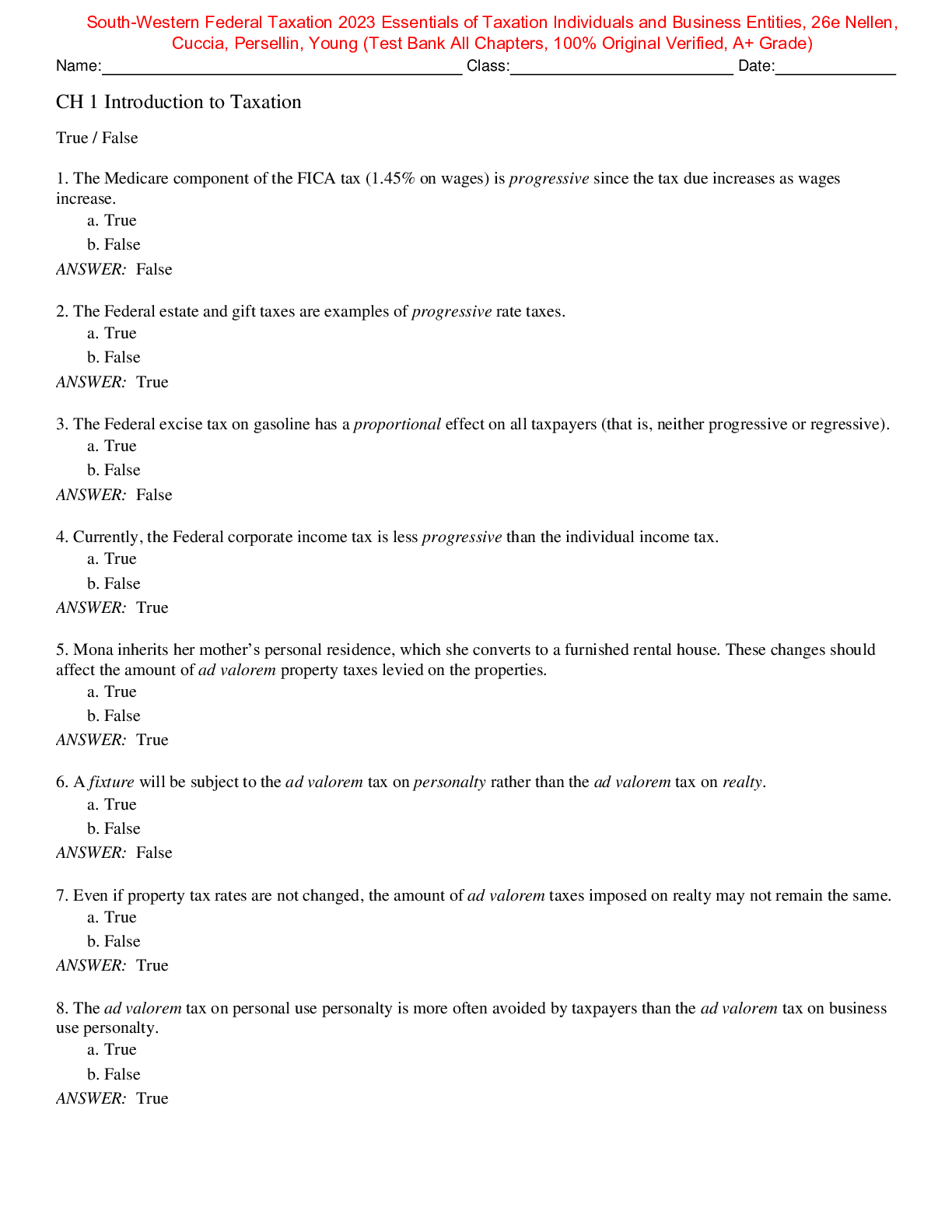

Financial Accounting > TEST BANK > South-Western Federal Taxation 2023, Essentials of Taxation, Individuals and Business Entities, 26th (All)

South-Western Federal Taxation 2023, Essentials of Taxation, Individuals and Business Entities, 26th Edition by Nellen Test Bank

