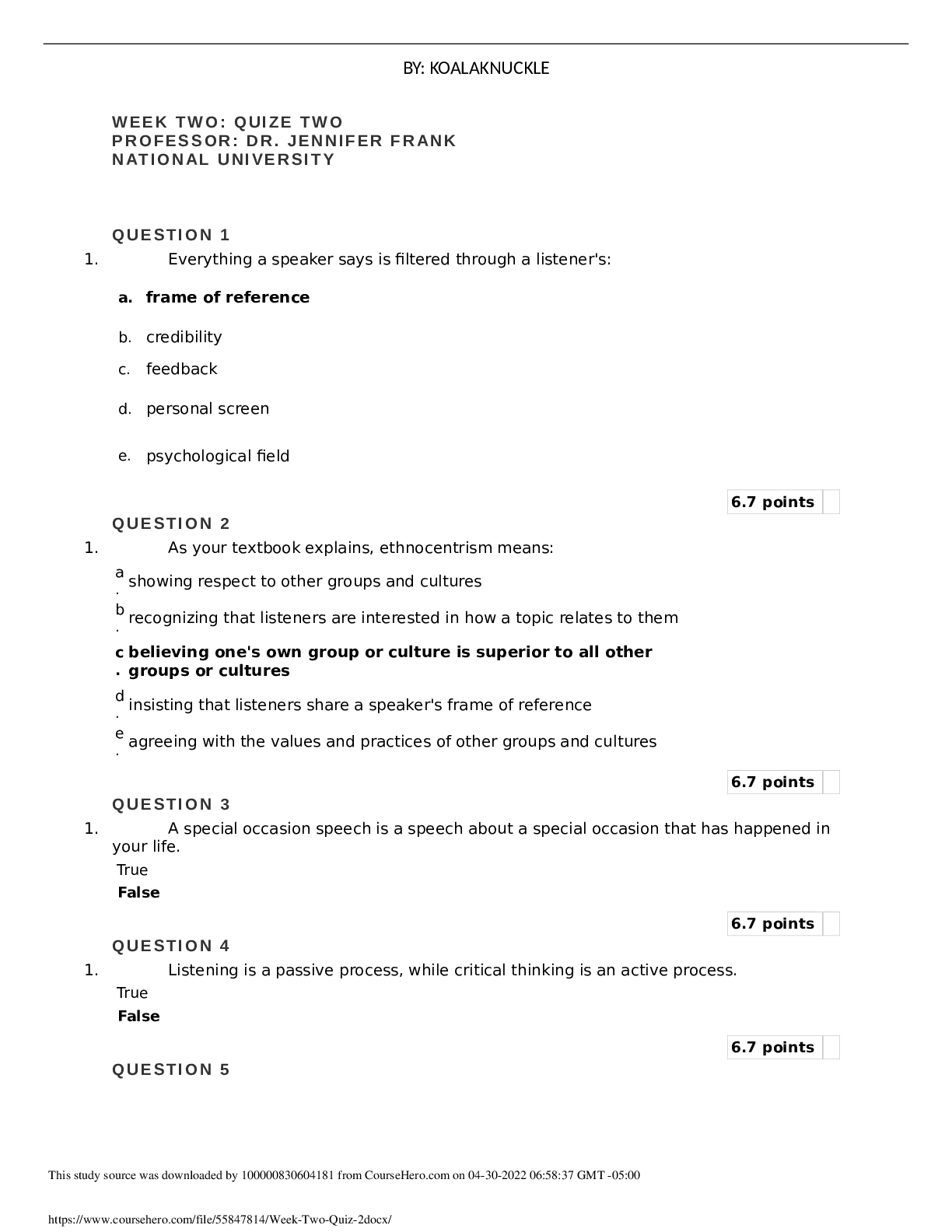

Financial Accounting > Quiz > ACCT 640 Accounting Concepts and Procedures I -15C - Quiz 1 - Key (All)

