Finance > STUDY GUIDE > C214 Financial Management Notes (All)

C214 Financial Management Notes

Document Content and Description Below

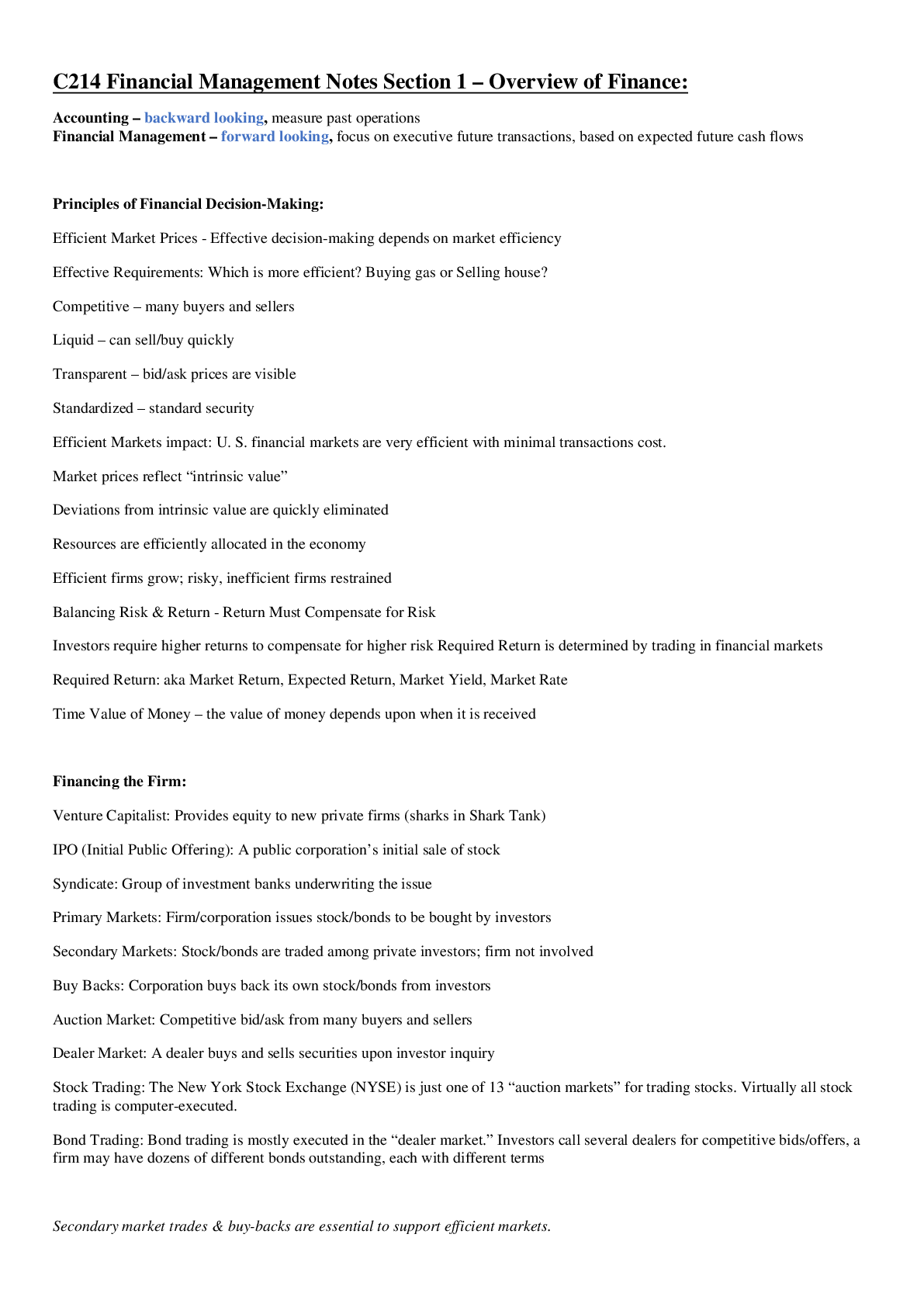

Section 1 – Overview of Finance: Accounting – backward looking, measure past operations Financial Management – forward looking, focus on executive future transactions, based on expected future... cash flows Principles of Financial Decision-Making: 1. Efficient Market Prices - Effective decision-making depends on market efficiency a. Effective Requirements: Which is more efficient? Buying gas or Selling house? i. Competitive – many buyers and sellers ii. Liquid – can sell/buy quickly iii. Transparent – bid/ask prices are visible iv. Standardized – standard security b. Efficient Markets impact: U. S. financial markets are very efficient with minimal transactions cost. i. Market prices reflect “intrinsic value” ii. Deviations from intrinsic value are quickly eliminated iii. Resources are efficiently allocated in the economy iv. Efficient firms grow; risky, inefficient firms restrained 2. Balancing Risk & Return - Return Must Compensate for Risk a. Investors require higher returns to compensate for higher risk Required Return is determined by trading in financial markets b. Required Return: aka Market Return, Expected Return, Market Yield, Market Rate 3. Time Value of Money – the value of money depends upon when it is received Financing the Firm: • Venture Capitalist: Provides equity to new private firms (sharks in Shark Tank) • IPO (Initial Public Offering): A public corporation’s initial sale of stock • Syndicate: Group of investment banks underwriting the issue • Primary Markets: Firm/corporation issues stock/bonds to be bought by investors • Secondary Markets: Stock/bonds are traded among private investors; firm not involved • Buy Backs: Corporation buys back its own stock/bonds from investors • Auction Market: Competitive bid/ask from many buyers and sellers • Dealer Market: A dealer buys and sells securities upon investor inquiry • Stock Trading: The New York Stock Exchange (NYSE) is just one of 13 “auction markets” for trading stocks. Virtually all stock trading is computer-executed. • Bond Trading: Bond trading is mostly executed in the “dealer market.” Investors call several dealers for competitive bids/offers, a firm may have dozens of different bonds outstanding, each with different terms Secondary market trades & buy-backs are essential to support efficient markets. RECAP: a. A bond is similar to a loan. b. A bond is a debt instrument issued by corporations or governments. c. A syndicate is a group of investors that is temporarily formed to handle the issuance of new bonds. d. If the price of a particular stock begins to heavily fluctuate, then the specialist will increase the spread. e. A stock is a share of ownership in a particular company. f. The New York Stock Exchange is an auction market. g. Some high frequency traders provide liquidity to the rest of the market. h. If providing liquidity becomes riskier, then dealers will increase the spread. i. Without financial markets, exchange would become more costly. j. NYSE daily trading volume has increased over the last 50 years. k. Negotiated sale is a type of bond placement that requires a more thorough interview process. l. An IPO is where a company goes public or sells shares to the public for the first time. Section 2 – Financial Statements: