Finance > QUESTIONS & ANSWERS > University of Illinois, Chicago - FIN 494Final Exam prepared. ( ANSWERS + SOLUTIONS ) 100% CORRECT (All)

University of Illinois, Chicago - FIN 494Final Exam prepared. ( ANSWERS + SOLUTIONS ) 100% CORRECT

Document Content and Description Below

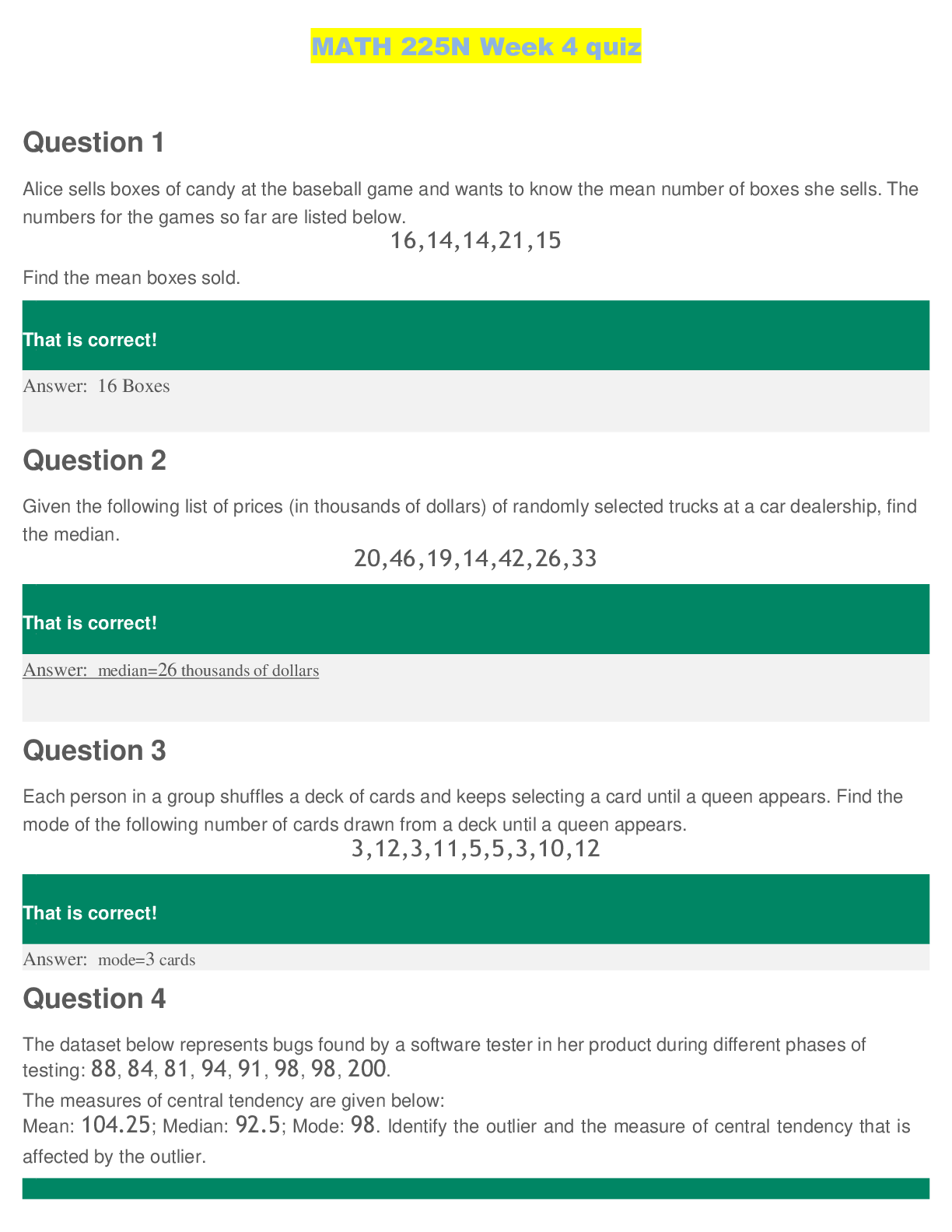

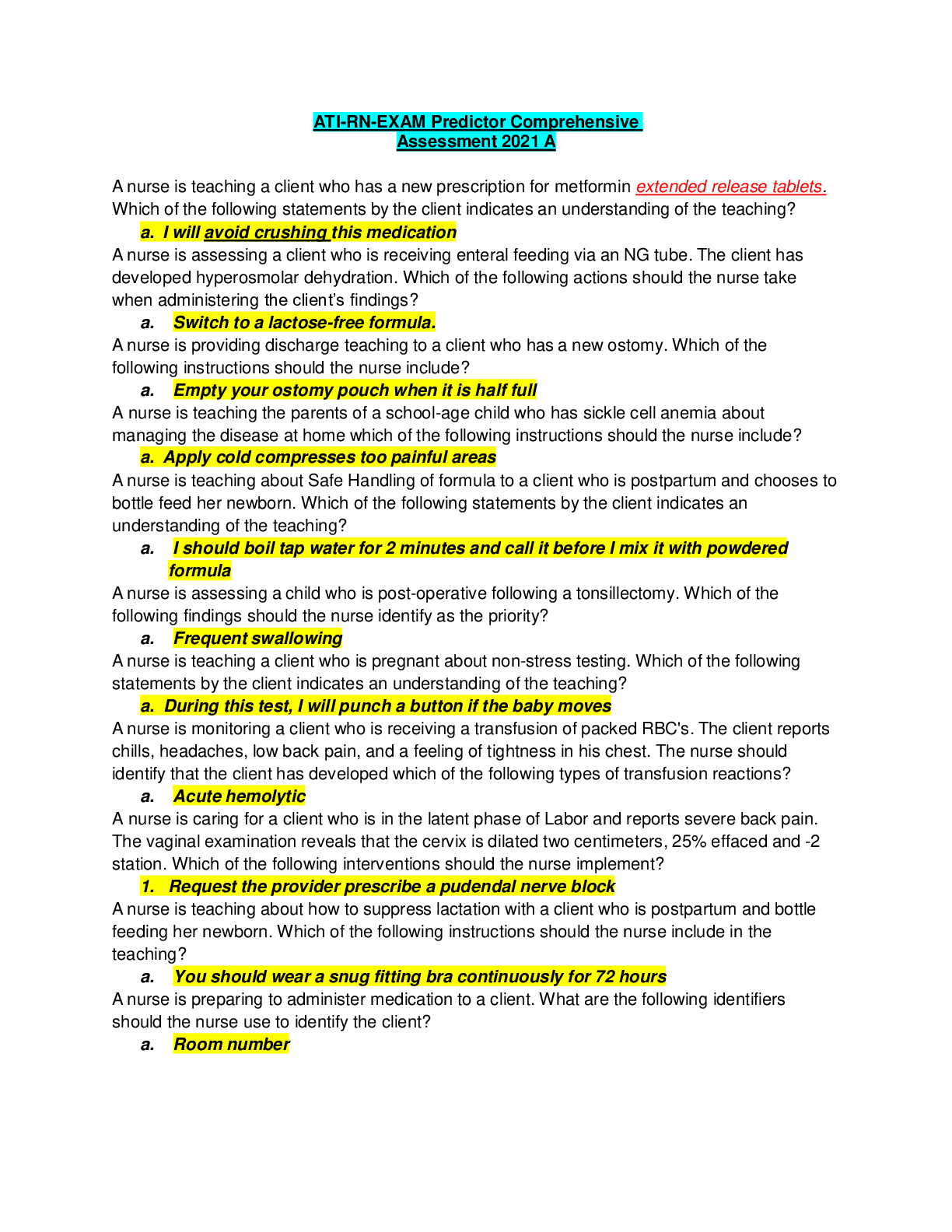

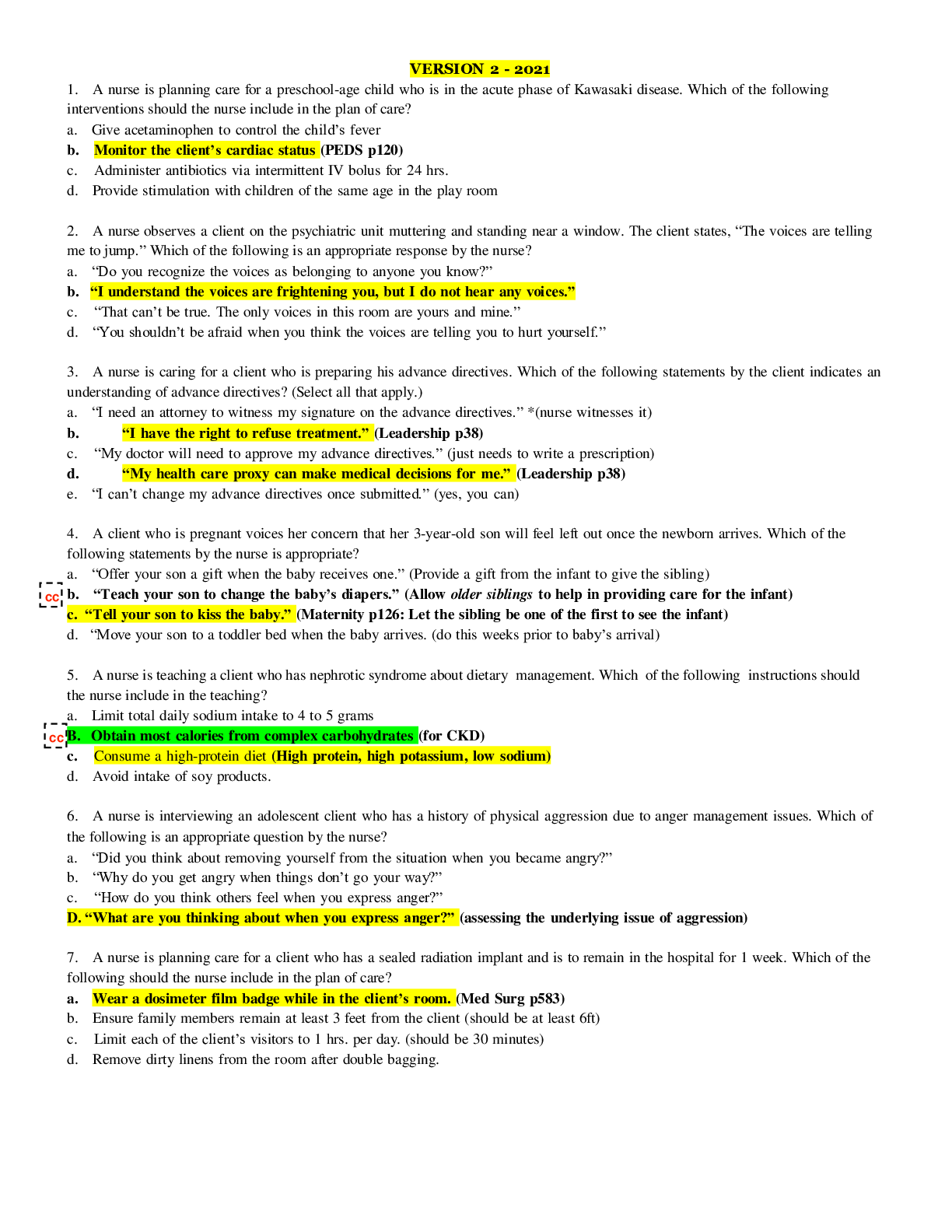

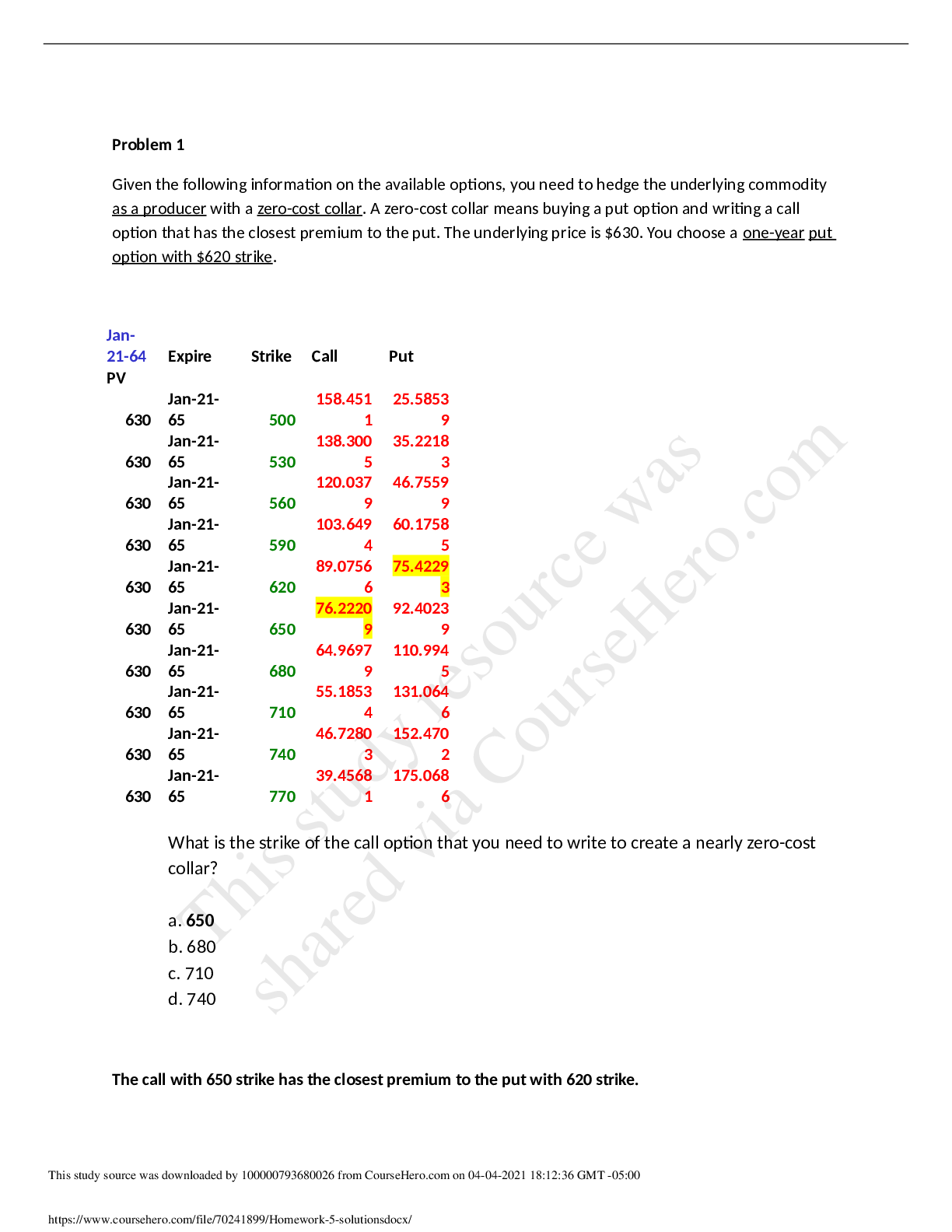

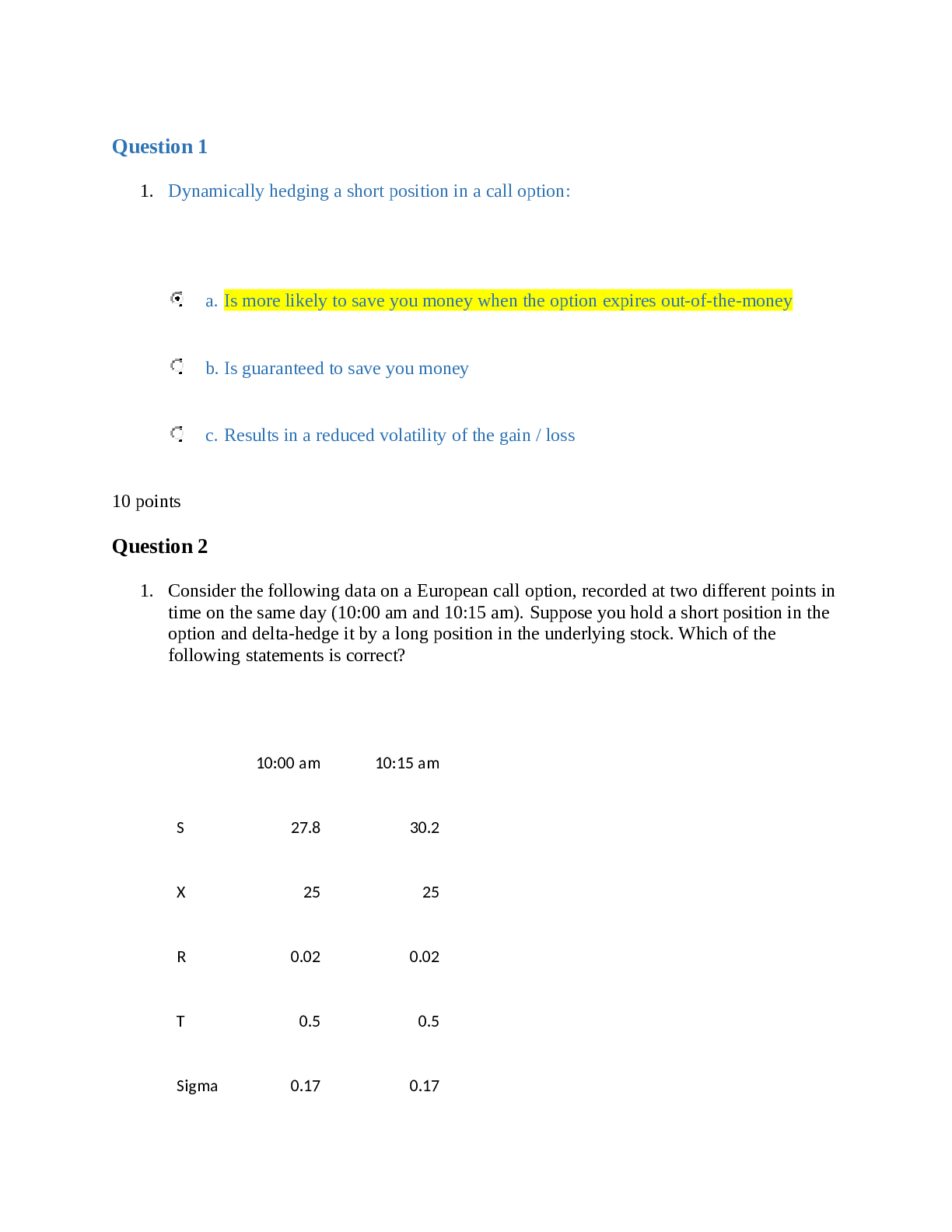

@3,4,6 10check 15 Exchange rate is currently $0.7 US per 1 Canadian Dollar. Interest rate is 2% in the US and 1% in Canada. A bank is short a futures contract on 1,000,000 Canadian Dollars with F= $... 