Law > QUESTIONS and ANSWERS > Fiscal Law Final Exam answered- spring 2022. (All)

Fiscal Law Final Exam answered- spring 2022.

Document Content and Description Below

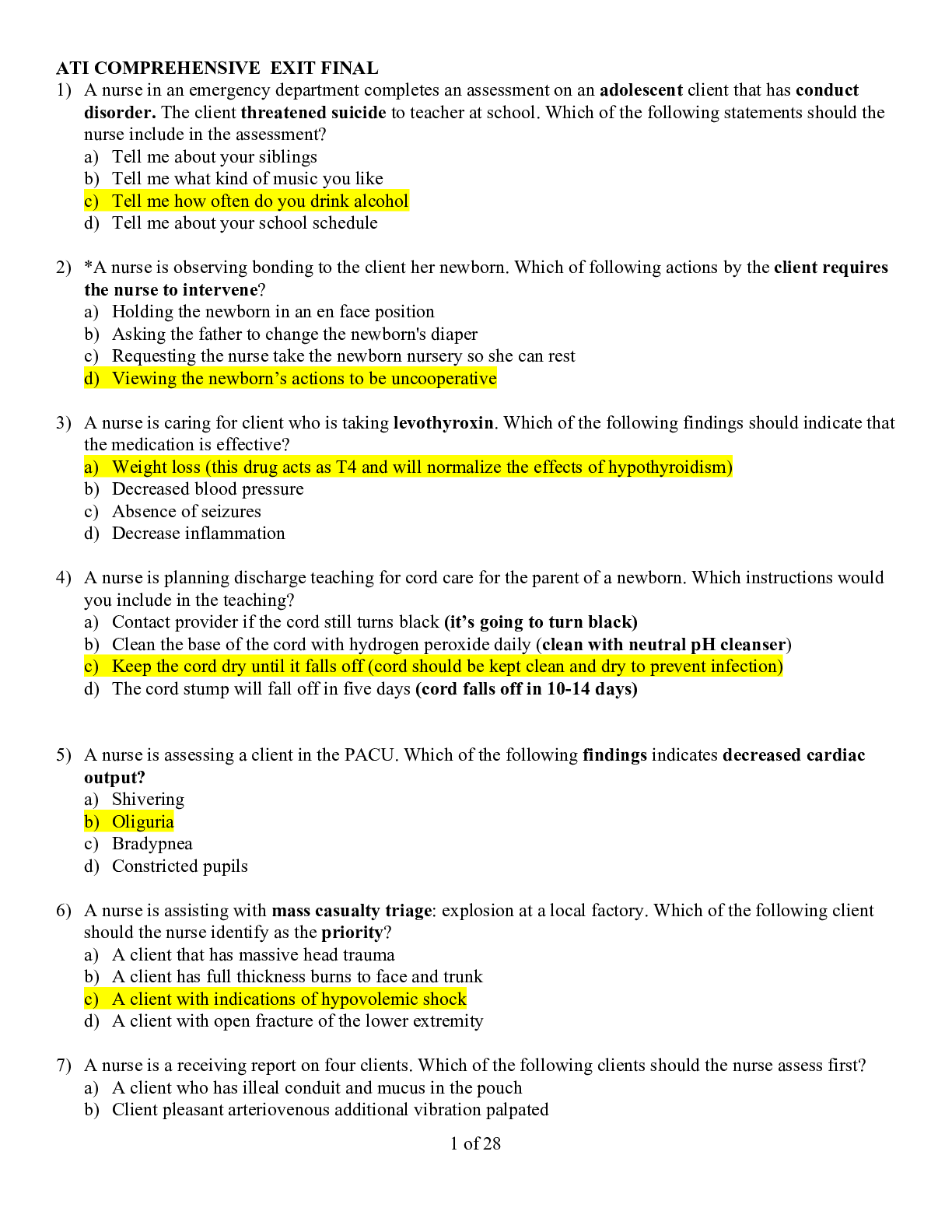

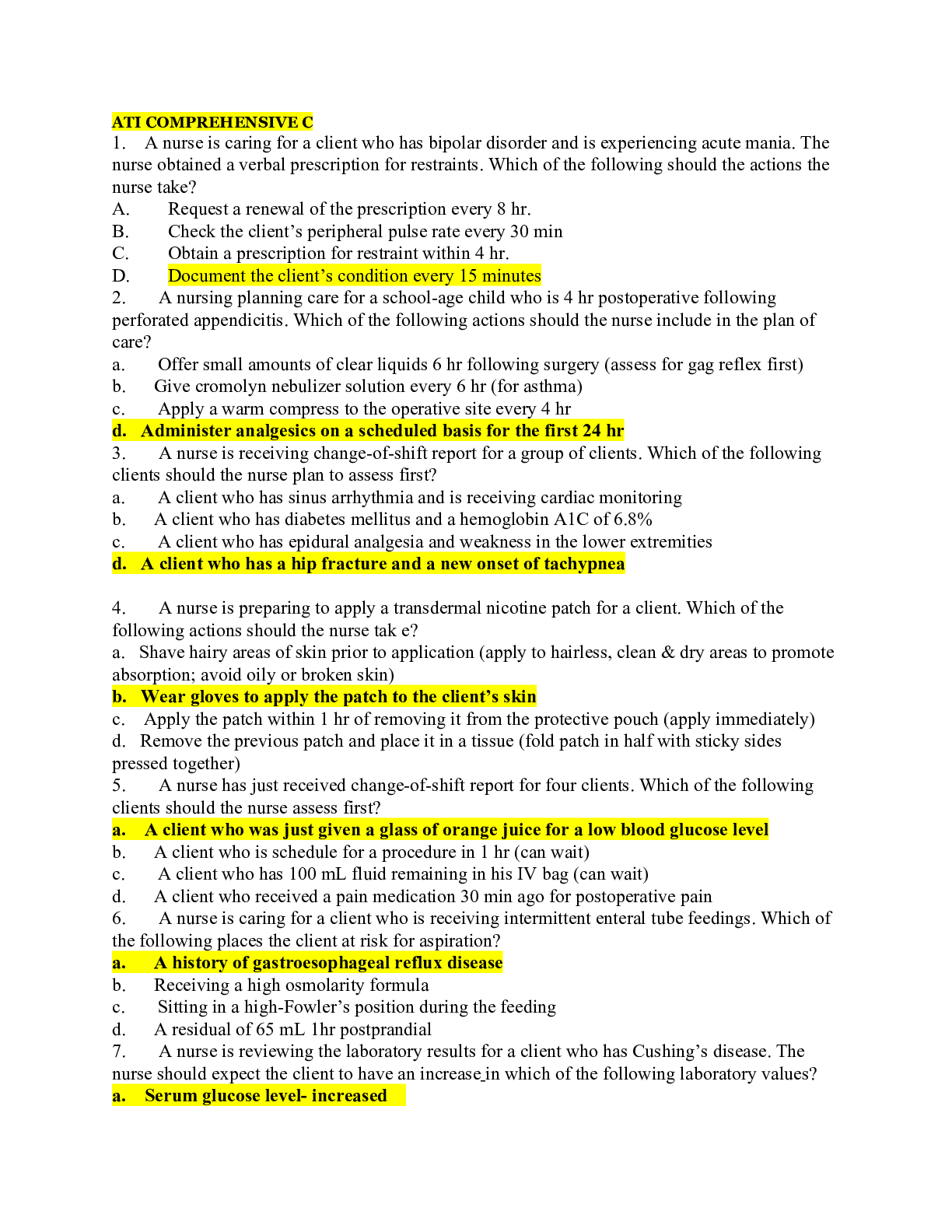

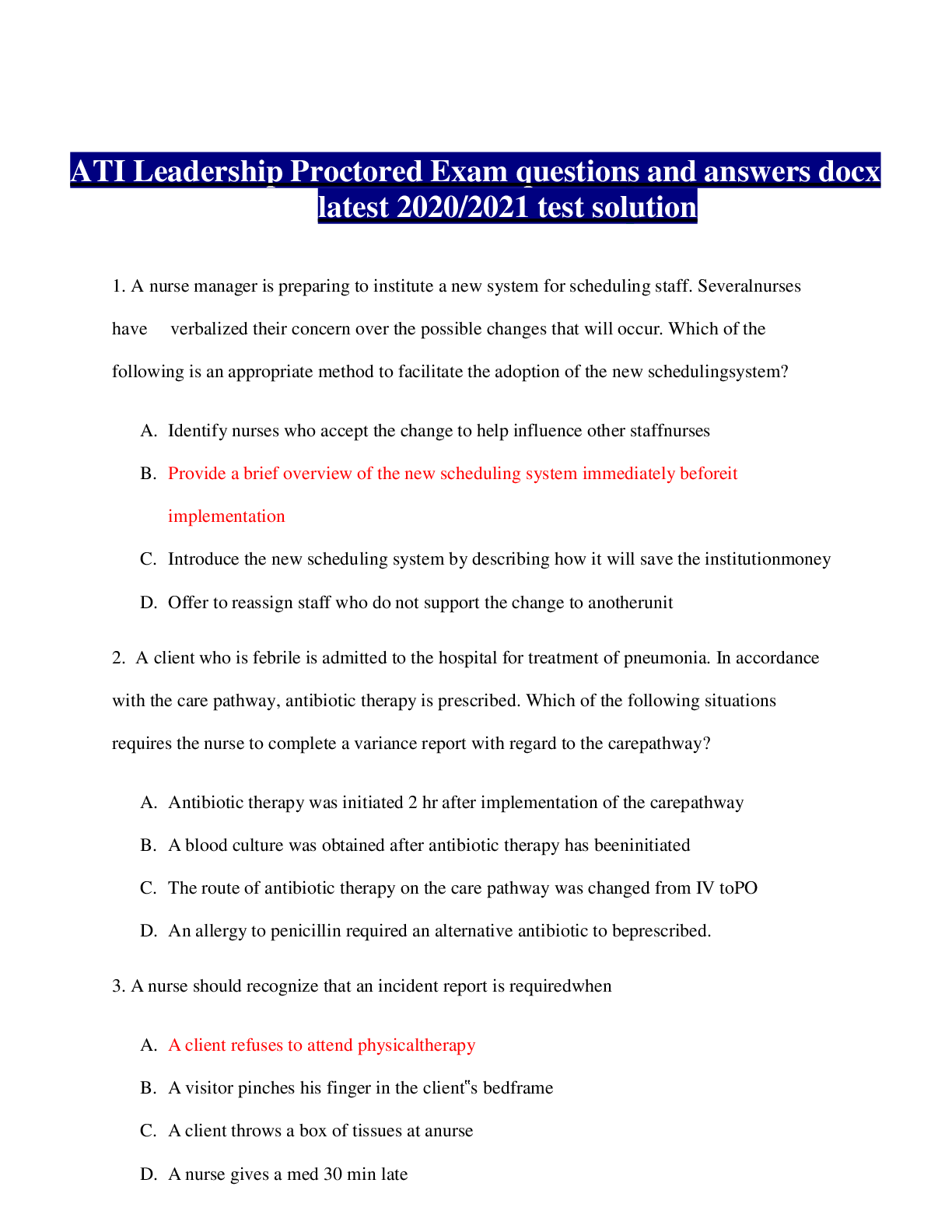

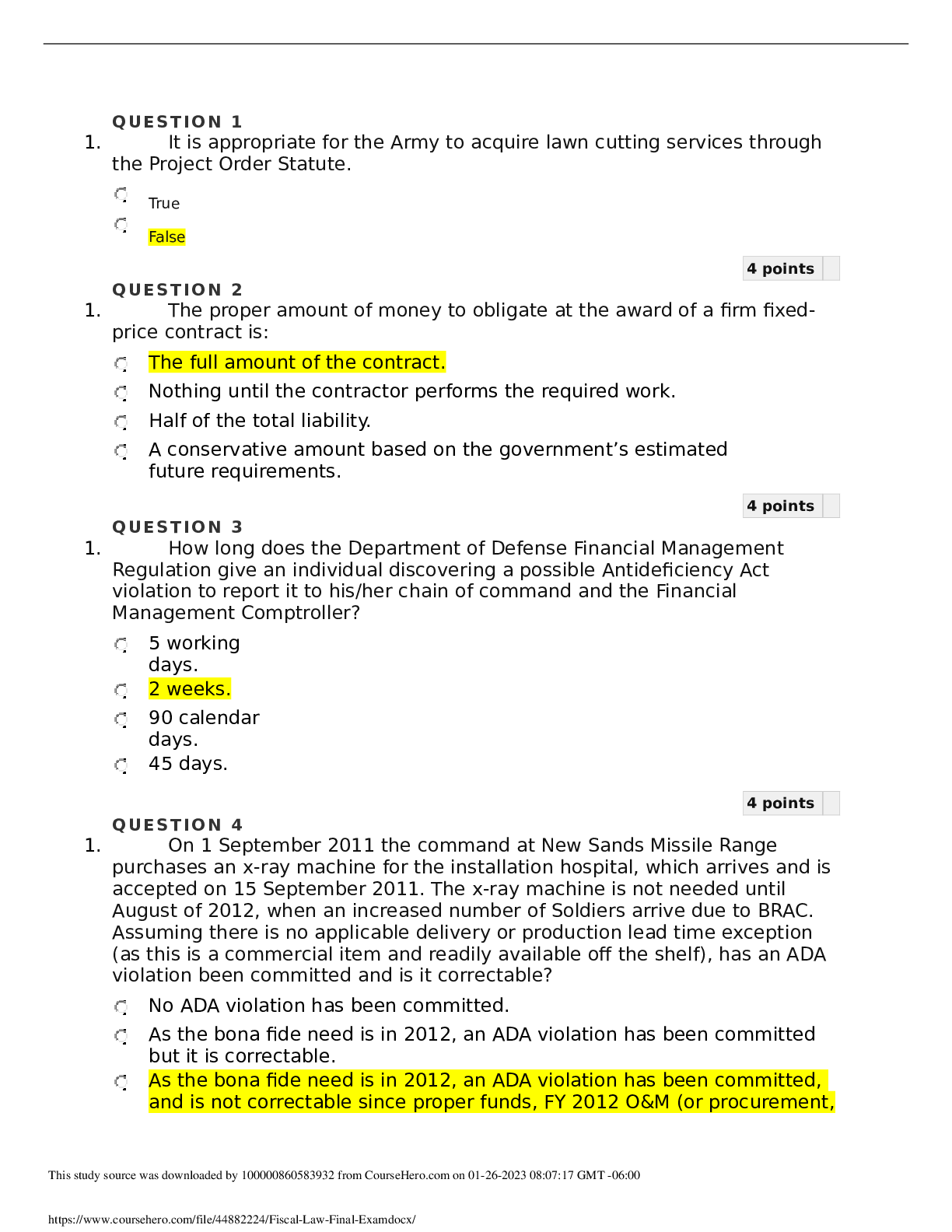

1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False 4 points QUE ST ION 2 1. The proper amount of money to obligate at the award of a... firm fixedprice contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. A conservative amount based on the government’s estimated future requirements. 4 points QUE ST ION 3 1. How long does the Department of Defense Financial Management Regulation give an individual discovering a possible Antideficiency Act violation to report it to his/her chain of command and the Financial Management Comptroller? 5 working days. 2 weeks. 90 calendar days. 45 days. 4 points QUE ST ION 4 1. On 1 September 2011 the command at New Sands Missile Range purchases an x-ray machine for the installation hospital, which arrives and is accepted on 15 September 2011. The x-ray machine is not needed until August of 2012, when an increased number of Soldiers arrive due to BRAC. Assuming there is no applicable delivery or production lead time exception (as this is a commercial item and readily available off the shelf), has an ADA violation been committed and is it correctable? No ADA violation has been committed. As the bona fide need is in 2012, an ADA violation has been committed but it is correctable. As the bona fide need is in 2012, an ADA violation has been committed, and is not correctable since proper funds, FY 2012 O&M (or procurement, This study source was downloaded by 100000860583932 from CourseHero.com on 01-26-2023 08:07:17 GMT -06:00 https://www.coursehero.com/file/44882224/Fiscal-Law-Final-Examdocx/ depending on the value) were not available at the time of obligation. Although the bona fide need is in 2012, there is no ADA violation because the command was engaged in advanced planning, and was smartly purchasing an item ahead of the expected need and perhaps even getting a better price. 