RECAP: • SCF tracks all cash in and out of the firm. • Cash accounting: cash in = revenue; cash out = expense • Accrual accounting: Revenues are recognized when the earnings process is complete; expenses are "matched" to recognized revenues Financial Statements 10K Reports: • The SEC requires all public corporations to file audited financial reports. • Stringent required financial transparency supports efficient financial markets. Balance Sheet - offers a "snapshot" of the firm's assets and financing at a particular point in time. It can be viewed as a still shot of what the firm has at one particular moment. At the top, highlighted in blue, are current assets and current liabilities. These reflect daily operations, like acquiring resources, producing the product, collecting cash from the customer. In the lower right quadrant, highlighted in green is the process of raising cash. Selling stocks and bonds to raise cash to finance the operations of the firm. On the left, highlighted in orange, is the long-term assets. This is buying equipment to release the product. At the top in the blue highlighted area is the Net Working Capital. Net Working Capital = Current Assets – Current Liabilities • Example: 540 current assets – 340 current liabilities = 240 Net Working Capital On the left, highlighted in orange, we have the Gross PPE. Gross PPE = Net PPE + Accumulated Depreciation • Example: 1000 Net PPE + 200 Accumulated Depreciation = 1200 Gross PPE Increase in Asset = Cash Outflow (ON THE LEFT) Increase in Liability = Cash Inflow (ON THE RIGHT) Increase in NWC (Net Working Capital) = Cash Outflow (CURRENT ASSETS INCREASE MORE THAN CURRENT LIABILITIES SO IT’S A CASH OUTFLOW) Income statement - shows the results of operations over time. Think of the income statement as a video camera tracking performance for a period. • Earnings Before Interests & Taxes (EBIT) is also called Operating Income • COGS: represents the direct costs (direct materials and direct labor) associated with production and suffers from the same recognition predicament as revenue. regardless of when a company incurs cost, it is reported only when the associated revenue is recognized. Neither revenue nor COGS represents actual cash. • Retained earnings - represents the cumulative amount of the firm’s earnings not distributed to shareholders • There are only two things a company can do with net income: o Pay it out as dividends to shareholders o Retain it within the firm Those are the only options for net income – pay it out or plow it back. Algebraically, we could express this as follows: o Net Income = Dividends + Change in RE Net Margin = Net Income / Sales (provided on OA) Net Income = Dividends Paid + Added to Retained Earnings (provided on OA) Payout Ration = Dividends Paid / Net Income (provided on OA) Solve for Net Income & RE: A firm has $600 in sales, operating expenses of $300, depreciation expense of $100, and a 25% tax rate. 600 sales - 300 operating expenses - 100 depreciation expense = EBIT 200 .25 tax rate * 200 EBIT= 50 200 EBIT – 50 = 150 net income [Show More]

Last updated: 1 year ago

Preview 1 out of 50 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$15.00

Document information

Connected school, study & course

About the document

Uploaded On

Mar 22, 2023

Number of pages

50

Written in

Additional information

This document has been written for:

Uploaded

Mar 22, 2023

Downloads

0

Views

38