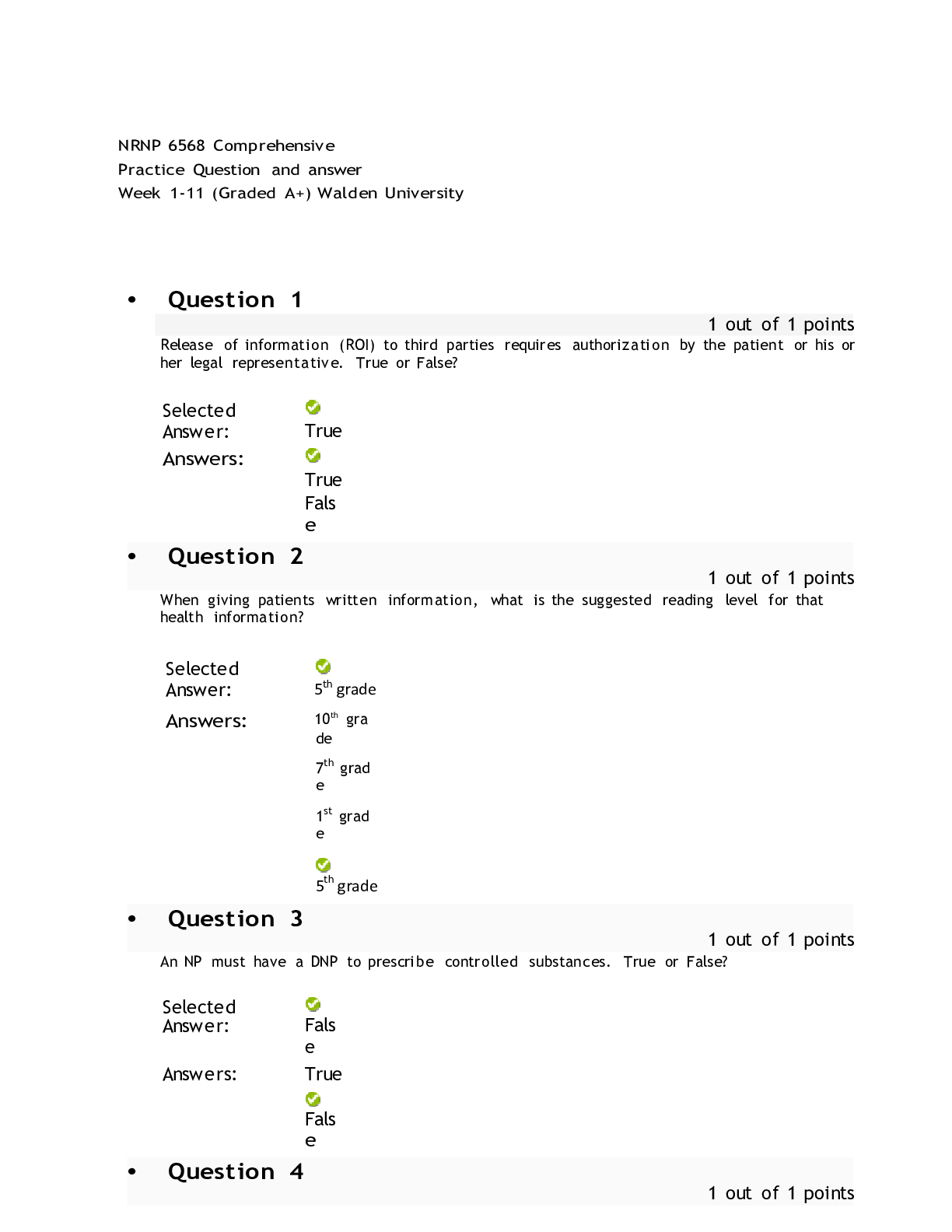

WALL STREET PREP PREMIUM EXAM 2023 QUESTIONS WITH VERIFIED ANSWERS

Document Content and Description Below

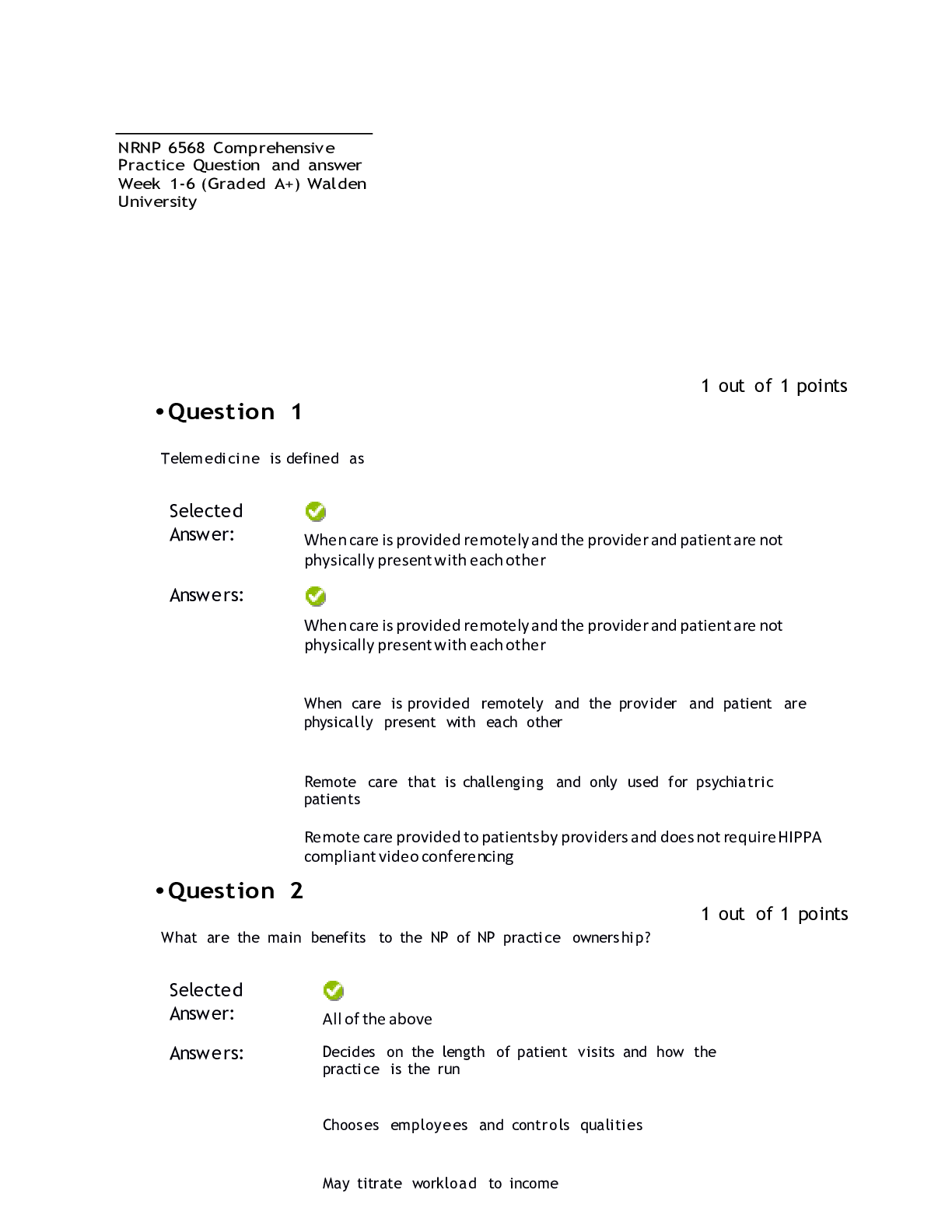

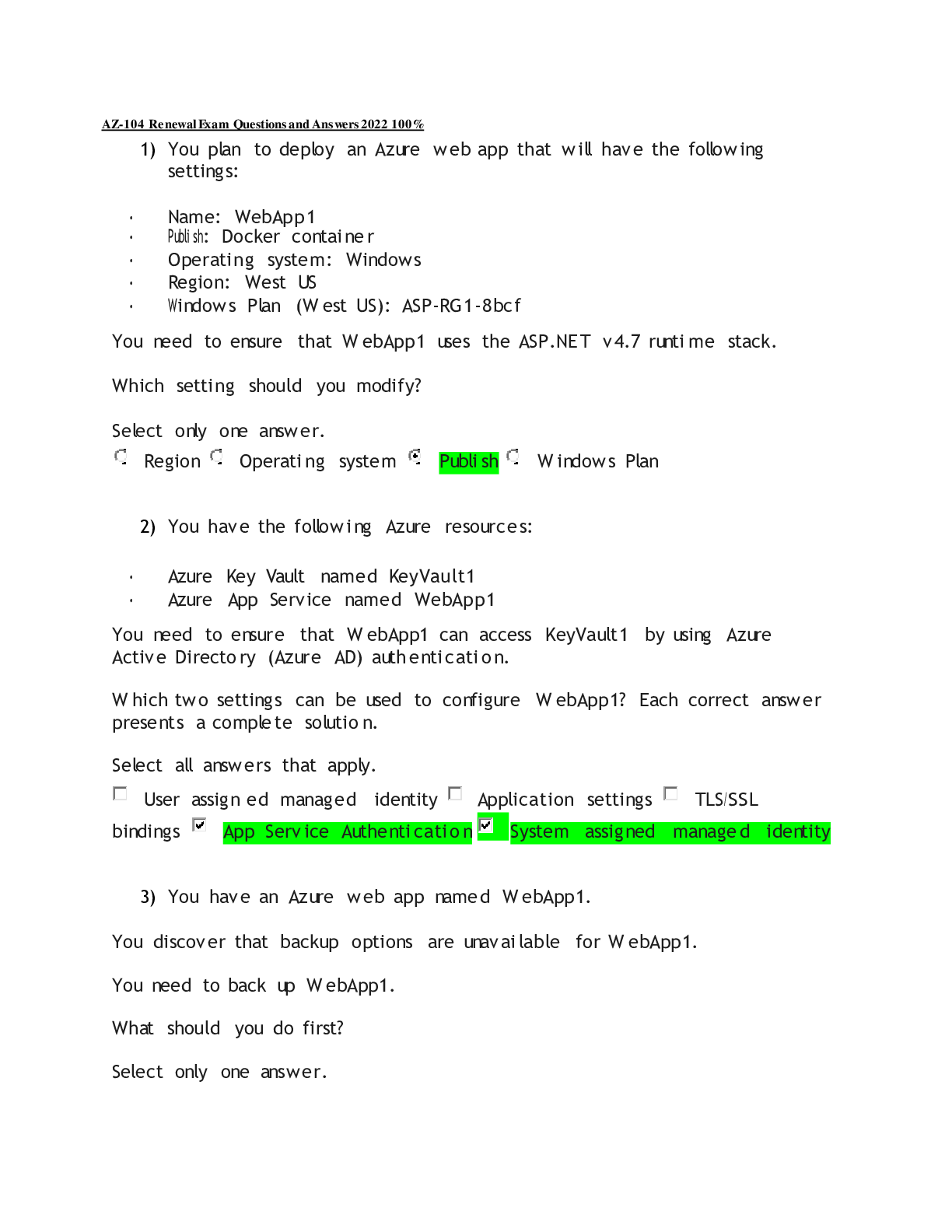

What is generally not considered to be a pre-tax non-recurring (unusual or infrequent) item? - ANSWER-Extraordinary gains/losses what is false about depreciation and amortization - ANSWER-D&A may be c... lassified within interest expense Company X's current assets increased by $40 million from 2007-2008 while the companies current liabilities increased by $25 million over the same period. the cash impact of the change in working capital was - ANSWER-a decrease of 15 million the final component of an earnings projection model is calculating interest expense. the calculation may create a circular reference because - ANSWER-interest expense affects net income, which affects FCF, which affects the amount of debt a company pays down, which, in turn affects the interest expense, hence the circular reference a 10-q financial filing has all of the following characteristics except - ANSWER-issued four times a year. Depreciation Expense found in the SG&A line of the income statement for a manufacturing firm would most likely be attributable to which of the following - ANSWER-computers used by the accounting department If a company has projected revenues of $10 billion, a gross profit margin of 65%, and projected SG&A expenses of $2billion, what is the company's operating (EBIT) margin? - ANSWER-45% A company has the following information, 1. 