Financial Accounting > QUESTIONS & ANSWERS > Herzing University - ACCOUNTING AC107 MIDTERM. 91% Grade. All Answers Explained (All)

Herzing University - ACCOUNTING AC107 MIDTERM. 91% Grade. All Answers Explained

Document Content and Description Below

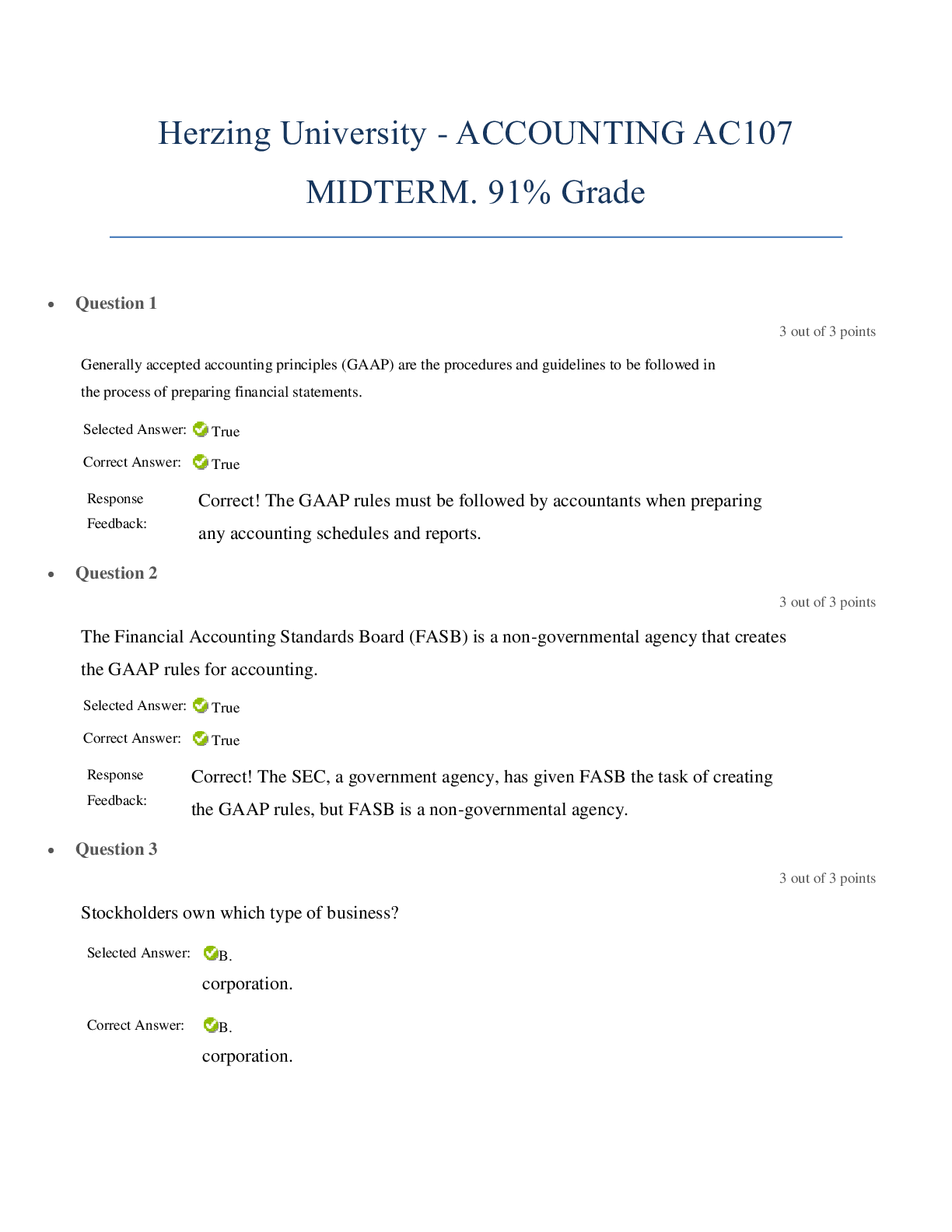

• Question 1 3 out of 3 points Generally accepted accounting principles (GAAP) are the procedures and guidelines to be followed in the process of preparing financial statements. �... � Question 2 3 out of 3 points The Financial Accounting Standards Board (FASB) is a non-governmental agency that creates the GAAP rules for accounting. • Question 3 3 out of 3 points Stockholders own which type of business? • Question 4 3 out of 3 points If owner's equity and liabilities increased during the period, then assets must also have increased. • Question 5 3 out of 3 points When the owner withdraws cash from the business it will result in an increase in owner's equity. • Question 6 3 out of 3 points The balance sheet reports assets, liabilities and owner's equity on a specific date. • Question 7 0 out of 3 points Stephen purchased office supplies for $800 in cash. This transaction would • Question 8 3 out of 3 points To debit an account is to enter an amount on the left column in the journal entry. • Question 9 0 out of 3 points Prepaid Insurance is an expense account. • Question 10 3 out of 3 points Mary's business has performed services on account. The journal entry to record this transaction would include a debit to Cash and a credit to Service Revenue. • Question 11 3 out of 3 points The normal balance of the Owner, Capital account • Question 12 3 out of 3 points The normal balance of the Accounts Receivable account is • Question 13 3 out of 3 points The balance sheet • Question 14 3 out of 3 points The purpose of the general journal is to provide a chronological record of all transactions completed by the business. • Question 15 3 out of 3 points The purpose of the trial balance is to prove that the total of the debit balances and the total of the credit balances in the ledger accounts are equal. • Question 16 3 out of 3 points The journal provides the information needed to transfer debits and credits to the accounts in the general ledger. • Question 17 0 out of 3 points Jason's business has purchased a new delivery van on account. The journal entry to record this transaction includes • Question 18 0 out of 3 points The journal entry to record payment for Delivery Equipment that was previously purchased on account would include • Question 19 3 out of 3 points If the owner of a company invests cash in the business, the journal entry would include • Question 20 3 out of 3 points Service Revenue performed for cash received immediately is recorded in the journal by • Question 21 3 out of 3 points If cash is paid for office rent, the journal entry includes • Question 22 3 out of 3 points Accounting for revenue using the cash basis of