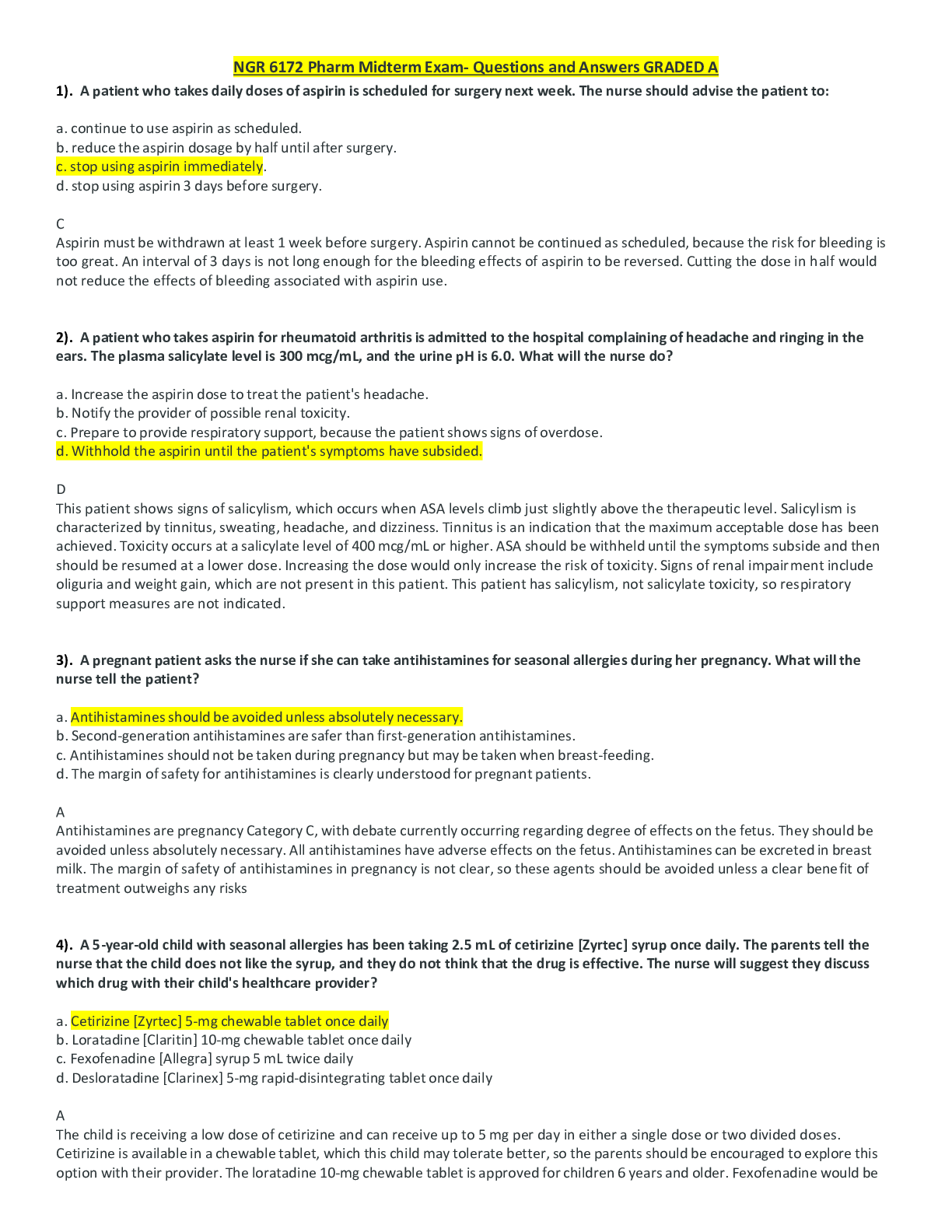

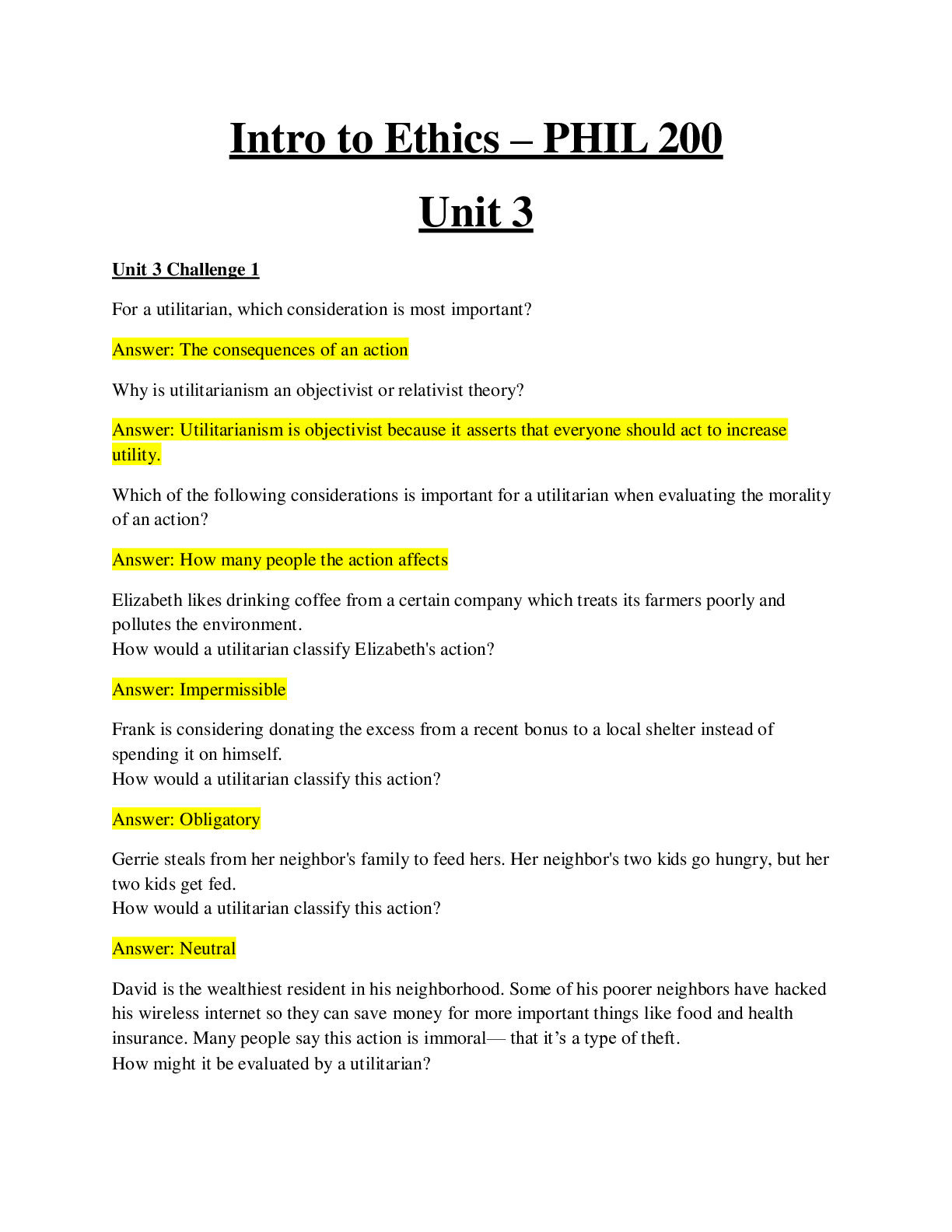

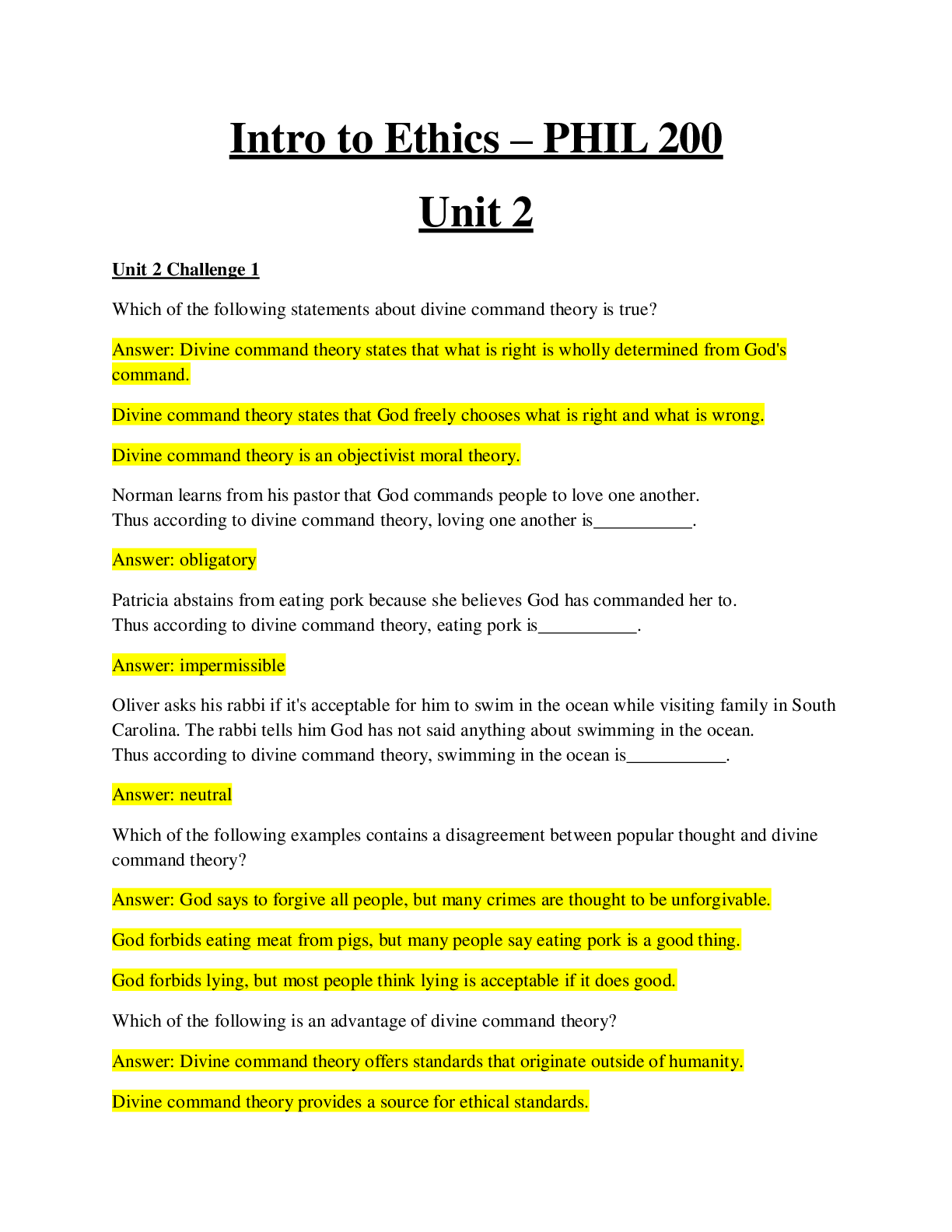

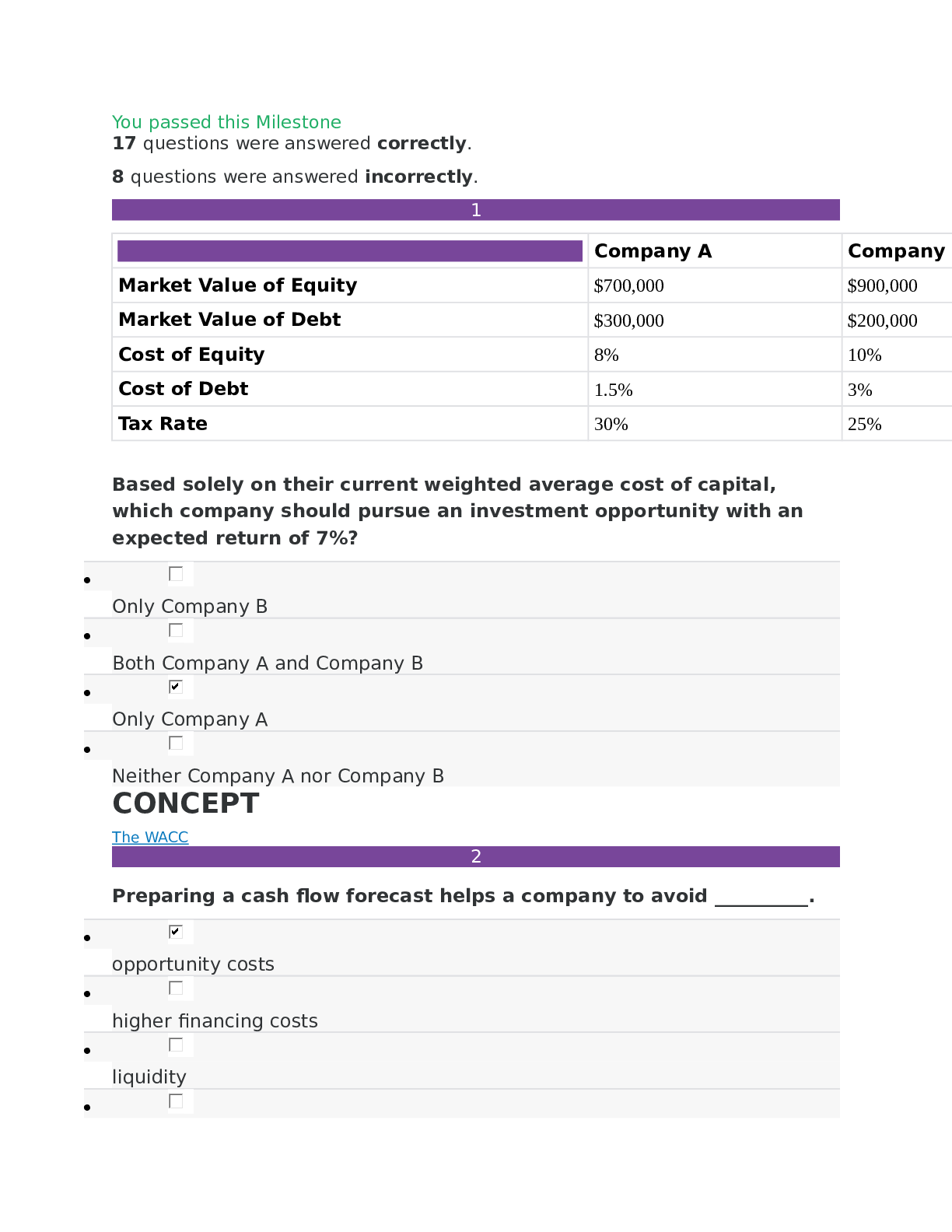

Company A Company B Market Value of Equity $700,000 $900,000 Market Value of Debt $300,000 $200,000 Cost of Equity 8% 10% Cost of Debt 1.5% 3% Tax Rate 30% 25% Based solely on their current we... ighted average cost of capital, which company should pursue an investment opportunity with an expected return of 7%? • Only Company B • Both Company A and Company B • Only Company A • Neither Company A nor Company B 2 Preparing a cash flow forecast helps a company to avoid __________. • opportunity costs • higher financing costs • liquidity • net losses 3 What must be forecasted first in order to prepare the pro forma income statement? • Cost of goods sold • Sales • Expenses • Net income 4 Select the statement that correctly explains the relationship between interest rates and present or future value. • Assuming other variables stay the same, if the interest rate decreases, the future value of an investment increases. • Assuming other variables stay the same, if the interest rate decreases, the present value of an investment decreases. • The interest rate and the future value of an investment are inversely related. • Assuming other variables stay the same, if the interest rate increases, the future value of an investment increases. 