2014 revenues of $5 billion,2013 Accounts receivable of $400 million, 2014 accounts receivable of $600 million, what are the days sales outstanding - ANSWER-36.5 A company has the following information: • 2014 Revenues of $8 billion • 2014 COGS of $5 billion • 2013 Accounts receivable of $400 million • 2014 Accounts receivable of $600 million • 2013 Inventories of $1 billion • 2014 Inventories of $800 million • 2013 Accounts payable of $250 million • 2014 Accounts payable of $300 million What are the inventory days for the company? - ANSWER-65.7 days Which of the following is true - ANSWER-Coca Cola's brand name is not reflected as an intangible asset on its balance sheet A company has the following information: • 2014 share repurchase plan of $4 billion • Average share price of $60 for the year 2013 • Expected EPS growth for 2014 of 10% What should the number of shares repurchased by the company be in your financial model? - ANSWER-60.6 million non-controlling interest - ANSWER-is an expense on the income statement and equity o the balance sheet A company has the following information: • 2013 retained earnings balance of $12 billion • Net income of $3.5 billion in 2014 • Capex of $200 million in 2014 • Preferred dividends of $100 million in 2014 • Common dividends of $400 million in 2014 What is the retained earnings balance at the end of 2014? - ANSWER-15 billion in order to find out how much