Economics > QUESTIONS & ANSWERS > Chapter 30 Bankruptcy Law All Questions and Answers (All)

Chapter 30 Bankruptcy Law All Questions and Answers

Document Content and Description Below

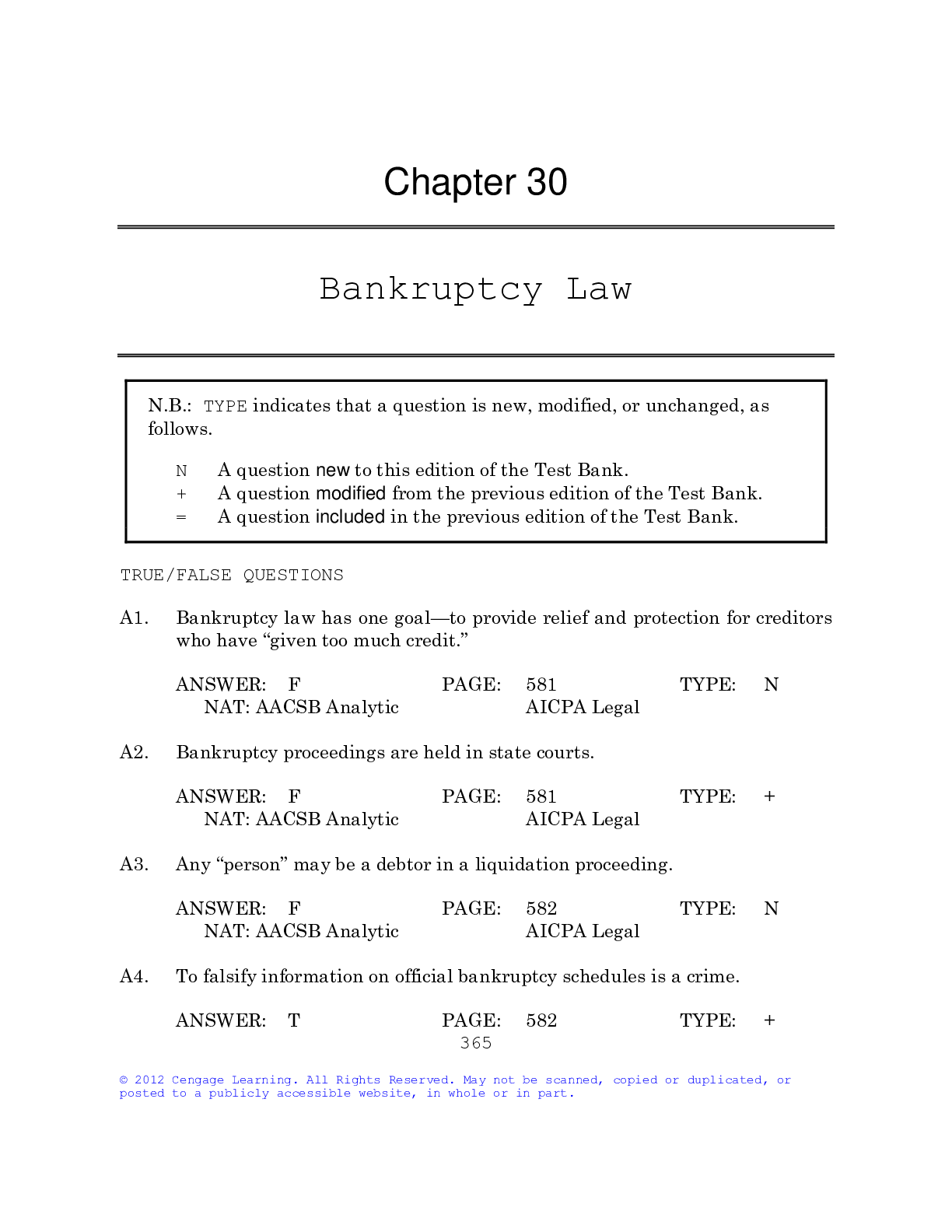

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows. N A question new to this edition of the Test Bank. + A question modified from the previous edition of the Test Ban... k. = A question included in the previous edition of the Test Bank. TRUE/FALSE QUESTIONS A1. Bankruptcy law has one goal—to provide relief and protection for creditors who have “given too much credit.” F PAGE: 581 TYPE: N NAT: AACSB Analytic AICPA Legal A2. Bankruptcy proceedings are held in state courts. F PAGE: 581 TYPE: + NAT: AACSB Analytic AICPA Legal A3. Any “person” may be a debtor in a liquidation proceeding. F PAGE: 582 TYPE: N NAT: AACSB Analytic AICPA Legal A4. To falsify information on official bankruptcy schedules is a crime. T PAGE: 582 TYPE: + NAT: AACSB Analytic AICPA Legal A5. If a debtor’s income is below the median income, there is a presumption of bankruptcy abuse. F PAGE: 582 TYPE: N NAT: AACSB Analytic AICPA Legal A6. An involuntary bankruptcy occurs when a debtor’s creditors are forced to accept a discharge of the debtor’s debts. F PAGE: 583 TYPE: N NAT: AACSB Analytic AICPA Legal A7. A bankruptcy estate consists of all the debtor’s interests in property currently held, wherever located. T PAGE: 587 TYPE: N NAT: AACSB Analytic AICPA Legal A8. The basic duty of a trustee is to collect and reduce to cash the property in the bankruptcy estate that is not exempt. T PAGE: 587 TYPE: N NAT: AACSB Analytic AICPA Legal A9. In most states, debtors may use only federal exemptions to exempt certain property from the bankruptcy. F PAGE: 590 TYPE: N NAT: AACSB Analytic AICPA Legal A10. A trustee must call a meeting of the creditors listed in the schedules filed by the debtor. T PAGE: 591 TYPE: N NAT: AACSB Analytic AICPA Legal A11. In the distribution of the debtor’s estate, secured creditors take priority over unsecured creditors. T PAGE: 591 TYPE: N NAT: AACSB Analytic AICPA Legal A12. Certain debtors may not qualify to have all debts discharged in bankruptcy. T PAGE: 592 TYPE: N NAT: AACSB Analytic AICPA Legal A13. Discharge of a debt is never denied because of the nature of a claim. F PAGE: 592 TYPE: N NAT: AACSB Analytic AICPA Legal A14. One of the primary effects of a discharge is to relieve the liability of a co-debtor. F PAGE: 593 TYPE: N NAT: AACSB Analytic AICPA Legal A15. The same principles that govern the filing of a liquidation petition apply to reorganization proceedings. T PAGE: 595 TYPE: N NAT: AACSB Analytic AICPA Legal A16. On the entry of an order for relief in a reorganization case, the creditors generally take over the operation of the debtor’s business. F PAGE: 595 TYPE: N NAT: AACSB Analytic AICPA Legal A17. For individual debtors, the plan in a reorganization case must be completed before discharge will be granted. T PAGE: 596 TYPE: N NAT: AACSB Analytic AICPA Legal A18. Certain liquidation cases may be converted to repayment plan