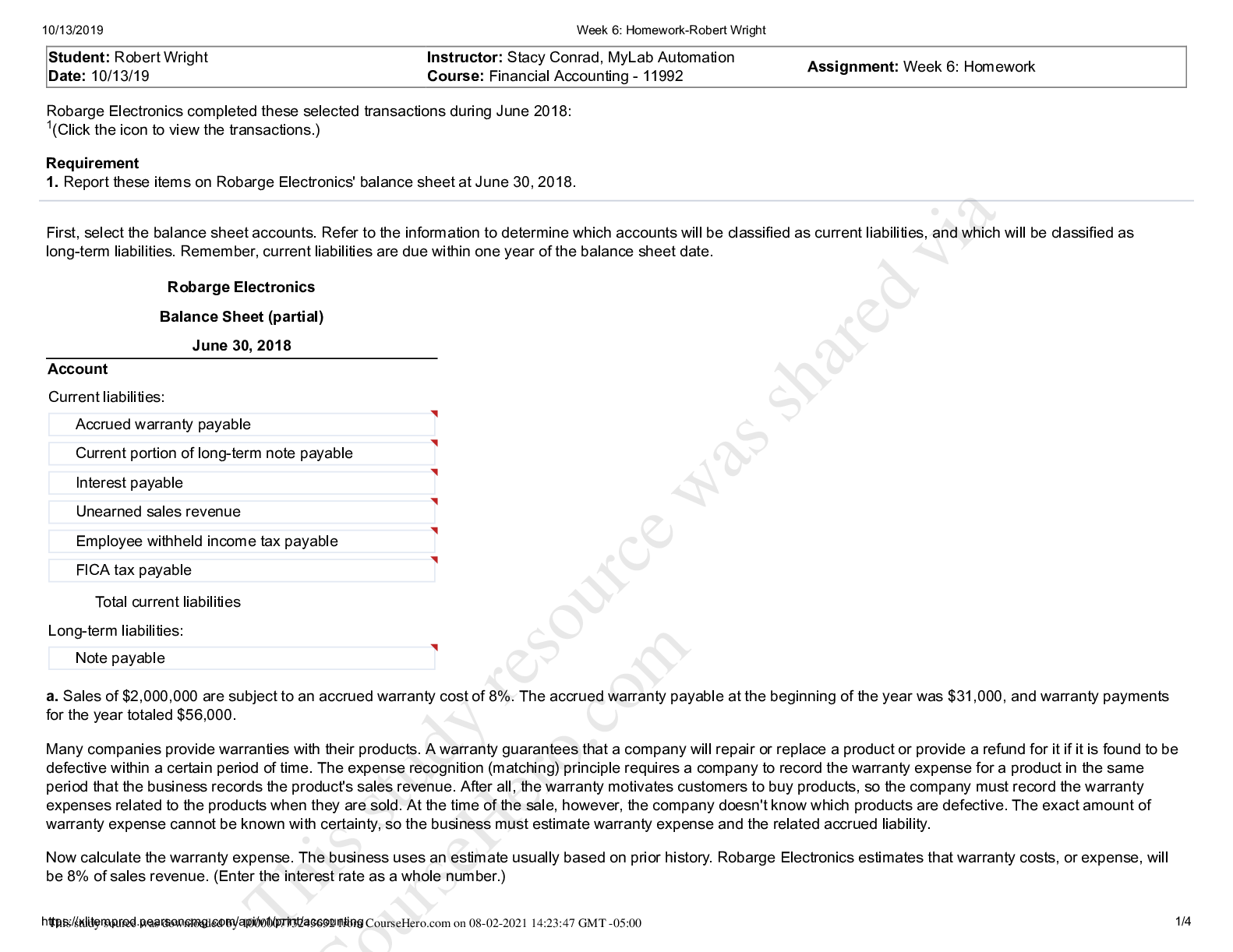

Financial Accounting > QUESTION PAPER (QP) > ACC 632 TBChap012, TEST PREP QUESTIONS. DOWNLOAD FOR REVISION TO SCORE A+ (All)

