Financial Accounting > QUESTION PAPER (QP) > TBChap011. ACCOUNTING 340 REVISION QUESTIONS BANK. 99% pass rate (All)

TBChap011. ACCOUNTING 340 REVISION QUESTIONS BANK. 99% pass rate

Document Content and Description Below

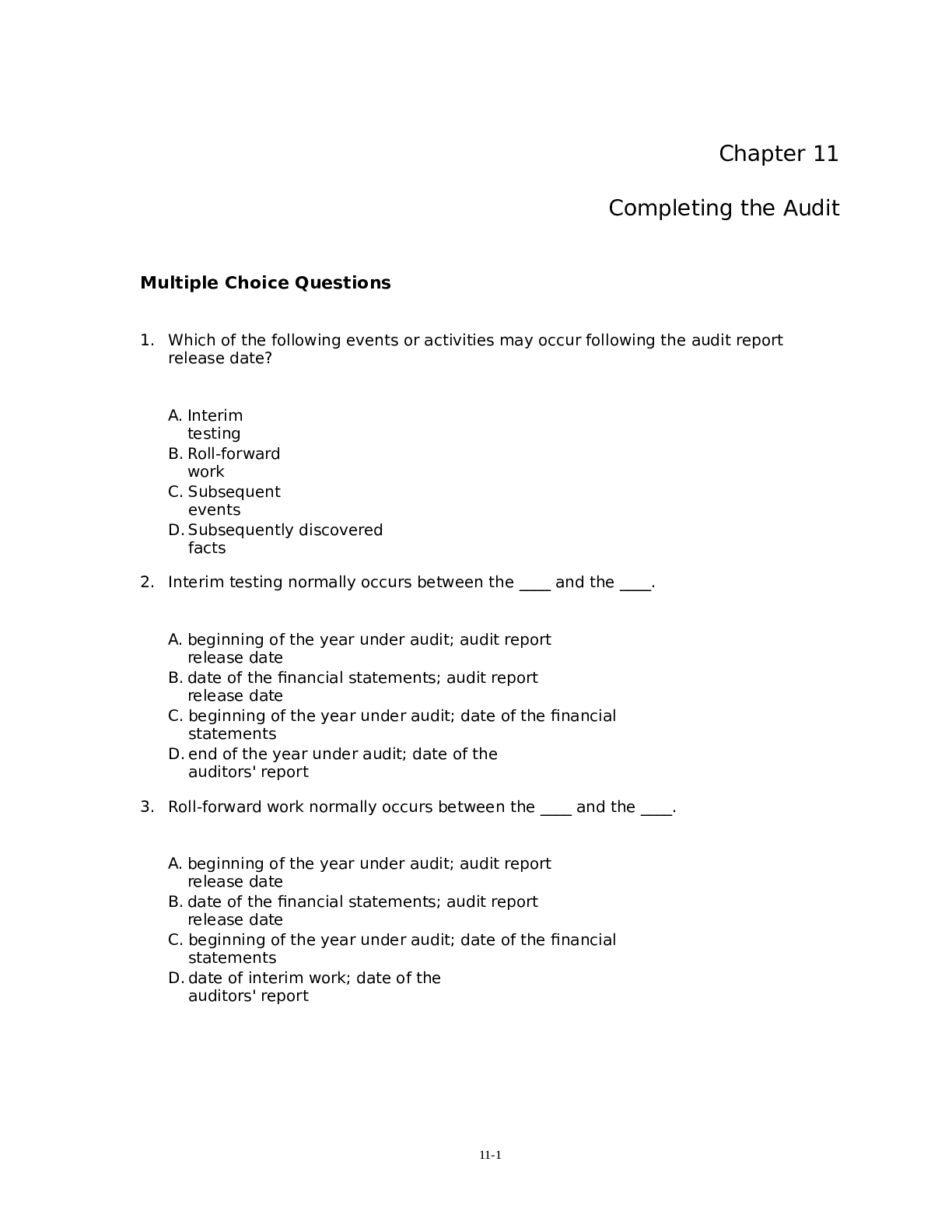

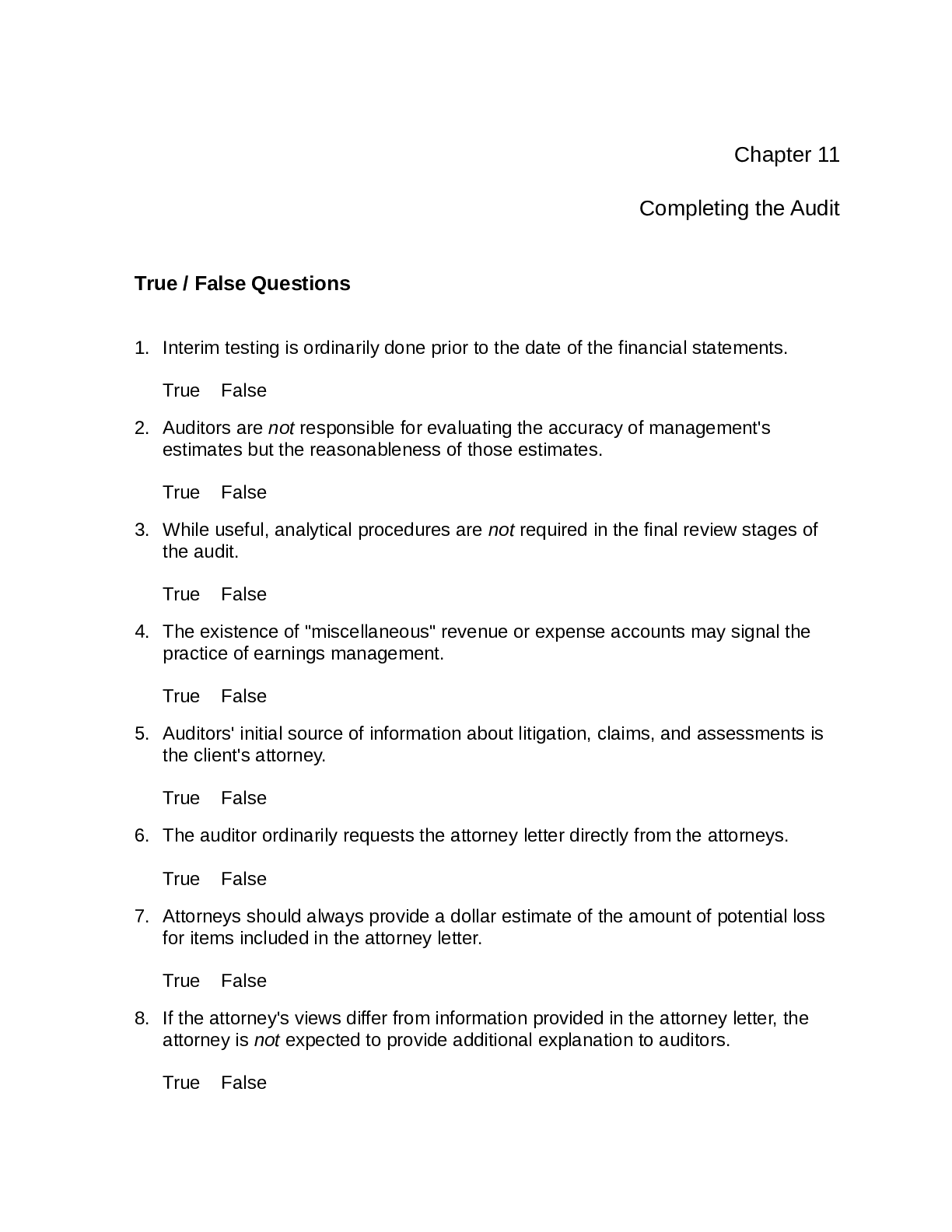

Multiple Choice Questions 1. Which of the following events or activities may occur following the audit report release date? A. Interim testing B. Roll-forward work C. Subsequent events D. Sub... sequently discovered facts 2. Interim testing normally occurs between the ____ and the ____. A. beginning of the year under audit; audit report release date B. date of the financial statements; audit report release date C. beginning of the year under audit; date of the financial statements D. end of the year under audit; date of the auditors' report 3. Roll-forward work normally occurs between the ____ and the ____. A. beginning of the year under audit; audit report release date B. date of the financial statements; audit report release date C. beginning of the year under audit; date of the financial statements D. date of interim work; date of the auditors' report 11-1 4. For which of the following objectives would auditors be least likely to use analytical procedures near the end of the audit? A. Obtaining evidence about assertions related to account balances or classes of transactions B. Evaluating the adequacy of evidence gathered in response to unexpected account balances C. Identifying unusual or unexpected account balances or relationships among account balances that were not previously identified during the audit D. Evaluating the adequacy of evidence gathered in response to unexpected relationships among account balances 5. Which of the following best describes the auditors' responsibility with respect to management's estimates? A. Verifying the mathematical accuracy of management estimates B. Assessing the likelihood that actual results will be consistent with management's estimates C. Evaluating the reasonableness of management's estimates D. Identifying how the failure of the entity to achieve management's estimates will influence users' decisions 6. Which of the following would not ordinarily be considered when using analytical procedures to verify the overall reasonableness of revenue and expense accounts? A. Current-year recorded (unaudited) balances B. Expected balances using a statistical analysis or relationships among accounts C. Internal budgets and reports D. Prior-year balances 7. Why should auditors be particularly concerned with "miscellaneous", "other", and "clearing" accounts classified as revenues or expenses? A. These accounts are likely to relate to going-concern matters. B. These accounts are often more difficult to audit using normal substantive procedures. C. These accounts may represent attempts of earnings management. D. These accounts are likely to require the assistance of a specialist. 