ACCT 640 Accounting Concepts and Procedures I -15C - Quiz 1 - Key

Document Content and Description Below

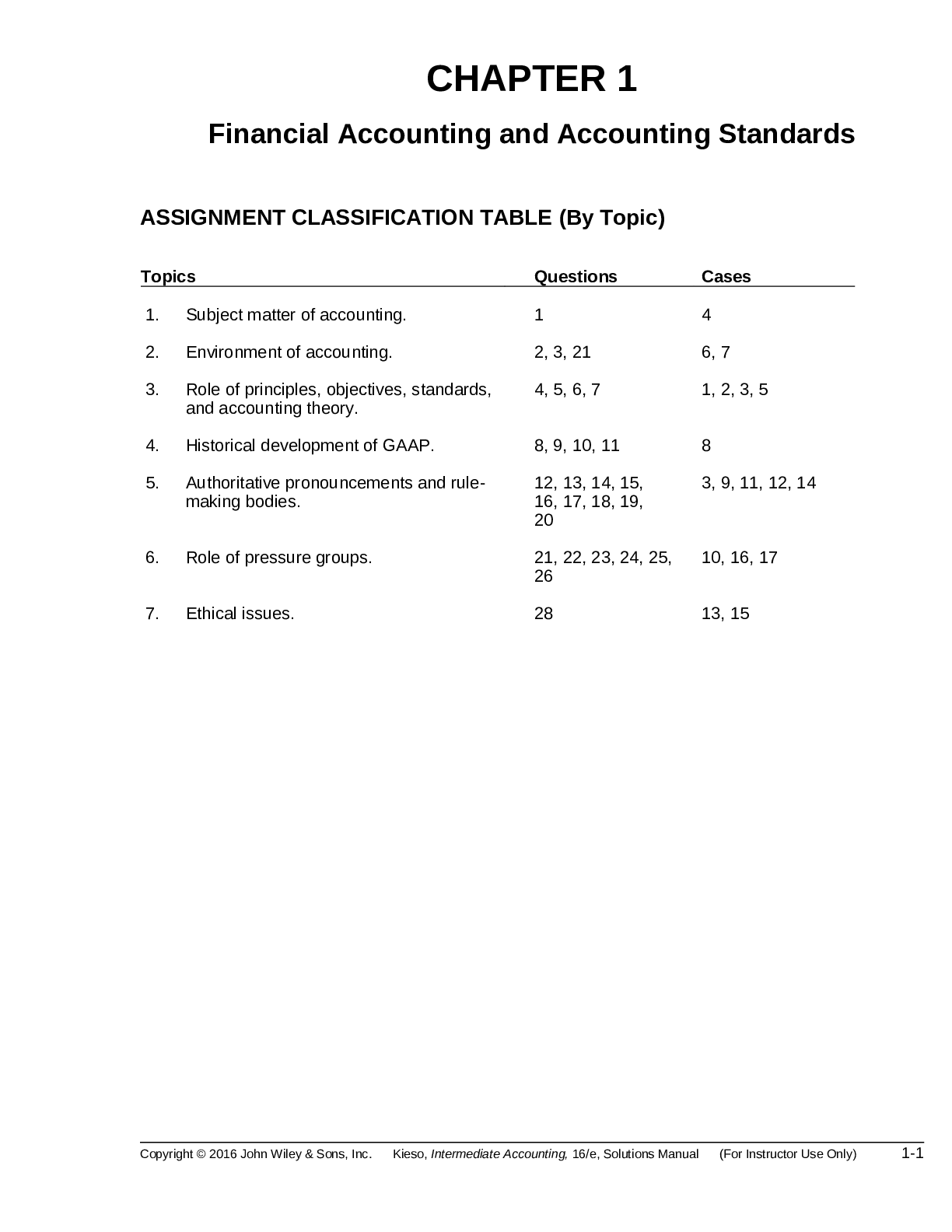

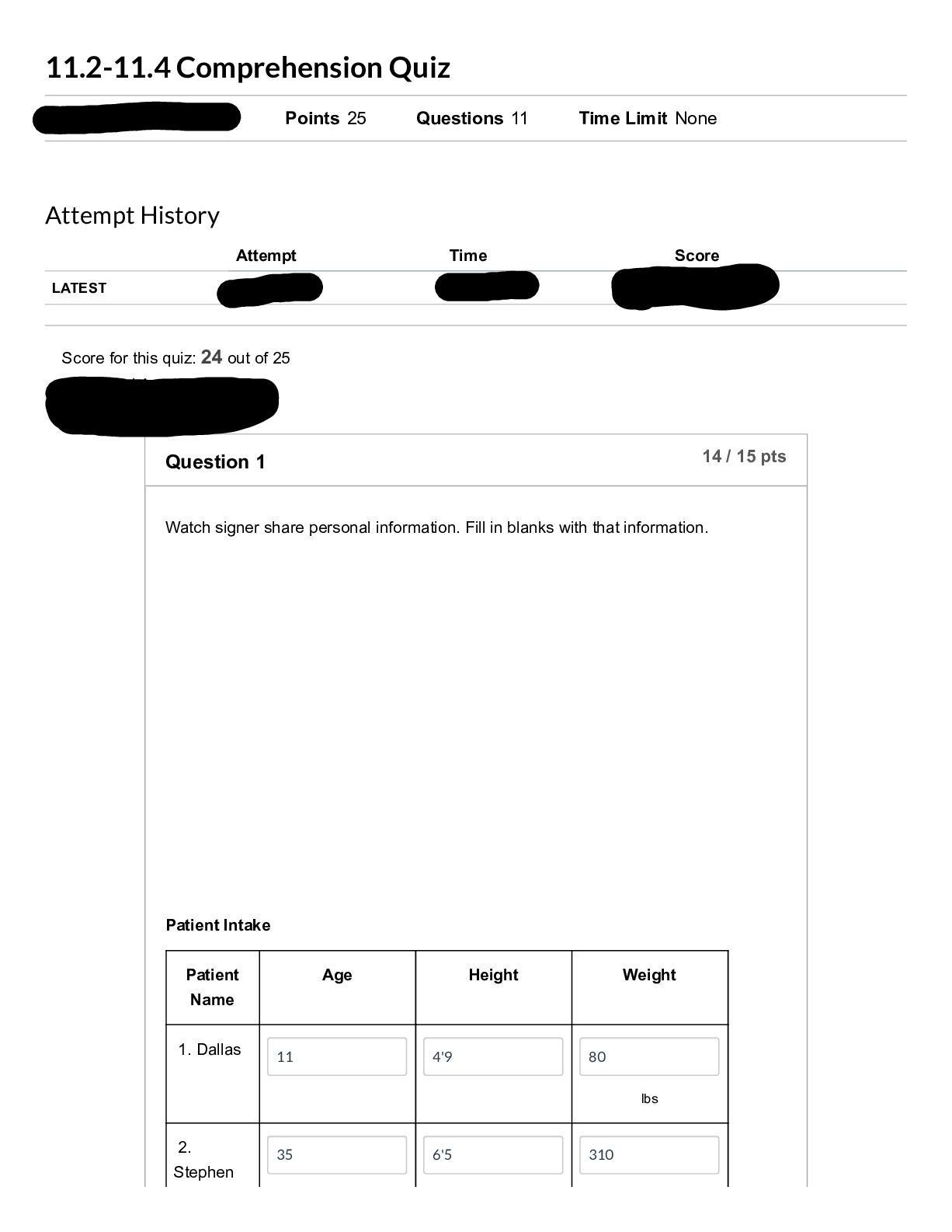

Quiz 1- Chapter 1 Submit your answers on eCampus. Keep this to study for the Mid-Term Exam. 1. Which of the following statements is false? A. An advantage of incorporation is the limited liability o... f the owners. B. Financial statements prepared for a sole proprietorship must not be combined with the owner’s personal affairs. C. Capital stock is a liability. D. The Securities and Exchange Commission (SEC) is the governmental agency that regulates the stock market and enforces reporting standards for publicly traded corporations. E. Earning revenue is an operating activity of a business. 2. Answer the following statements concerning the balance sheet as true or false, then select the correct multiple choice answer. __________ The balance sheet is also called a statement of financial position. __________ The balance sheet summarizes assets, liabilities, and owners’ equity for a period of time. __________ Assets minus liabilities equals the owners’ interest in the business. ___________ Expenses reduce total assets on the balance sheet. A. True, True, True, True B. True, False, True, False C. False, False, False, True D. False, True, False, True E. True, True, True, False 3. The balance sheet for Aggie Company at December 31, 2014 indicated that total assets were $725 and total liabilities were $580. At December 31, 2015 total assets had decreased to $640. Additional information available for 2015 included the following: Revenues ………………………$290 Expenses …………………… $185 Dividends……………………….