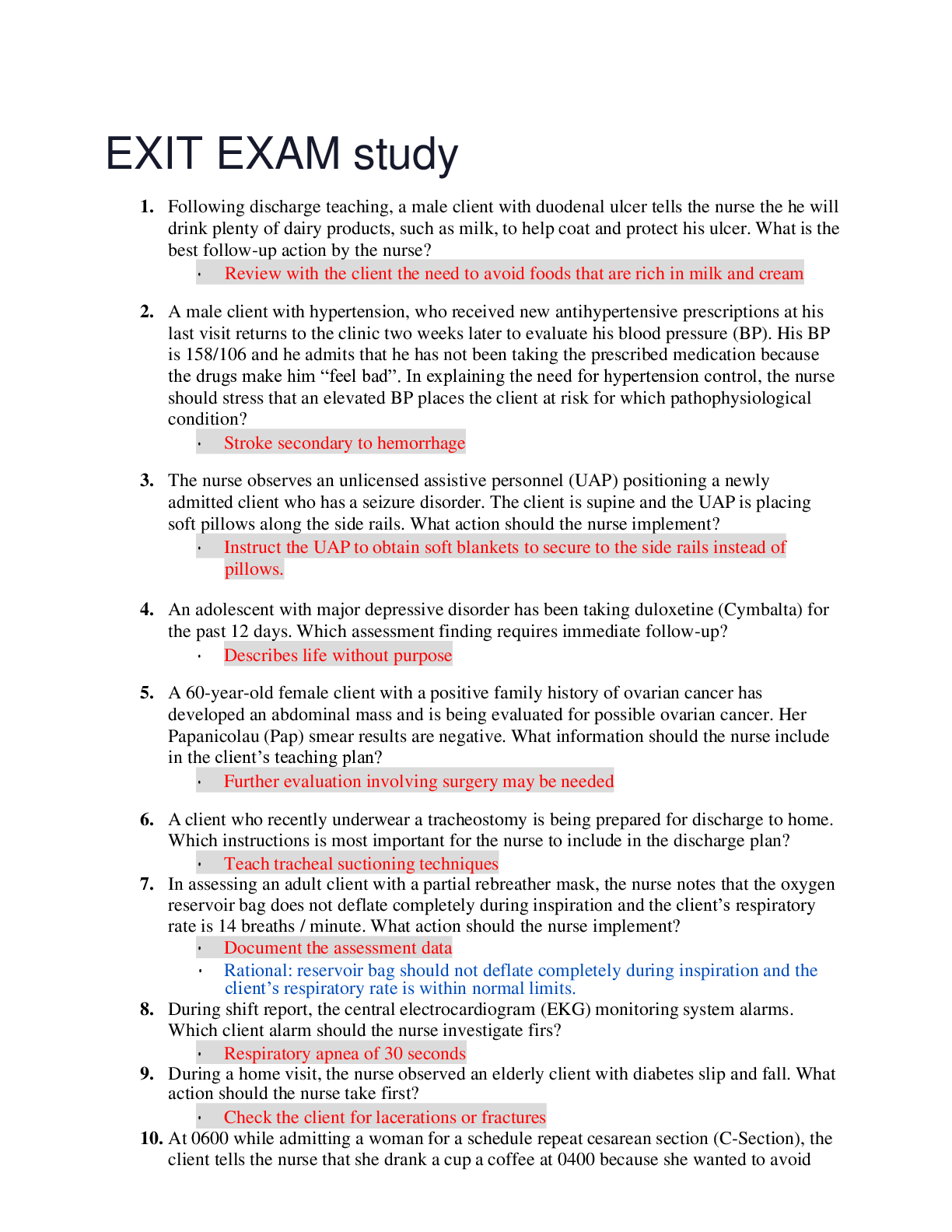

Insurance Studies > EXAM > Michigan Life And Health Final Exam Questions & Answers, 100% Rated (All)