11-2 8. Which of the following is the most effective method of identifying potential earnings management attempts? A. Analytical procedures B. Detailed substantive procedures C. Inquiry of client management and key financial personnel D. Scanning accounts for unusual items 9. An important method used by auditors to learn of material contingencies is A. examining documents in the client's possession concerning contingencies. B. inquiring and discussing them with management. C. obtaining responses to an attorney letter. D. confirming accounts receivable with the client's customers. 10. Which of the following procedures is not used in auditors' examination of litigation, claims, and assessments? A. Obtaining a description and evaluation of litigation, claims, and assessments from management B. Examining documentary evidence regarding litigation, claims, and assessments C. Reading minutes of meetings of stockholders, directors, and appropriate committees D. Performing analytical procedures 11. Which of the following is typically not included in the inquiry letter sent to the client's attorneys? A. A disclaimer regarding the likelihood of settlement of pending litigation B. A listing of pending or threatened litigation, claims, or assessments C. An evaluation of the likelihood of an unfavorable outcome D. An estimate of the range of potential loss 11-3 12. Which party should request a letter regarding litigation, claims, and assessments from the client's attorney? A. Attorne y B. Auditor s C. Clien t D. Securities and Exchange Commission or other regulatory body 13. To whom should written representations be addressed? A. Auditor s B. Board of directors C. Clien t D. Stockholde rs 14. Which of the following items would appear in written representations in the audit of a public entity but not a nonpublic entity? A. Statements related to management's responsibility for the entity's financial statements B. Statements related to management's responsibility for designing internal control to prevent and detect fraud C. An indication that all subsequent events have been disclosed to the auditors D. Management's opinion as to the effectiveness of its internal control over financial reporting 15. What is the primary purpose of obtaining written representations? A. To provide auditors with substantive evidence of important assertions B. To impress upon management its primary responsibility for the financial statements