4 points QUE ST ION 5 1. On 30 September 2010, $275,000 remains in the Operations and Maintenance, Army (OMA) allowance at the XVIII Airborne Corps. On that day, the contracting officer is about to award a supply contract, obligating $300,000 OMA. Award of the supply contract: Will cause an Antideficiency Act (ADA) violation because the contract price exceeds the amount of OMA available at the XVIII Airborne Corps. Will cause an ADA violation unless the contracting officer shows that she neither knew nor should have known that the XVIII Airborne Corps had only $275,000 in the OMA account. Will cause an ADA violation if the XVIII Airborne Corps’s major command, FORSCOM, lacks sufficient OMA funds in its formal subdivision to cover the overobligation. Will not cause an ADA violation if Congress enacts either a Continuing Resolution Authority (CRA) or a permanent appropriation before the vendor seeks payment for the supplies. Will not cause an ADA violation because the OMA account at the XVIII Airborne Corps was a target/allowance and an obligation in excess of a target/allowance can never result in an ADA violation. 4 points QUE ST ION 6 1. Assume a contracting officer (KO) at Ft. Bragg, NC awards a contract on 20 September 2010 for $10 million inadvertently committing an ADA violation by causing the Army to exceed the amount available in its FY 2010 O&M appropriation. Which of the following is correct: The KO is subject to administrative discipline because good faith or mistake of fact does not relieve him from liability under the ADA. There is no ADA violation if DoD has sufficient funds to cover the overage. The KO is not subject to criminal or adverse administrative action because Ft. Bragg's allotment is an informal subdivision of funds. The KO will surely go to jail for an ADA violation, serving a mandatory minimum. 