CFA Level 1 Formulas Exams 245 Questions with Answers,100% CORRECT

Document Content and Description Below

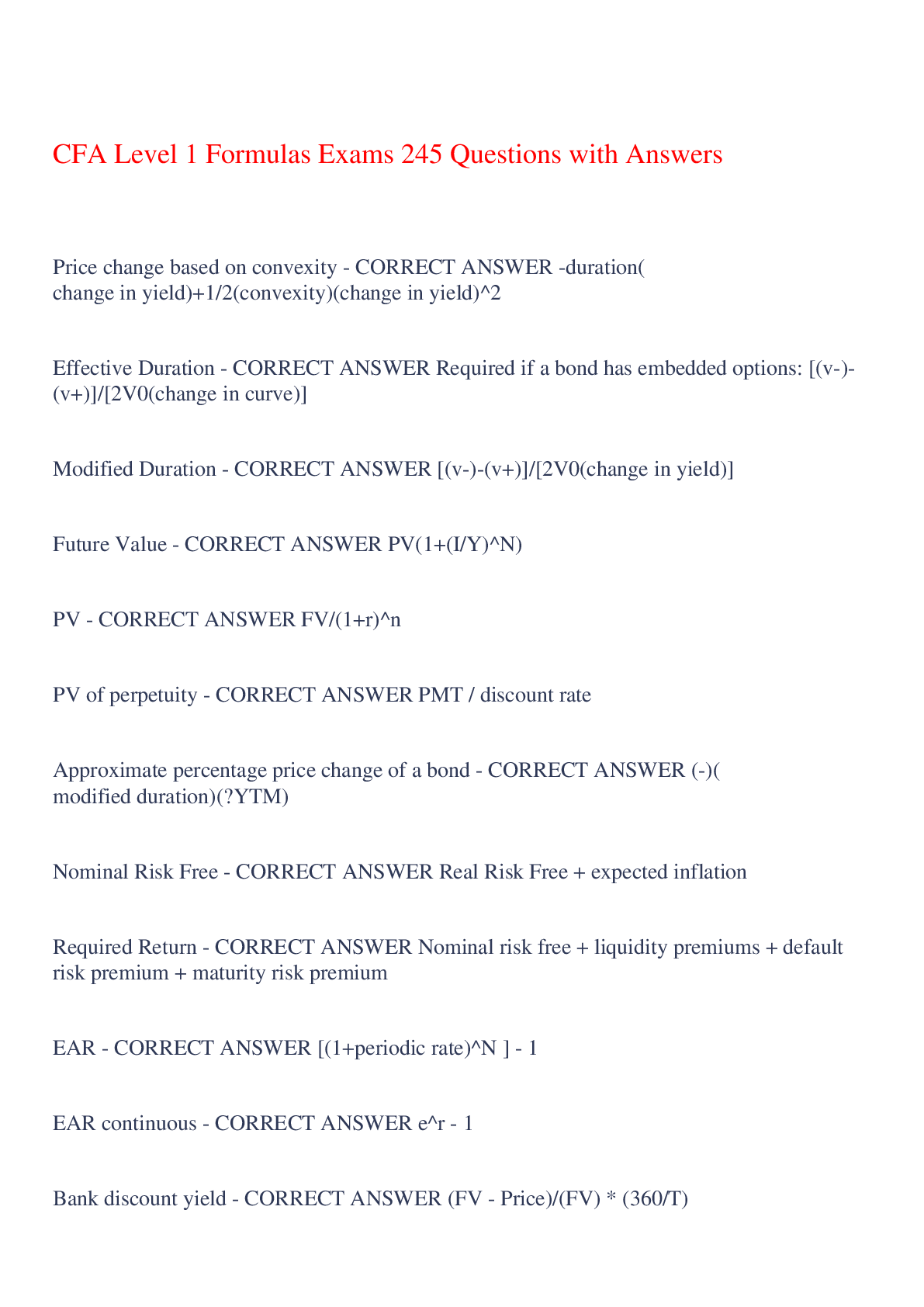

CFA Level 1 Formulas Exams 245 Questions with Answers Price change based on convexity - CORRECT ANSWER -duration(change in yield)+1/2(convexity)(change in yield)^2 Effective Duration - CORRECT... ANSWER Required if a bond has embedded options: [(v-)-(v+)]/[2V0(change in curve)] Modified Duration - CORRECT ANSWER [(v-)-(v+)]/[2V0(change in yield)] Future Value - CORRECT ANSWER PV(1+(I/Y)^N) PV - CORRECT ANSWER FV/(1+r)^n PV of perpetuity - CORRECT ANSWER PMT / discount rate Approximate percentage price change of a bond - CORRECT ANSWER (-)(modified duration)(ΔYTM) Nominal Risk Free - CORRECT ANSWER Real Risk Free + expected inflation Required Return - CORRECT ANSWER Nominal risk free + liquidity premiums + default risk premium + maturity risk premium EAR - CORRECT ANSWER [(1+periodic rate)^N ] - 1 EAR continuous - CORRECT ANSWER e^r - 1 Bank discount yield - CORRECT ANSWER (FV - Price)/(FV) * (360/T) HPY - CORRECT ANSWER [(P1+D1)/P0] - 1 EAY - CORRECT ANSWER (1+HPY)^(365/T) - 1 HPY (MMY equation) - CORRECT ANSWER MMY * (T/360) MMY - CORRECT ANSWER HPY * (360/T) Geometric return - CORRECT ANSWER [(1+r1)(1+r2)(1+r3)]^(1/n) - 1 Time weighted return - CORRECT ANSWER [(1+HPY1)(1+HPY2)(1+HPY3)]^(1/n) - 1 Harmonic Mean - CORRECT ANSWER [N/(sum of (1/sample means))] Position of observation - CORRECT ANSWER (n+1)*(k/100) Excess kurtosis - CORRECT ANSWER Sample kurtosis - 3 (3 is normal kurtosis) Mean absolute deviation - CORRECT ANSWER sum of: (mean - sample mean)/n-1 Variance - CORRECT ANSWER (x-mean)^2/N (population) and divided by (n-1) for a sample Coefficient of Variation - CORRECT ANSWER Sample standard deviation/sample mean Sharpe Ratio - CORRECT ANSWER Risk of portfolio - risk free / Standard deviation of portfolio Joint Probability - CORRECT ANSWER P(AB) = P(A|B) * P(B) Addition rule - CORRECT ANSWER P(A or B) = P(A) + P(B) - P(AB) Multiplication rule - CORRECT ANSWER P(A and B) = P(A)*P(B) Total Probability Rule - CORRECT ANSWER P(A) = P(A|B1)*P(B1)...+P(A|B2)*P(B2) Expected Value - CORRECT ANSWER P(x)*(x) Covariance - CORRECT ANSWER P[(Ra - E(Ra) * (Rb - E(Rb)] - sum for all probabilities that sum to 1 OR [SDa*SDb*correlation) Correlation - CORRECT ANSWER Covariance(A,B) / SDa*SDb Portfolio expected return - CORRECT ANSWER weight times the E(R) of each stock Portfolio variance - CORRECT ANSWER Wa^2*SDa^2 + Wb^2*SDb^2 + 2WaWb*SDa*SDb*Corr(a,b) Baye's formula - CORRECT ANSWER P(new info) / unconditional probability of new info*prior prob of event Combination binomial - CORRECT ANSWER nCr - order doesn't matter Permutation binomial - CORRECT ANSWER nPr - order matters Binomial probability - CORRECT ANSWER nCx * p^x * (1-p)^(n-x) Binomial Expected value - CORRECT ANSWER nP Binomial variance - CORRECT ANSWER np(1-p) 90% confidence interval - CORRECT ANSWER +/- 1.645 SDs 95% confidence interval - CORRECT ANSWER +/- 1.96 SDs 99% confidence interval - CORRECT ANSWER +/- 2.58 SDs Z score - CORRECT ANSWER (x-mean)/SD Roy's safety first ratio - CORRECT ANSWER (E(Rp) - Rtarget)/SD Mean sampling error - CORRECT ANSWER mean - miu Standard error - CORRECT ANSWER SD/ sqrt (n) Confidence interval - CORRECT ANSWER x+/- z*(SD/sqrt(n)) Type 