$24 Total liabilities on the December 31, 2015 balance sheet were: A. $226 B. $250 C. $438 D. $516 E. $414 4. Aggie Divers, Inc. was started on September 1, 2015. Following are the assets and liabilities of the company on September 30, 2015 and the revenues and expenses for the month of September. Cash $ 8,000 Notes Payable $30,800 Accounts Receivable 7,000 Rent Expense 1,200 Equipment 44,000 Repair Expense 400 Service Revenue 11,200 Supply Expense 2,200 Advertising Expense 500 Insurance Expense 400 Common Stock 45,000 Retained Earnings (Sept.1) 0 Supplies 1,500 Accounts Payable 2,300 Vehicle 22,400 Dividend 1,700 What is Net Income for the month of September? A. $ 6,500 B. $ 4,800 C. $ 8,700 D. $ 8,200 E. $14,500 5. John Smith is the sole owner and manager of the Aggie Lawn and Grass Shop. In 2015, John purchased a new Vehicle for personal use only. Which of the following assumptions, principles, or concepts prevents John from recording the price of the vehicle as an asset of the business? A. Time Period Assumption B. Economic Entity Concept C. Cost Principle D. Going-Concern Assumption E. Monetary Unit Assumption Use the following information to answer the next two questions: Pet Corporation has been in the business of providing dog and cat grooming services since 2003. The following information concerning financial activities during 2015 is available at December 31, 2015: Grooming Revenue $145,000 Cash $29,000 Accounts Receivable 21,000 Advertising Expense 4,000 Land 48,000 Common Stock 55,000 Accounts Payable 17,000 Retained Earnings, 1/1/15 13,000 Salary Expense 59,000 Utilities Expense 11,000 Building 52,000 Rent Expense 23,000 Note Payable 36,000 Supplies 1,000 Dividends 8,000 Insurance Expense 10,000 6. Total assets as of December 31, 2015 are: A. $150,000 B. $130,000 C. $189,000 D. $151,000 E. $147,000 7. Retained Earnings on December 31, 2015 is: A. $ 98,000 B. $ 22,000 C. $ 51,000 D. $ 26,000 E. $ 43,000 8. Answer the following statements as true or false, then select the correct multiple choice answer: _____ Generally Accepted Accounting Principles (GAAP) are essentially the identical in most