Finance > QUESTIONS & ANSWERS > University of Illinois, Chicago - FIN 494Homework 5 solutions (All)

University of Illinois, Chicago - FIN 494Homework 5 solutions

Document Content and Description Below

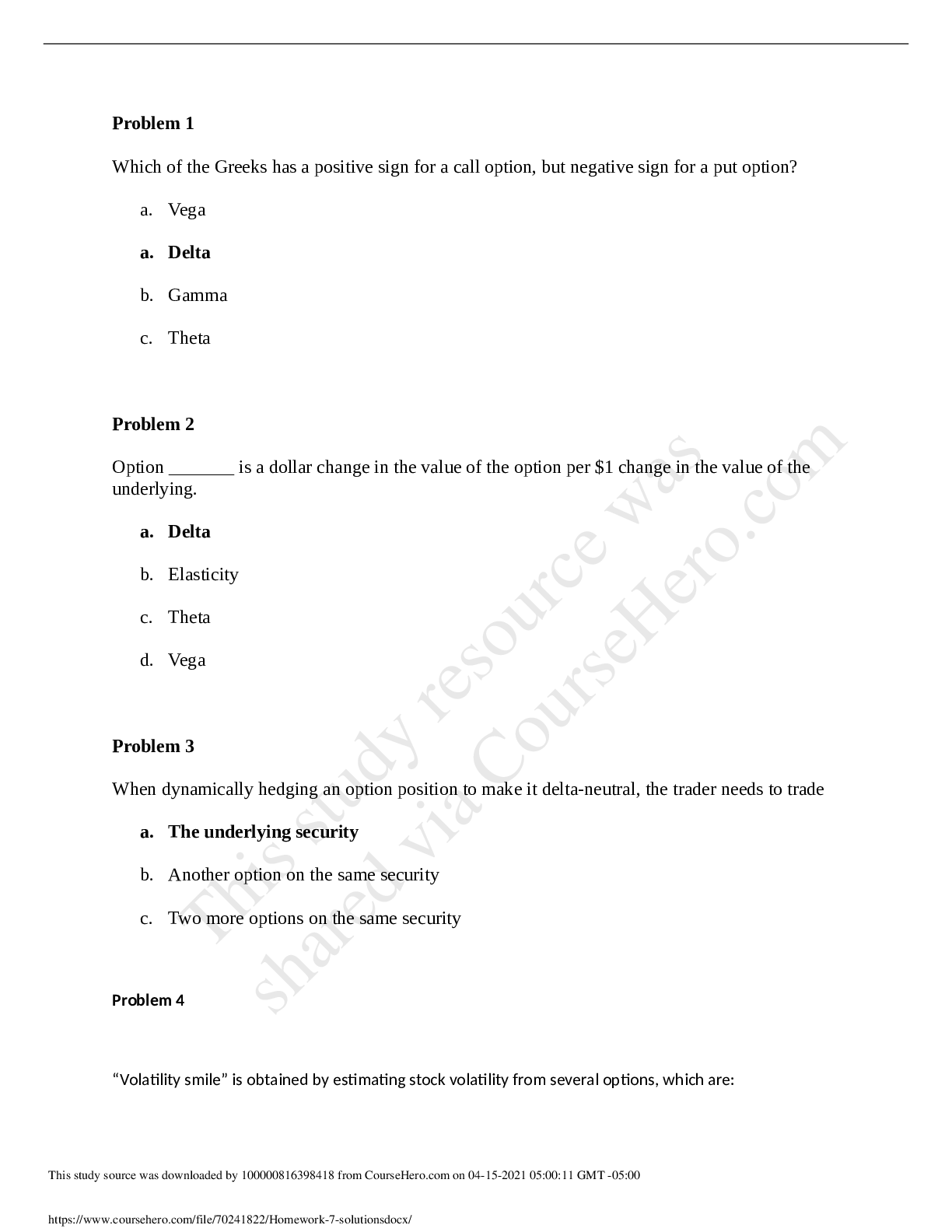

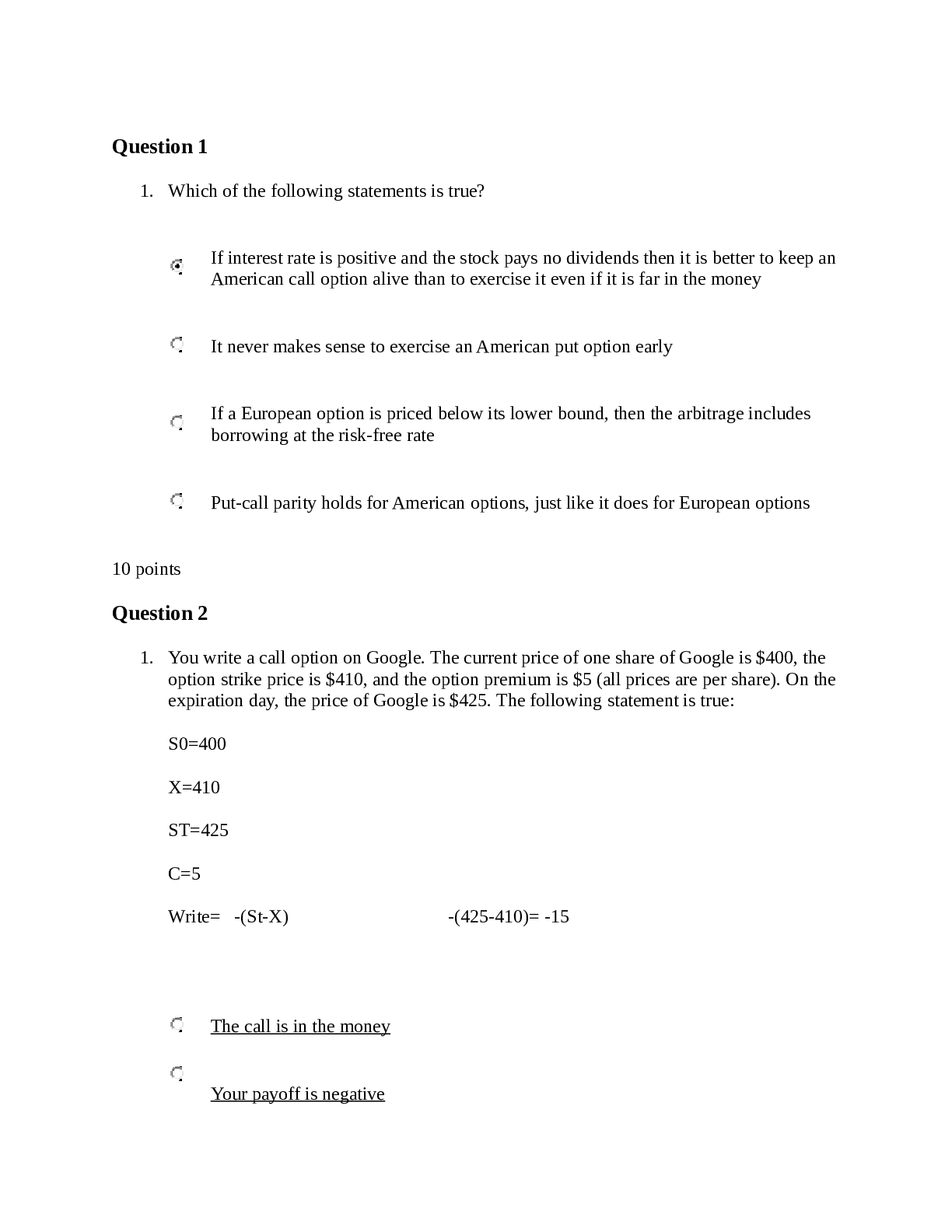

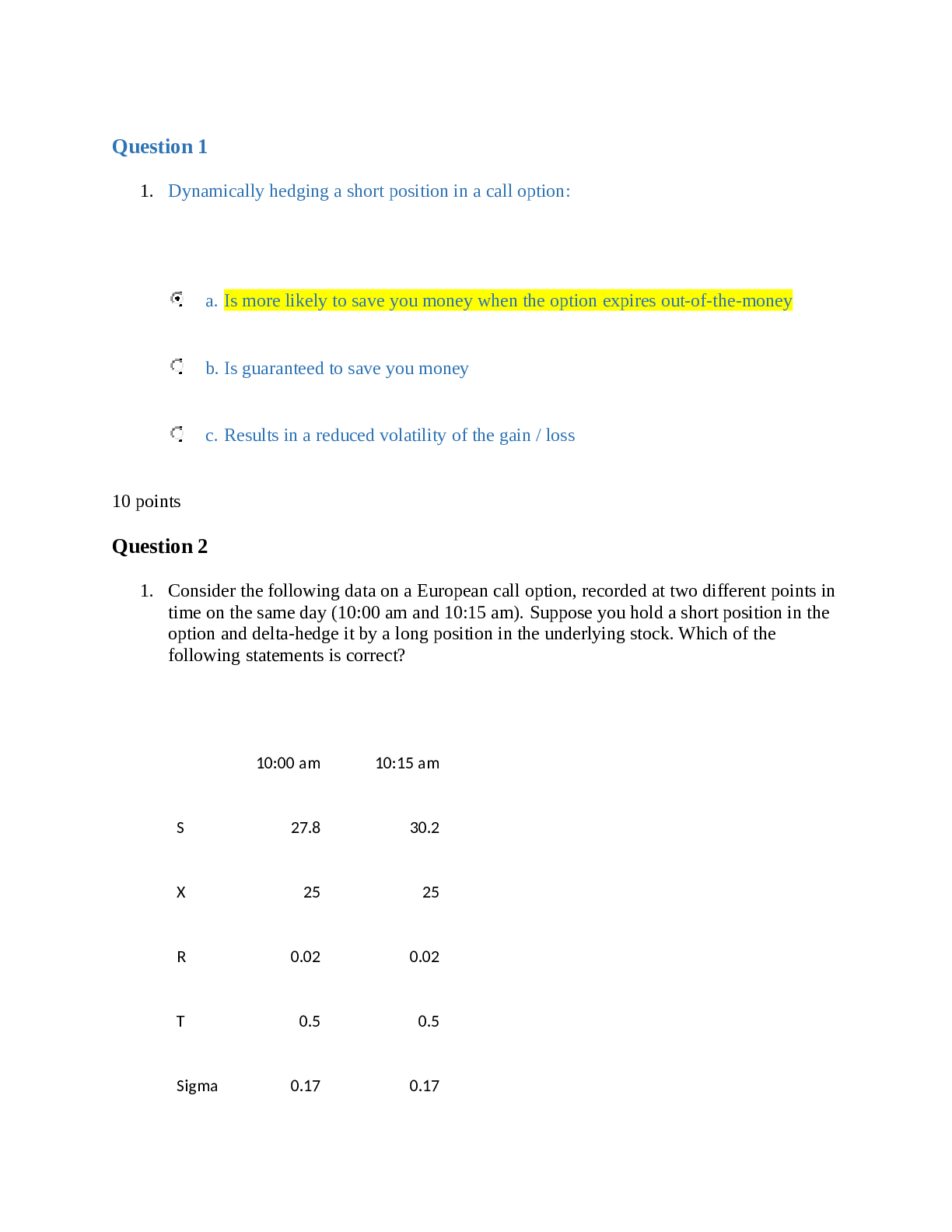

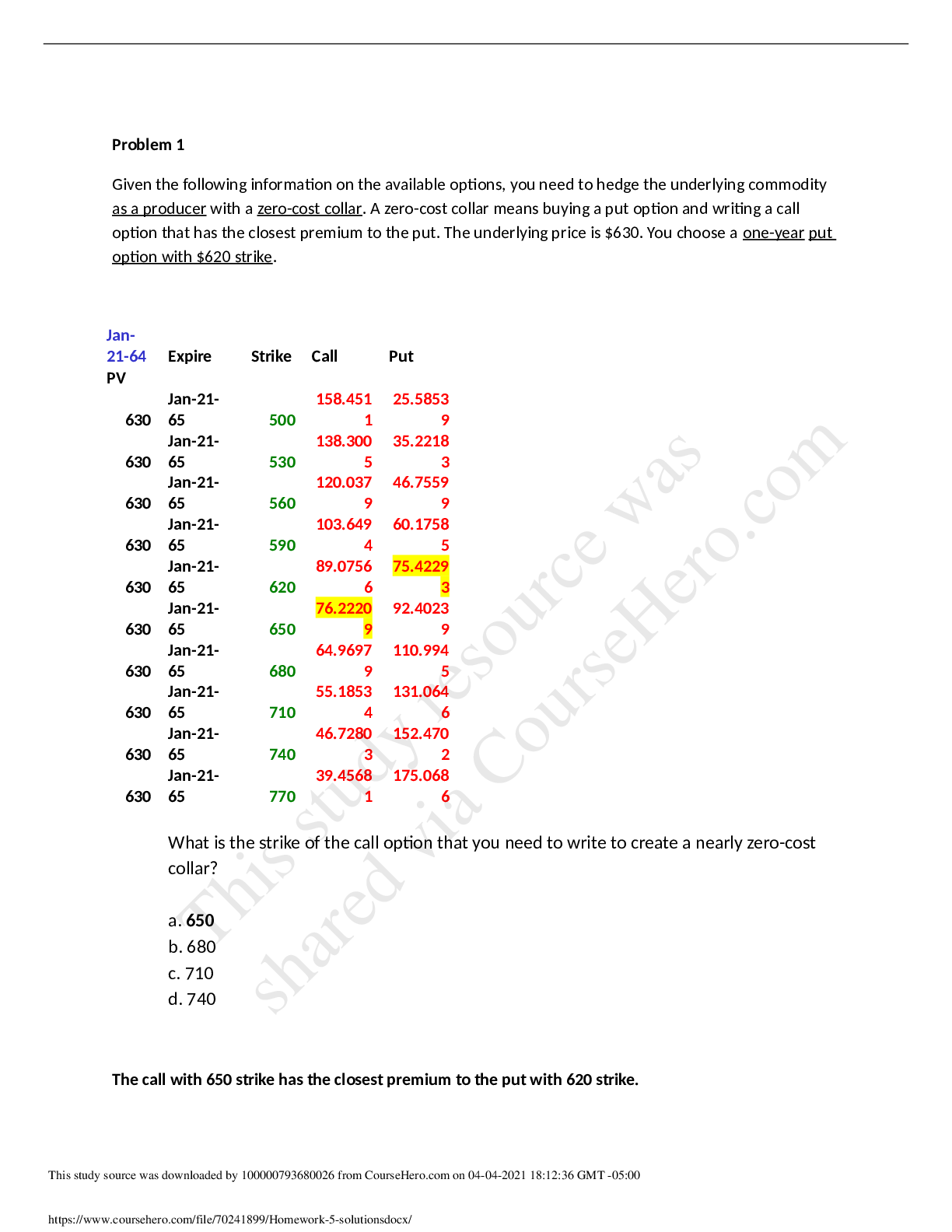

What is the strike of the call option that you need to write to create a nearly zero-cost collar? a. 650 b. 680 c. 710 d. 740 The call with 650 strike