Management > TEST BANK > Multinational Financial Management, 11th Edition by Shapiro Test Bank (All)

Multinational Financial Management, 11th Edition by Shapiro Test Bank

Document Content and Description Below

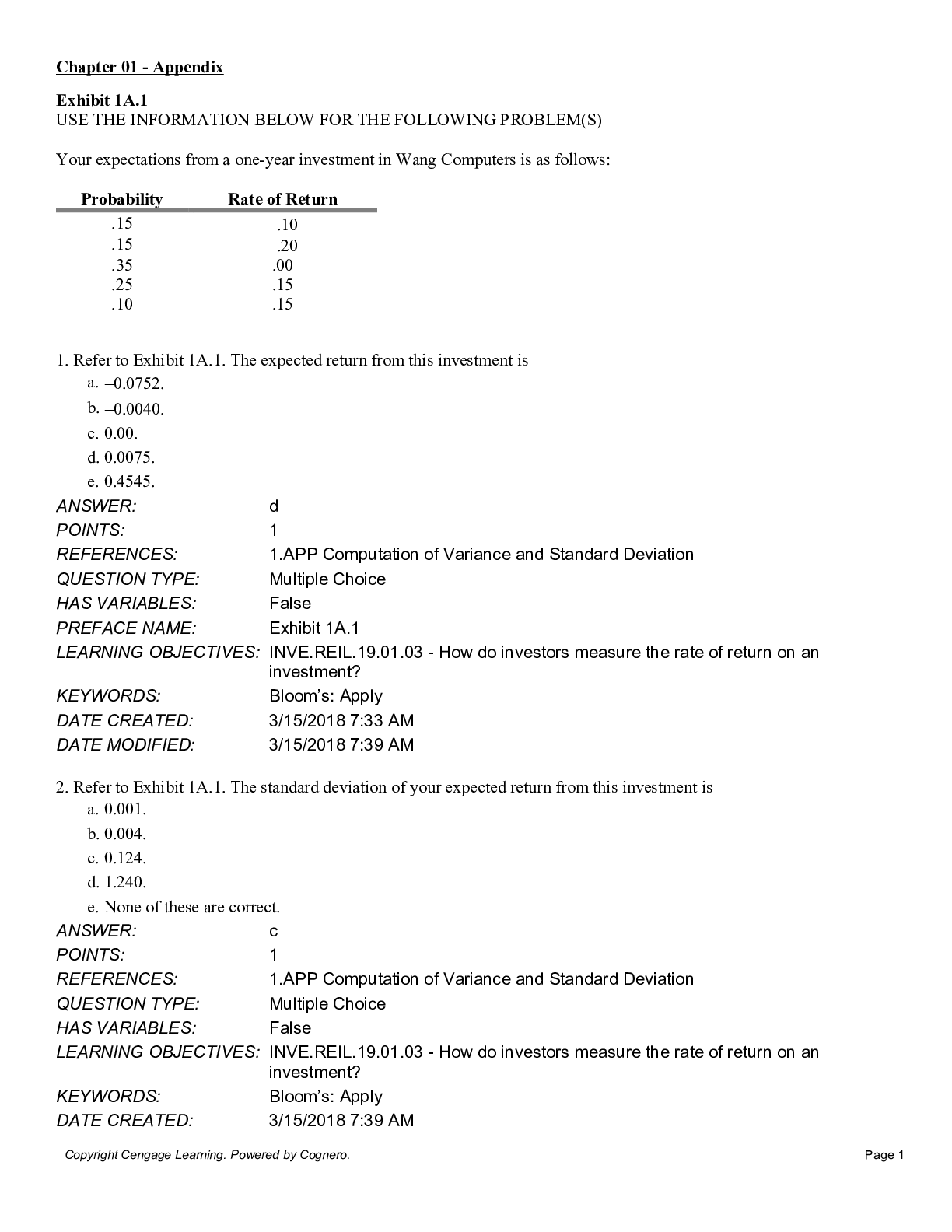

Test Bank for Multinational Financial Management, 11th Edition, 11e by Alan C. Shapiro TEST BANK ISBN-13: 9781119559900 Full chapters included PART I: THE INTERNATIONAL FINANCIAL MANAGEMENT ENVIR... ONMENT CHAPTER 1: INTRODUCTION: MULTINATIONAL CORPORATIONS AND FINANCIAL MANAGEMENT 1.1 THE RISE OF THE MULTINATIONAL CORPORATION 1.2 THE INTERNATIONALIZATION OF BUSINESS AND FINANCE 1.3 MULTINATIONAL FINANCIAL MANAGEMENT: THEORY AND PRACTICE 1.4 OUTLINE OF THE BOOK QUESTIONS APPENDIX: THE ORIGINS AND CONSEQUENCES OF INTERNATIONAL TRADE QUESTIONS NOTES CHAPTER 2: THE DETERMINATION OF EXCHANGE RATES 2.1 SETTING THE EQUILIBRIUM SPOT EXCHANGE RATE 2.2 EXPECTATIONS AND THE ASSET MARKET MODEL OF EXCHANGE RATES 2.3 THE FUNDAMENTALS OF CENTRAL BANK INTERVENTION 2.4 THE EQUILIBRIUM APPROACH TO EXCHANGE RATES 2.5 DISEQUILIBRIUM THEORY AND EXCHANGE RATE OVERSHOOTING 2.6 CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 3: THE INTERNATIONAL MONETARY SYSTEM 3.1 ALTERNATIVE EXCHANGE RATE SYSTEMS 3.2 A BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYSTEM 3.3 THE EUROPEAN MONETARY SYSTEM AND MONETARY UNION 3.4 EMERGING MARKET CURRENCY CRISES 3.5 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 4: PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTING 4.1 ARBITRAGE AND THE LAW OF ONE PRICE 4.2 PURCHASING POWER PARITY 4.3 THE FISHER EFFECT 4.4 THE INTERNATIONAL FISHER EFFECT 4.5 INTEREST RATE PARITY THEORY 4.6 THE RELATIONSHIP BETWEEN THE FORWARD RATE AND THE FUTURE SPOT RATE 4.7 CURRENCY FORECASTING 4.8 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 5: THE BALANCE OF PAYMENTS AND INTERNATIONAL ECONOMIC LINKAGES 5.1 BALANCE-OF-PAYMENTS CATEGORIES 5.2 THE INTERNATIONAL FLOW OF GOODS, SERVICES, AND CAPITAL 5.3 COPING WITH THE CURRENT-ACCOUNT DEFICIT 5.4 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES PART II: THE FOREIGN EXCHANGE AND DERIVATIVE MARKETS CHAPTER 6: THE FOREIGN