Document Content and Description Below

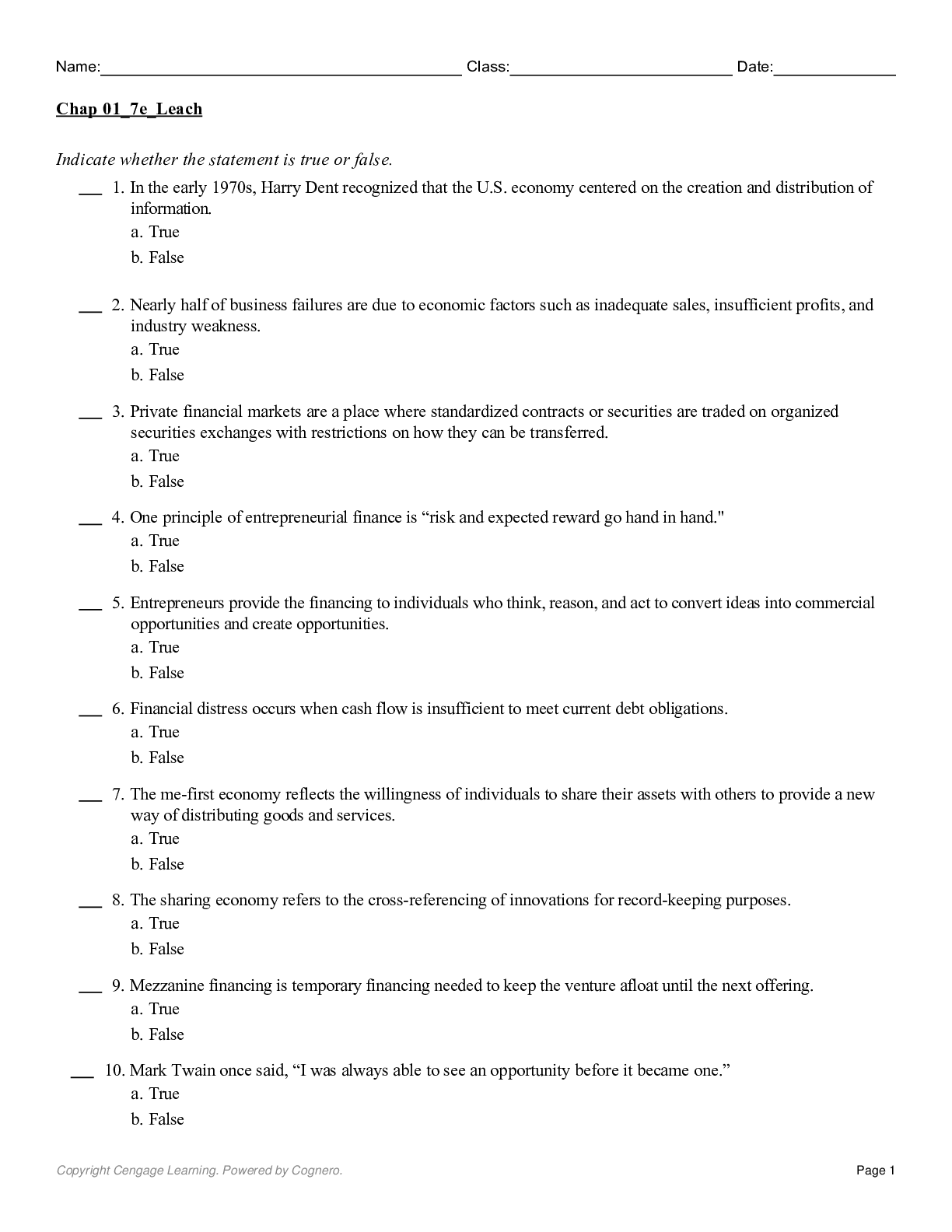

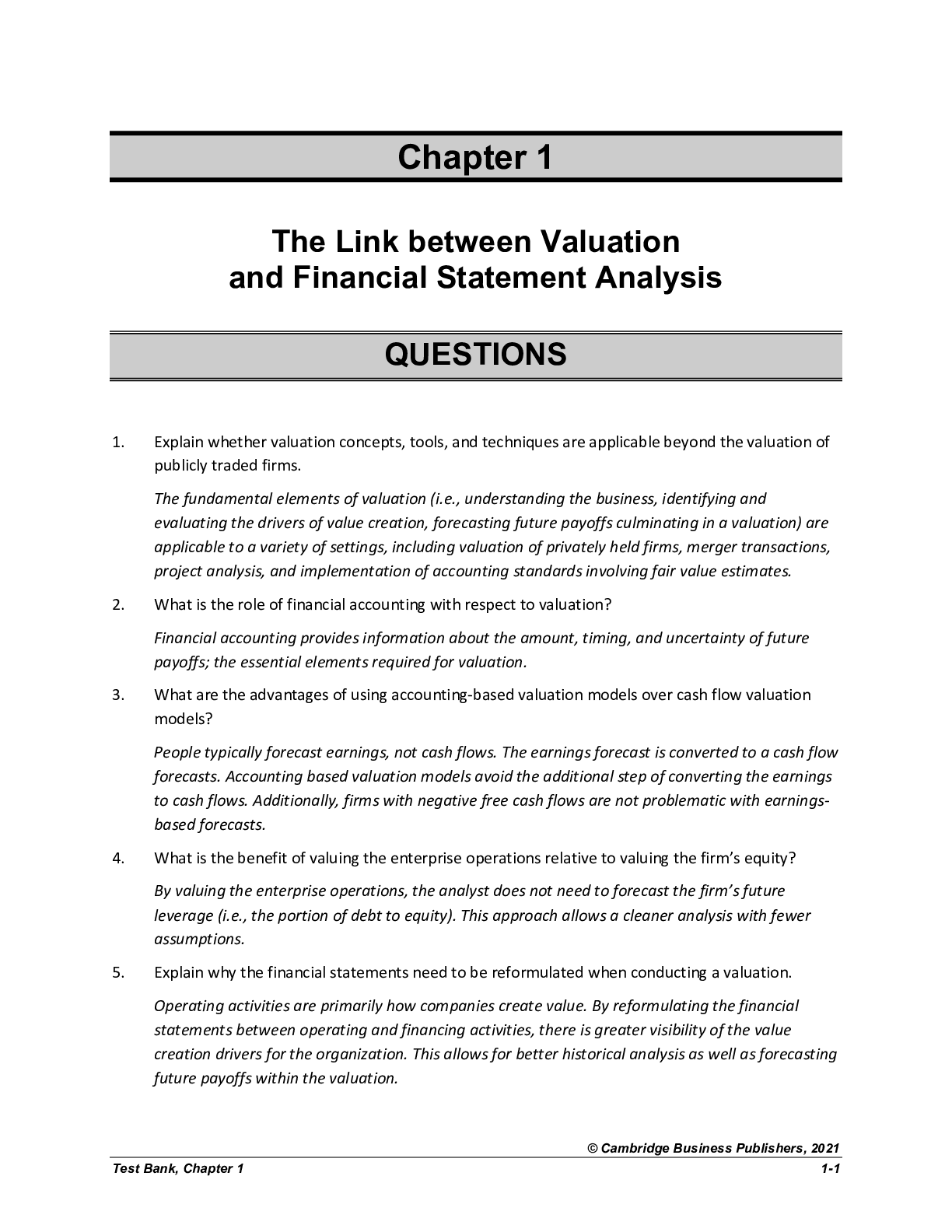

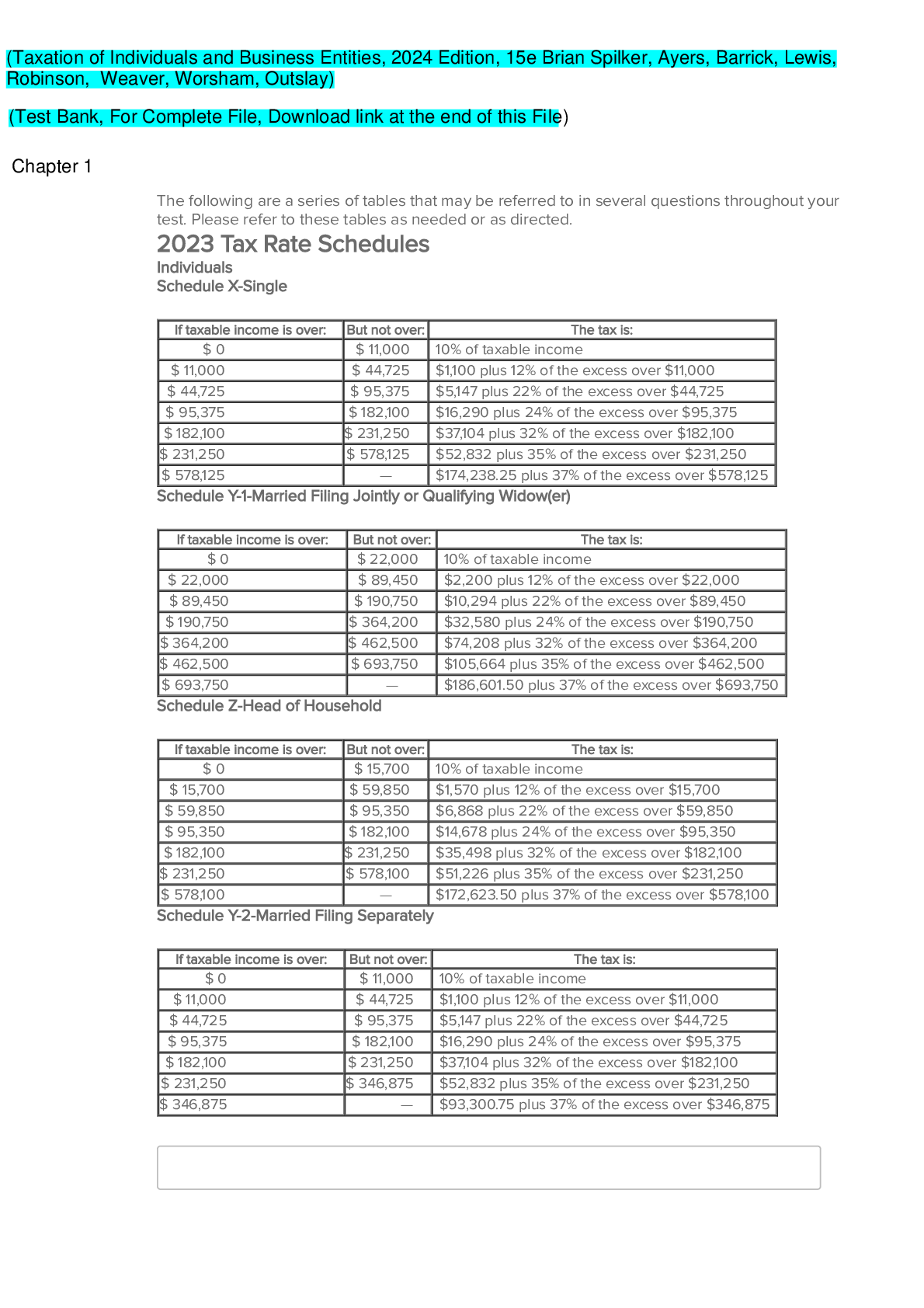

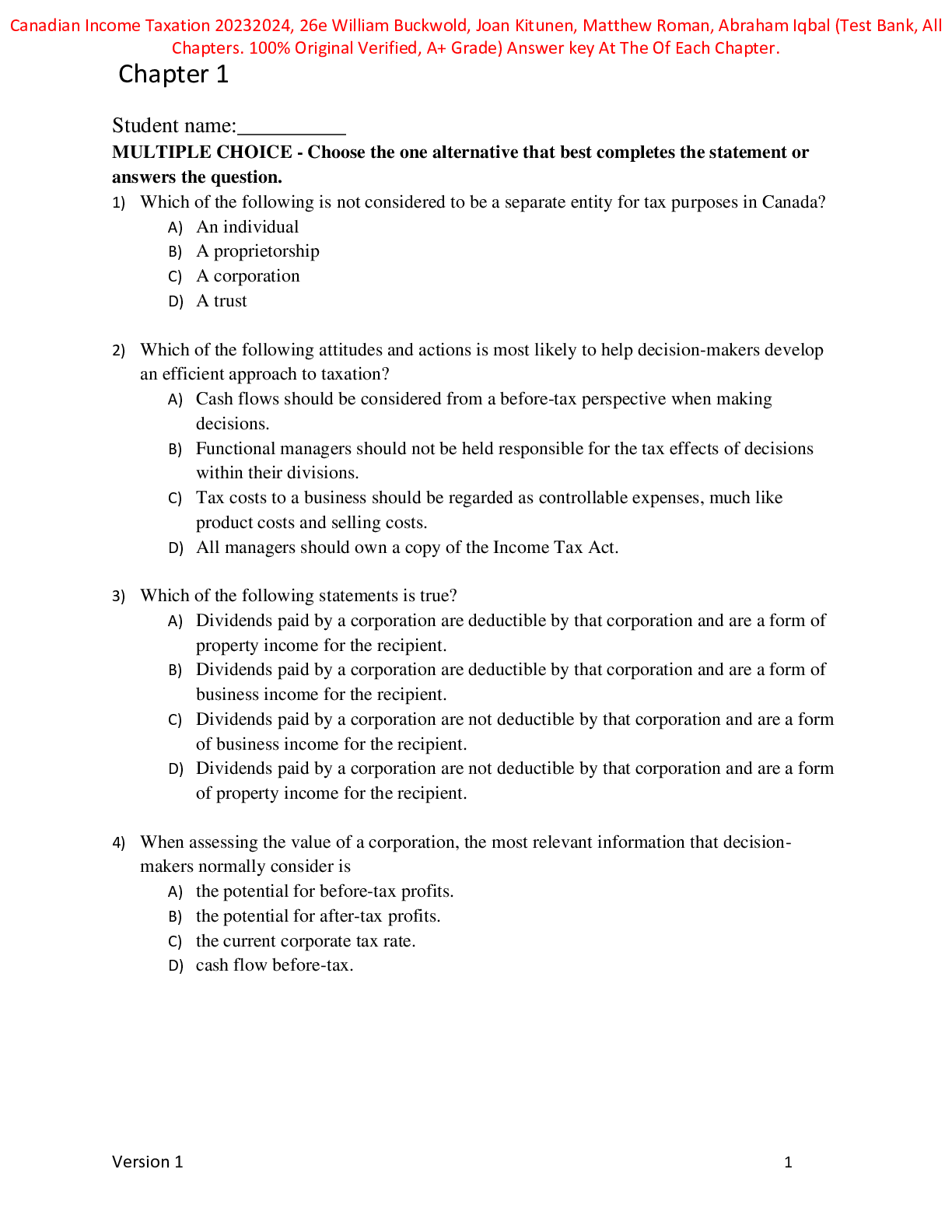

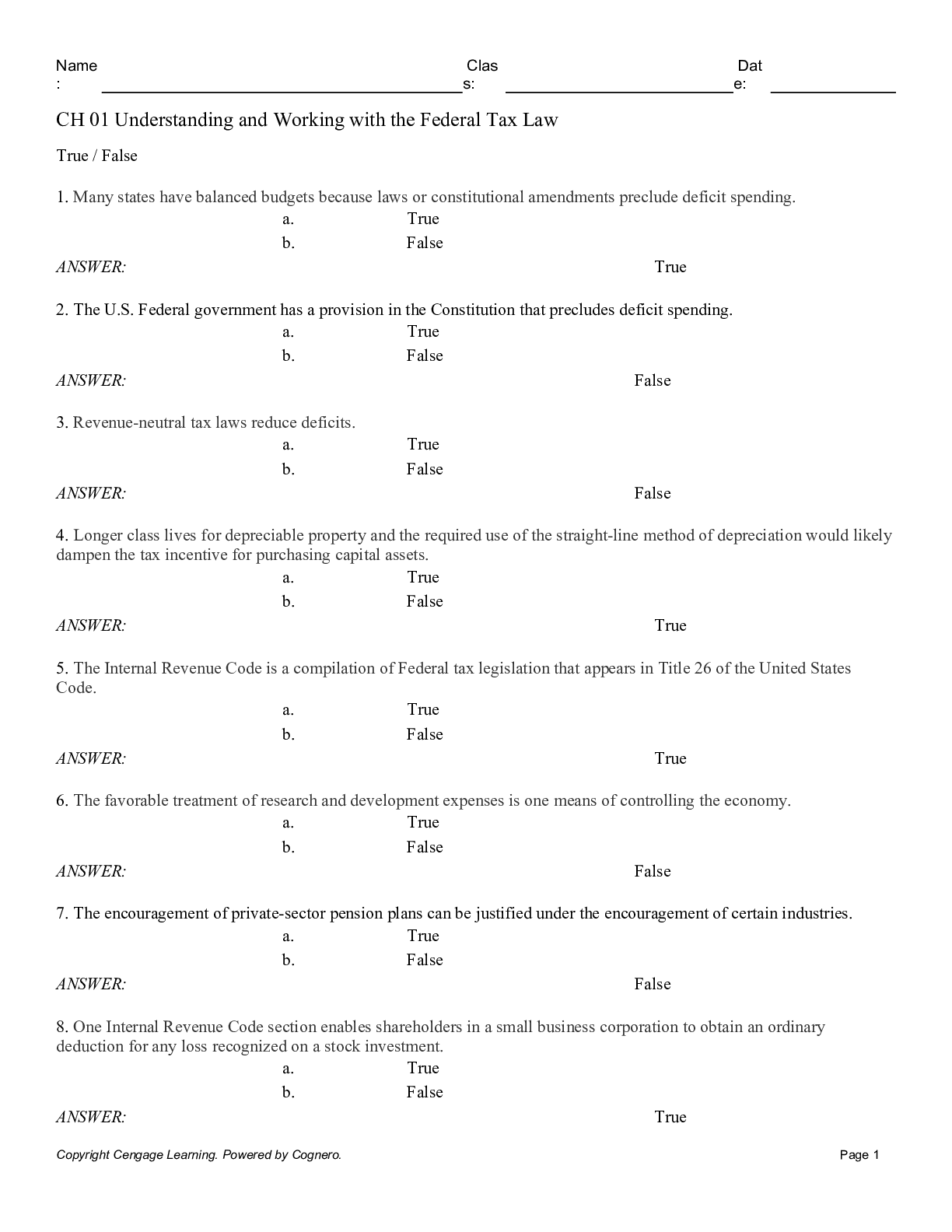

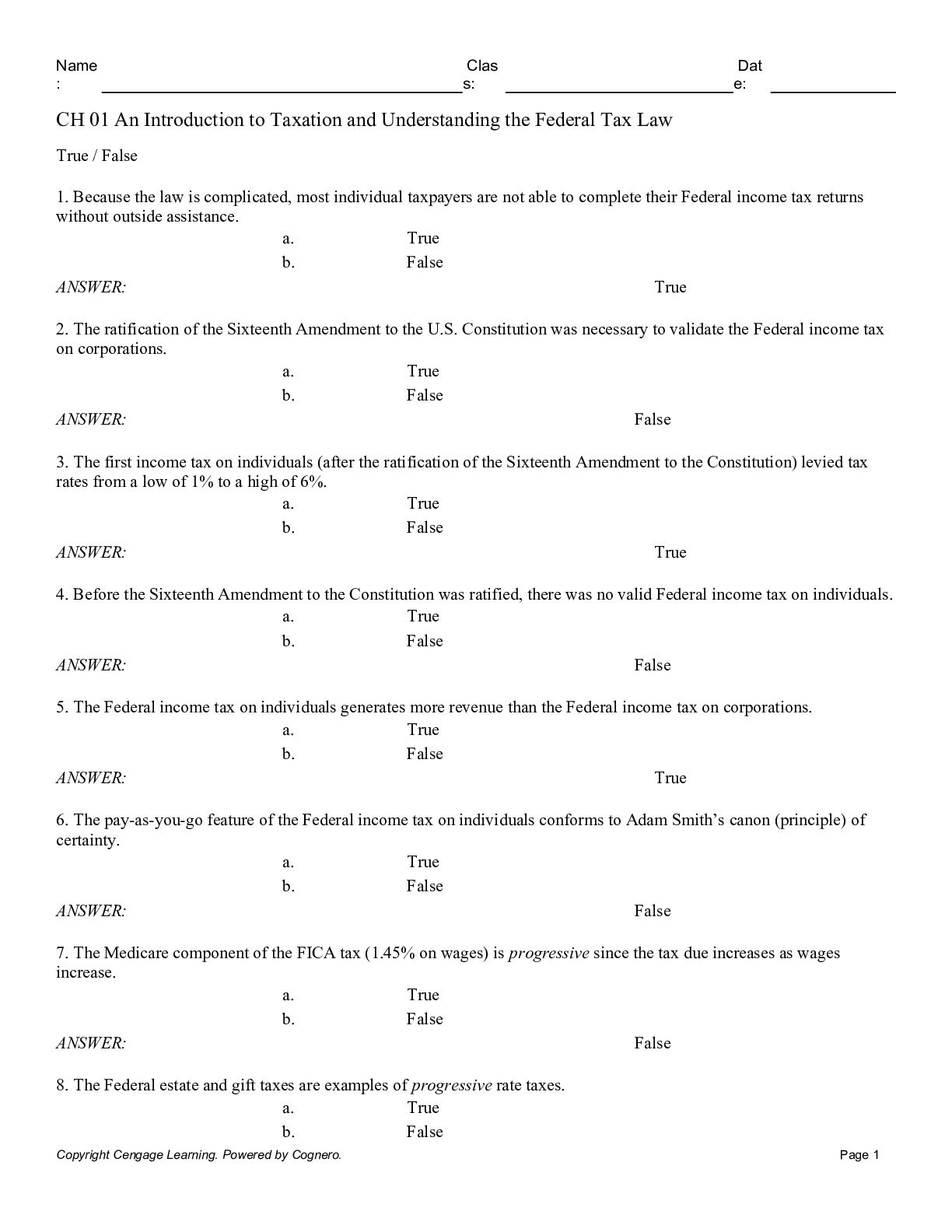

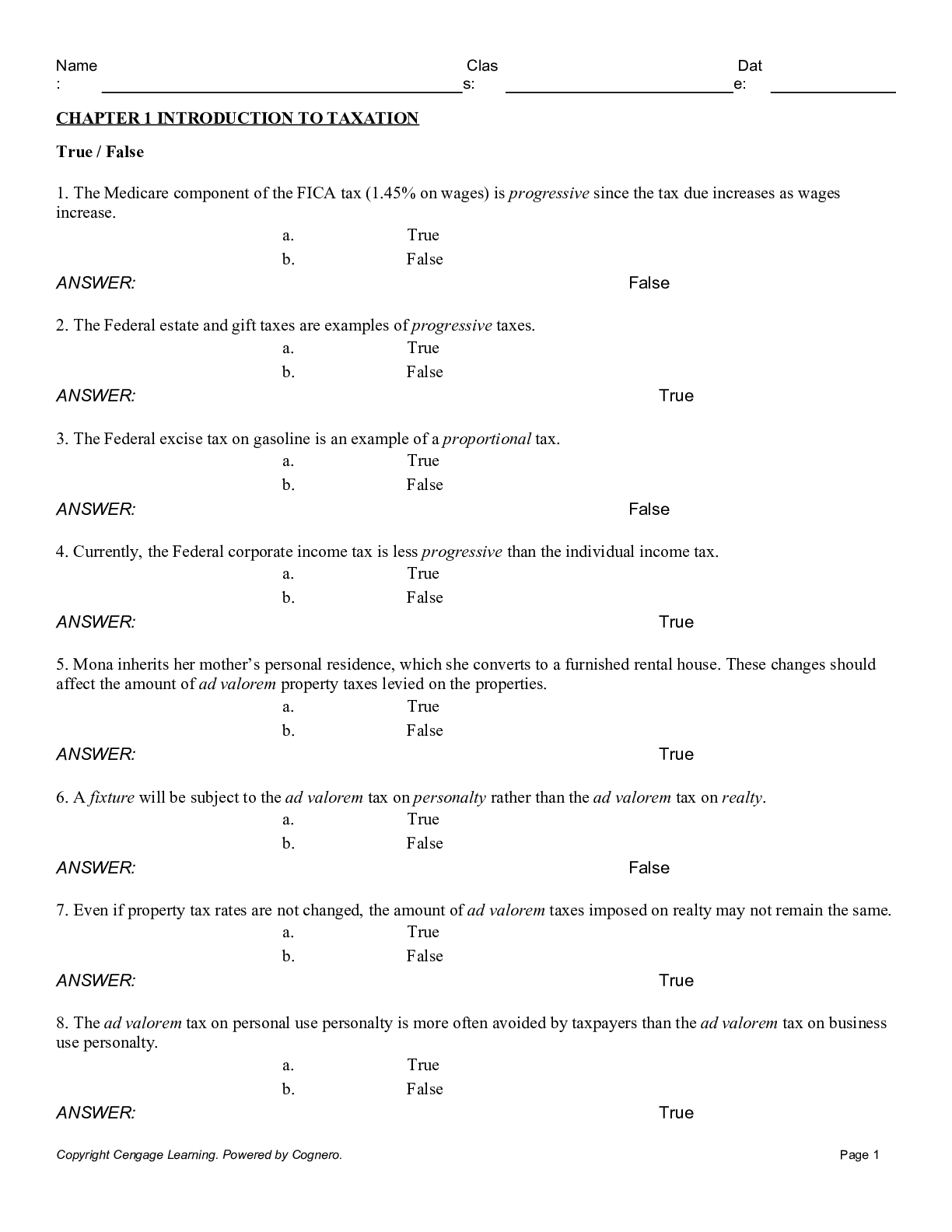

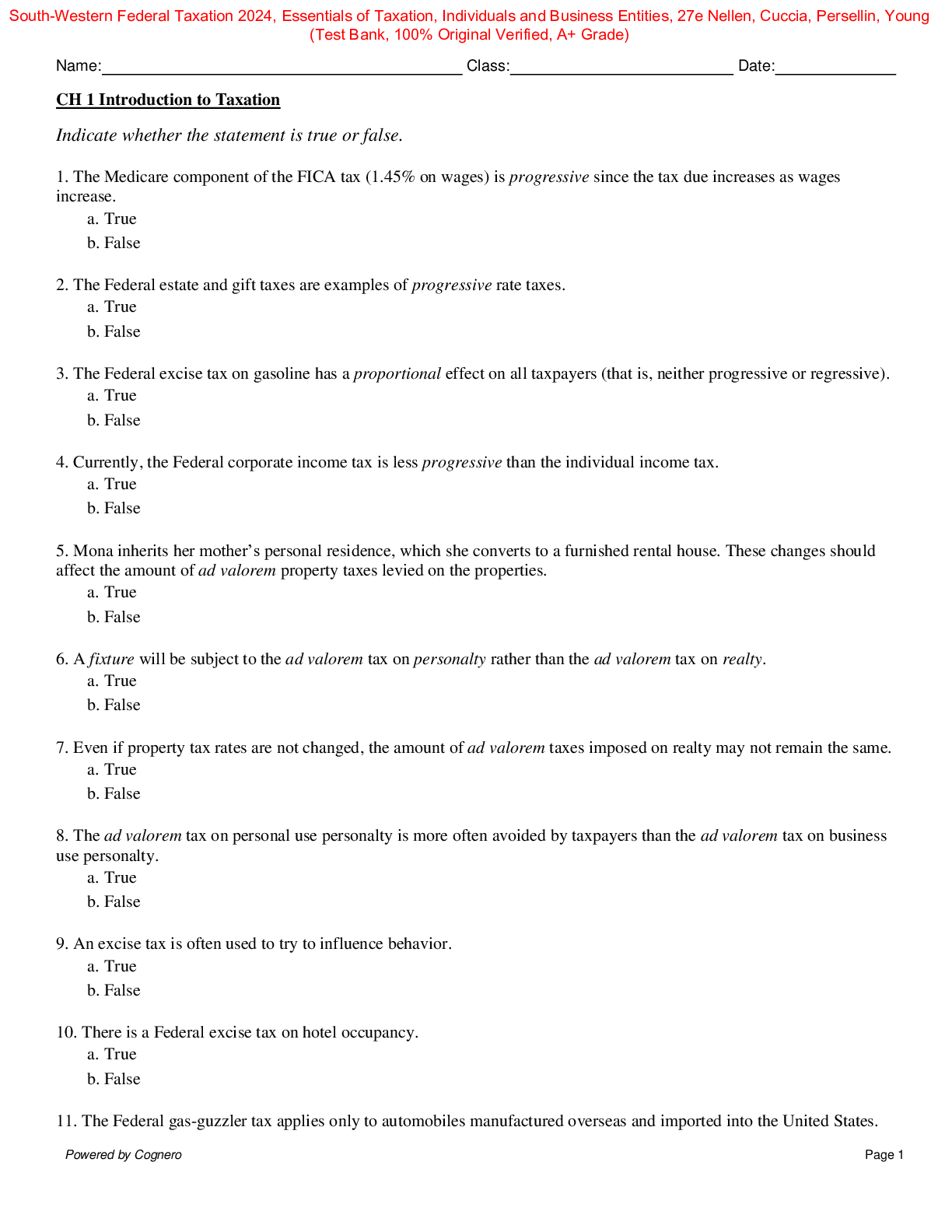

Test Bank for South-Western Federal Taxation 2023, Essentials of Taxation, Individuals and Business Entities, 26th Edition, 26e by Annette Nellen, James C. Young, William A. Raabe, David M. Maloney TE... ST BANK ISBN-13: 9780357720103 FULL CHAPTERS INCLUDED Chapter 1: Introduction to Taxation 1-1 Taxes in Our Lives 1-2 The Structure of Tax Systems 1-3 Types of Taxes 1-4 Income Taxation of Business Entities 1-5 Tax Planning Fundamentals 1-6 Understanding the