4 points QUE ST ION 7 1. The fiscal year for the U.S. Government is a 12-month period from: This study source was downloaded by 100000860583932 from CourseHero.com on 01-26-2023 08:07:17 GMT -06:00 https://www.coursehero.com/file/44882224/Fiscal-Law-Final-Examdocx/ 1 July through 30 June. 1 October through 30 September. 1 September through 30 August. 1 January through 31 December 4 points QUE ST ION 8 1. Any obligation of appropriated funds must comply with which of the following fiscal constraints: The Minimum Needs Rule. The Bona Fide Needs Rule. The Paperwork Reduction Act. The Cost Accounting Standards Board. Omnibus Budget Reconciliation Act of 1947. 4 points QUE ST ION 9 1. Due to increased operations in Afghanistan, the Army is running low on Hellfire missiles (air launch, anti-tank missile.) Having exhausted the Missile Procurement, Army appropriation, an enterprising comptroller recommends using funds from the Procurement of Ammunition, Army appropriation. His argument is that “missiles are a type of ammunition so we can use either.” Can the Army use the Procurement of Ammunition, Army appropriation? Yes. It is for the war effort so anything goes. Yes. The enterprising comptroller is correct; missiles are a type of ammunition. No. This purchase should be handled by the Department of State as it deals with overseas activities. No. There is a specific appropriation for the purchase of missiles. This is the only proper appropriation that can be used. 4 points QUE ST ION 10 1. You work at the Orange Sands Missile Range (OSMR) Legal Office. The SJA wants your advice on two pieces of equipment that he personally would like to see purchased for use in the common break area of the legal office. He wants to use appropriated funds to buy a refrigerator and a microwave. His rationale is that employees (both military and civilian) need a place to This study source was downloaded by 100000860583932 from CourseHero.com on 01-26-2023 08:07:17 GMT -06:00 https://www.coursehero.com/file/44882224/Fiscal-Law-Final-Examdocx/ store and prepare food they bring in from home. You respond by telling him: (Select the best answer) The