Financial Accounting > EXAM > ACC501: Financial Accounting and Analysis. Final Exam. Correct Answers and Rationale Provided. Court (All)

ACC501: Financial Accounting and Analysis. Final Exam. Correct Answers and Rationale Provided. Courtesy of: mybusinesscourse.com

Document Content and Description Below

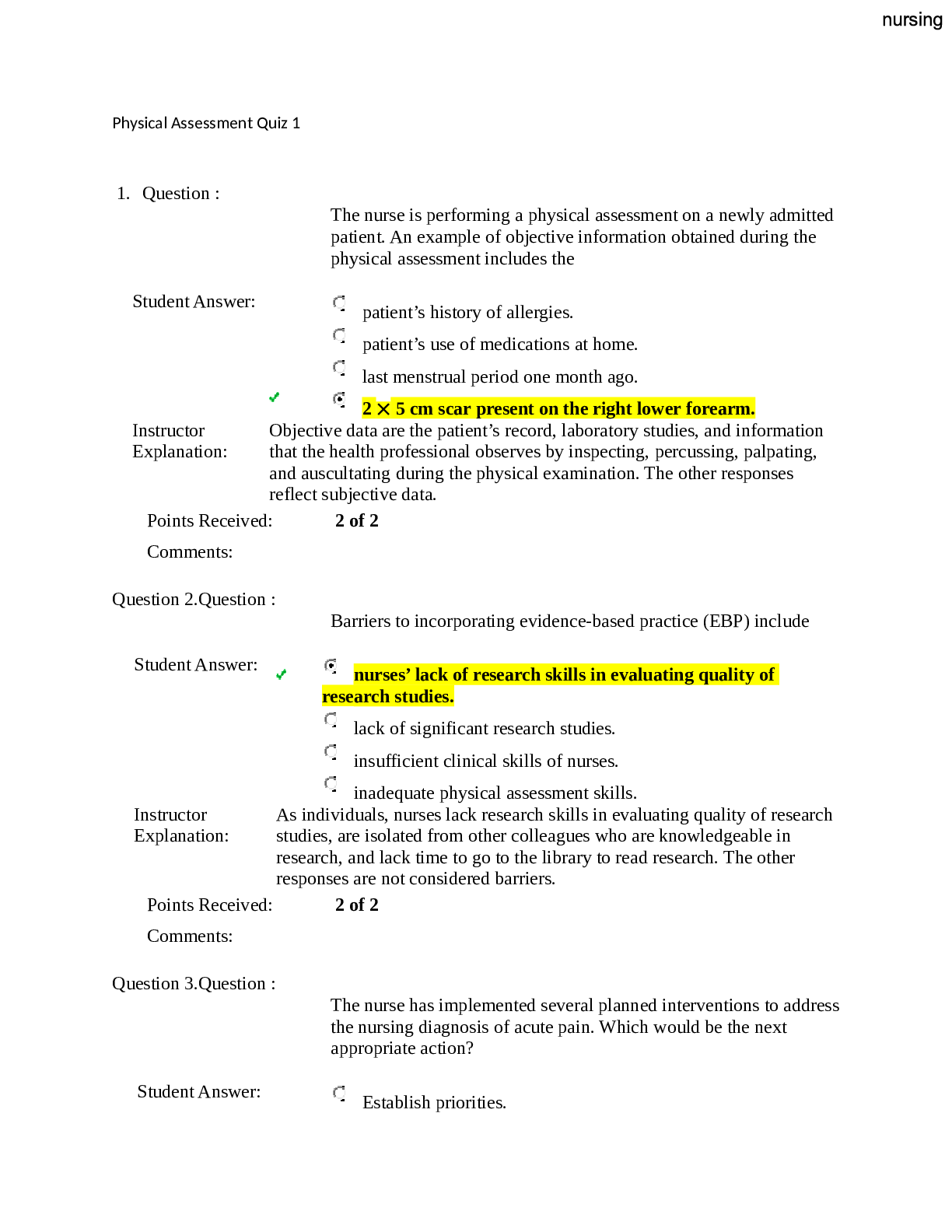

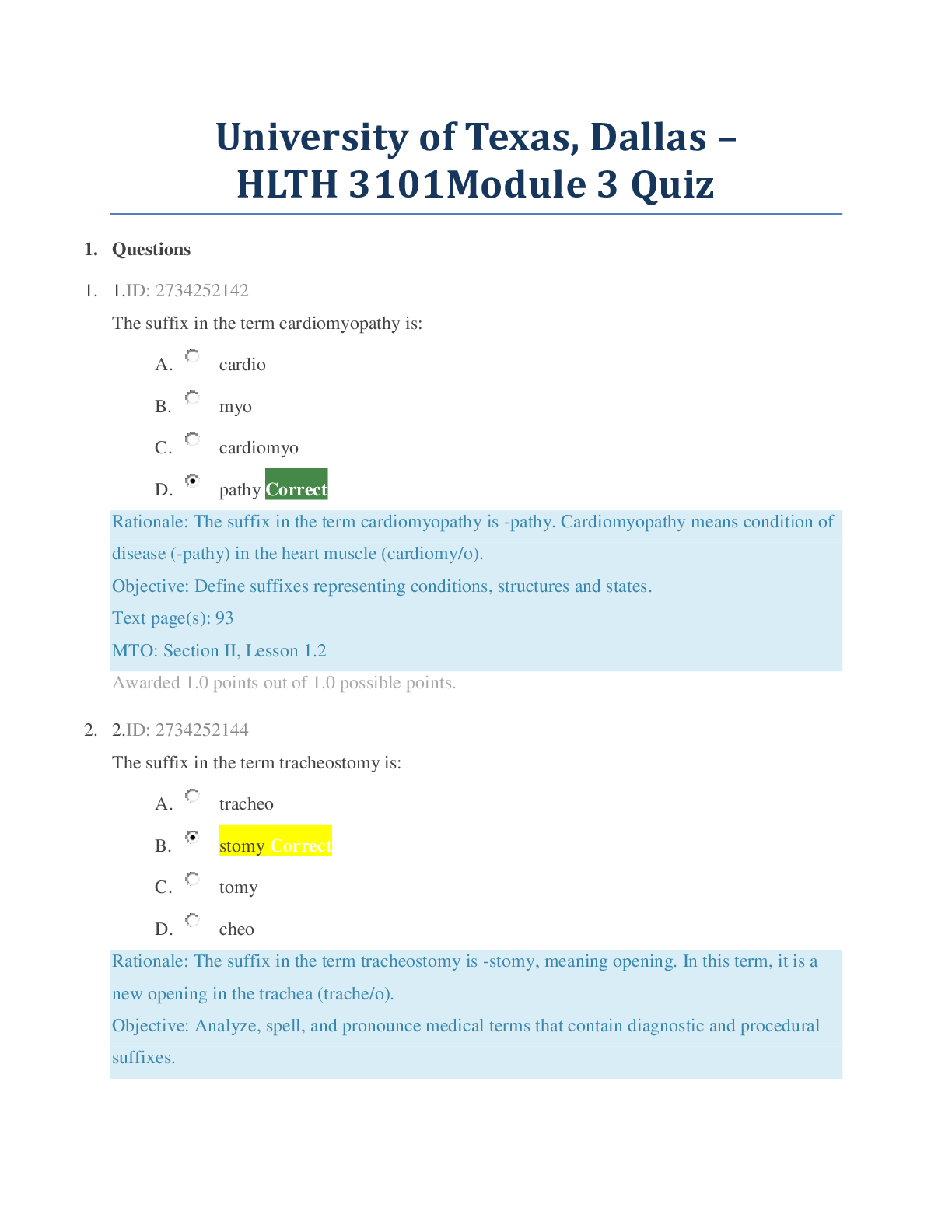

ACC501:80-Financial Accounting and Analysis / Final Exam Started on Thursday, October 12, 2017, 8:18 PM State Finished Completed on Thursday, October 12, 2017, 11:11 PM Time taken 2 hours 53 min s Gra... de 208.00 out of 250.00 (83%) QUESTION 1 Correct 4.00 points out of 4.00 Kroger's 2016 financial statements show net operating profit after tax of 2,286 million, net income of $1,975 million, sales of $115,337 million, and average net operating assets of 18,616 million. Kroger's net operating asset turnover for the year is: Select one: A. 12.3% B. 8.11 C. 6.20 D. 10.9% E. There is not enough information to calculate the ratio. QUESTION 2 Correct 4.00 points out of 4.00 Mattel Inc.'s 2016 financial statements show operating profit before interest and tax of $519,233 thousand, net income of $318,022 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of $109,491 thousand. Assume Mattel’s statutory tax rate for 2016 is 37%. Mattel's 2016 tax shield is: Select one: A. $ 68,979 thousand B. $ 40,512 thousand C. $277,510 thousand D. $186,460 thousand E. None of the above QUESTION 3 Correct 4.00 points out of 4.00 Which one of the following is not correct? Select one: A. For debt issued at par: interest expense reported on the income statement equals the cash paid for interest. B. For bond repurchases: Gain (loss) on bond repurchase = Cash paid to repurchase – Net book value of bonds. C. For debt issued at a discount: interest expense reported on the income statement equals cash interest payment less amortization of the discount. ! D. For debt issued at a premium, interest expense reported on the income statement equals cash interest payment less amortization of the premium. equals cash interest payment less amortization of the premium. E. None of the above QUESTION 4 Correct 4.00 points out of 4.00 Interest expense appears in which financial statement? Select one: A. Statement of stockholders' equity B. Balance sheet C. Income statement D. Statement of cash flows E. All of the above QUESTION 5 Correct 4.00 points out of 4.00 Which of the following is not a category for classifying cash flows in a statement of cash flows? Select one: A. Operating activities B. Nonoperating activities C. Financing activities D. Investing activities E. None of the above QUESTION 6 Correct 4.00 points out of 4.00 Aiello, Inc. had the following inventory in fiscal 2016. The company uses the LIFO method of accounting for inventory. Beginning Inventory, January 1, 2016: 130 units @ $15.00 Purchase 200 units @ $18.00 Purchase 50 units @ $13.50 Purchase 110 units @ $15.75 Ending Inventory, December 31, 2016: 120 units The company’s cost of goods sold for fiscal 2016 is: Select one: A. $6,090.00 B. $1,800.00 C. $5,305.75 D. $6,157.50 E. None of the above *Cost of goods available for sale: (130 units × $15) + (200 units × $18) + (50 units × $13.50) + (110 units × $15.75) = $7,957.50 QUESTION 7 Incorrect 0.00 points out of 4.00 Which of the following is added to net income to reconcile to cash from operations? Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 5 of 36 Which of the following is added to net income to reconcile to cash from operations? Select one: A. Loss from sale of property, plant and equipment B. Decrease in accounts receivable C. Depreciation expense D. All of the above E. None of the above QUESTION 8 Correct 4.00 points out of 4.00 Mattel Inc.'s2016 financial statements show operating profit before interest and tax of $519,233 thousand, net income of $318,022 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of $109,491 thousand. Assume Mattel’s statutory tax rate for 2016 is 37%. Mattel's 2016 effective tax rate is: Select one: A. 22.4% B. 37.0% C. 19.4% D. 17.7% E. None of the above QUESTION 9 Correct 4.00 points out of 4.00 The fiscal 2016 financial statements for Walgreens Boots Alliance, Inc., report net sales of $117,351 million, net operating profit after tax of $4,687 million, net operating assets of $39,502 million. The 2015 balance sheet reports net operating assets of $42,683 million. Walgreen's 2016 net operating asset turnover is: Select one: A. 11.5% B. 2.86 C. 13.3% D. 2.97 E. There is not enough information to calculate the ratio. QUESTION 10 Incorrect 0.00 points out of 5.00 Which one of the following is not a factor that changes a company's pension obligation during the year (select all that apply). Select one or more: A. Contributions to the pension plan B. Benefits paid C. Service cost D. Actuarial losses (gains) E. Interest cost QUESTION 11 Correct 4.00 points out of 4.00 Ennis, Inc. has 35,000 common shares issued at a $2.25 par value of which 22,000 are outstanding. If Ennis has no other outstanding stock, what size dividend must be paid such that each share receives $3.20? Select one: A. $96,500 B. $52,500 C. $70,400 D. $44,000 E. None of the above QUESTION 12 Correct 4.00 points out of 4.00 In its fiscal year ended January 28, 2017 balance sheet, Big Lots, Inc., reported cash and cash equivalents at the start of the year of $54,144 thousand. By the end of the year, the cash and cash equivalents had decreased to $51,164 thousand. The company’s statement of cash flows reported cash from operating activities of $311,925 thousand, cash from financing activities of $(230,204) thousand. Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 8 of 36 What amount did the company report for cash from investing activities? Select one: A. $122,391 thousand cash inflow B. $7,966 thousand cash outflow C. $84,801 thousand cash inflow D. $84,701 thousand cash outflow E. None of the above Rationale: QUESTION 13 Correct 4.00 points out of 4.00 Sales on account would produce what effect on the balance sheet? Select one: A. Increase the Revenue account B. Increase noncash assets (Accounts receivable) C. Increase cash assets D. A and B E. A, B and C QUESTION 14 Correct 4.00 points out of 4.00 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 9 of 36 QUESTION 14 Correct 4.00 points out of 4.00 Which of the following is included as a component of stockholders' equity? Select one: A. Dividends B. Accounts payable C. Retained earnings D. Prepaid property taxes E. Buildings QUESTION 15 Correct 5.00 points out of 5.00 In fiscal 2016, Snap-On Inc. reported a statutory tax rate of 35%, an effective tax rate of 30.5%. Income before income tax for 2016 was $801.4 million. What did Snap-On report as tax expense (on its income statement) in 2016? Select one: A. $166.7 million B. $244.4 million C. $184.7 million D. $170.0 million E. None of the above QUESTION 16 Correct 4.00 points out of 4.00 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 10 of 36 QUESTION 16 Correct 4.00 points out of 4.00 In a statement of cash flows, interest received from loans made as investments is classified as a cash flow from: Select one: A. Operating activities B. Trading activities C. Financing activities D. Investing activities E. None of the above QUESTION 17 Incorrect 0.00 points out of 4.00 Pfizer Inc., a pharmaceutical company, reported net income for fiscal 2016 of $7,215 million, retained earnings at the start of the year of $71,993 million and dividends of $7,448 million, and other transactions with shareholders that increased retained earnings during the year by $14 million. If there were no additional transactions during the year that affected retained earnings, what was the balance of retained earnings at the end of the year? Select one: A. $ 71,774 million B. $ 38,748 million C. $124,926 million D. $ 47,729 million E. There is not enough information to calculate the amount. QUESTION 18 Correct 4.00 points out of 4.00 A firm's net cash flow from operating activities is not affected by: Select one: A. Cash paid for interest B. Cash paid to suppliers C. Cash received for income tax refunds D. Cash received from customers E. None of the above QUESTION 19 Correct 4.00 points out of 4.00 Which one of the following is not a current liability? Select one: A. Taxes payable B. Accounts payable C. Wages payable D. Wage expense E. None of the above QUESTION 20 Incorrect 0.00 points out of 4.00 Heller Company offers an unconditional return policy to its customers. During the current period, the company records total sales of $850,000, with a cost of merchandise to Heller of $340,000. Based on past experience, Heller Company expects 4% of sales to be returned. How much in net sales will Heller Company recognize for the current period? Select one: A. $360,400 B. $850,000 C. $510,000 D. $489,600 E. $816,000 QUESTION 21 Correct 4.00 points out of 4.00 On October 2, 2016, Starbucks Corporation reported, on its Form 10-K, the following (in millions): 2016 2015 Total expenses Operating income Net earnings $18,497.0 (4,171.9 ) 2,818.9 $16,403.4 3,601.0 2,759.3 What amount of revenues did Starbucks report for the year ending October 2, 2016? Select one: A. $24,883.4 B. $25,208.8 C. $24,558.0 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 13 of 36 C. $24,558.0 D. $21,315.9 E. None of the above QUESTION 22 Correct 4.00 points out of 4.00 Examine the financial statements effects template below. Then select the answer that best describes the transaction. Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities + Contrib. Capital + Earned Capital Revenues – ? -120 +600 = +480 – Select one: A. Repay accounts payable of $120, net B. Record accounts receivable of $600 and cash collected of $120 C. Purchase inventory of $600 partially on account D. Purchase $600 of equipment on account E. None of the above Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 14 of 36 QUESTION 23 Correct 4.00 points out of 4.00 A firm's net cash flow from operating activities includes which of the following: Select one: A. Cash received from sale of equipment B. Cash received from issuance of common