EXCHANGE MARKET 6.1 ORGANIZATION OF THE FOREIGN EXCHANGE MARKET 6.2 THE SPOT MARKET 6.3 THE FORWARD MARKET 6.4 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 7: CURRENCY FUTURES AND OPTIONS MARKETS 7.1 FUTURES CONTRACTS 7.2 CURRENCY OPTIONS 7.3 READING CURRENCY FUTURES AND OPTIONS PRICES 7.4 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS APPENDIX: OPTION PRICING USING BLACK-SCHOLES PROBLEMS APPENDIX: PUT-CALL OPTION INTEREST RATE PARITY PROBLEMS REFERENCES NOTES CHAPTER 8: CURRENCY, INTEREST RATE, AND CREDIT DERIVATIVES AND SWAPS 8.1 INTEREST RATE AND CURRENCY SWAPS 8.2 INTEREST RATE FORWARDS AND FUTURES 8.3 STRUCTURED NOTES 8.4 CREDIT DEFAULT SWAPS 8.5 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCE NOTES PART III: THE INTERNATIONAL FINANCIAL MANAGEMENT ENVIRONMENT CHAPTER 9: MEASURING AND MANAGING TRANSLATION AND TRANSACTION EXPOSURE 9.1 ALTERNATIVE MEASURES OF FOREIGN EXCHANGE EXPOSURE 9.2 ALTERNATIVE CURRENCY TRANSLATION METHODS 9.3 TRANSACTION EXPOSURE 9.4 DESIGNING A HEDGING STRATEGY 9.5 MANAGING TRANSLATION EXPOSURE 9.6 MANAGING TRANSACTION EXPOSURE 9.7 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES APPENDIX: STATEMENT OF FINANCIAL ACCOUNTING STANDARDS NO. 52 NOTES CHAPTER 10: MEASURING AND MANAGING ECONOMIC EXPOSURE 10.1 FOREIGN EXCHANGE RISK AND ECONOMIC EXPOSURE 10.2 THE ECONOMIC CONSEQUENCES OF EXCHANGE RATE CHANGES 10.3 IDENTIFYING ECONOMIC EXPOSURE 10.4 CALCULATING ECONOMIC EXPOSURE 10.5 AN OPERATIONAL MEASURE OF EXCHANGE RISK 10.6 MANAGING OPERATING EXPOSURE 10.7 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES PART IV: THE INTERNATIONAL CAPITAL MARKETS AND PORTFOLIO MANAGEMENT CHAPTER 11: INTERNATIONAL FINANCING AND NATIONAL CAPITAL MARKETS 11.1 CORPORATE SOURCES AND USES OF FUNDS 11.2 NATIONAL CAPITAL MARKETS AS INTERNATIONAL FINANCIAL CENTERS 11.3 DEVELOPMENT BANKS 11.4 PROJECT FINANCE 11.5 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 12: THE EUROMARKETS 12.1 THE EUROCURRENCY MARKET 12.2 EUROBONDS 12.3 NOTE ISSUANCE FACILITIES AND EURONOTES 12.4 EURO-COMMERCIAL PAPER 12.5 THE ASIACURRENCY MARKET 12.6 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 13: INTERNATIONAL