refrigerator and microwave must be purchased using private resources. The SJA may either pay for their purchase entirely out of his own pocket or he may take up a collection from others in the office who will also utilize these items. Absent any local or service-level policies to the contrary, the refrigerator and microwave may be purchased with Operations and Maintenance, Army appropriations. The Comptroller General has determined that such equipment reasonably relates to the efficient performance of the agency. The refrigerator and microwave may be purchased with Operations and Maintenance, Army appropriations only if it is determined commercial eating facilities are not reasonably available within the immediate area of OSMR, or it is expected that employees will be required to work evening or weekend hours. Since the primary purpose of the equipment is to enhance office morale, Morale, Welfare, and Recreation (MWR) funds should be used for the proposed purchase. 4 points QUE ST ION 11 1. On 1 September 2010 a Contracting Officer properly awards a contract to ABC Corporation for 1000 widgets. The widgets are delivered on 1 November 2010. The Contracting Officer correctly determined that the "leadtime" exception for supplies was applicable under the circumstances. The government paid ABC Corporation on 15 November 2010. What day did obligation of funds for this contract occur? 1 September 2010 1 November 2010 15 November 2010 The Government and the contractor can agree on an obligation date so the government can use funds from the fiscal year with the most money available. 4 points QUE ST ION 12 1. If a particular expenditure is not provided for by Congress, in order to meet the requirements of the Purpose Statute, 31 U.S.C. § 1301, the expenditure must be necessary and incident to the proper execution of the general purpose of the appropriation. The GAO has created a three-part test to determine whether an expenditure is a “necessary expense” of an appropriation. Which of the following IS NOT part of the three-part