Federal Tax Law 1-7 Summary Chapter 2: Working with the Tax Law 2-1 Tax Law Sources 2-2 Working with the Tax Law - Tax Research 2-3 Tax Research on the CPA Examination Chapter 3: Taxes in the Financial Statements 3-1 Accounting for Income Taxes - Basic Principles 3-2 Capturing, Measuring, and Recording Tax Expense - The Provision Process 3-3 Tax Disclosures in the Financial Statements 3-4 Special Issues 3-5 Benchmarking Part 2: Structure of the Federal Income Tax Chapter 4: Gross Income 4-1 The Tax Formula 4-2 Gross Income 4-3 Timing of Income Recognition 4-4 General Sources of Income 4-5 Specific Items of Gross Income Chapter 5: Business Deductions 5-1 The Deductibility of Business Expenses - Overview 5-2 The Timing of Deduction Recognition 5-3 Disallowance Possibilities 5-4 Research and Experimental Expenditures 5-5 Issues Related to Other Common Business Deductions 5-6 Charitable Contributions 5-7 Cost Recovery Allowances 5-8 Amortization 5-9 Depletion 5-10 Cost Recovery Tables Chapter 6: Losses and Loss Limitations 6-1 Bad Debts 6-2 Worthless Securities and Small - Business Stock Losses 6-3 Casualty and Theft Losses 6-4 Net Operating Losses 6-5 The Tax Shelter Problem 6-6 At-Risk Limitations 6-7 Passive Activity Loss Limits 6-8 Excess Business Losses Part 3: Property Transactions Chapter 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges 7-1 Determining Gain or Loss 7-2 Basis Considerations 7-3 Disallowed Losses 7-4 Nontaxable Exchanges - General Concepts 7-5 Like-Kind Exchanges - Section 1031 7-6 Involuntary Conversions - Section 1033 7-7 Sale of a Principal Residence - Section 121 Chapter 8: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions 8-1 General Scheme of Property Taxation 8-2 Capital Assets 8-3 Special Rules 8-4 Holding Period 8-5 Tax Treatment of Capital Gains and Losses of Noncorporate Taxpayers 8-6 Tax Treatment of Capital Gains and Losses of Corporate Taxpayers 8-7 Section 1231 Gains and Losses 8-8 Section 1245 Recapture 8-9 Section 1250 Recapture 8-10 Depreciation Recapture and Nontaxable and Tax-Free Transactions Part 4: Taxation of Individuals Chapter 9: Individuals as Taxpayers 9-1 The Individual Tax Formula 9-2 Standard Deduction 9-3 Dependents 9-4 Filing Status and Filing Requirements 9-5 Tax Determination 9-6 Tax Return Filing Procedures Chapter 10: Individuals: Income, Deductions, and Credits 10-1 Overview of Income Provisions Applicable to Individuals 10-2 Specific Inclusions Applicable to Individuals 10-3 Specific Exclusions Applicable to Individuals 10-4 Itemized Deductions 10-5 Individual Tax Credits Chapter 11: Individuals as Employees and Proprietors 11-1 Employee versus Independent Contractor 11-2 Exclusions Available to Employees 11-3 Expenses Relating to Time at Work 11-4 Individuals as Proprietors 11-5 Hobby Losses Part 5: Business Entities Chapter 12: Corporations: Organization, Capital Structure, and Operating Rules 12-1 An Introduction to Corporate Income Taxation 12-2 Organization of and Transfers to Controlled Corporations 12-3 Capital Structure of a Corporation 12-4 Taxing Corporate Operations 12-5 Procedural Matters Chapter 13: Corporations: Earnings and Profits and Distributions 13-1 Corporate Distributions - Overview 13-2 Earnings and Profits (E and P) 13-3 Noncash Dividends 13-4 Constructive Dividends 13-5 Stock Dividends 13-6 Stock Redemptions 