stock C. Cash received from sale of merchandise D. Cash received as payment of loan from a borrower E. None of the above QUESTION 24 Correct 4.00 points out of 4.00 The Goodyear Tire & Rubber Company's December 31, 2016 financial statements reported the following (in millions) Total assets Total liabilities $16,511 11,786 Total shareholders' equity 4,725 Dividends Net income (loss) Retained earnings, December 31, 2015 82 1.264 $ 4,570 What did Goodyear report for retained earnings at December 31, 2016? Select one: A. $5,907 million B. $5,752 million C. $5,916 million D. $5,834 million Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 15 of 36 E. There is not enough information to determine the answer. QUESTION 25 Incorrect 0.00 points out of 4.00 Acadia, Inc. recorded restructuring charges of $235,542 thousand during fiscal 2017 related entirely to anticipated employee separation payments. Acadia, Inc. had never before incurred restructuring charges. At the end of the year, the company’s balance sheet included a restructuring accrual of $29,643 thousand. The cash flow effect of Acadia’s restructuring during fiscal 2017 was: Select one: A. $205,899 thousand B. $235,542 thousand C. $265,185 thousand D. $ 29,643 thousand E. None of the above QUESTION 26 Correct 5.00 points out of 5.00 The income tax footnote to the financial statements of Apple Inc., for the year ended December 31, 2016, includes the following information (in millions). ($ millions) 2016 Current tax provision Federal $7,652 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 16 of 36 State 990 Foreign 2,105 10,747 Deferred tax provision Federal 5,043 State (138 ) Foreign 33 4,938 Provision for income taxes $15,685 How much of the income tax expense is payable in 2016? Select one: A. $10,747 million B. $ 4,938 million C. $15,685 million D. $13,547 million E. None of the above QUESTION 27 Correct 4.00 points out of 4.00 Sales for the year = $246,687, Net Income for the year = $22,965, and average Assets during the year = $136,357. Return on Assets (ROA) for the year is: Select one: A. 53.8% B. 16.8% C. 9.3% C. 9.3% D. There is not enough information to calculate ROA. E. None of the above QUESTION 28 Correct 4.00 points out of 4.00 The Goodyear Tire & Rubber Company's December 31, 2016, financial statements reported the following (in millions). Cash December 31, 2016 Cash from operating activities Cash from investing activities Cash from financing activities $ 1,132 1,504 (973 ) (875 ) What did Goodyear report for cash on its December 31, 2015 balance sheet? Select one: A. $1,476 million B. $2,281 million C. $3,711 million D. $ 715 million E. None of the above QUESTION 29 Correct 4.00 points out of 4.00 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 18 of 36 Prestige Company has determined the following information for its recent fiscal year. Days inventory outstanding Days payable outstanding Days sales outstanding 42.7 days 56.8 days 91.3 days Compute Prestige Company’s cash conversion cycle. Select one: A. 8.2 days B. 77.2 days C. 105.4 days D. 99.5 days E. None of the above QUESTION 30 Incorrect 0.00 points out of 4.00 A clean audit opinion includes which of the following assertions: (Select as many as apply) Select one or more: A. Financial statements present fairly the company's financial condition B. The auditor certifies the financials to be error free C. The