purpose test? The expenditure must be necessary and incident to the purposes This study source was downloaded by 100000860583932 from CourseHero.com on 01-26-2023 08:07:17 GMT -06:00 https://www.coursehero.com/file/44882224/Fiscal-Law-Final-Examdocx/ of the appropriation. The expenditure must not be prohibited by law. The comptroller must certify the funds. The expenditure must not be otherwise provided for. 4 points QUE ST ION 13 1. A continuing resolution is: an authorization act an appropriation, in the form of a joint resolution, that provides budget authority for federal agencies, specific activities, or both to continue operation when Congress and the President have not completed action on the regular appropriations acts by the beginning of the fiscal year The Department of Defense Appropriations Act none of the above 4 points QUE ST ION 14 1. The Department of Justice Trial Attorneys spoke to your contracting officer because the contractor was successful on a claim that was filed by the contractor on a 2005 construction project. The Court of Federal Claims ruled that the contractor's claim was based on an in-scope modification and the agency is responsible for paying the claimed amount. Fortunately, the funds which funded the original contract are not yet closed. Unfortunately, the expired funds which funded the original contract are exhausted. How should the agency handle this judgment? The contracting officer should seek payment from the Judgment Fund and reimbursement using current funds. The contracting officer should seek payment from the Judgment Fund and disregard any reimbursement since the funds are exhausted. The contracting officer should reallocate the FY 2005 funds to create funding to pay the judgment. The contracting officer cannot pay the claim without creating an Antideficiency Act Violation. 