Financial Accounting > QUESTIONS & ANSWERS > University of Illinois, Chicago - FIN 494exam prepared(6) (All)

University of Illinois, Chicago - FIN 494exam prepared(6)

Document Content and Description Below

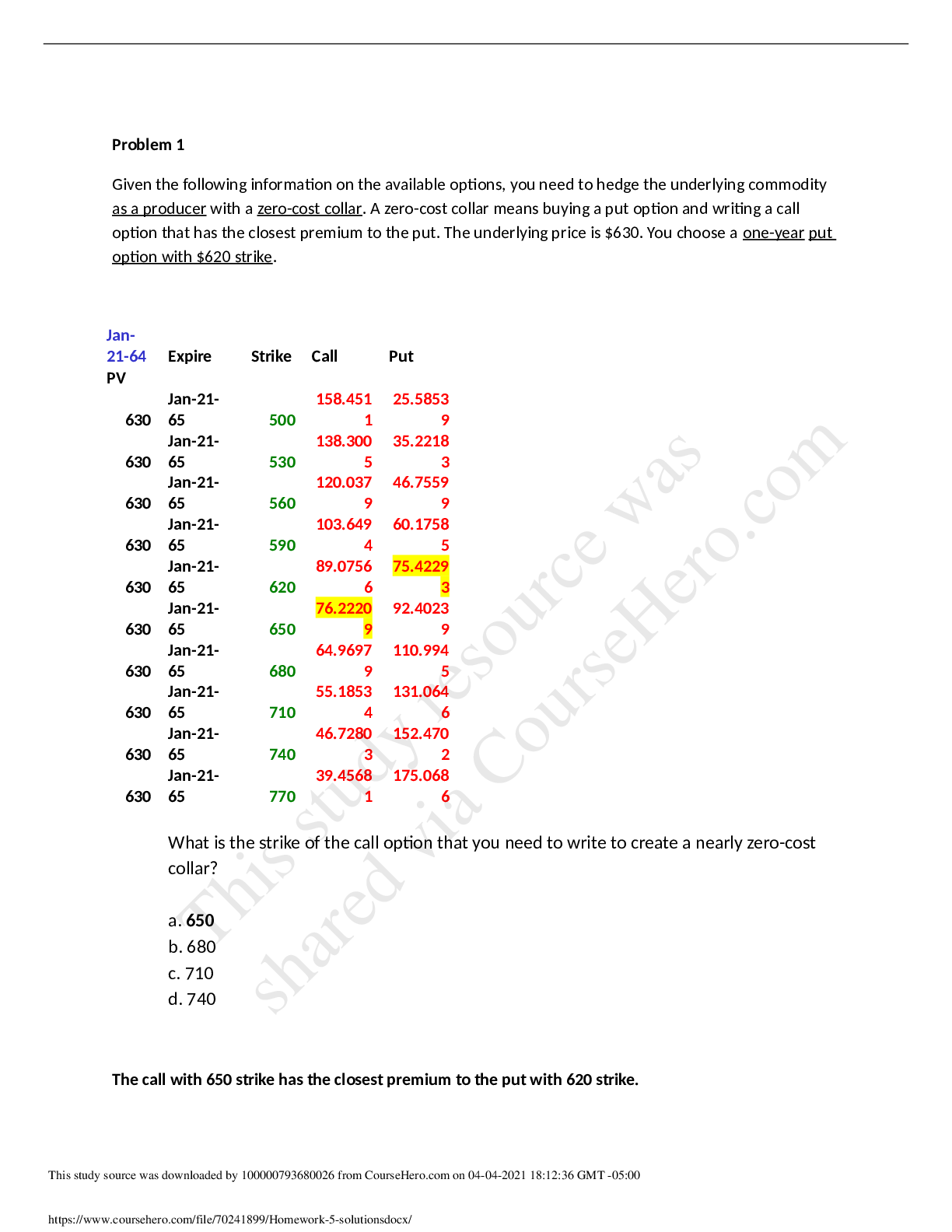

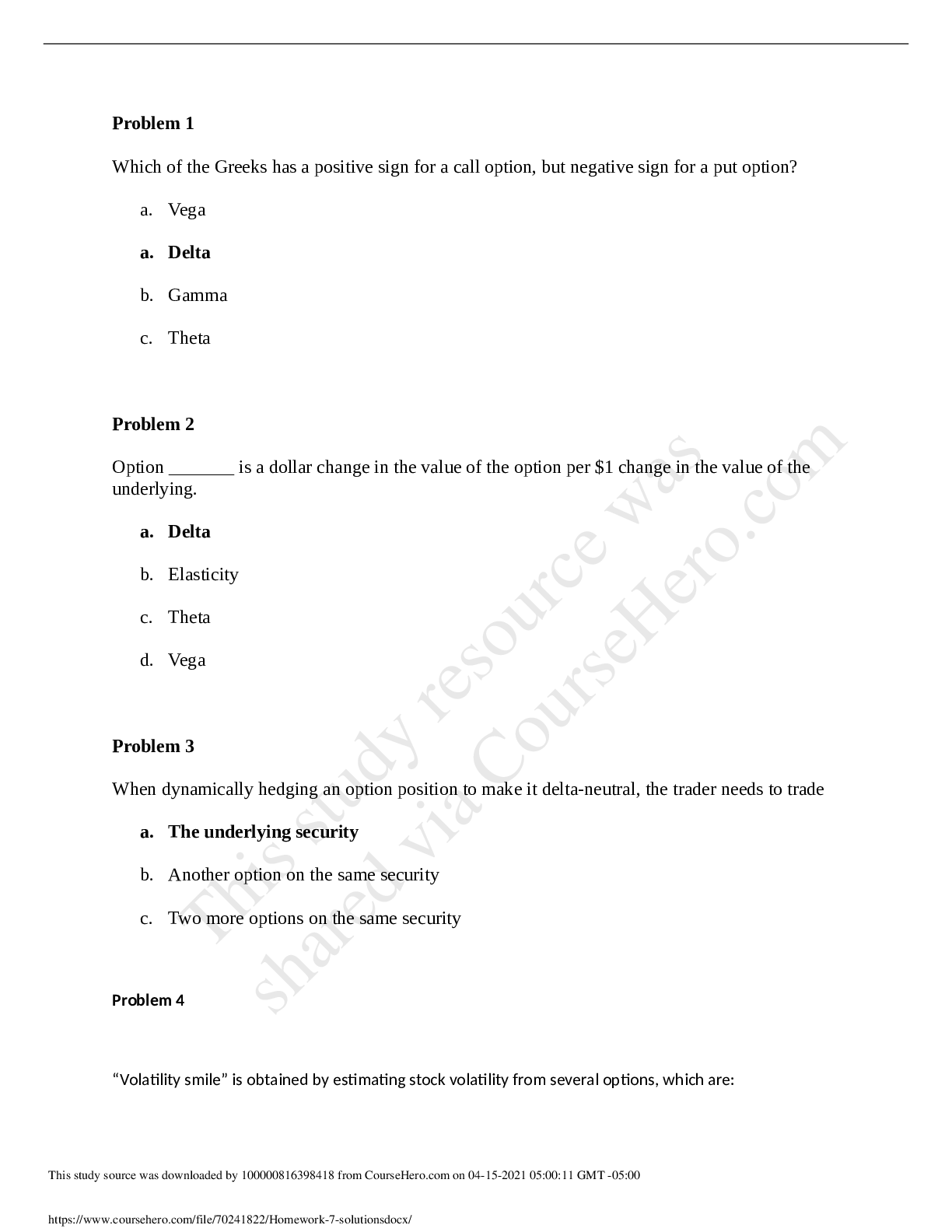

