Finance > QUESTIONS & ANSWERS > SCENARIO: You are bullish on company ABC and company XYZ. Suppose you have $2 million to invest. You (All)

SCENARIO: You are bullish on company ABC and company XYZ. Suppose you have $2 million to invest. You consider four different investment strategies in the form of portfolios: Note that we assume the variances of ABC and XYZ are similar (say within 20% of each other) AND positively correlated.

Document Content and Description Below

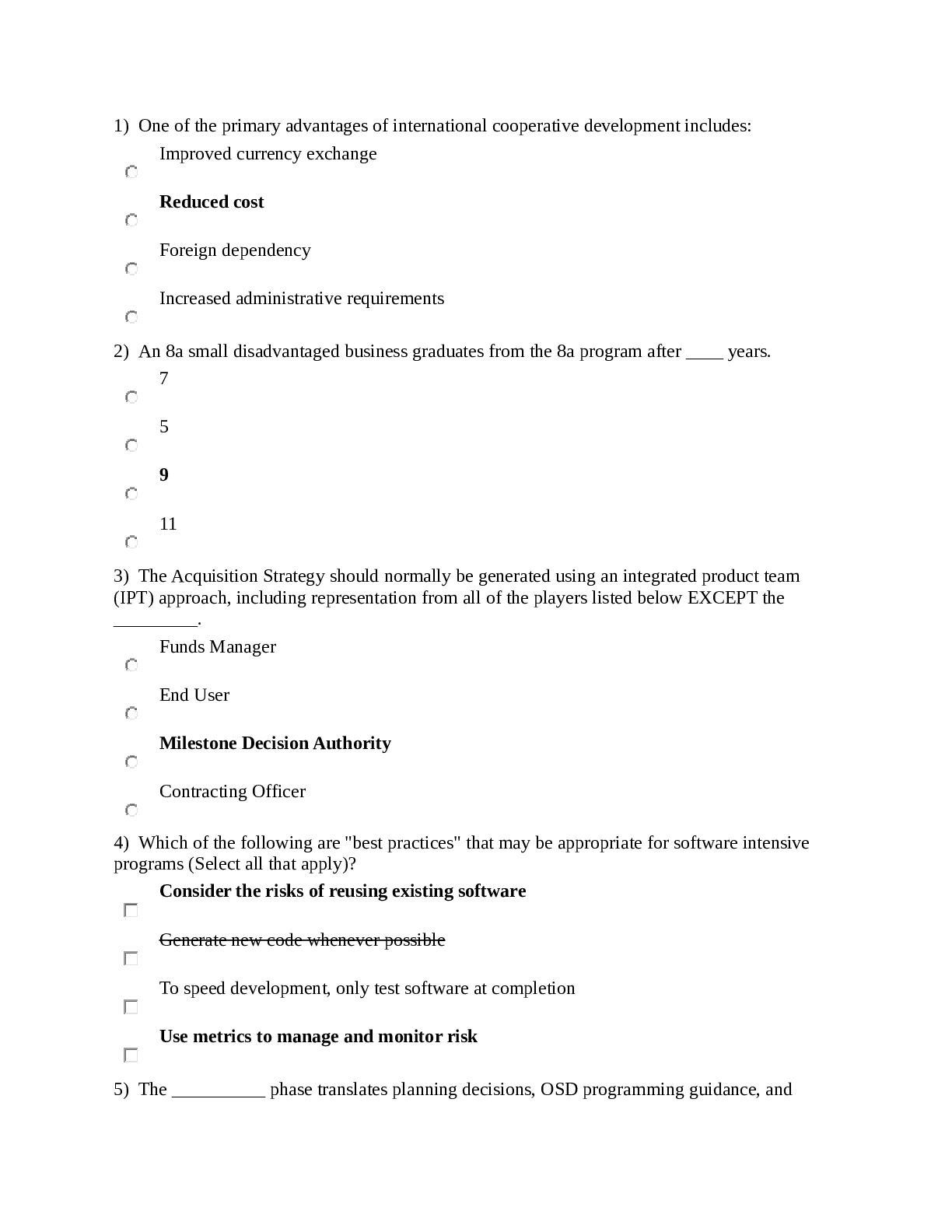

SCENARIO You are bullish on company ABC and company XYZ. Suppose you have $2 million to invest. You consider four different investment strategies in the form of portfolios: Note that we assume the ... variances of ABC and XYZ are similar (say within 20% of each other) AND positively correlated. Portfolio A Buy $1 million worth of ABC stock using cash. Buy $1 million worth of XYZ stocks using cash. Portfolio B Buy $2 million worth of ABC stock using $1 million and borrowing $1 million. Buy $2 million worth of XYZ stock using $1 million and borrowing $1 million. Portfolio C Buy call options on ABC stock expiring in 1 month, with strike $5 higher than ABC's stock price. The cost of all these ABC options is not more than $500,000. Buy call options on XYZ expiring in 1 month, with strike $5 higher than XYZ's stock price. The cost of all these XYZ options is not more than $500,000. Portfolio D Sell put options on ABC expiring in 1 month, with strike $5 lower than ABC's stock price. Sell put options on XYZ expiring in 1 month, with strike $5 lower than XYZs' stock price. **NOTE: **Questions 5 and 6 are **not **based on this scenario. Question 1: Which portfolio(s) are affected by higher-than-expected covariance? Give at least 2 reasons. Question 2: What happens to the option portfolios if the correlation between ABC and XYZ is 0? Describe effects on return and risk. Question 3: Excluding Portfolio D, which portfolio(s) has the potential to make more than 100%? Give at least 2 reasons. Question 4: For proper risk management, which of the portfolios should be hedged? Give at least 2 reasons. Question 5: What happens when you have both high volatility AND high correlation? Provide at least 2 arguments. Question 6: Which of the portfolios have a non-linear payoff? Give at least 2 reasons. [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$9.00

Document information

Connected school, study & course

About the document

Uploaded On

Aug 29, 2022

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Aug 29, 2022

Downloads

1

Views

203

.png)