1 error - CORRECT ANSWER rejection of null hypothesis when it is actually true Type 2 error - CORRECT ANSWER Accepting the null when it is false t-stat - CORRECT ANSWER t-statistic for tests involving the population mean (location of mean, difference in means, paired comparisons) chi square test - CORRECT ANSWER Use chi-square statistic for tests of a single population variance ([(n-1)SD^2]/Variance - observed) F stat - CORRECT ANSWER Use F-statistic for tests comparing two population variances. (SD1/SD2) Price elasticity of demand - CORRECT ANSWER %Δ Qd/Δ% price Income elasticity - CORRECT ANSWER %Δ Qd/%Δ income Accounting profit - CORRECT ANSWER Total revenue - total explicit/acctg costs Economic profit - CORRECT ANSWER Total revenue - explicit costs - implicit costs(opportunity costs) Normal profit - CORRECT ANSWER Acctg profit - economic profit (equals 0) Total revenue - CORRECT ANSWER Price * quantity Avg total revenue - CORRECT ANSWER TR/Q Marginal revenue - CORRECT ANSWER ΔTR/ΔQ Marginal cost - CORRECT ANSWER ΔTC/ΔQ Avg total cost - CORRECT ANSWER total costs/total product Avg variable cost - CORRECT ANSWER total VC/total product Shutdown point - CORRECT ANSWER TR < TVC HHI - CORRECT ANSWER Sum of market shares of each firms squared GDP Deflator - CORRECT ANSWER Nominal GDP/Real GDP * 100 Fiscal Multiplier - CORRECT ANSWER 1/[(1-Marginal propensity to consume)(1-t) Money multiplier - CORRECT ANSWER 1/Reserve Requirement GDP - CORRECT ANSWER consumption spending + investment + government spending + net exports (C+I+G+NX) FX formula layout - CORRECT ANSWER FX rates are expressed as price currency / base currency and interpreted as the number of units of the price currency for each unit of the base currency. CPI - CORRECT ANSWER (basket of good prices)/(basket of goods base year)*100 Real FX rate - CORRECT ANSWER Nominal FX rate * (base currency CPI/price currency CPI) No-Arbitrage Forward Exchange Rate - CORRECT ANSWER (forward/sport) = (1+price currency interest rate)/(1+base currency interest rate) Equation of exchange - CORRECT ANSWER money supply * velocity = Price * real output Interest rate parity - CORRECT ANSWER Forward/spot = (1+domestic rate)/(1+foreign rate) Receivables turnover - CORRECT ANSWER Sales/Average AR Inventory turnover - CORRECT ANSWER Sales/Average inventory Payables turnover - CORRECT ANSWER COGS/Average payables Total Asset turnover - CORRECT ANSWER Sales/Average assets Fixed Asset turnover - CORRECT ANSWER Sales/Average net fixed assets Working capital turnover - CORRECT ANSWER Sales/Average working capital Days outstanding formulas - CORRECT ANSWER 365/ratio Current ratio - CORRECT ANSWER CA/CL Quick ratio - CORRECT ANSWER Cash + marketable securities+receivables/current liabilities Cash ratio - CORRECT ANSWER Cash + securities/current liabilities Defense interval - CORRECT ANSWER Cash+securities+receivables/average daily expenditures Cash conversion cycle - CORRECT ANSWER Days receivables + inventory days outstanding - days of paybales Operating cycle - CORRECT ANSWER Average days inventory + average days receivables Debt to equity - CORRECT ANSWER total debt/shareholder's equity Debt to capital - CORRECT ANSWER total debt/debt+equity Debt to assets - CORRECT ANSWER total debt/total assets Financial leverage - CORRECT ANSWER