PORTFOLIO MANAGEMENT 13.1 THE RISKS AND BENEFITS OF INTERNATIONAL EQUITY INVESTING 13.2 INTERNATIONAL BOND INVESTING 13.3 OPTIMAL INTERNATIONAL ASSET ALLOCATION 13.4 MEASURING THE TOTAL RETURN FROM FOREIGN PORTFOLIO INVESTING 13.5 MEASURING EXCHANGE RISK ON FOREIGN SECURITIES 13.6 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES PART V: INTERNATIONAL CAPITAL BUDGETING CHAPTER 14: COUNTRY RISK ANALYSIS 14.1 LEARNING OBJECTIVES 14.2 MEASURING POLITICAL RISK 14.3 ECONOMIC AND POLITICAL FACTORS UNDERLYING COUNTRY RISK 14.4 COUNTRY RISK ANALYSIS IN INTERNATIONAL LENDING 14.5 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 15: THE COST OF CAPITAL FOR FOREIGN INVESTMENTS 15.1 THE COST OF EQUITY CAPITAL 15.2 THE WEIGHTED AVERAGE COST OF CAPITAL FOR FOREIGN PROJECTS 15.3 DISCOUNT RATES FOR FOREIGN INVESTMENTS 15.4 THE COST OF DEBT CAPITAL 15.5 ESTABLISHING A WORLDWIDE CAPITAL STRUCTURE 15.6 VALUING LOW-COST FINANCING OPPORTUNITIES 15.7 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 16: CORPORATE STRATEGY AND FOREIGN DIRECT INVESTMENT 16.1 THEORY OF THE MULTINATIONAL CORPORATION 16.2 DESIGNING A GLOBAL EXPANSION STRATEGY 16.3 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES NOTES CHAPTER 17: CAPITAL BUDGETING FOR THE MULTINATIONAL CORPORATION 17.1 BASICS OF CAPITAL BUDGETING 17.2 ISSUES IN FOREIGN INVESTMENT ANALYSIS 17.3 FOREIGN PROJECT APPRAISAL: THE CASE OF INTERNATIONAL DIESEL CORPORATION 17.4 POLITICAL RISK ANALYSIS 17.5 GROWTH OPTIONS AND PROJECT EVALUATION 17.6 SUMMARY AND CONCLUSIONS QUESTIONS PROBLEMS REFERENCES APPENDIX: MANAGING POLITICAL RISKS NOTES CHAPTER 18: MANAGING THE INTERNAL CAPITAL MARKETS OF MULTINATIONAL CORPORATIONS 18.1 THE VALUE OF THE MULTINATIONAL FINANCIAL SYSTEM 18.2 INTERCOMPANY FUND-FLOW MECHANISMS: COSTS AND BENEFITS 18.3 DESIGNING A GLOBAL REMITTANCE POLICY 18.4 SUMMARY AND CONCLUSIONS [Show More]

Last updated: 1 year ago

Preview 1 out of 162 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 20, 2022

Number of pages

162

Written in

Additional information

This document has been written for:

Uploaded

Sep 20, 2022

Downloads

1

Views

98

.png)

11e Madura test bank.png)