cases with the consent of the debtor. T PAGE: 596 TYPE: N NAT: AACSB Analytic AICPA Legal A19. In a repayment plan case, the plan must provide for payment of all obligations in full. F PAGE: 597 TYPE: N NAT: AACSB Analytic AICPA Legal A20. The procedure for filing a family-farmer bankruptcy plan is very similar to the proce¬dure for filing a repayment plan. T PAGE: 600 TYPE: + NAT: AACSB Analytic AICPA Legal MULTIPLE CHOICE QUESTIONS A1. Mikhail files a petition in bankruptcy. One of the goals of bankruptcy law with respect to a debtor who has “gotten in over his head” is to a. encourage the continued use of credit to borrow funds. b. ensure that co-debtors will continue to guarantee loans. c. provide relief and protection. d. shield assets from creditors. C PAGE: 581 TYPE: + NAT: AACSB Reflective AICPA Legal A2. Bernice files a petition in bankruptcy. The initial proceeding on this peti¬tion will be in a. a federal bankruptcy court. b. a state bankruptcy court. c. the highest court in the state in which Bernice is located. d. the United States Supreme Court. A PAGE: 581 TYPE: = NAT: AACSB Reflective AICPA Legal A3. A petition for a discharge in bankruptcy in a liquidation proceeding may be filed by a. Eminent Employees Credit Union, a corporation. b. Federal Savings & Loan Association, a corporation. c. Goodhands Insurance Company, a corporation. d. Henry, an independent financial adviser. D PAGE: 582 TYPE: = NAT: AACSB Reflective AICPA Legal A4. Kenyon files a petition for bankruptcy. Kenyon must include with the petition a. a plan to turn over his future income to the trustee. b. a certificate proving attendance at a credit-counseling briefing. c. a provision of adequate means for the petition’s execution. d a statement of preference for one creditor over another. B PAGE: 582 TYPE: N NAT: AACSB Reflective AICPA Legal A5. Verna files a petition in bankruptcy in a liquidation proceeding. If the court administers the means test and concludes that Verna is abusing the bankruptcy process by filing for a liquidation, the court will most likely a. force Verna to file for relief through an individual repayment plan. b. discharge Verna’s debts. c. distribute Verna’s property to Verna’s creditors. d. issue an automatic stay against any actions by Verna’s creditors. A PAGE: 583 TYPE: N NAT: AACSB Reflective AICPA Legal A6. Mia’s voluntary petition for bankruptcy is found to be proper. The order for relief is effective as soon as a. Mia files the petition. b. Mia posts a bond to cover the costs of the proceedings. c. Mia’s creditors agree to the terms. d. the trustee collects and distributes the property of Mia’s estate. A PAGE: 585 TYPE: = NAT: AACSB Reflective AICPA Legal A7. Hasty Pastries declares bankruptcy, idling Hasty’s delivery vehicles. The court can compel Hasty to make periodic cash payments to a credi¬tor with a se¬cured interest in the vehicles to offset the depreciation in their value. This is a. the adequate protection doctrine. b. the avoidance doctrine. c. a preferential transfer. d. the automatic stay. A PAGE: 587 TYPE: + NAT: AACSB Reflective AICPA