ACC 632 TBChap012, TEST PREP QUESTIONS. DOWNLOAD FOR REVISION TO SCORE A+

Document Content and Description Below

Multiple Choice Questions 1. Which of the following statements is not included in the Auditor's Responsibility section of the standard (unmodified) report? A. "In accordance with accounting princip... les generally accepted in the United States of America." B. "We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion." C. "An audit also includes evaluating the appropriateness of accounting policies used…" D. "Those standards require that we plan and perform the audit to obtain reasonable assurance…" 2. Which of the following situations would not result in auditors adding an additional paragraph to their report without modifying the introductory, scope, or opinion paragraphs of that report? A. Reference to a change in the method of accounting mandated by the issuance of a new accounting standard. B. Reference to a going-concern uncertainty facing the entity. C. Reference to a departure from GAAP that is material, but not pervasive, to the financial statements. D. Reference to an acquisition made by the entity during the most recent fiscal year. 3. Which of the following statements is not included in the Auditor's responsibility section of the standard (unmodified) report on the entity's financial statements? A. "We have audited the accompanying financial statements…" B. "Those standards require that we plan and perform the audit…" C. "The procedures selected depend upon the auditor's judgment…" D. "An audit involves performing procedures to obtain audit evidence about the amounts and disclosures…" 12-1 4. Auditors are required to reference consistency in their report when there are changes in A. accounting estimates. B. the format of the Statement of Cash Flows. C. the classification of financial statement amounts. D. accounting principles. 5. If financial statements contain a material but non-pervasive departure from generally accepted accounting principles, the auditors should render a(n) A. qualified opinion with reference to departure. B. adverse opinion with scope limitation reference. C. adverse opinion with reference to departure. D. disclaimer of opinion. 6. Which of the following scope limitations would ordinarily be of most concern to the auditors? A. The inability to observe inventories because auditors were appointed following the date of the financial statements B. Management's refusal to provide auditors with written representations C. The inability to obtain confirmation of year-end balances from customers because of different billing dates D. The use of the work of component auditors in the audit of group financial statements 7. When auditors are engaged to examine an entity's financial statements but decide to issue a disclaimer of opinion because of a scope limitation, the report would not A. identify management's responsibility for the financial statements. B. refer to any scope limitation in an additional paragraph. C. modify the Auditor's Responsibility section to identify the basis for the disclaimer. D. indicate that the auditors were engaged to audit the financial statements. 12-2 8. A report that acknowledges reliance on the reports of component auditors is a type of report modification known as a(n) A. qualificatio n. B. division of responsibility. C. expansion of scope. D. scope limitation. 9. "As described in Note 5 to the financial statements, General Express changed its statistical method of computing product warranty expense for the year ended December 31, 2014…" is an illustration of a A. consistency change requiring a qualified opinion. B. scope limitation. C. departure from generally accepted accounting principles. D. report with a consistency modification. 10. The auditors' report on the entity's financial statements included an additional paragraph disclosing a difference of opinion between the auditors and the entity for which the auditors believed an adjustment to the financial statements should be made. The opinion paragraph of the auditors' report should express a(n) A. unmodified opinion. B. qualified opinion citing a departure from generally accepted accounting principles. C. qualified opinion citing a scope limitation and lack of specific evidence. D. disclaimer of opinion. 11. Auditors will issue an adverse opinion when A. a severe scope limitation has been imposed by the entity. B. a violation of generally accepted accounting principles is sufficiently material and pervasive that a qualified opinion is not justified. C. a qualified opinion cannot be rendered because the auditors lack independence. D.the entity's ability to continue as a going concern is subject to substantial doubt. 12-3 12. The issuance of a disclaimer of opinion generally indicates A. the auditors cannot form an opinion on the fairness of presentation of the financial statements as a whole. B. the auditors have some uncertainties, but these uncertainties are not so material that they cannot form an opinion on the fairness of presentation of the financial statements as a whole. C. the auditors have observed a departure from generally accepted accounting principles but the departure is not of sufficient materiality to justify a qualified opinion. D.the auditors have observed a departure from generally accepted accounting principles that is so material and pervasive that a qualified opinion is not justified. 13. When an entity will not permit inquiry of outside legal counsel, the auditors' report on the entity's financial statements will ordinarily contain a(n) A. disclaimer of opinion. B. qualified opinion referencing a departure from generally accepted accounting principles. C. unmodified opinion with an additional paragraph. D. adverse opinion. 