5 Calculate a company's total leverage given the following information: • Net income = $80,000 • Revenue = $120,000 • Variable costs = $25,000 • 1.19 • Cannot calculate without knowing degree of financial leverage • 1.14 • Cannot calculate without EPS data 6 You would like to have $10,000 in an account after eight years’ time. If the account earns 2.5% compounded interest yearly, how much would you have to deposit today? • $9,464 • $8,207 • $8,333 • $9,765 7 What is the recent trend of algorithmic trading criticized for? • Being too transparent • Over-extending credit • Increasing market volatility • Improving market liquidity 8 If a portfolio regularly falls twice as much as a benchmark index rises, the portfolio's beta coefficient is __________. • 0.5% • -2.0% • -0.5% • 2.0% 9 A company with a 120-day operating cycle determines its cash conversion cycle using the following data: • Receivable days: 35 • Inventory days: 95 • Payable days: 45 What is the company's cash conversion cycle? • 85 • 105 • 25 • 165 10 If operating income is $155,000 and total revenue is $577,000, then the operating margin is __________. • 72.20% • 26.80% • incalculable without equity data • incalculable without net income data 11 A company invests $600,000 in a project with the following net cash flows: • Year 1: $130,000 • Year 2: $113,000 • Year 3: $98,000 • Year 4: $92,000 • Year 5: $89,000 • Year 6: $95,000 In what year does payback occur? • Year 6 • After Year 6 • Year 4 • Year 5 12 Determine the value of a stock with the following variables using the constant growth model: • Current annual dividend: $0.85 per share • Required return rate: 7% • Constant growth rate: 4% • $28.33 • $30.32 • $22.74 • $29.47 13 Select the pairing that is correctly matched. • Preferred stock: may be purchased by converting common stock shares into preferred ones • Common stock: holders can mail in their votes if they can't attend a company's annual general meeting • Common stock: may come with an additional dividend provision attached to company financial goals • Preferred stock: is a less stable investment than common stock with fewer rights of ownership 14 Strategic planning answers the question "__________" • How much money do we have? • How many people do we need? • Where are we going? • Who are we competing with? 15 Using the following variables, calculate an organization's cost of preferred stock. • Dpref: $4 • Ppref: $30 • g: 2% • $12.66% • 15% • 24% • 15.33% 16 Over the last six years, prices and investing activity in the bond market rose for two years and