Legal Fact Pattern 30-1A (Questions A8–A9 apply) Stacy sells her all-terrain vehicle (ATV) to her brother Terrill for $1,000. Twelve days later, Stacy files a petition in bankruptcy for relief through a liquidation. A8. Refer to Fact Pattern 30-1A. Terrill dies while riding the ATV. Stacy is Terrill’s only heir. With respect to the bankruptcy estate, the inheritance is a. exempt property. b. part of the estate if Terrill died more than 180 days after Stacy’s filing. c. part of the estate if Terrill died within 180 days after Stacy’s filing. d. part of the estate if the accident was in some way Stacy’s fault. C PAGE: 587 TYPE: = NAT: AACSB Reflective AICPA Legal A9. Refer to Fact Pattern 30-1A. Regarding the sale of the ATV, the trustee may a. cancel it as a fraudulent transfer. b. cancel it as a voidable preference. c. not cancel it because it is a sale, not a gift. d. not cancel it, but can sue Terrill’s estate for the return of the $1,000. A PAGE: 589 TYPE: = NAT: AACSB Reflective AICPA Legal A10. Lorissa files a petition for bankruptcy. Lorissa’s creditors must file with the court their proof of claims against Lorissa’s assets within a. fifteen days of the order for relief. b. thirty days of the filing of the petition. c. sixty days of the automatic stay. d. ninety days of the creditors’ meeting. D PAGE: 591 TYPE: N NAT: AACSB Reflective AICPA Legal A11. Kipper files a petition in bankruptcy. Kipper’s dischargeable debts include a. domestic-support obligations. b. student loans unless the lender would suffer undue hardship. c. unpaid state and federal taxes. d. unsecured credit-card debt. D PAGE: 592 TYPE: = NAT: AACSB Reflective AICPA Legal A12. Teona files a vol¬untary petition in bankruptcy for relief through a liquidation. Debts that will not be discharged include claims for a. domestic-support obligations. b. money to be paid for goods not delivered. c. contributions to employee benefit plans. d. long overdue credit-card debt. A PAGE: 592 TYPE: N NAT: AACSB Reflective AICPA Legal A13. Ronaldo agrees to pay Simplex Cash Store a debt that is otherwise dis¬chargeable in bankruptcy. This is a. a reaffirmation. b. a liquidation. c. a reorganization. d. a petition. A PAGE: 593 TYPE: N NAT: AACSB Reflective AICPA Legal A14. Reconstruction Building Services receives a discharge in bankruptcy, even though some creditors hold judgments on overdue debts against it and others filed ac¬tions to collect on overdue debts before the bankruptcy. Reconstruction’s dis¬charge will a. absolve the liability of any co-debtors. b. permit the debtor to enter into reaffirmation agreements. c. allow the debtor to file a petition for a reorganization. d. prohibit actions and void judgments regarding overdue debts. D PAGE: 593 TYPE: N NAT: AACSB Reflective AICPA Legal A15. Swim & Trim Fitness Corporation wants to formulate a plan under which it pays a portion of its debts and is discharged of the remainder while continuing in business. To accomplish this goal, Swim & Trim should file a petition in bankruptcy for relief through a. a liquidation. b. a reorganization. c. a repayment