financial statements are management's responsibility D. Management has handled transactions efficiently in all material respects E. All of the above QUESTION 31 Correct 4.00 points out of 4.00 QUESTION 31 Correct 4.00 points out of 4.00 Pinto Corp. sells $300,000 of bonds to private investors. The bonds have a 4% coupon rate and interest is paid semiannually. The bonds were sold to yield 5%. What periodic interest payment does Pinto make to its investors? Select one: A. $6,000 B. $5,000 C. $2,500 D. $3,000 E. None of the above QUESTION 32 Correct 5.00 points out of 5.00 In June 2017, Newcastle Inc. announced a 3-for-1 stock split. On the split date, Newcastle had about 81.9 million shares outstanding. After the split the number of shares outstanding was: Select one: A. 245.7 million B. 54.6 million C. 27.3 million D. 163.8 million E. None of the above QUESTION 33 Incorrect 0.00 points out of 5.00 Indianapolis Corporation makes an equity-method investment in Richmond Inc. at a purchase price of $4.42 million cash, representing 30% (at book value) of Richmond Inc. During the year, Richmond reports net income of $5,280,500 and Indianapolis receives $877,500 of cash dividends from Richmond. At the end of the year, the market value of Indianapolis’s investment is $4.03 million. At year end, what does Indianapolis Corporation report on its balance sheet for its investment in Richmond Inc.? Select one: A. $5,126,650 B. $4,420,000 C. $5,740,900 D. $5,280,500 E. None of the above QUESTION 34 Correct 4.00 points out of 4.00 In its 2016 annual report, Mattel Inc. reported the following (in millions): Total liabilities Total shareholders' equity $4,086.0 $2,407.8 What proportion of Mattel is financed by nonowners? Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 21 of 36 Select one: A. 64.6% B. 53.0% C. 78.6% D. 62.9% E. None of the above QUESTION 35 Correct 4.00 points out of 4.00 Cash collected on accounts receivable would produce what effect on the balance sheet? Select one: A. Increase liabilities and decrease equity B. Decrease liabilities and increase equity C. Increase assets and decrease assets D. Decrease assets and decrease liabilities E. None of the above. QUESTION 36 Correct 4.00 points out of 4.00 A company records an adjusting journal entry to record $10,000 depreciation expense. Which of the following describes the entry? Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 22 of 36 Which of the following describes the entry? Select one: A. Debit Net Income and Credit Property Plant and Equipment B. Debit Property Plant and Equipment and Credit Depreciation expense C. Debit Property Plant and Equipment and Credit Cash D. Debit Depreciation expense and Credit Cash E. Debit Depreciation expense and Credit Property Plant and Equipment QUESTION 37 Correct 4.00 points out of 4.00 During 2016, Nike Inc., reported net income of $3,760 million. The company declared dividends of $1,022 million. The closing entry for dividends would include which of the following? Select one: A. Credit Retained earnings for $1,022 million B. Credit Dividends for $1,022 million C. Debit Net income for $1,022 million D. Debit Dividends for $1,022 million E. Credit Cash for $1,022 million QUESTION 38 Correct 4.00 points out of 4.00 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 23 of 36 A firm's cash flow from investing activities is not affected by: Select one: