Health Care > EXAM > WGU C214 OA Financial Management Retake Exam Questions and Answers/ Guaranteed A+/Latest Update (All)

WGU C214 OA Financial Management Retake Exam Questions and Answers/ Guaranteed A+/Latest Update

Document Content and Description Below

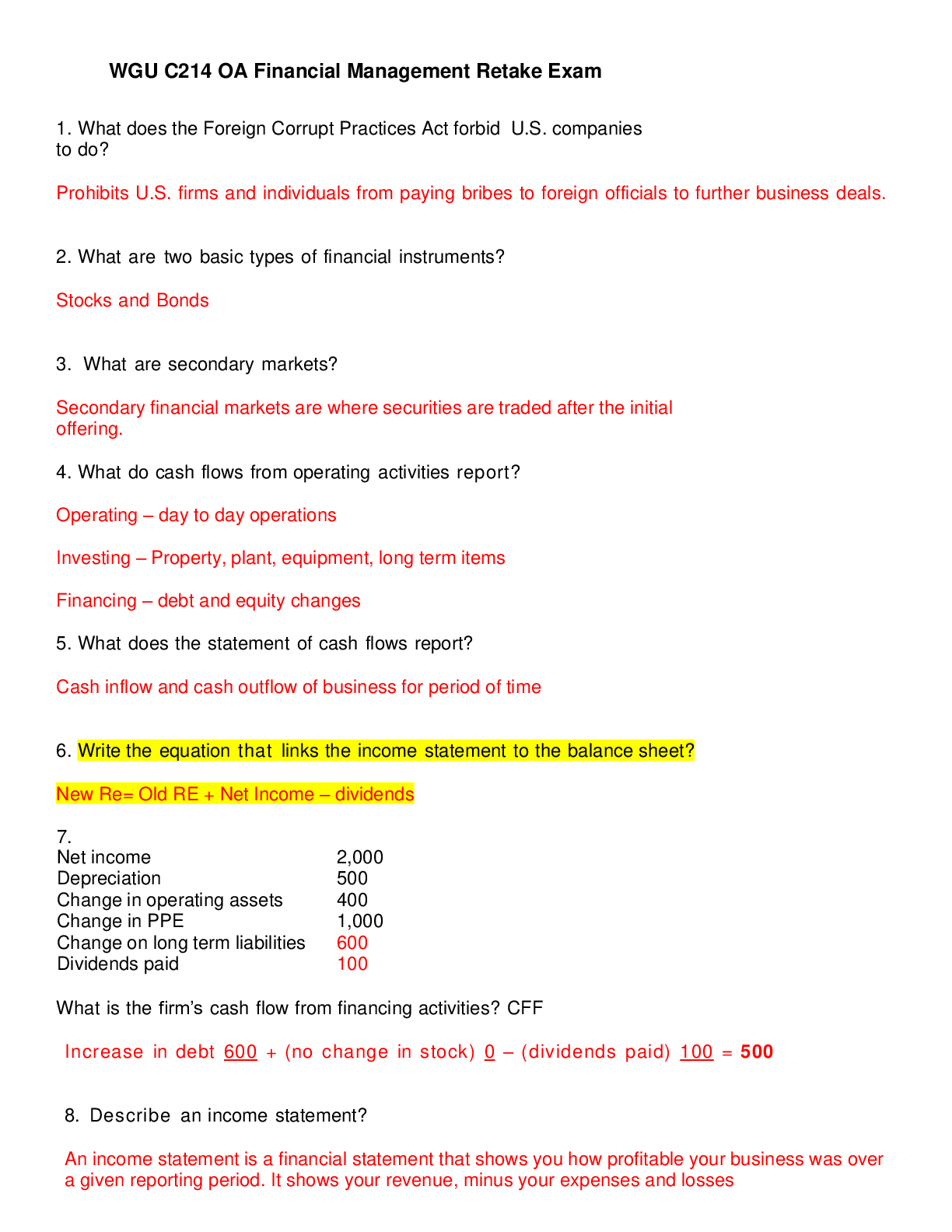

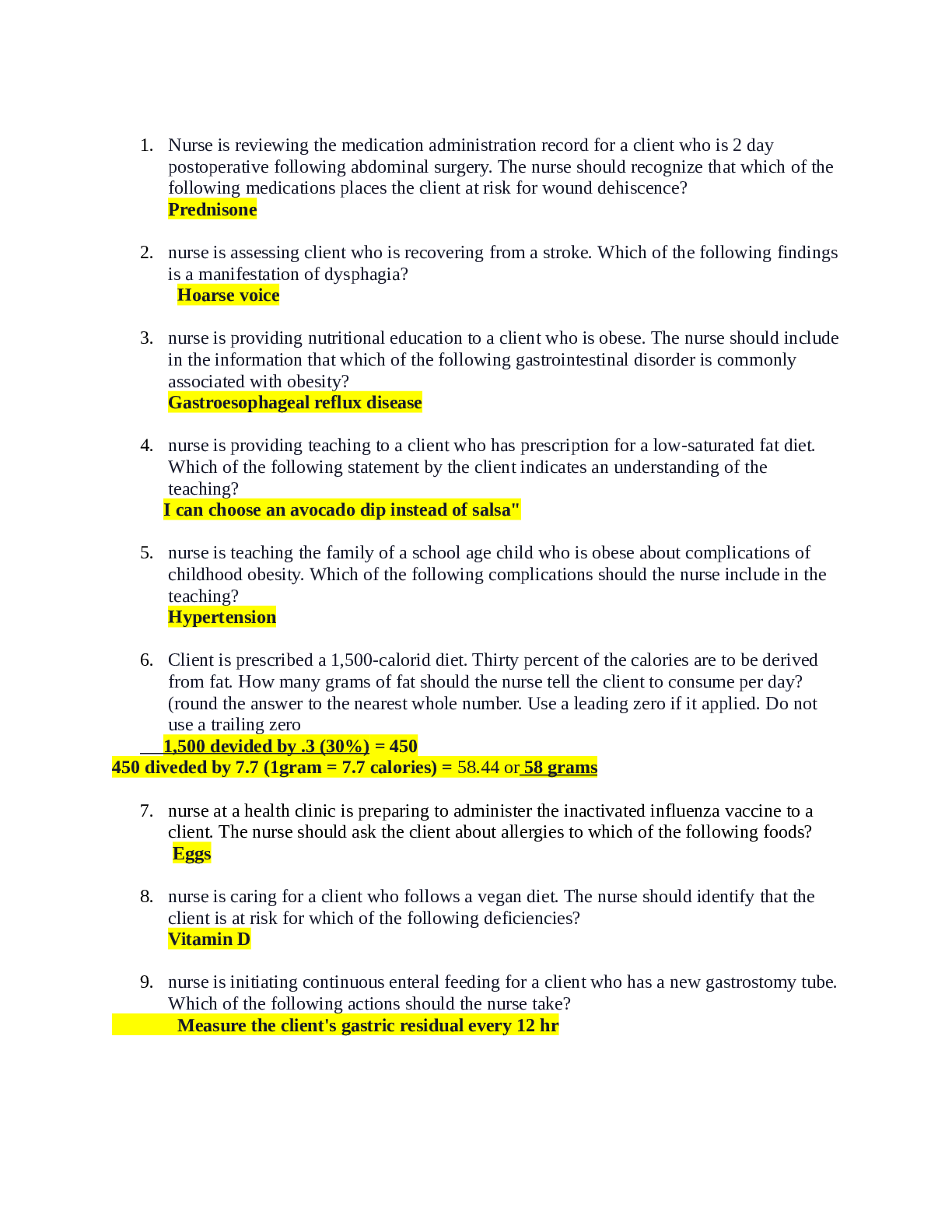

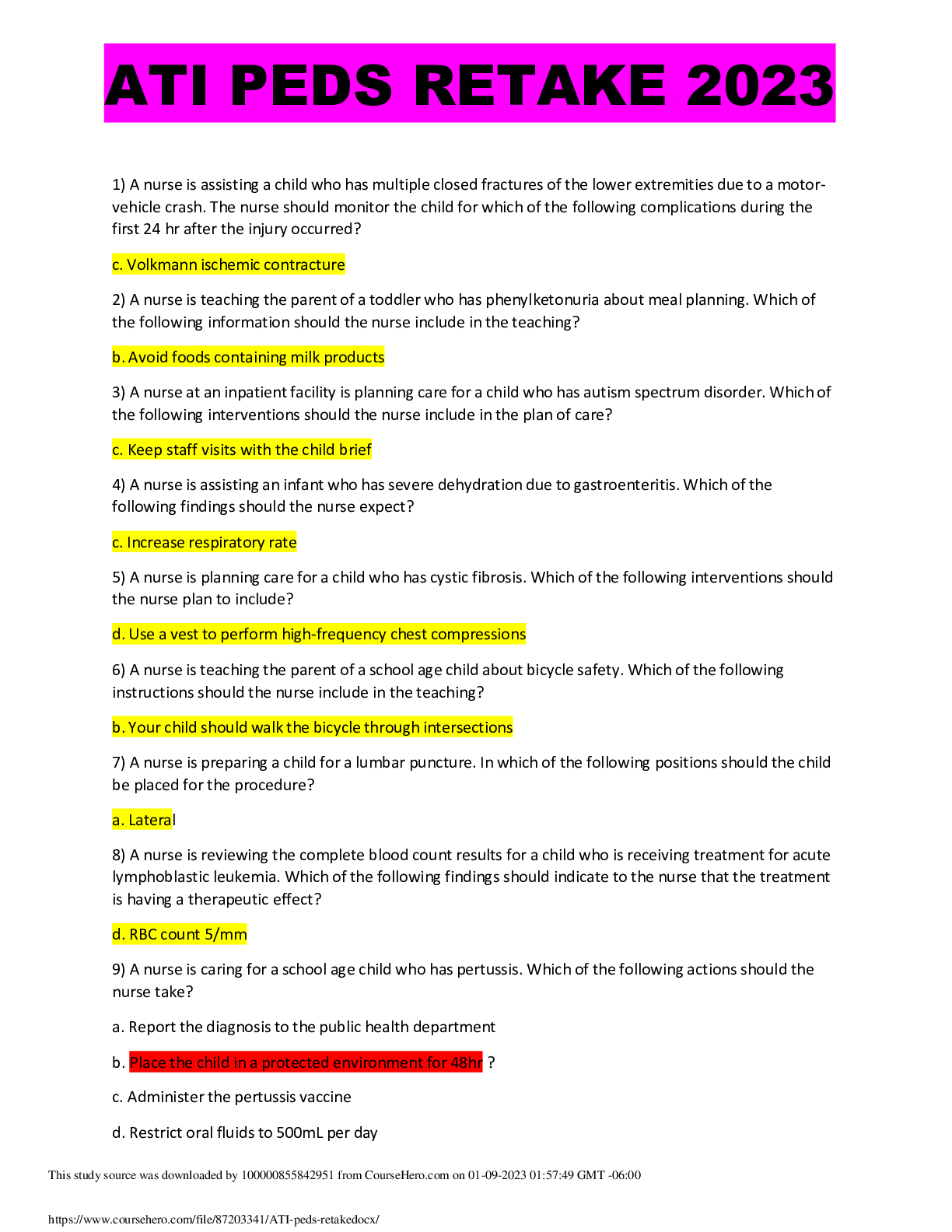

WGU C214 OA Financial Management Retake Exam Questions and Answers 1. What does the Foreign Corrupt Practices Act forbid U.S. companies to do? Prohibits U.S. firms and individuals from paying b... ribes to foreign officials to further business deals. 2. What are two basic types of financial instruments? Stocks and Bonds 3. What are secondary markets? Secondary financial markets are where securities are traded after the initial offering. 