then fell consistently for the next four years. How is this market classified? • Primary bull market • Primary bear market • Secular bull market • Secular bear market 17 Which of the following is true of systematic risk? • It is less tightly linked to the market as a whole than unsystematic risk. • It does not require additional compensation in terms of expected return. • It cannot be diversified away by holding a pool of individual assets. • An investor can avoid this type of risk through calculated investment choices. 18 In what way are debt securities, equity securities and derivatives similar? • They all confer ownership in a business. • Their value is derived from an underlying asset. • They can all be used to hedge against risk. • They all have fixed terms. 19 When does a company know that it has sufficient working capital? • When its total assets are equal to its total liabilities • When its working capital is positive • When it can meet all of its short-term expenses and debts with current assets • When it has cash reserves 20 Betina is trying to convince a buyer to purchase her company. The buyer wants to know what the company's overall financial condition was on December 31, 2018. What type of financial statement should Betina provide? • Statement of changes in equity • Balance sheet • Cash flow statement • Income statement 21 When managing its cash, a company should make use of float to __________. • make payments before they come due • decrease the length of time for a payment to clear the bank • set aside cash for future payments • increase the length of the disbursement cycle 22 Which of the following is a goal of working capital management? • To make long-term capital investment decisions • To balance the cash conversion cycle against maximum revenue • To eliminate the risk of customers defaulting on credit • To minimize liquidity and maximize profitability 23 Lee purchased stock with an initial share price of $32, and sold it when the share price was $50. While he owned the stock, he earned $2 in dividends. What was his total percentage return on the investment? • 56.25% • 62.50% • 36.00% • 40.00% 24 In calculating the yield of an investment, what is EAR equivalent to? • IRR • NPV • APY • APR 25 Consider what you have learned about valuing bonds. • A: Coupon rate = 3.5%, YTM = 4% • B: Coupon rate = 3.2%, YTM = 3.2% • C: Coupon rate = 2.8%, YTM = 3.5% • D: Coupon rate = 4%, YTM = 3.7% Which of the bonds is selling at a premium? • B • D • A • C [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 24, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Oct 24, 2020

Downloads

1

Views

296