accounting means that no entry is made to the revenue account until the cash is received for the services performed. • Question 23 3 out of 3 points The book value of an asset is calculated by subtracting the accumulated depreciation from the cost of the plant asset. • Question 24 0 out of 3 points If the total of expenses is greater than the total of revenue in the income statement, the business has a net loss. • Question 25 3 out of 3 points A contra-asset has a normal debit balance. • Question 26 3 out of 3 points Adjusting entries always affect both an income statement account and a balance sheet account. • Question 27 0 out of 3 points A business records revenue when earned and records expenses when they are incurred regardless of whether the cash has been received or paid. This business is using which basis of accounting? • Question 28 0 out of 3 points Supplies are reported at $500 on the trial balance, but only $350 are still on hand as found during a physical count. The adjusting journal entry would be: • Question 29 0 out of 3 points The Income Summary account appears on the income statement at the end of the accounting period. • Question 30 3 out of 3 points The statement of owner's equity is a statement which summarizes all of the changes in the Owner, Capital account during the accounting period. • Question 31 3 out of 3 points Assets, liabilities, and Owner, Capital are permanent accounts. • Question 32 3 out of 3 points The total revenue for the month of June was $6,500. The total expenses for the month were $3,500. Withdrawals (Owner, Drawing) for the month were $600. The net income for the month was • Question 33 3 out of 3 points The order in which the financial statements should be prepared is • Question 34 3 out of 3 points The journal entry to close the revenue accounts includes • Question 35 3 out of 3 points The account to which the Owner, Drawing account is closed at the end of the accounting period is • Question 36 3 out of 3 points The business entity concepts requires that non-business assets and liabilities are not included in the business' records. • Question 37 3 out of 3 points A compound journal entry is one that records the transaction in three or more accounts. • Question 38 0 out of 3 points The Generally Accepted Accounting Principle (GAAP) rule which says that we record assets at their original cost is called the • Question 39 0 out of 3 points As of the end of the accounting period the employees have earned $1,000, but payday is not until the next period. The adjusting entry prepared at the end of the accounting period to record this includes • Question 40 3 out of 3 points Under which basis of accounting are plant assets such as buildings and equipment recorded as assets when purchased and then depreciated as they are used? [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 02, 2020

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

May 02, 2020

Downloads

0

Views

52