Accounting > Class Notes > MAC3701 CTM Study Notes Tutoring 2020 Application of Management techniques (University of South Afri (All)

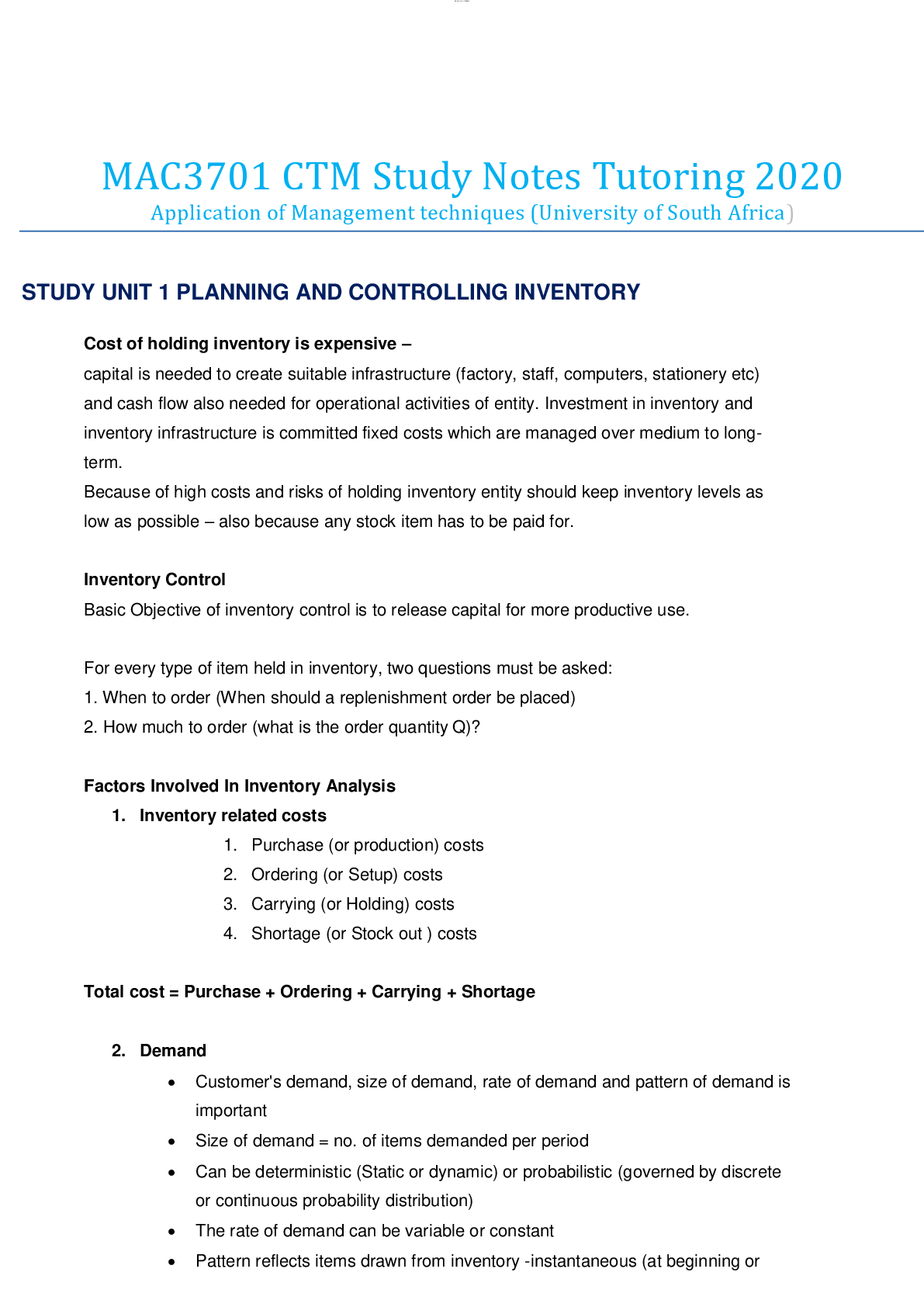

MAC3701 CTM Study Notes Tutoring 2020 Application of Management techniques (University of South Africa)