4 points QUE ST ION 15 1. Mr. Sanders is a Government Commercial Purchase Card (GCPC) holder at Fort Coop. His boss, COL Perdue, is the G-4 (Logistics Officer). One of her collateral duties as the G-4 includes serving as the certifying official for the ten GCPC holders in her office. Mr. Sanders used his GCPC to pay for BG Rooster’s (Ft. Coop’s Commander) annual Labor Day BBQ for the 25 military This study source was downloaded by 100000860583932 from CourseHero.com on 01-26-2023 08:07:17 GMT -06:00 https://www.coursehero.com/file/44882224/Fiscal-Law-Final-Examdocx/ and civilian employees and 12 contractors that work in Fort Coop’s headquarters building. It is now 1 November and someone is questioning the purchase. Which statement is true? Commanders have complete authority and are certainly entitled to treat their employees to a BBQ once a year. Since the expenditure obviously was made with last year’s funds, and the period of availability of those funds has ended, it’s really too late to do anything. Since food is generally considered a personal expense, the only issue raised by these facts is a potential ADA violation. COL Perdue could be held pecuniarily liable if the purchase is found to be improper. 4 points QUE ST ION 16 1. An accountable officer is not liable for an improper payment: if there was a lack of fault or negligence; if the certification was based upon official records and the accountable officer using reasonable diligence could not have discovered the correct information; or if the obligation was incurred in good faith, no law specifically prohibits the payment, and the government received some benefit. in some parallel universe. In our world, an accountable officer of the U.S. Government is always strictly liable for improper payments. if the accountable officer obtained an advance decision from the proper authority and the improper payment was made in reliance on that advanced decision, or if he's a DoD Departmental Accountable Official and there was no fault or negligence. if he was completely without fault or negligence, and he sought and reasonably relied upon th [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 26, 2023

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Jan 26, 2023

Downloads

0

Views

111