Financial Accounting > QUESTIONS & ANSWERS > CHAPTER 19 ACCOUNTING FOR INCOME TAXES IFRS questions are available at the end of this chapter with (All)

CHAPTER 19 ACCOUNTING FOR INCOME TAXES IFRS questions are available at the end of this chapter with correct answers

Document Content and Description Below

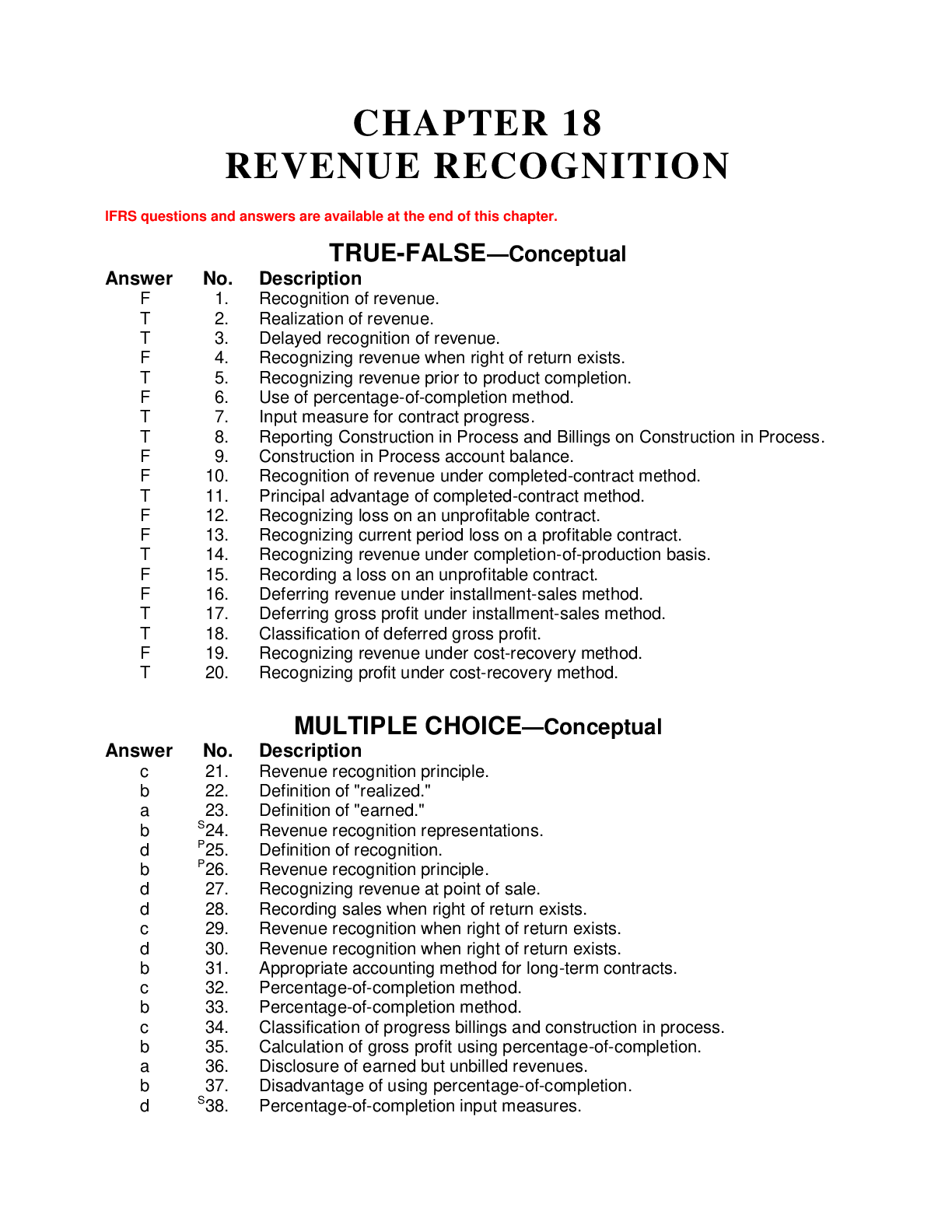

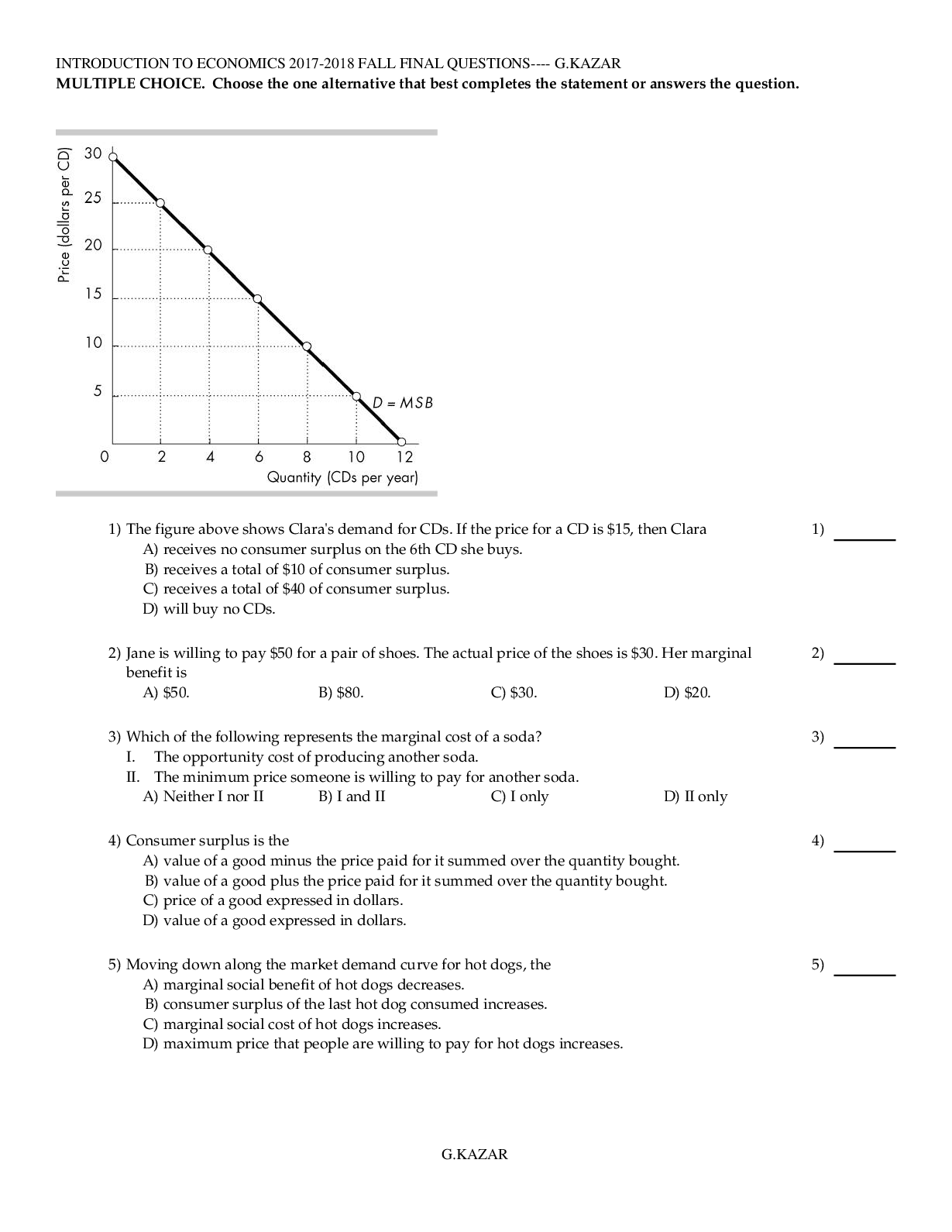

5. Deductible amounts cause taxable income to be greater than pretax financial income in the future as a result of existing temporary differences. Ans: F, LO: 1, Bloom: C, Difficulty: Moderate, Min:... 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 6. A deferred tax asset represents the increase in taxes refundable in future years as a result of deductible temporary differences existing at the end of the current year. Ans: T, LO: 1, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 7. A company reduces a deferred tax asset by a valuation allowance if it is probable that it will not realize some portion of the deferred tax asset. Ans: F, LO: 1, Bloom: C, Difficulty: Difficult, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 8. Companies should consider both positive and negative evidence to determine whether it needs to record a valuation allowance to reduce a deferred tax asset. Ans: T, LO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 9. A company should add a decrease in a deferred tax liability to income taxes payable in computing income tax expense. Ans: F, LO: 2, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 10. Taxable temporary differences will result in taxable amounts in future years when the related assets are recovered. Ans: T, LO: 2, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 11. Examples of taxable temporary differences are subscriptions received in advance and advance rental receipts. Ans: F, LO: 2, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 19 - 6 12. Permanent differences do not give rise to future taxable or deductible amounts. Ans: T, LO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 13. Companies must consider