Document Content and Description Below

STUDY UNIT 1 PLANNING AND CONTROLLING INVENTORY Factors Involved In Inventory Analysis Economic Order Quantity ABC Ltd. is engaged in sale of footballs. Its cost per order is $400 and its carryin... g cost unit is $10 per unit per annum. The company has a demand for 20,000 units per year. Calculated the order size, total orders required during a year, total carrying cost and total ordering cost for the year. Re-Order Point and Safety Stock Determination of the order point is based on three factors: Effect of holding safety stock on the total stockholding cost STUDY UNIT 2 : FURTHER ISSUES IN OVERHEAD ALLOCATIONS Nonmanufacturing Overhead Costs Methods of Allocating Nonmanufacturing Overhead Costs ABC – Activity Based Costing Traditional Absorption Costing and ABC ABC cost hierarchy ABC and Decision Making Advantages of ABC: Disadvantages of ABC STUDY UNIT 3 COST ESTIMATION AND COST BEHAVIOUR Cost estimating learning curve Incremental Unit Time (or Cost) Model Using Wright's Model to find the Learning Rate: Using Crawford's Model to find the Learning Rate: STUDY UNIT 4 PROCESS COSTING Strategic Role of Process Costing. Accounting for losses in process Scrap value 5,000kg of material are input to a process in a period. The normal loss is 10% of input. There is no work-in-progress at the end of each period. Costs incurred in the process in the period totalled $40,500. Required Calculatedulate: Assume that the data in the above question and answer is provided. Required Prepare the process account and the abnormal loss/gain account for the period: (i) if the actual output is 4,650kg (ii) (ii) if the actual output is 4,400kg STUDY UNIT 5 JOINT AND BY-PRODUCT COSTING Accounting treatment for joint products Accounting treatment for by-products Net income (or net realisable value) = Final sales value - Further processing costs Joint Cost Allocation Methods Physical measurement method Relative sales value method Net realizable value (NRV) method STUDY UNIT 6 : THE OPERATING BUDGET How to Complete a Master Budget Sales and Production Budgets Behavioural aspects surrounding Budgets Comprehensive Budgeting Example SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Direct Labor Budget Ending Finished Goods Inventory Budget Selling and Administrative Expense Budget STUDY UNIT 7 : STANDARD COSTING AND VARIANCE ANALYSIS Purpose of standard costing Direct materials variances formulas Direct labor variances formulas Factory overhead variances formulas STUDY UNIT 8 STANDARDS COSTING : FURTHER ASPECTS Recording of standard costs in the accounts Accounting for overhead variances: Accounting for direct labuor rate and efficiency variances. Accounting for direct materials price and usage variances. STUDY UNIT 9 DIVISIONAL FINANCIAL PERFORMANCE MEASURES Example of the Divisional Organization Structure Divisional performance measurement Characteristics of Effective Performance Measures Performance Measurement in divisions Advantages and Disadvantages of ROI Decomposing Return on Investment Non financial measures of divisional performance STUDY UNIT 10 ADVANCED DECISION-MAKING SCENARIOS Calculating expected value of decisions and events Shortcomings of expected value approach STUDY UNIT 11 BASIC LINEAR PROGRAMMING Finding the optimum solution - Using the isocontribution line Calculatedulating shadow prices STUDY UNIT 12 INTRODUCTIONS TO TRANSFER PRICING. STUDY UNIT 13 LONG TERM EXTERNAL PRICE SETTING Pricing in Different Types of Markets Consumer Price Sensitivity Pricing Strategies Driven By Consumers and Competitors Important Economic Considerations The Difference between Cost and Value STUDY UNIT 14 ADVANCED SENSITIVITY ANALYSES A Recap of Basic CVP Analysis for Single Product Breakeven analysis The Graphical Approach for Single Product Breakeven Analysis for Multiple Products A major assumption PL produces and sells two products. The M sells for $7 per unit and has a total variable cost of $2.94 per unit, while the N sells for $15 per unit and has a total variable cost of $4.5 per unit. The marketing department has estimated that for every five units of M sold, one unit of N will be sold. The organization’s fixed costs total $36,000. Contribution to sales (C/S) ratio for multiple products Points to Bear in Mind Any change in the proportions of products in the mix will change the contribution per mix and the average C/S ratio and hence the breakeven point. BA produces and sells two products. The W sells for $8 per unit and has a total variable cost of $3.80 per unit, while the R sells for $14 per unit and has a total variable cost of $4.20. For every five units of W sold, six units of R are sold. BA's fixed costs are $43,890 per period. [Show More]

Last updated: 1 year ago

Preview 1 out of 118 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 09, 2020

Number of pages

118

Written in

Additional information

This document has been written for:

Uploaded

May 09, 2020

Downloads

0

Views

71