14. In which of the following circumstances may auditors issue the standard (unmodified) report on the entity's financial statements? A. The entity changed accounting principles having an immaterial effect on the entity's financial position, results of operations, and cash flows. B. The auditors wish to emphasize a matter regarding the financial statements. C. The auditors reference component auditors who examined a subsidiary of group financial statements. D. The auditors have not been able to audit a substantial portion of the balance sheet because of a circumstance-imposed scope limitation. 12-4 15. The auditors conclude that there is a material inconsistency in the "other information" in an annual report to shareholders containing audited financial statements. If the auditors conclude that the financial statements do not require revision, but the entity refuses to revise or eliminate the material inconsistency, the auditors may A. issue a qualified opinion on the entity's financial statements, citing a departure from generally accepted accounting principles. B. consider the matter closed since the other information is not included in the audited financial statements. C. issue an adverse opinion on the entity's financial statements due to inadequate disclosure. D. revise the report on the entity's financial statements to include an other-matter paragraph describing the material inconsistency. 16. When auditors lack independence, which of the following is true about the report on the entity's financial statements that should be issued? A. The auditors should disclaim an opinion and should state specifically that they are not independent. B. The auditors should disclaim an opinion but not mention that they are not independent. C. The auditors should issue an unmodified opinion with an other-matter paragraph stating that they are not independent. D. The auditors should issue a qualified opinion with an other-matter paragraph stating that they are not independent. 17. In which of the following circumstances would a qualified opinion not be appropriate? A. A scope limitation prevents the auditors from completing an important auditing procedure. B. The entity has failed to properly disclose going-concern uncertainties. C. An accounting principle at variance with generally accepted accounting principles is used. D. The auditors lack independence with respect to the audited entity. 18. Auditors should disclose the substantive reasons for expressing an adverse opinion on the entity's financial statements in an additional paragraph A. preceding the Auditor's Responsibility section. B. preceding the opinion paragraph. C. following the opinion paragraph. D. within the footnotes to the financial statements. 12-5 19. When auditors qualify their opinion on the entity's financial statements because of inadequate disclosure, the auditors should describe the nature of the omission in an additional paragraph and modify A. the introductory paragraph and Auditor's Responsibility sections. B. the introductory paragraph only. C. the Auditor's Responsibility section only. D. neither the introductory paragraph nor Auditor's Responsibility section. 20. Restrictions imposed by an entity prohibited the observation of physical inventories, which accounted for 35% of total assets. Alternative auditing procedures were not feasible, although the auditors were able to examine satisfactory evidence for all other items in the financial statements. The auditors would most likely express A. a qualified opinion on the entity's financial statements, referring to a departure from generally accepted accounting principles. B. a disclaimer of opinion on the entity's financial statements. C. an unmodified opinion on the entity's financial statements with an additional paragraph. D. an unmodified opinion on the entity's financial statements with a modification of the Auditor's Responsibility section. 21. If management fails to provide adequate justification for a change from one generally accepted accounting principle to another, the auditors should A. add an additional paragraph and express a qualified or an adverse opinion on the entity's financial statements for lack of conformity with generally accepted accounting principles. B. disclaim an opinion on the entity's financial statements because of uncertainty. C. disclose the matter in an additional paragraph but not modify the opinion paragraph on the entity's financial statements. D. neither modify the opinion on the entity's financial statements nor disclose the matter because both principles are generally accepted accounting principles. 12-6 22. Charlie Company's comparative financial statements include the financial statements of the prior year that were audited by predecessor auditors whose report on those financial statements is not presented. If the predecessor's report was qualified, the successor auditors should A. indicate in their report the substantive reasons for the qualification issued by the predecessor auditors. B. request the entity to reissue the predecessor's report on the prior-years' statements. C. issue an updated comparative report on the entity's financial statements, indicating the involvement of component auditors. D. express an opinion only on the current-year's financial statements and make no reference to the prior-years' financial statements or opinion. 23. Auditors who are reporting on financial statements that contain a material departure from generally accepted accounting principles sho [Show More]

Last updated: 1 year ago

Preview 1 out of 89 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Mar 19, 2022

Number of pages

89

Written in

Additional information

This document has been written for:

Uploaded

Mar 19, 2022

Downloads

0

Views

44

.png)

.png)

.png)