C. To allow auditors to communicate important internal control deficiencies to management D. To allow auditors to communicate important suggestions for improvement to management 11-4 16. If auditors are appointed on January 3, 2014, the date of the financial statements is December 31, 2014, the date of the auditors' report is February 7, 2015 and the audit report release date is March 3, 2015, what is the appropriate date of the written representations? A. January 3, 2014 B. December 31, 2014 C. February 7, 2015 D. March 3, 2015 17. Which of the following reporting options is available if the client refuses to provide auditors with written representations? A. Unmodified or qualified opinion B. Qualified or adverse opinion C. Qualified opinion or disclaimer of opinion D. Disclaimer of opinion or adverse opinion 18. Why is it the client's decision to record adjustments to the financial statements? A. Having auditors adjust the financial statements would impair independence with respect to the client. B. The financial statements are the responsibility of the client's management. C. Auditors often do not have sufficient client-specific expertise to record adjustments to the financial statements. D. The client will ultimately suffer any losses related to misstated financial statements. 19. Which of the following is not a purpose of the review of audit documentation by a supervisor during fieldwork? A. To ensure that all appropriate steps in the audit plan were performed B. To ensure that referencing among audit documentation is clear C. To ensure that the explanations included in the audit documentation are understandable D. To ensure that the overall scope of the audit was appropriate 11-5 20. Before the impact of adjusting entries proposed by auditors are included in the client's financial statements, the adjustments must be approved by the A. client's management. B. audit manager. C. engagement partner. D. engagement quality review partner. 21. Subsequent events occur between the ____ and the ____. A. date of the financial statements; date of the auditors' report B. date of the auditors' report; audit report release date C. date of the financial statements; audit report release date D. audit report release date; beginning of subsequent year's audit 22. Which of the following substantive procedures would not ordinarily be used by auditors in evaluating the potential existence of subsequent events? A. Reviewing the latest interim financial statements B. Performing cut-off testing near year end C. Inquiring of officers and other client executives D. Obtaining written representations 23. Which of the following conditions or set of circumstances would not ordinarily