cash is available to pay down short term debt, such as revolving credit line, you must take - ANSWER-beginning cash balance + pre-debt cash flows - min. cash balance - required principal payments of LT and other debt to calculate interest expense in the future, you should do which of the following - ANSWER-apply a weighted average interest rate times the average debt balance over the course of the year enterprise (transaction) value represents the: - ANSWER-value of all capital invested in a business A debt holder would be primarily concerned with which of the following multiples? I. Enterprise (Transaction) Value / EBITDA II. Price/Earnings III. Enterprise (Transaction) Value / Sales - ANSWER-1 and 3 only On January 1, 2014, shares of Company X trade at $6.50 per share, with 400 million shares outstanding. The company has net debt of $300 million. After building an earnings model for Company X, you have projected free cash flow for each year through 2020 as follows: Year 2014 2015 2016 2017 2018 2019 2020 Free Cash Flow 110 120 150 170 200 250 280 You estimate that the weighted average cost of capital (WACC) for Company X is 10% and assume that free cash flows grow in perpetuity at 3.0% annually beyond 2020, the final projected year. Estimate the present value of the projected free cash flows through 2020, discounted at the stated WACC. Assume all cash flows are generated at the end of the year (i.e., no mid-year adjustment): - ANSWER-837 million On January 1, 2014, shares of