A. Cash received from sale of a piece of land B. Cash received from issuance of bonds payable C. Cash paid to purchase a plant asset D. Cash paid to purchase common stock of another company E. None of the above QUESTION 39 Correct 4.00 points out of 4.00 On October 2, 2016, Starbucks Corporation reported, on its Form 10-K, the following (in millions): 2016 2015 Operating income Net earnings $4,171.9 $2,818.9 $3,601.0 $2,759.3 Calculate year-over-year increase in net earnings, in percentage terms. Select one: A. (33.8)% B. 22.0% C. 16.5% D. 2.2% E. None of the above QUESTION 40 Correct 4.00 points out of 4.00 As inventory and PPE assets on the balance sheet are consumed, they are reflected: Select one: A. As a revenue on the income statement B. As an expense on the income statement C. As a cash flow outflow on the Statement of Cash flows D. Both B and C E. Assets are never consumed. QUESTION 41 Incorrect 0.00 points out of 4.00 On January 1, Fey Properties collected $7,200 for six months’ rent in advance from a tenant renting an apartment. Fey Company prepares monthly financial statements. Which of the following describes the required adjusting entry on January 31? Select one: A. Debit Cash for $6,000 and Credit Unearned rent revenue for $6,000 B. Debit Cash for $7,200 and Credit Rent revenue for $7,200 C. Debit Unearned rent revenue for $6,000 and Credit Cash for $6,000 D. Debit Unearned rent revenue for $1,200 and Credit Rent revenue for $1,200 E. Debit Rent revenue for $1,200 and Credit Unearned rent revenue for $1,200 QUESTION 42 Correct 4.00 points out of 4.00 Which of the following accounts would not appear in a closing entry? Select one: A. Net income B. Depreciation expense C. Cost of goods sold D. Inventory E. Both A and D QUESTION 43 Correct 4.00 points out of 4.00 The 2016 financial statements of The New York Times Company reveal average shareholders’ equity attributable to controlling interest of $837,283 thousand, net operating profit after tax of $48,032 thousand, net income attributable to The New York Times Company of $29,068 thousand, and average net operating assets of $354,414 thousand. The company's return on net operating assets (RNOA) for the year is: Select one: A. 3.5% B. 6.9% C. 13.6% D. 18.7% E. There is not enough information to calculate the ratio. QUESTION 44 Correct 4.00 points out of 4.00 The fiscal year-end 2016 financial statements for Walt Disney Co. report revenues of $55,632 million, net operating profit after tax of $9,954 million, net operating assets of $58,603 million. The fiscal year-end 2015 balance sheet reports net operating assets of $59,079 million. Walt Disney’s 2016 net operating profit margin is: Select one: A. 16.9% B. 12.5% C. 17.9% D. 11.7% E. There is not enough information to calculate the ratio. QUESTION 45 Correct 5.00 points out of 5.00 Under the pre-2019 accounting standards, which of the following is not a condition requiring the use of the capital lease reporting method? Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 27 of 36 Select one: A. The lease, by its terms, automatically transfers ownership of the leased asset from the lessor to the lessee at the termination of the lease. B. The lease term is at least 75% of the economic useful life of the leased asset C. The lease, by its terms, does not automatically transfer ownership of the leased asset from the lessor to the lessee at the termination of the lease. ! D. The lease provides that the lessee can purchase the leased asset for a nominal amount (bargain purchase price) at the termination of the lease. E. None of the above QUESTION 46 Correct 4.00 points out of 4.00 A firm sold property, plant, and equipment for cash proceeds of $4,200. The equipment originally cost $8,160. The company recorded a loss on sale of $2,520. The company uses the indirect method to prepare its statement of cash flows. Which of the following amounts would be included in cash from operations and cash from investing respectively? Select one: A. $2,520 and $3,300 B. $4,200 and $2,520 C. $2,520 and $4,200 D. $2,520 and $0 E. None of the above QUESTION 47 Correct 5.00 points out of 5.00 Which one of the following items is not a component of contributed capital? Select one: A. Preferred stock B. Retained earnings C. Common stock D. Additional paid-in capital E. All of the above QUESTION 48 Correct 5.00 points out of 5.00 When equity method accounting is used for investment, which component of ROE would always be understated? Select one: A. Net Profit Margin B. Total Asset Turnover C. Financial leverage D. Return on Equity E. None of the above QUESTION 49 Correct 4.00 points out of 4.00 Fey Enterprises recorded a restructuring charge of $16.2 million during fiscal 2016 related entirely to the closing of its division located in Denver, Colorado. The company’s financial statement footnotes indicated that expected employee separation payments amounted to $12.6 million and that fixed asset write-downs accounted for the remainder. Nickolas had never before incurred restructuring charges. At the end of the year, the company’s balance sheet included a restructuring accrual of $2,700,000. The cash flow effect of Fey Enterprises’ restructuring during fiscal 2016 is: Select one: A. $-0- (there was no cash flow effect in 2016) B. $21,600,000 C. $13,200,000 D. $16,800,000 E. $ 9,900,000 QUESTION 50 Correct 5.00 points out of 5.00 Nevada, Inc. reported the following items in the 2017 pension footnote (in millions). Service cost $1,171 Benefits paid to retirees 186 Interest cost 930 Actual returns on pension plan assets 1,204 Expected returns on pension plan assets 1,358 Amortization of deferred amounts 50 Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 30 of 36 The company's pension expense for the year is: Select one: A. $793 million B. $774 million C. $903 million D. $790 million E. $976 million QUESTION 51 Correct ROE is computed as: 4.00 points out of 4.00 Select one: A. Net income attributable to controlling interest / Average equity attributable to controlling interest B. Net income attributable to controlling interest / Net sales C. [RNOA + (FLEV × Spread)] x NCI ratio D. A and B E. A and C Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 31 of 36 QUESTION 52 Correct 4.00 points out of 4.00 What is the risk premium for a company that has a yield rate of 6.24% when the risk-free rate is 4.88%? Select one: A. 4.88% B. 1.36% C. 6.24% D. 11.12% E. None of the above QUESTION 53 Incorrect 0.00 points out of 4.00 Selected ratios follow for Nike, Inc., for the year ended December 31, 2013 (in millions): Return on Net Operating Assets (RNOA) Profit Margin (PM) Net Operating Profit Margin (NOPM) Asset Turnover (AT) Financial Leverage (FL) 43.6% 11.6% 11.4% 1.51 1.72 What is the company's return on