Michigan Life And Health Final Exam Questions & Answers, 100% Rated

Document Content and Description Below

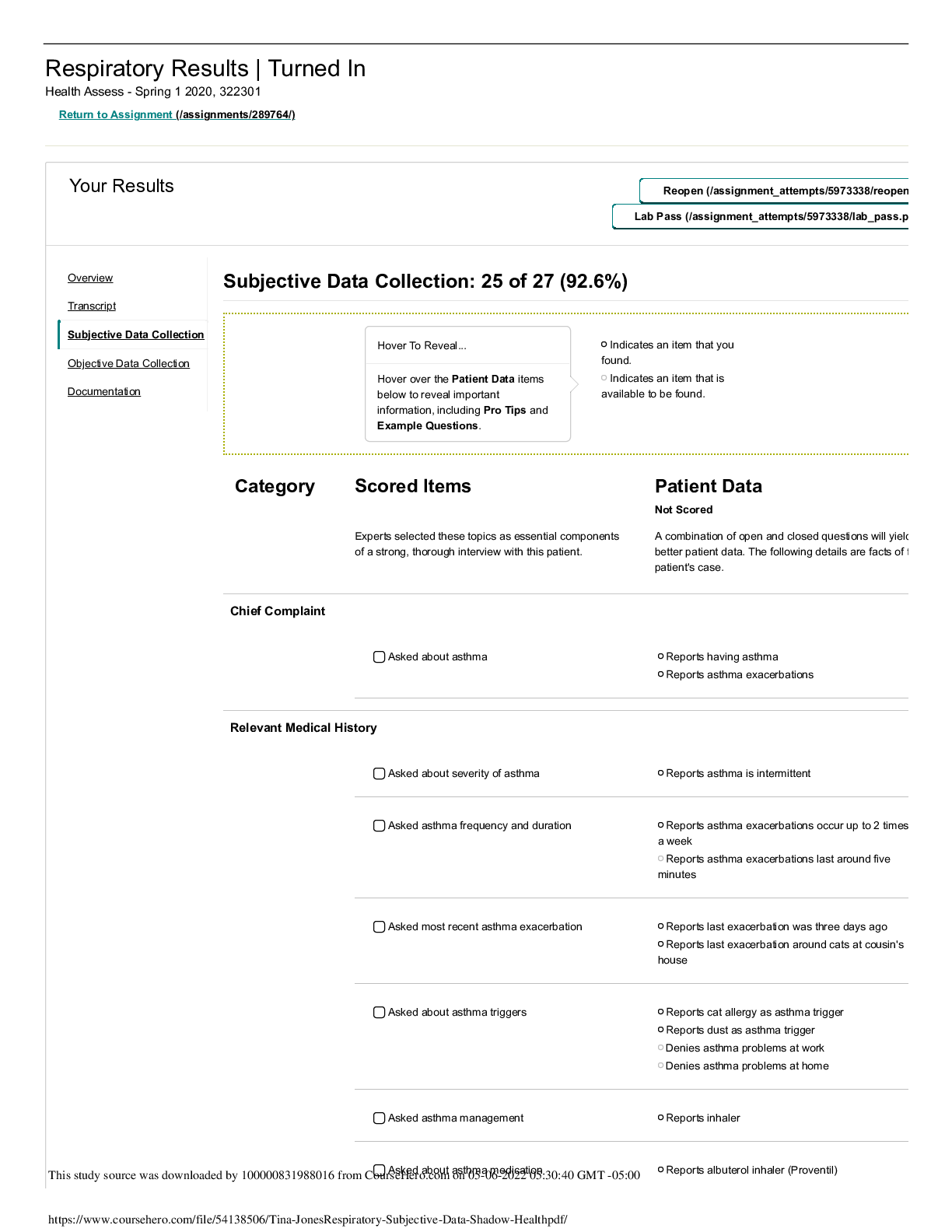

Michigan Life And Health Final Exam Questions & Answers, 100% Rated-What amount will be paid under a policy where the insured misstated his/her age? - an amount the premium would have purchased at the... correct age the acceptance of a credit life application requires the submission of a certificate of insurance to the insured within_____ days - 30 days which of these is considered to be a Living benefit option in a life insurance policy - Accelerated death benefit loans obtained by a policy owner against the cash value of a life insurance policy - would not be treated as taxable income A long term care policy typically provides all of the following levels of care EXCEPT - acute care the elimination period under a hospital indemnity plan is - the specific # of days an insured must wait before becoming eligible to receive benefits for each hospitalization what is an insurance policy's grace period? - Period of time after the premium is due but the policy remains in force How do interest earnings accumulate in a deferred annuity - On a tax-deferred basis a licensee who is required to take continuing education Must include how many ethics coursework hours - 3 the automatic premium loan provision authorizes an insurer to withdraw from a policy's cash value the amount of - Past due premiums that have not been paid by the end of the grace period health insurance involves two perils, accident and ______ - sickness Who is responsible for assembling the policy forms for insureds - Insurance carriers a securities license is required for a life insurance producer to sell - variable life insurance Which of the following is NOT an illegal inducement - giving the insured an article of merchandise printed with the producers name costing 5$ Which of the following is NOT a federal requirement of a qualified plan? - employee must be able to make unlimited contributions Which dividend option would an insurer invest the policy owner's money and add any interest earnings as the dividends accrue? - Accumulation at interest option a health insurance policy will typically cover - preventative health services a life insurance policy owner was injured in a car accident which results in a total and permanent disability. which rider would pay a monthly amount because of this disability? - Disability income rider in addition to the actual policy, an entire contract includes which of the following? - the application field underwriting preformed by the producer involves - completing the application and collecting initial premium Kathy pays a monthly premium on her health insurance policy. How long is her grace period? - 10 days Pierre is covered by his employer's group major medical plan. His employer pays for 75% of the premium and he pays for 25%. How much would a $10,000 benefit be taxable as income under this plan? - 0$ -benefits that fall under a major medical plan are considered to be a reimbursement for a loss, and is not taxable as income After an insured gives notice of loss, what must he/she do if the insurer does not furnish forms? - file a written proof of loss Under long term care insurance, which of the following MUST an insurer offer to each policy owner at the time of purchase? - An inflation protection feature What is the primary factor that determines the benefits paid under a disability income policy? - Wages What is the tax liability for employer contributions in Health Savings Accounts (HSA's)? - No tax payment needed -Employer paid contributions to HSA's are tax