4. What do cash flows from operating activities report? Operating – day to day operations Investing – Property, plant, equipment, long term items Financing – debt and equity changes 5. What does the statement of cash flows report? Cash inflow and cash outflow of business for period of time 6.Write the equation that links the income statement to the balance sheet ? New Re= Old RE + Net Income – dividends 7. Net income 2,000 Depreciation 500 Change in operating assets 400 Change in PPE 1,000 Change on long term liabilities 600 Dividends paid 100 What is the firm’s cash flow from financing activities? CFF Increase in debt 600 + (no change in stock) 0 – (dividends paid) 100 = 500 8. Describe an income statement? An income statement is a financial statement that shows you how profitable your business was over a given reporting period. It shows your revenue, minus your expenses and losses 9. What item is included in the income statement and not included in the statement of cash flows. Depreciation 10. A company sold goods in 2016 for $30,000 and collected the cash in 2017. In 2016, the company incurred and paid $20,000 in expenses related to the goods sold. How much income should the company report in 2016 under the accrual basis of accounting? 30,000-20,000= $10,000 11. EBIT: $1,000,000 Depreciation: $30,000 Changein working capital($5,000) Net capital expenditures: $10,000 Tax rate: 40% What is the company’s free cash flow? 1,000,000*(1-.40) + 30,000) – (-5,000) – 10,000 = 625,000 12. Define Free Cash Flow? Represents the cash available for the company to repay creditors or pay dividends and interest to investor [Show More]

Last updated: 1 year ago

Preview 1 out of 19 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 14, 2022

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Sep 14, 2022

Downloads

0

Views

56

.png)