Business Law > EXAM > ACC MISC 2021 final exam Personal Income Tax Return (All)

ACC MISC 2021 final exam Personal Income Tax Return

Document Content and Description Below

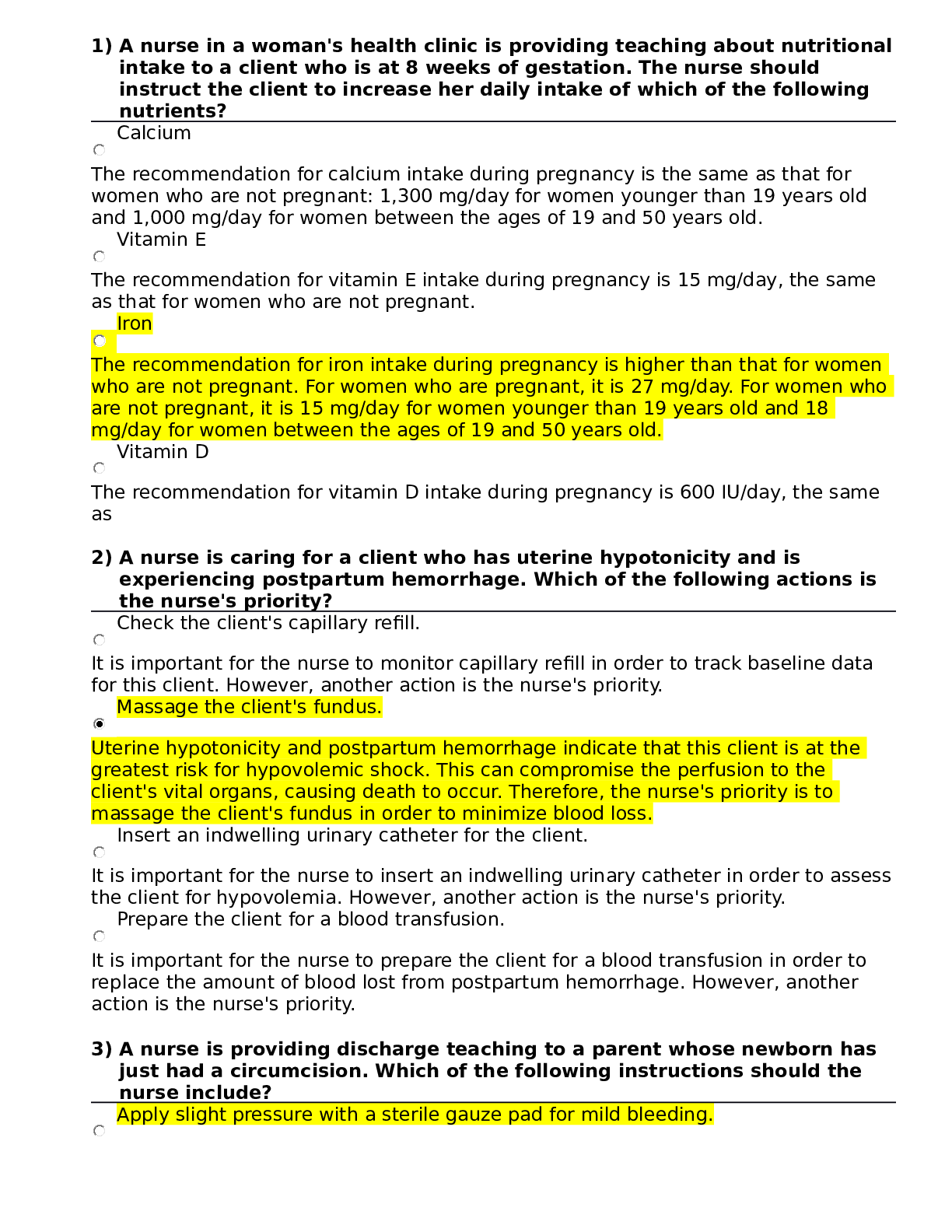

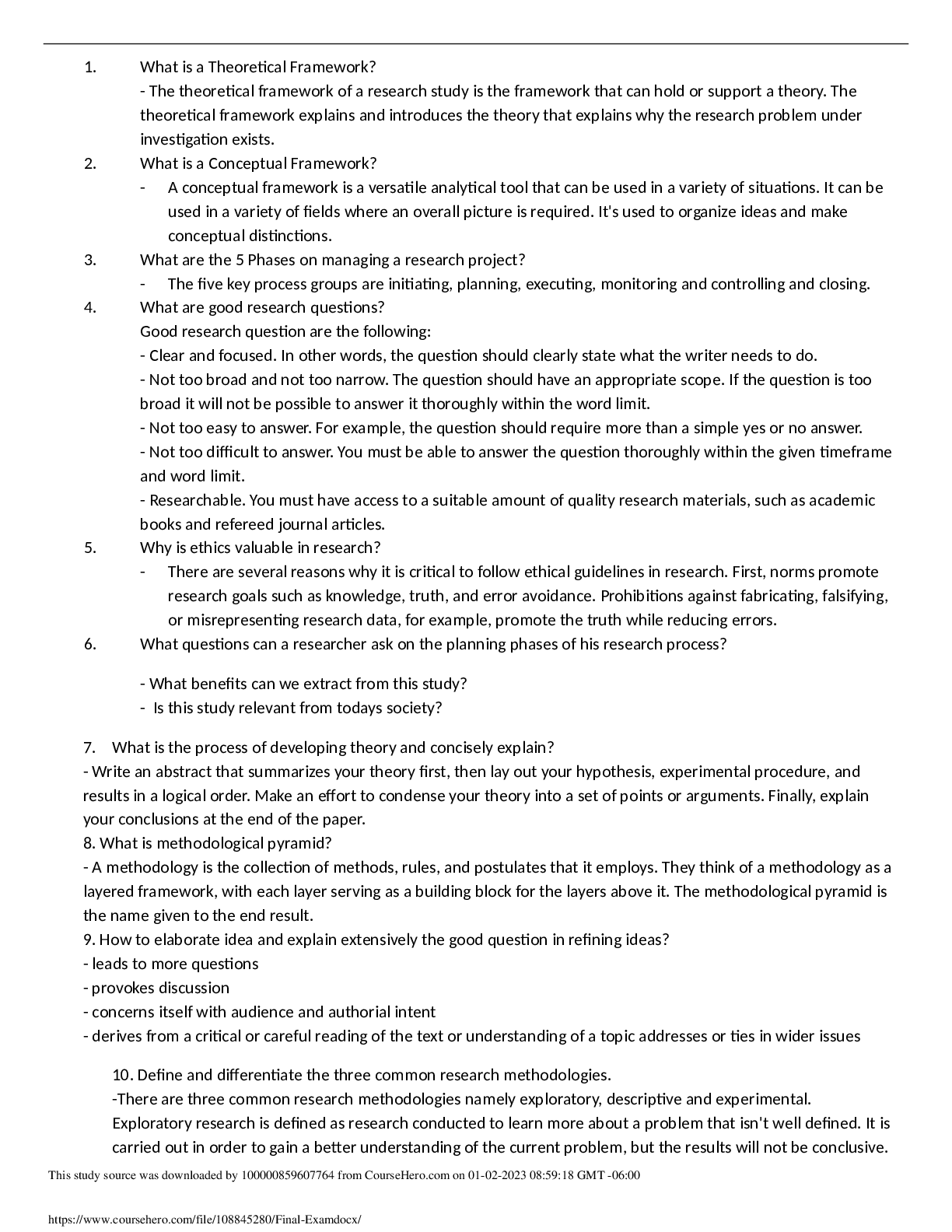

12/21/2020 Final Exam https://www.qwivy.com/report/printquiz/index.php?attempt=737415 1/14 Dashboard / My courses / 2021 IRS 10 Hour Continuing Education: Personal Income Tax Return / Final ... Exam / Final Exam 2021 IRS 10 Hour Continuing Education: Personal Income Tax Return Question 1 Question 2 Question 3 An individual can choose to le as Married Filing Separately if: Select one: a. They are divorced as evidenced by a nal divorce decree dated no later than September 30 of the tax year b. They are considered married on the last day of the tax year because they meet one of the tests for being considered married c. Their spouse died during the previous tax year d. They lived apart from their boyfriend for at least the last 6 months of the tax year Bob Jonas is a single parent who has been divorced for two years and who provides a home for his 10-year old dependent son. What ling status should Bob use? Select one: a. Married Filing Separate b. Head of Household c. Single d. Qualifying Widow(er) Ms. Sue Smith's husband passed away on March 6, of the previous tax year and Ms. Smith has not remarried. She maintains a home for herself and her 15-year old son. Ms. Smith provided over half of her son's support and he lived with her all year. What ling status should Ms. Smith use when ling her tax return for