free to the employee In the state of MI, properly filed health claims are not timely paid require the insurer to pay simple interest from a date 60 days from satisfactory proof of loss at the rate of? - 12% annum In MI, legal action can be taken against an insurer for failure to pay HEALTH insurance claims for a period not to exceed - 3 years Donald is the primary insured of life insurance policy and adds a children's term rider. What is the advantage of adding this rider? - Can be converted to permanent coverage without evidence of insurability -An advantage of a children's term rider is the ability to convert to permanent insurance without evidence of insurability When an insured changes to a more hazardous occupation, which disability policy provision allows an insurer to adjust policy benefits and rates? - Change of occupation provision The unfair trade practice of replacing an insurance policy from one insurer to another based on misrepresentation is called? - Twisting Which type of coverage pays an amount per day for hospitalization directly to the insured regardless of the insured's other health insurance? - Hospital Indemnity What kind of life insurance policy covers two or more people with the death benefit payable upon the last person's death? - Last Survivor Life Insurance Which of these premium payment frequencies is not typically available to a policyowner? - Bi-weekly Variable life insurance and Universal life insurance are very similar. Which of these features are held exclusively by variable universal life insurance? - Policyowner has the right to select the investment which will provide the greatest return Consumer privacy regulations permit the release of an insured's financial information when? - An authorized agency makes a written request to the insurer during an insurance fraud investigation Which type of life insurance policy pays the face amount at the end of the specified period if the insured is still alive? - Endowment Policy According to the Michigan Insurance Code, which of the following MUST a producer do when replacing a Life Insurance Policy? - Submit to the replacing insurer a list of all Life Insurance policies or annuity contracts proposed to be replaced A policy owner suffers an injury the renders him incapable of performing one or more important job duties. Any decrease in income resulting from this injury would make him eligible for benefits under which provision? - Partial Disability A pharmacy benefit covers prescription drugs derived from list called a(n) - Drug Formulary All of the following are examples of a Business Continuation Plan except - Deferred Compensation Which of the following actions MUST be taken by producers - Pay premiums due to insurers on a timely basis Rob has a benefit at work which enables him to defer his current receipt of income and have it paid at a later date, when he will probably be in a lower tax bracket. Which benefit fits his description? - Deferred Compensation Option What does the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 allow an employee to do? - In the event of employment termination, group health insurance can be kept if the employee pays the premiums Distribution from a Health Savings Account (HSA) for qualified medical expenses are - Tax Free [Show More]

Last updated: 1 month ago

Preview 1 out of 38 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$11.50

Document information

Connected school, study & course

About the document

Uploaded On

May 21, 2024

Number of pages

38

Written in

Additional information

This document has been written for:

Uploaded

May 21, 2024

Downloads

0

Views

5

.png)

.png)