developed countries. _____ Net Income is another name for revenue. _____ The Securities and Exchange Commission (SEC) is a governmental agency that regulates the stock market and enforces reporting standards for publicly traded corporations. _____ The purpose of an audit is to prove the accuracy of an entity’s financial statements. A. True, True, True, True B. False, False, False, False C. True, False, True, False D. False, False, True, False E. False, True, False, True 9. As a result of the Sarbanes-Oxley Act, which of the following statements is false? A. Top management must now take more responsibility for the company’s financial information; this includes certifying the accuracy of the financial statements and reporting on the effectiveness of the company’s internal control structure. B. Audit committee members must be independent of the company’s management. C. All Board of Directors members must be independent of management. D. The Public Company Accounting Oversight Board (PCAOB) was created to regulate auditing firms, and all firms that audit publicly traded companies must register with the PCAOB. 10. A company began operations at the start of 2015. During the year, it made cash sales of $150,000 and credit sales totaling $500,000. $420,000 in cash from these credit sales was collected during the year. The company purchased land for $60,000 for a new location. Expenses totaled $339,000, of which $300,000 was paid in cash. Dividends of $10,000 were paid to stockholders. What was income for 2015? A. $311,000 B. $270,000 C. $301,000 D. $350,000 E. None of the above [Show More]

Last updated: 1 year ago

Preview 1 out of 2 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$5.00

Document information

Connected school, study & course

About the document

Uploaded On

Sep 07, 2022

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Sep 07, 2022

Downloads

0

Views

82

.png)

.png)