0.75 per unit, maturing in one year. What position should the bank take to hedge the currency risk? Delta is position size discounted by the foreign interest rate. It should be negative because the bank is short. Delta = - 1,000,000 / 1.01 = -990,099 To hedge, the bank should buy 990,099 CAD Borrow 990,099 * 0.7 = $693,069 U.S. to purchase the necessary CAD amount a. Borrow $735,294 US b. Borrow $693,069 US c. Borrow $990,099 US Which is correct regarding call option elasticity? a. It measures a percentage change in the option price per 1% change in the stock price b. It is positive c. It is higher than one d. All of the aboveDelta of a contract is +1 and gamma is 0. Which type of contract is this? Futures is a linear contract, it has gamma of zero. A call and a put are non-linear contracts, they cannot have zero gamma. a. A futures contract b. A put option c. A call option Exchange rate is currently $0.7 US per 1 Canadian dollar. Interest rate is 2% in the US and 1% in Canada. A company has entered a futures contract to buy 1,000,000 Canadian dollars for $710,000 U.S. in one year. Which of the following statements is correct? Expected future exchange rate is found from interest rate parity 0.7*(1.02)/(1.01) = 0.706931 For 1,000,000 that’s $706,931 The company is buying for more than that. a. The company has contracted to buy Canadian dollars at the expected future exchange rate b. The company has contracted to buy Canadian dollars above the expected future exchange rate c. The company has contracted to buy Canadian dollars below the expected future exchangerate Delta of a call option is 0.85. Stock price is currently $50. How much money do you need to borrow to hedge a short position in 200 call contracts (each contract is for 100 shares of stock), provided that you finance the hedge entirely with borrowed funds? Delta of option position = 0.85*200*100 = 17,000 Need to buy 17,000 shares of stock to hedge. 17,000 * $50 = $850,000 a. 1,000,000 b. 850,000 c. 500,000 d. 950,000 Discount factor is 0.985. Stock XYZ is selling for $40 a share. A European option on this stock with a strike price of $38 is trading at $0.50 per share. If it is known that this option is priced above its intrinsic value, what type of option is it? [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 15, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Apr 15, 2021

Downloads

0

Views

26