Finance > TEST BANK > Test bank for Personal Financial Planning 15th Edition by Randy Billingsley, Lawrence J. Gitman & Mi (All)

Test bank for Personal Financial Planning 15th Edition by Randy Billingsley, Lawrence J. Gitman & Michael D. Joehnk

Document Content and Description Below

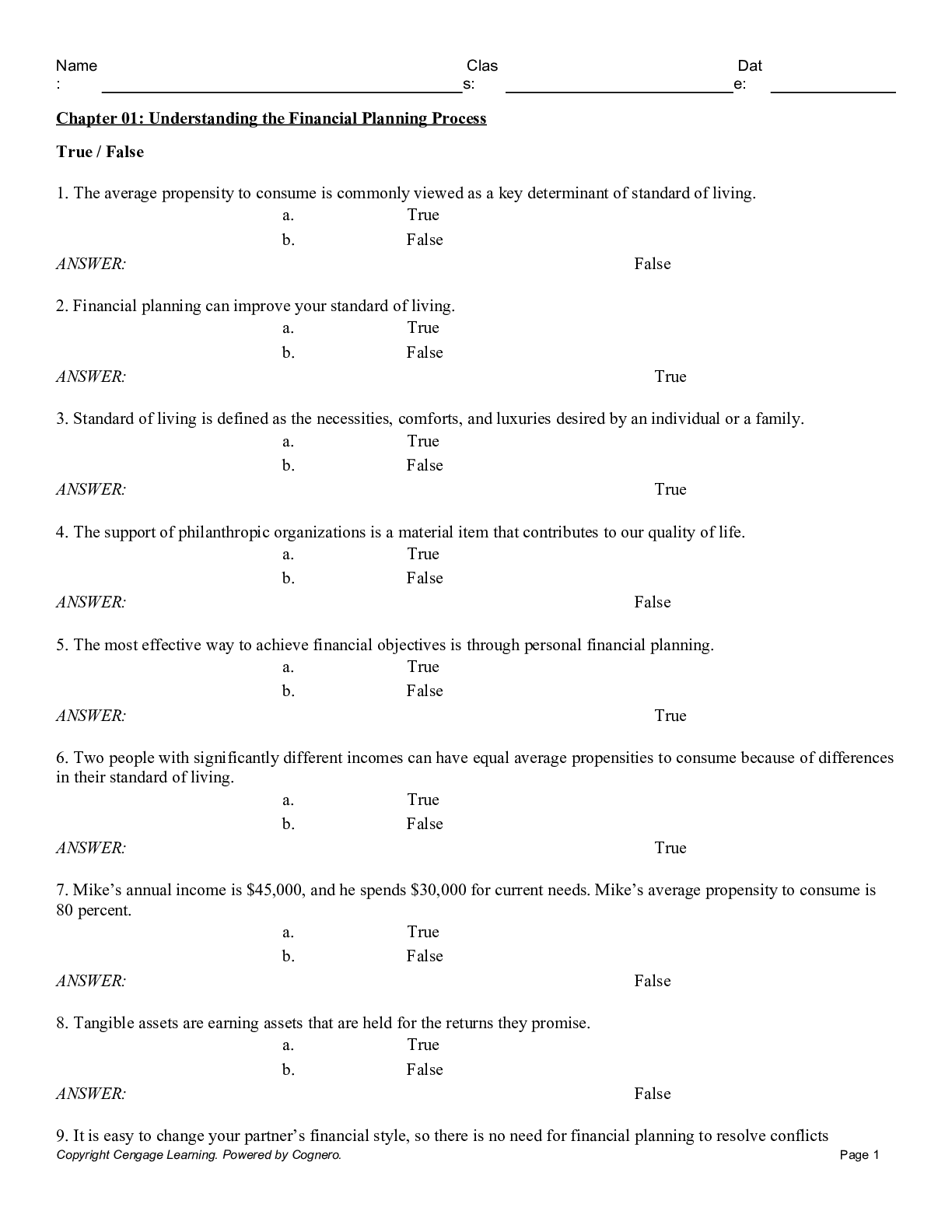

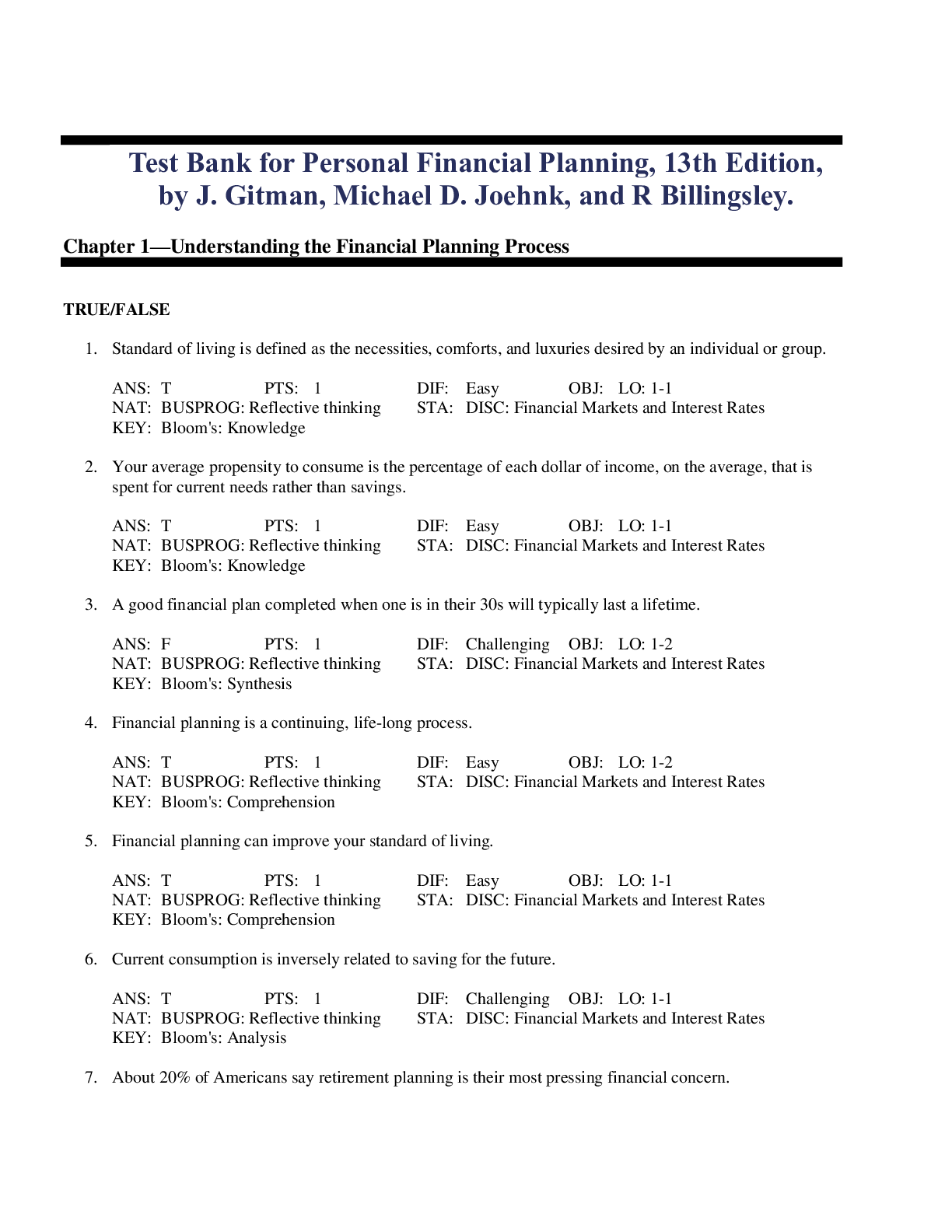

Test Bank for Personal Financial Planning, 13th Edition, by J. Gitman, Michael D. Joehnk, and R Billingsley. Chapter 1—Understanding the Financial Planning Process TRUE/FALSE 1. Standard of livi... ng is defined as the necessities, comforts, and luxuries desired by an individual or group. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Knowledge 2. Your average propensity to consume is the percentage of each dollar of income, on the average, that is spent for current needs rather than savings. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Knowledge 3. A good financial plan completed when one is in their 30s will typically last a lifetime. ANS: F PTS: 1 DIF: Challenging OBJ: LO: 1-2 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Synthesis 4. Financial planning is a continuing, life-long process. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-2 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Comprehension 5. Financial planning can improve your standard of living. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Comprehension 6. Current consumption is inversely related to saving for the future. ANS: T PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Analysis 7. About 20% of Americans say retirement planning is their most pressing financial concern. ANS: F PTS: 1 DIF: Moderate OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Knowledge 8. The most effective way to achieve financial objectives is through financial planning. ANS: T PTS: 1 DIF: Moderate OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Comprehension 9. Defining financial goals is an important first step in personal financial planning process. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-2 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Comprehension 10. Two persons with equal average propensities to consume will not necessarily have equal standards of living because of differences in income. ANS: T PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Evaluation 11. The need for financial planning declines as your income increases. ANS: F PTS: 1 DIF: Moderate OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Synthesis 12. Current consumption effects future consumption. ANS: T PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Analysis 13. A person who has $2,000 monthly income and spends $1,800 monthly has an average propensity to consume of 90%. ANS: T PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Evaluation 14. A person making $35,000 and spending $30,800 has an average propensity to consume of 80%. ANS: F PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Evaluation 15. Most families find it difficult to discuss money matters. ANS: T PTS: 1 DIF: Easy OBJ: LO: 1-2 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Knowledge 16. Average propensity to consume refers to how much of your money you plan to save in your financial plan. ANS: F PTS: 1 DIF: Challenging OBJ: LO: 1-1 NAT: BUSPROG: Reflective thinking STA: DISC: Financial Markets and Interest Rates KEY: Bloom's: Comprehension [Show More]

Last updated: 8 months ago

Preview 1 out of 461 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 21, 2022

Number of pages

461

Written in

Additional information

This document has been written for:

Uploaded

Oct 21, 2022

Downloads

0

Views

36