Average total assets/average total equity Interest coverage - CORRECT ANSWER EBIT/Interest payments Fixed charge coverage - CORRECT ANSWER EBIT+lease payments/Interest + lease payments CFO (direct) - CORRECT ANSWER Cash collections (cash equivalent of sales) - cash inputs (cash equivalent of COGS) - cash opex - cash interest exp - cash taxes CFO (indirect) - CORRECT ANSWER NI - gains + losses +noncash charges (depr) - current asset accts + liability accts FCF - CORRECT ANSWER NI+depr/amortization - ΔNWC+(interest expense(1-tax rate)) Growth rate - CORRECT ANSWER Retention Rate x ROE Retention rate - CORRECT ANSWER 1 - [dividends declared/operating income after taxes] OR (1-Div payout ratio) ROE (DuPont) - CORRECT ANSWER (NI/Sales)(Sales/Assets)(Assets/Equity) OR net margin*asset turnover*leverage ratio ROE (extended DuPont) - CORRECT ANSWER (NI/EBT)(EBT/EBIT)(EBIT/Revenue)(Revenue/Avg Assets)(Avg Assets/Avg Equity) OR tax burden*interest burden*EBIT margin*asset turnover*leverage) Fair Value security - CORRECT ANSWER Held for trading and available for sale Amortized cost security - CORRECT ANSWER Held to maturity Pretax Margin - CORRECT ANSWER EBT/Revenue ROA - CORRECT ANSWER NI/avg total assets ROTC - CORRECT ANSWER EBIT/average total capital ROE - CORRECT ANSWER NI/avg total equity ROCE - CORRECT ANSWER NIAC/Avg common equity Basic EPS - CORRECT ANSWER (NI - Preferred dividends)/weighted average number of shares outstanding Diluted EPS - CORRECT ANSWER [(NI - Preferred dividends)+convertible preferred dividends+(convertible debt interest(1-t))] / [(weighted average shares)+(shares from conversion of convertible preferreds)+(shares from conversion of convertible debt)+(shares issuable from stock options)] Straight-line depreciation - CORRECT ANSWER (cost - SV)/ useful life Double declining balance - CORRECT ANSWER (2/useful life)*(cost - accumulated depreciation) Dilutive convertibles IF - CORRECT ANSWER (converted preferred dividends/common stock per share) < Basic EPS OR (Converted debt interest(1-t))/common stock per share < Basic EPS Coefficient of Variation - CORRECT ANSWER Standard deviation / mean Interest Expense of a bond - CORRECT ANSWER Beginning BV*market interest rate at issuance FIFO COGS - CORRECT ANSWER LIFO COGS - (Δ LIFO Reserve) Units of production depreciation - CORRECT ANSWER (Original cost - salvage value)/life in output units* output units in period Average age - CORRECT ANSWER Accumulated depreciation/Annual depreciation expense Total Useful Life - CORRECT ANSWER Historical cost/Annual depreciation expense Remaining Useful life - CORRECT ANSWER Ending net PP&E/annual depreciation expense WACC - CORRECT ANSWER (Wd)[Kd(1-t)]+(Wps)(Kps)+(Wce)(Ks) Cost of preferred stock - CORRECT ANSWER Dps/P Cost of equity capital - CORRECT ANSWER (D1/Po) +g Cost of Equity (CAPM) - CORRECT ANSWER Risk free + Beta(Risk risk - Risk free) NPV - CORRECT ANSWER CF/(1+r)^t IRR - CORRECT ANSWER Discount rate that makes NPV equal to zero Beta Unlevered - CORRECT ANSWER B * 1/[1+(1-t)D/E] Beta Relevered - CORRECT ANSWER B * [1+[(1-t)D/E]] Degree of Total Leverage - CORRECT ANSWER % Δ EPS / % Δ in sales or Gross margin / (Sales-TVC-FC-I) or DOL*DFL or Gross margin/EBT Degree of Operating Leverage - CORRECT ANSWER % Δ EBIT / % Δ sales or Gross margin/(gross margin - FC) Degree