plan. d. a family-farmer bankruptcy plan. B PAGE: 594 TYPE: N NAT: AACSB Reflective AICPA Legal A16. Resources Exploitation, Inc. (REI), files a petition in bankruptcy for relief through a reorganization and assumes the role of a debtor in possession. In this role, REI is simi¬lar to a. a creditor at a creditors’ meeting. b. a farmer after a discharge through family-farmer bankruptcy plan. c. a secured creditor in possession of collateral. d. a trustee in a liquidation. D PAGE: 595 TYPE: + NAT: AACSB Reflective AICPA Legal A17. To adjust debt and institute a repayment plan, Charlie—who is not a corpo-ration, a partnership, or a family farmer or fisherman—may file a peti¬tion in bankruptcy for relief through a. a liquidation. b. a reorganization. c. a repayment plan. d. a family-farmer bankruptcy plan. C PAGE: 596 TYPE: + NAT: AACSB Reflective AICPA Legal A18. Tippi believes that she needs to obtain a discharge in bank¬ruptcy through an individual’s repayment plan. This proceeding can be initiated by a filing of a pe¬tition by a. a creditor. b. a debtor. c. a corporation. d. a partnership. B PAGE: 596 TYPE: + NAT: AACSB Reflective AICPA Legal A19. Wilbur files a petition in bankruptcy for relief through an individual’s repayment plan. Wilbur is granted a discharge. Debts that will not be discharged include claims for a. contributions to employee benefit plans. b. money to be paid for services not rendered. c. fraudulently incurred debt. d. long overdue credit-card debt. C PAGE: 597 TYPE: N NAT: AACSB Reflective AICPA Legal A20. To adjust debt and institute a repayment plan, Norman, a family fisherman, may file a petition in bankruptcy for relief under the Bankruptcy Code’s Chapter a. 1. b. 3. c. 5. d. 12. D PAGE: 600 TYPE: = NAT: AACSB Reflective AICPA Legal ESSAY QUESTIONS A1. Current City (CC) is a retail seller of television sets. CC sells Dhani a $5,000 large-screen, high-definition, plasma set on a retail installment security agreement in which he pays $100 down and agrees to pay the balance in equal installments. CC retains a security interest in the set, and perfects that interest by filing a financing statement centrally. Two months later, Dhani is in default on the payments to CC and is involun¬tarily petitioned into bankruptcy by other creditors. Discuss CC’s right to repossess the TV set and whether CC has priority over the trustee in bankruptcy to any proceeds from the disposal of the set. A2. Job Service, Inc., needs funds to meet its payroll, to make other cur¬rent operating expenses, and to pay its creditors. Kelly, Job Service’s only shareholder, loans the company $10,000 and accepts a promissory note signed on behalf of Job Service by Luna, the firm’s accountant. Job Service’s fi¬nancial problems continue, however, and the firm’s creditors file an in-voluntary petition to force it into bankruptcy. Is Kelly entitled to repay¬ment of the loan to Job Service? If so, what is the priority of the claim? [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 18, 2019

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Dec 18, 2019

Downloads

0

Views

56