the tax year that her husband passed away? Select one: a. Qualifying Widow(er) b. Single c. Married Filing Joint d. Head of Household 1 / 2 12/21/2020 Final Exam https://www.qwivy.com/report/printquiz/index.php?attempt=737415 2/14 Question 4 Question 5 Question 6 Question 7 IRS Form 1040EZ was replaced by: Select one: a. Form 1040A b. Schedule 1 c. Form 1040 d. Form 1040EZ will not be replaced. Form 1040X is used to: Select one: a. Amend a U.S. Individual Income Tax Return. b. Request an extension to le a U.S. Individual Income Tax Return. c. Report Self-Employment Income. d. Report Income When the Taxpayer Does Not Have a Social Security Number. Which of the following organizations/entities will qualify as a charitable organization so that contributions can qualify as charitable giving? Select one: a. A religious Temple b. A nonprot cemetery company c. A nonprot organization for the prevention of cruelty to animals d. All of the above may qualify e. None of the above qualify The Age Test for a child to qualify as a dependent varies depending upon the tax benet involved. In general, a child must be under the age of ___ (or under age 24 in the case of a full-time student) in order to be a qualifying child. Select one: a. 17 [Show More]

Last updated: 1 year ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$9.50

Document information

Connected school, study & course

About the document

Uploaded On

Sep 16, 2022

Number of pages

14

Written in

Additional information

This document has been written for:

Uploaded

Sep 16, 2022

Downloads

0

Views

41