of Financial Leverage - CORRECT ANSWER % Δ EPS /% Δ EBIT or EBIT/(EBIT-Interest) Breakeven quantity of sales - CORRECT ANSWER fixed operating & financing costs/price-VC per unit operating breakeven quantity of sales - CORRECT ANSWER fixed operating costs/price-VC per unit Profitability index - CORRECT ANSWER 1+(NPV/CFo) Cost of equity (volatile market) - CORRECT ANSWER Rf + B(Rm-Rf+country risk premium) Payback period - CORRECT ANSWER full year payment until recovery +(uncovered cost at beginning of the year/cash flow during past year) Cost of trade credit - CORRECT ANSWER [1+(%discount/1-%discount)]^(365/days past discount) - 1 EPS after stock buyback - CORRECT ANSWER Total earnings - after tax cost of funds / shares outstanding after buy back Bond equivalent yield - CORRECT ANSWER (FV-PV)/PV * (365/t) or (Add-on yield) * (n/365) Diversification ratio - CORRECT ANSWER standard deviation of equally weighted investments / standard deviation of a randomly chosen security IPS Investment objectives - CORRECT ANSWER Return objectives and risk tolerance IPS Constraints - CORRECT ANSWER Liquidity needs, time horizon, tax concerns, legal/regulatory factors, unique needs and preferences Markowitz Efficient fronteir - CORRECT ANSWER Set of portfolios with highest return for given level of risk Security Market Line - CORRECT ANSWER Total risk = systematic + unsystematic risk --> CAPM: E(R) = Rf +B(Rm-Rf) - under the SML is underpriced and above is overpriced Unsystematic risk - CORRECT ANSWER Can be diversified away - not related to market Systematic risk - CORRECT ANSWER market risk - investors are compensated for this kind of risk Beta of stock - CORRECT ANSWER Covariance/variance of market Treynor measure - CORRECT ANSWER Measures excess return per unit of risk - (Rportfolio-Rf)/beta of portfolio Sharpe ratio - CORRECT ANSWER Measures total portfolio risk: (Rp-Rf)/SD porfolio Jensen's alpha - CORRECT ANSWER Measures excess return per unit of risk: Rp - (Rf + B(MRP)) Margin call price - CORRECT ANSWER Po * [(1-initial margin)/(1-maintainance margin)] Price weighted index - CORRECT ANSWER Sum of stock prices/number of stocks in index Market weighted index - CORRECT ANSWER Sum of current market values/sum of base year market values (base year is usually 100) Leverage factor - CORRECT ANSWER 1/margin percentage Levered return - CORRECT ANSWER HPR * leverage factor Margin Return % - CORRECT ANSWER [((Ending Value - Loan Payoff) / Beginning Equity Position) - 1] * 100 DOL - CORRECT ANSWER (sales - variable costs) / (sales - variable costs - fixed costs) DFL - CORRECT ANSWER EBIT / (EBIT - interest) Equity one period valuation model - CORRECT ANSWER (D/(1+k))+(P/(1+k)) Preferred equity stock valuation model - CORRECT ANSWER Dp/Kp Equity constant growth valuation model - CORRECT ANSWER D/r-g OR D(1+g)/(r-g) Equity multi-stage growth valuation model - CORRECT ANSWER Dn/(1+Kn) + Pn/(1+Kn) where Pn = D(n+1)/(r-g) P/E multiplier - CORRECT ANSWER (Dividends/Earnings)/(k-g) where D/E = dividend payout ratio Leading/trailing P/E ratio - CORRECT ANSWER Price per share/(EPS forecast or previous 12 mo) P/B - CORRECT ANSWER Price per share/book value per share P/S - CORRECT ANSWER Price per share/sales per share P/CF - CORRECT ANSWER Price per share/cash flow per share Enterprise Value - CORRECT ANSWER Market value of common stock + market value of preferred stock + market value of debt - cash and short-term investments Bond Price - CORRECT ANSWER Coupon / (1+s)^n Full/dirty price - CORRECT ANSWER PV * (1+YTM)^ (days since last coupon/days between coupons) Full/clean price - CORRECT ANSWER Full price - accrued interest Accrued itnerest - CORRECT ANSWER Coupon * (days since last coupon/days between coupons) Current yield - CORRECT ANSWER Annual coupon payment/current bond price Effective Yield/EaR - CORRECT ANSWER [1+(YTM/N)]^N - 1 Semi-annual bond basis - CORRECT ANSWER 2 * semi-annual discount rate Repo Rate - CORRECT ANSWER (future exchange/current value of exchange)^(360/n) - 1 Discount price - CORRECT ANSWER (%discount/(360/n)) * Face Value Add-on yield - CORRECT ANSWER [(Face-price)/price]*(360/n) Forward and spot rates - CORRECT ANSWER (1+S)^2 = (1+S)(1+1y1y) 1y3y meaning - CORRECT ANSWER 3-year forward rate 1 year from today LTV ratio - CORRECT ANSWER loan amount/appraised value of asset Option adjusted spread - CORRECT ANSWER Z spread - option value Bullet cash flow - CORRECT ANSWER All principal repaid at maturity Fully amortizing - CORRECT ANSWER Equal periodic payments include both interest and principal Partially amortizing - CORRECT ANSWER Periodic payments include interest and principal with a balloon payment at maturity to repay remaining principal Sinking fund - CORRECT ANSWER Schedule for early redemption Floating-rate - CORRECT ANSWER Coupon payments based on reference rate + margin Flat price of a bond - CORRECT ANSWER Doesn't include accrued interest Full price of a bond - CORRECT ANSWER PV at last coupon date * (1+YTM)^t/T Accrued interest = coupon payment * (days from most recent coupon payment to trade settlement/days in coupon payment period) Includes accrued interest Approximate Modified Duration - CORRECT ANSWER (V_ - V+)/2Vo * ΔYTM Money Duration - CORRECT ANSWER Modified duration * full price of bond position Price value of a basis point - CORRECT ANSWER [[(V_-V+)/2]* Face value * 0.01 Approximate convexity - CORRECT ANSWER V_+V+-2Vo / (ΔYTM)^2*Vo Approximate effective convexity - CORRECT ANSWER V_+V+-2Vo / (Δcurve)^2*Vo %Δ full bond price - CORRECT ANSWER [-modified duration * ΔYTM] + [1/2 * annual convexity * ΔYTM^2 Duration gap - CORRECT ANSWER Macaulay duration - investment horizon Risk free asset (derivatives) - CORRECT ANSWER Risky asset + derivative position Derivative position - CORRECT ANSWER Risk free asset - risky asset Risky asset - CORRECT ANSWER Risk free asset - derivative position No-arbitrage forward price - CORRECT ANSWER So(1+Rf)^t Payoff to loans forward at expiration - CORRECT ANSWER S(t) - F(t) Intrinsic call value - CORRECT ANSWER MAX [ 0, S-X] Intrinsic put value - CORRECT ANSWER MAX [0, X-S] Option value - CORRECT ANSWER Intrinsic value + time value Put-call parity - CORRECT ANSWER Stock Price = call price + [x/(1+r)^t] - put price Put-call forward parity - CORRECT ANSWER Fo/(1+R)^t = Co + (x/(1+r)^t) - Po Callable bond - CORRECT ANSWER ISSUER benefits - may repay principal early. Increases yield and decreases duration Putable bond - CORRECT ANSWER BONDHOLDER benefits - can sell back to issuer - decreases yield and duration Embedded warrants - CORRECT ANSWER BONDHOLER may be issuer's common stock