13-7 Corporate Liquidations 13-8 Restrictions on Corporate Accumulations Chapter 14: Partnerships and Limited Liability Entities 14-1 Overview of Partnership Taxation 14-2 Formation of a Partnership: Tax Effects 14-3 Operations of the Partnership 14-4 Transactions between Partner and Partnership 14-5 Limited Liability Companies 14-6 Summary Chapter 15: S Corporations 15-1 An Overview of S Corporations 15-2 Qualifying for S Corporation Status 15-3 Operational Rules 15-4 Entity-Level Taxes 15-5 Summary Part 6: Special Business Topics Chapter 16: Multijurisdictional Taxation 16-1 The Multijurisdictional Taxpayer 16-2 U.S. Taxation of Multinational Transactions 16-3 Crossing State Lines: State and Local Income Taxation in the United States 16-4 Common Challenges Chapter 17: Business Tax Credits and the Alternative Minimum Tax 17-1 General Business Tax Credit Overview 17-2 Specific Credits in General Business Credit 17-3 Foreign Tax Credit 17-4 Alternative Minimum Tax (AMT) Chapter 18: Comparative Forms of Doing Business 18-1 Alternative Organizational Forms in Which Businesses May Be Conducted 18-2 Nontax Factors Affecting the Choice of Business Form 18-3 The Tax Consequences of Organizational Form Choice 18-4 Minimizing Double Taxation 18-5 The Tax Consequences of Disposing of a Business 18-6 The Tax Consequences of Converting to Another Business Form 18-7 Overall Comparison of Business Forms [Show More]

Last updated: 11 months ago

Preview 1 out of 754 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 07, 2022

Number of pages

754

Written in

Additional information

This document has been written for:

Uploaded

Dec 07, 2022

Downloads

0

Views

59