has the closest premium to the put with 620... strike. This study source was downloaded by 100000793680026 from CourseHero.com on 04-04-2021 18:12:36 GMT -05:00 https://www.coursehero.com/file/70241899/Homework-5-solutionsdocx/ This study resource was shared via CourseHero.comProblem 2 Stock is trading at $100 and you buy a put option on it with one year to expiration and a strike price of $110. The put premium is $15. What is the maximum profit you can make on this put option if you wait until expiration? a. 110 b. 95 c. 85 d. unlimited Maximum profit = 110 – 15 = 95 Problem 3 Stock price is $150. You see an at-the-money call option trading at $15, and at-the-money put trading at $5. The options have the same expiration date. You decide to buy a straddle. What will be the breakeven points of the strategy, i.e., at what stock prices will your profit will be exactly zero? a. One breakeven point, S* = 150 b. Two breakeven points, S* = 145 and S* = 165 c. Two breakeven points, S* = 130 and S* = 170 d. Two breakeven points, S* = 135 and S* = 155 A straddle has two breakeven points: X – (c + p) and X + (c + p) Since both options are at-the-money, it means X = S = 150 The first breakeven is 150 – (15 + 5) = 130 The second breakeven is 150 + (15 + 5) = 170 Problem 4 Which of the following strategies pays off when the volatility is expected to be low? a. Long straddle b. Short straddle c. Bullish spread [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 05, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Apr 05, 2021

Downloads

0

Views

29

.png)