Financial Accounting > STUDY GUIDE > ACCT 211 Connect Homework Chapter 10 Exercises answers complete solutions (All)

ACCT 211 Connect Homework Chapter 10 Exercises answers complete solutions

Document Content and Description Below

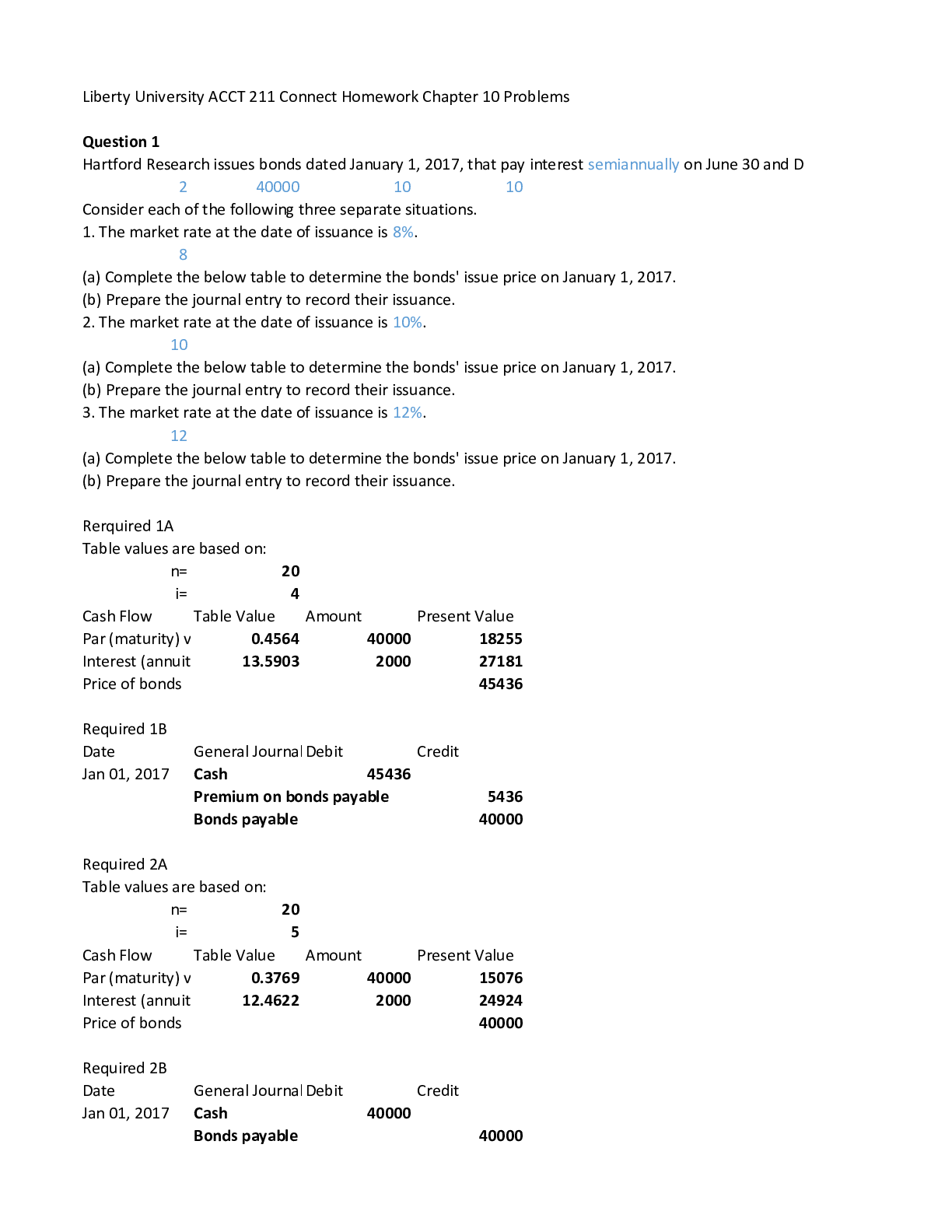

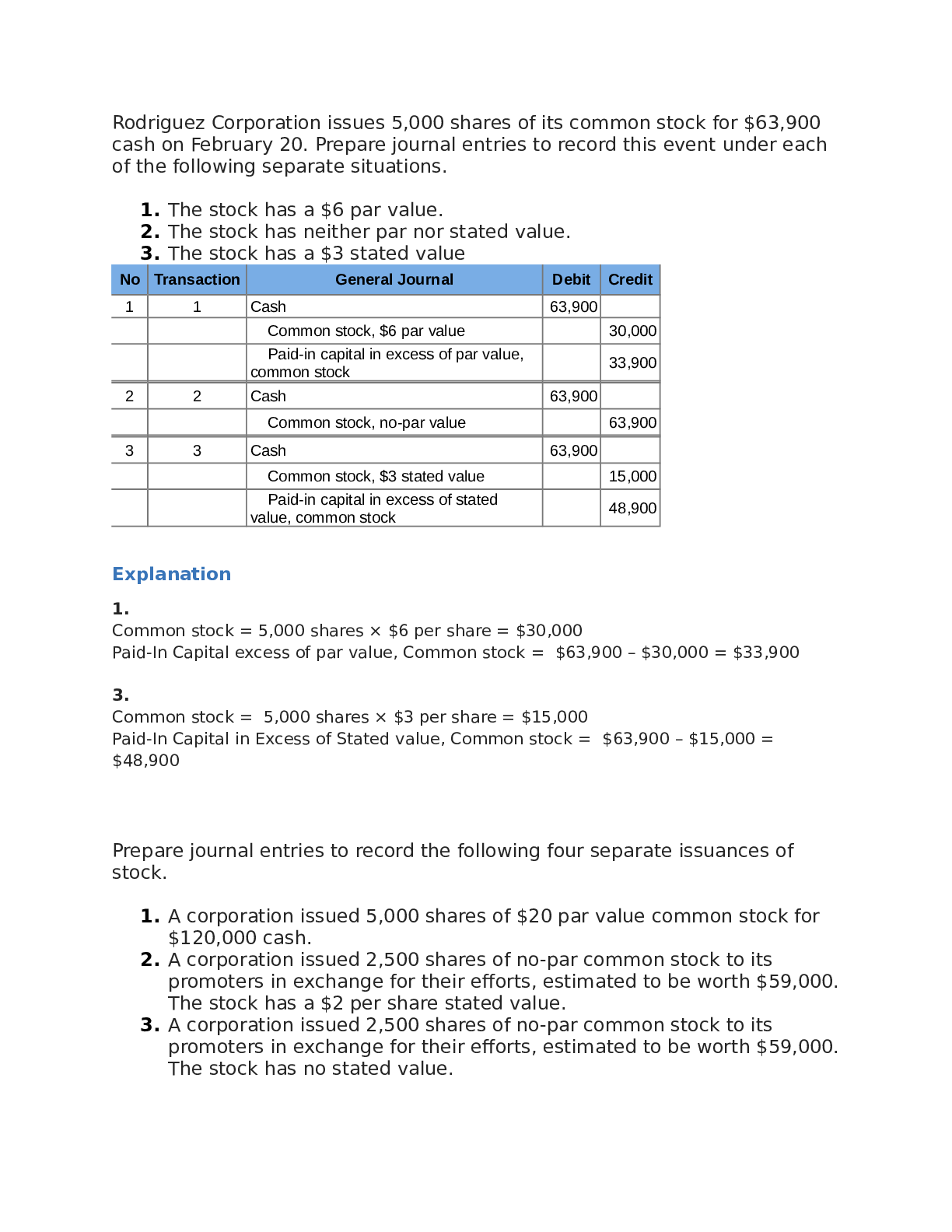

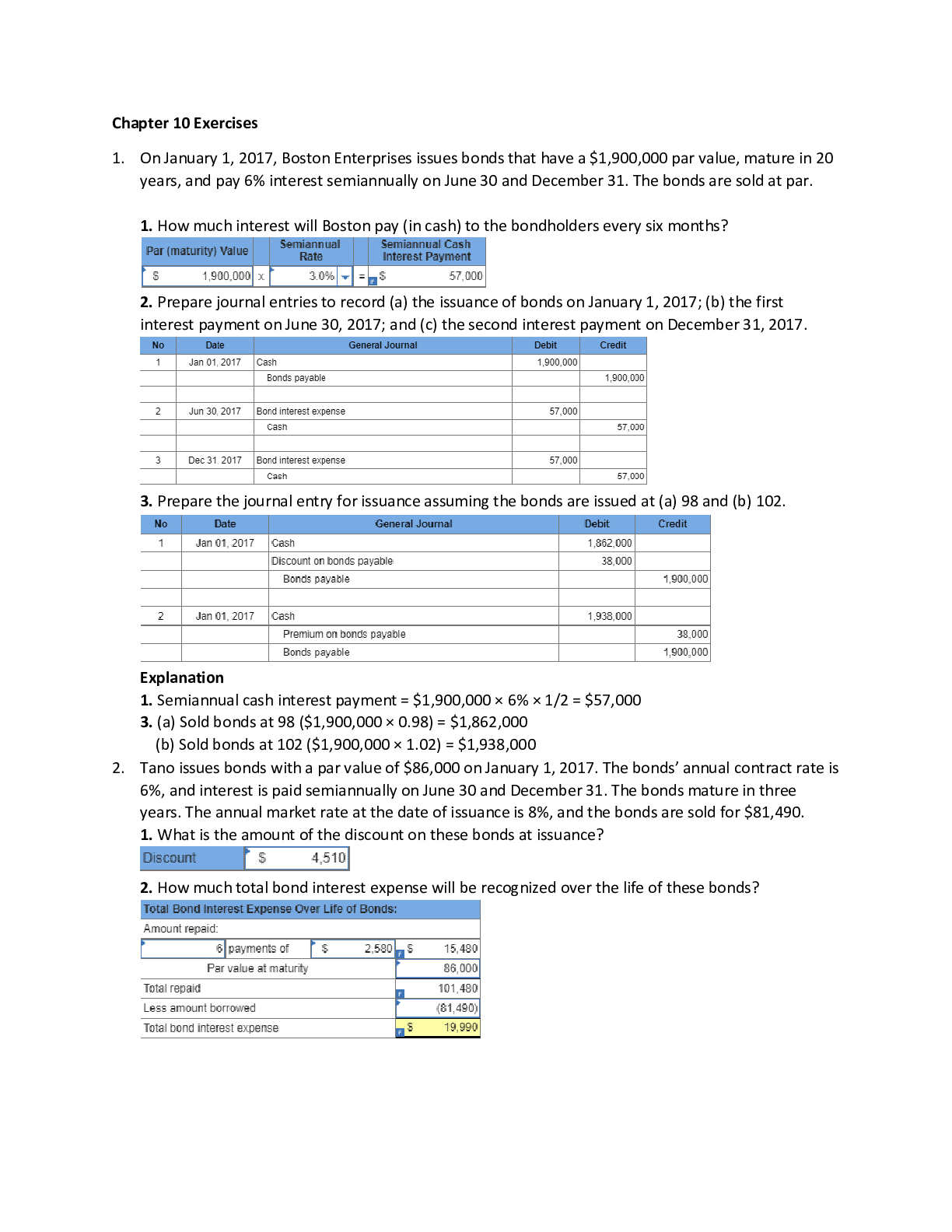

ACCT 211 Connect Homework Chapter 10 Exercises answers complete solutions Just put your values given in Excel and automatically provide answers for you! Question 1 On January 1, 2017, Boston Enterp... rises issues bonds that have a $1,200,000 par value, mature in 20 years, and pay 9% interest semiannually on June 30 and December 31. The bonds are sold at par. 1. How much interest will Boston pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1, 2017; (b) the first interest payment on June 30, 2017; and (c) the second interest payment on December 31, 2017. 3. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Question 2 Tano issues bonds with a par value of $97,000 on January 1, 2017. The bonds’ annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $92,234. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an amortization table using the straight-line method to amortize the discount for these bonds. Question 3 Bringham Company issues bonds with a par value of $700,000 on their stated issue date. The bonds mature in 6 years and pay 6% annual interest in semiannual payments. On the issue date, the annual market rate for the bonds is 8%. 2. How many semiannual interest payments will be made on these bonds over their life? 3. Use the interest rates given to select whether the bonds are issued at par, at a discount, or at a premium. Question 4 Paulson Company issues 6%, four-year bonds, on December 31, 2017, with a par value of $105,000 and semiannual interest payments. Question 5 Quatro Co. issues bonds dated January 1, 2017, with a par value of $890,000. The bonds’ annual contract rate is 12%, and interest is paid semiannually on June 30 and December 31. 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an amortization table for these bonds; use the straight-line method to amortize the premium. Question 6 On January 1, 2017, Boston Enterprises issues bonds that have a $2,050,000 par value, mature in 20 years, and pay 8% interest semiannually on June 30 and December 31. 2. Prepare journal entries to record (a) the issuance of bonds on January 1, 2017; (b) the first interest payment on June 30, 2017; and (c) the second interest payment on December 31, 2017. Question 7 Tano issues bonds with a par value of $90,000 on January 1, 2017. The bonds’ annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. 3. Prepare an amortization table using the straight-line method to amortize the discount for these bonds. Question 8 Bringham Company issues bonds with a par value of $700,000 on their stated issue date. The bonds mature in 6 years and pay 6% annual interest in semiannual payments. 2. How many semiannual interest payments will be made on these bonds over their life? 3. Use the interest rates given to select whether the bonds are issued at par, at a discount, or at a premium. Question 9 Paulson Company issues 7%, four-year bonds, on December 31, 2017, with a par value of $96,000 and semiannual interest payments. [Show More]

Last updated: 1 year ago

Preview 1 out of 27 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 19, 2021

Number of pages

27

Written in

Additional information

This document has been written for:

Uploaded

Feb 19, 2021

Downloads

0

Views

45