equity (ROE) for the year? Select one: A. 13.1% B. 32.2% C. 17.5% D. 30.1% E. None of the above Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 32 of 36 E. None of the above QUESTION 54 Correct 4.00 points out of 4.00 Which of the following is not a cash flow from financing activities? Select one: A. Cash received from issuance of preferred stock B. Cash paid to settle accounts payable C. Cash paid as dividends on common stock D. Cash received from issuance of bonds payable E. None of the above QUESTION 55 Correct 5.00 points out of 5.00 The equity carve-out in which the parent company distributes the subsidiary’s shares as a dividend to shareholders is called which of the following? Select one: A. Sell-Off B. Spin-Off C. Split-Off D. Stock Split E. None of the above Final Exam 10/13/17, 1(15 PM QUESTION 56 Incorrect 0.00 points out of 4.00 In 2016, Southwest Airlines had negative net working capital of $(2,346) million and current assets of $4,498 million. The firm’s current liabilities are: Select one: A. $2,152 million B. $6,844 million C. $2,346 million D. $5,236 million E. There is not enough information to calculate the amount. QUESTION 57 Correct 4.00 points out of 4.00 During 2016, Skechers U.S.A., Inc. had Sales of $3,563.3 million, Gross profit of $1,634.6 million and Selling, general, and administrative expenses of $1,278.0 million. What was Skechers’ Cost of sales for 2016? Select one: A. $1,115.7 million B. $1,928.7 million Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 34 of 36 C. $ 88.1 million D. $1,549.5 million E. There is not enough information to calculate the amount. QUESTION 58 Correct 4.00 points out of 4.00 The SEC adopted Regulation FD, to curb public companies' practice of: Select one: A. Routinely filing extensions for annual reports (Form 10-K) B. Selectively disclosing information C. Reporting pro forma (non-GAAP) numbers D. Hiring auditors for non-audit services such as consulting engagements E. None of the above QUESTION 59 Correct 4.00 points out of 4.00 McKinnon Enterprises owns a professional ice hockey team, the Rockford Penguins. The company sells season tickets for its upcoming season and receives $960,000 cash. The season starts January 1, 2018, with five home games occurring monthly over the next six months. How much revenue will McKinnon Enterprises recognize from its season ticket sales Final Exam 10/13/17, 1(15 PM https://mybusinesscourse.com/platform/mod/quiz/review.php?attempt=1403017&showall=1 Page 35 of 36 How much revenue will McKinnon Enterprises recognize from its season ticket sales through the end of April 2018? Select one: A. $480,000 B. $640,000 C. $960,000 D. $320,000 E. None of the above QUESTION 60 Correct 4.00 points out of 4.00 Intel Corporation reported the following in its 2016 financial statements (in millions): December 31, 2016 2015 Total assets Revenues $113,327 59,387 $101,459 55,355 Research and development 12,740 12,128 Net income 10,316 11,420 What is the common-size amount for Intel Corporation’s research and development expense for 2016? Select one: A. 17.4% B. 21.5% C. 11.2% D. 78.5% E. None of the above [Show More]

Last updated: 1 year ago

Preview 1 out of 36 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Mar 04, 2021

Number of pages

36

Written in

Additional information

This document has been written for:

Uploaded

Mar 04, 2021

Downloads

0

Views

73