at exercise price Current Yield - CORRECT ANSWER Annual coupon/price Simple yield - CORRECT ANSWER Current yield +/- amortization Yield to worst - CORRECT ANSWER Lowest of bonds YTC or YTM Money market yields - CORRECT ANSWER Discount or add-on basis yield and use 360 or 365 day G-spread - CORRECT ANSWER Basis points above government yield I-spread - CORRECT ANSWER Basis points above swap rate Z-spread - CORRECT ANSWER Accounts for shape of yield curve Option-adjusted spread - CORRECT ANSWER Adjusts Z-spread for effects of embedded option Definition of Macaulay Duration - CORRECT ANSWER The horizon at which market price risk and reinvestment risk just offset - The weighted average of times until a bond's cash flows are scheduled to be paid Definition of Modified Duration - CORRECT ANSWER The approximate change in a bond's price given a 1% change in its YTM Residential MBS - CORRECT ANSWER Home mortgages are collateral Agency RMBS - CORRECT ANSWER Include only conforming loans Nonagency RMBS - CORRECT ANSWER May include nonconforming loans and need credit enhancement Prepayment risk - CORRECT ANSWER Contraction risk from faster prepayments and extension risk from slower prepayments CMO - CORRECT ANSWER Pass-through MBS are collateral - may have sequential pay or PAC/support structure Non-recourse loans - CORRECT ANSWER if the borrower defaults, the loan owner can seek out the underlying collateral CDO - CORRECT ANSWER Bonds, bank loans, MBS, ABS, or other are collateral Internal credit enhancement - CORRECT ANSWER Excess spread, overcollateralization, waterfall structure External credit enhancement - CORRECT ANSWER Surety bonds, letters of credit, bank guarantees Investment grade - CORRECT ANSWER Baa3/BBB- or above Non-investment grade - CORRECT ANSWER Ba1 - BB+ or below Corporate family rating - CORRECT ANSWER Issuer rating Corporate credit rating - CORRECT ANSWER Security rating Four C's - CORRECT ANSWER Capacity, collateral, covenants, character Expected loss - CORRECT ANSWER Default risk * loss secerity Recovery rate - CORRECT ANSWER 1 - expected loss percentage Law of one price - CORRECT ANSWER Two assets with identical cash flows in future, regardless of future events, should have the same price Forward Contract value - CORRECT ANSWER Value of zero at initiation St + PV(cost) - PV(benefit) - F(T) / [(1+Rf)^T-t] Payoff to long = St - F(T) Futures contracts - CORRECT ANSWER Exchange-traded, standardized contracts, guaranteed by clearinghouse, regulated Forward contracts - CORRECT ANSWER Private contracts, unique contracts, default risk, little to no regulation Forward Rate Agreements (FRA) - CORRECT ANSWER Can be viewed as a forward contract to borrow/lend money at a certain rate at some future date Put-call parity for European options - CORRECT ANSWER Ct + X/(1+rf)^T = St + Pt Futures price of commodity - CORRECT ANSWER spot price (1+Rf) + storage costs - convenience yield Contango - CORRECT ANSWER Futures price > spot price Backwardation - CORRECT ANSWER Futures price < spot price [Show More]

Last updated: 1 year ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.50

Document information

Connected school, study & course

About the document

Uploaded On

Jun 18, 2023

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Jun 18, 2023

Downloads

0

Views

114