raise questions about the entity's ability to continue as a going concern? A. Violation of debt covenants B. Failure to meet forecasted earnings per share C. Legal proceedings that may have a significant negative impact on the entity D. Negative cash flow from operations for each of the last three years 11-6 24. Which of the following subsequent events would represent an event that provides information about conditions that arose following the date of the financial statements? A. Settlement of long outstanding litigation B. Collection of a past due accounts receivable C. Loss of inventory as a result of a flood D. An additional tax assessment on prior income 25. The Orange Corporation was audited for the year ended December 31. The audit was completed on January 25; prior to the release of the report, auditors learned of a twofor-one stock split on February 1. If dual dating is used, what are the proper dates for the auditors' reports? A. December 31 and January 25 B. January 25 and February 1 C. January 25 and February 15 D. February I and February 15 26. Auditors have a responsibility to evaluate whether financial statements properly reflect all known events through the A. date of the financial statements. B. date of the auditors' report. C. audit report release date. D. subsequent year's date of the financial statements. 27. Management letters are not a means of A. reporting recommendations to the client. B. assisting the client in improving its operations. C. satisfying professional requirements to communicate matters related to the client's internal control. D. developing rapport with the client. 11-7 28. An engagement quality review by a second partner of the audit documentation and financial statements is performed to ensure that the: A. "to-do lists" are reviewed and cleared. B. audit plan procedures are "signed off." C. tick-mark notations are cleared. D. audit work meets the quality standards of the firm. 29. Auditors must complete various phases of an audit after the date of the financial statements. The auditors' responsibility for matters affecting the client extends from the date of the financial statements to the A. date of the auditors' report. B. final review of the audit documentation. C. audit report release date. D. delivery of the auditors' reports to the [Show More]

Last updated: 1 year ago

Preview 1 out of 54 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$12.00

Document information

Connected school, study & course

About the document

Uploaded On

Mar 19, 2022

Number of pages

54

Written in

Additional information

This document has been written for:

Uploaded

Mar 19, 2022

Downloads

0

Views

53

.png)

.png)

.png)

.png)