Company X trade at $6.50 per share, with 400 million shares outstanding. The company has net debt of $300 million. After building an earnings model for Company X, you have projected free cash flow for each year through 2014 as follows: Year 2014 2015 2016 2017 2018 2019 2020 Free Cash Flow 110 120 150 170 200 250 280 You estimate that the weighted average cost of capital (WACC) for Company X is 10% and assume that free cash flows grow in perpetuity at 3.0% annually beyond 2020, the final projected year. Calculate Company X's implied Enterprise Value by using the discounted cash flow method: - ANSWER-2951.2 million On January 1, 2014, shares of Company X trade at $6.50 per share, with 400 million shares outstanding. The company has net debt of $300 million. After building an earnings model for Company X, you have projected free cash flow for each year through 2014 as follows: Year 2014 2015 2016 2017 2018 2019 2020 Free Cash Flow 110 120 150 170 200 250 280 You estimate that the weighted average cost of capital (WACC) for Company X is 10% and assume that free cash flows grow in perpetuity at 3.0% annually beyond 2020, the final projected year. According to the discounted cash flow valuation method, Company X shares are: - ANSWER-.13 per share overvalued the formula for discounting any specific period cash flow in period [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 03, 2023

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Feb 03, 2023

Downloads

0

Views

58

.png)