presently enacted changes in the tax rate that become effective in future years when determining the tax rate to apply to existing temporary differences. Ans: T, LO: 2, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 14. When a change in the tax rate is enacted, the effect is reported as an adjustment to income tax payable in the period of the change. Ans: F, LO: 2, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 15. Under the loss carryback approach, companies must apply a current year loss to the most recent year first and then to an earlier year. Ans: F, LO: 3, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 16. The tax effect of a loss carryforward represents future tax savings and results in the recognition of a deferred tax asset. Ans: T, LO: 3, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 17. A possible source of taxable income that may be available to realize a tax benefit for loss carryforwards is future reversals of existing taxable temporary differences. Ans: T, LO: 3, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 18. Companies are permitted to offset any balances in income taxes payable against related income tax refund receivable or prepaid income taxes balances. Ans: T, LO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Communication, AICPA BB: None, AICPA FN: Reporting, AICPA PC: Communication, IMA: Reporting, IFRS: None 19. Companies should classify deferred tax accounts on the balance sheet as current assets or current liabilities. Ans: F, LO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Communication, AICPA BB: None, AICPA FN: Reporting, AICPA PC: Communication, IMA: Reporting, IFRS: None 20. The FASB believes that the defe [Show More]

Last updated: 1 year ago

Preview 1 out of 53 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$12.00

Document information

Connected school, study & course

About the document

Uploaded On

Sep 04, 2022

Number of pages

53

Written in

Additional information

This document has been written for:

Uploaded

Sep 04, 2022

Downloads

0

Views

42

.png)

.png)

.png)

.png)