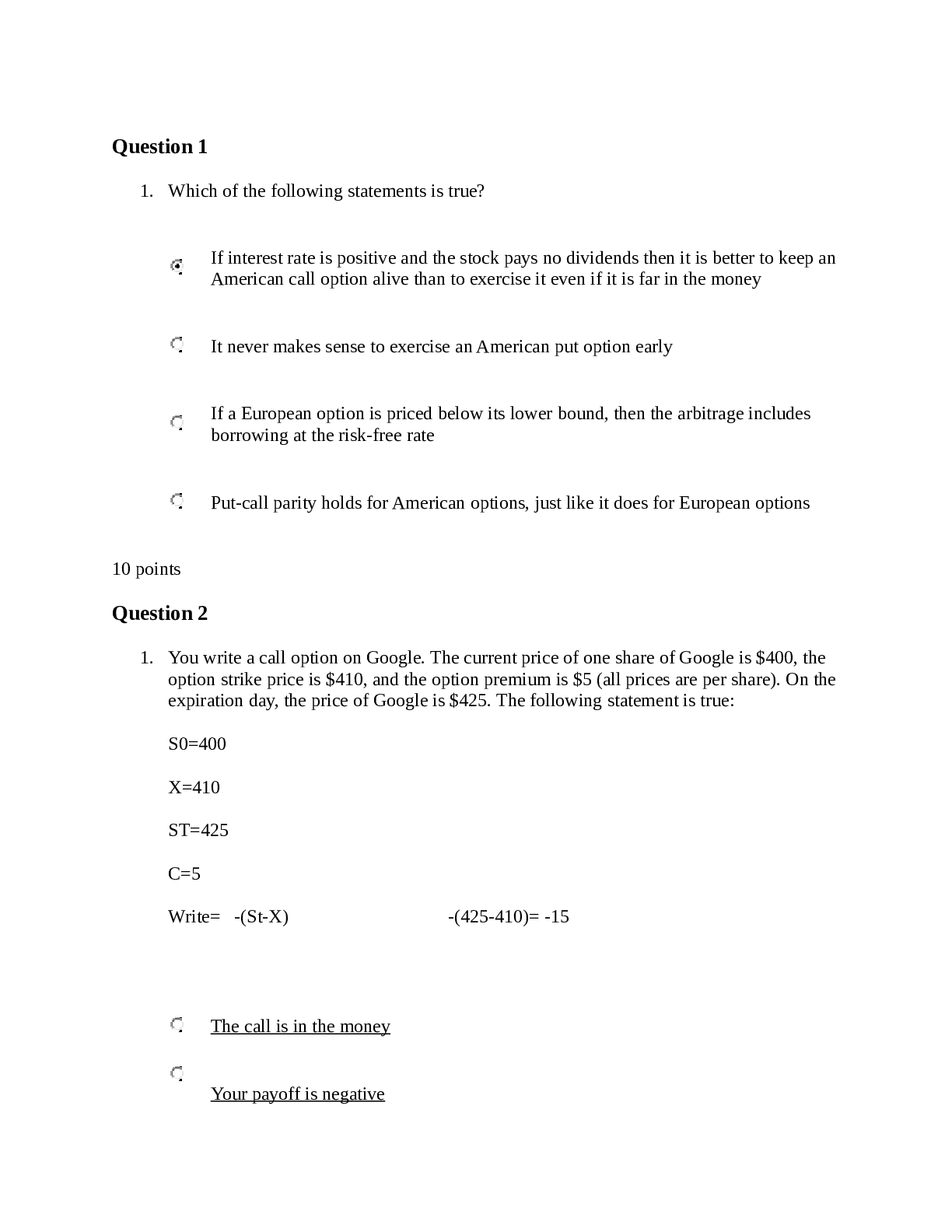

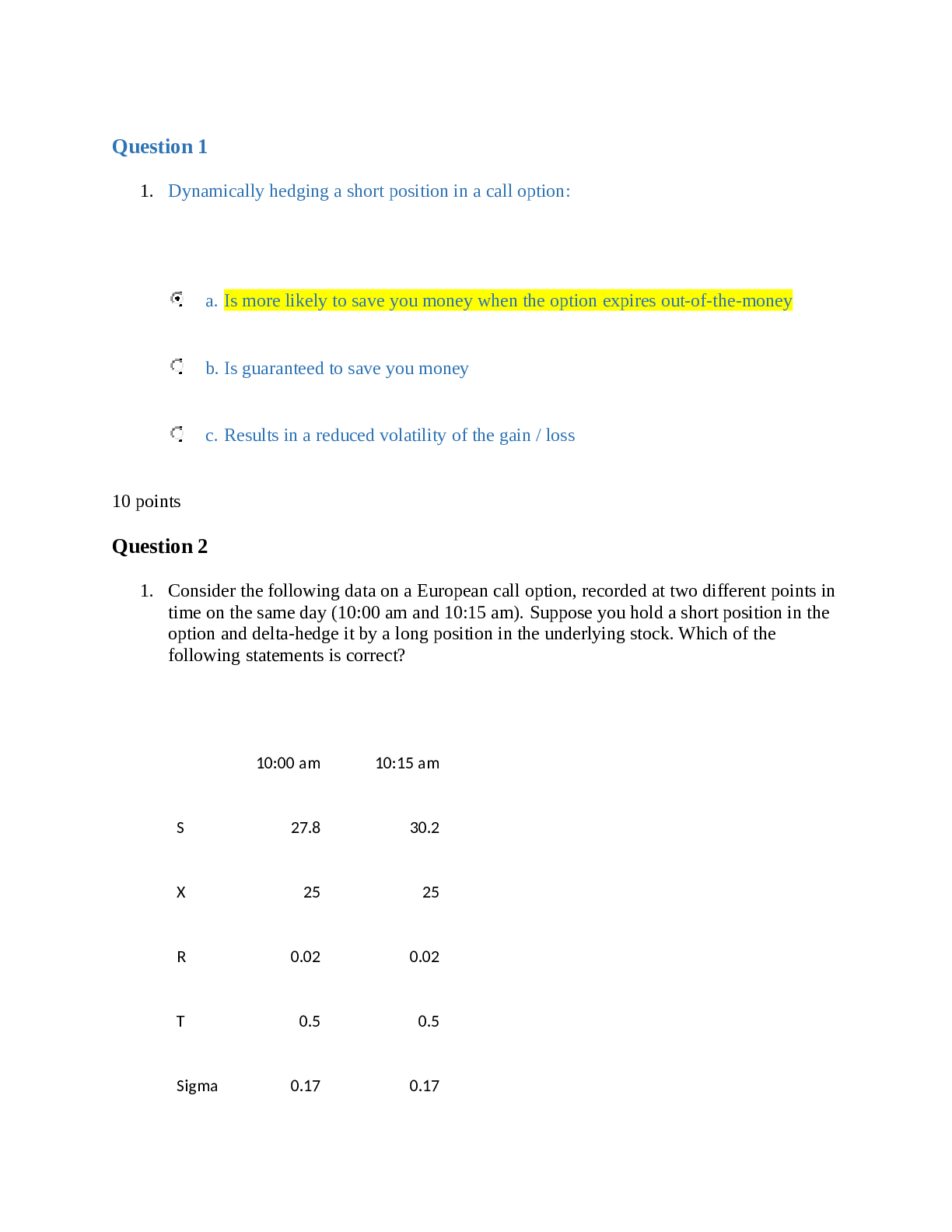

Question 1 1. Dynamically hedging a short position in a call option: a. Is more likely to save you money when the option expires out-of-the-money b. Is guaranteed to save you money c. Results in a... reduced volatility of the gain / loss 10 points Question 2 1. Consider the following data on a European call option, recorded at two different points in time on the same day (10:00 am and 10:15 am). Suppose you hold a short position in the option and delta-hedge it by a long position in the underlying stock. Which of the following statements is correct? 10:00 am 10:15 am S 27.8 30.2 X 25 25 R 0.02 0.02 T 0.5 0.5 Sigma 0.17 0.17 a. Black-Scholes price of the option is higher at 10:15 am b. Delta of the option is higher at 10:15 am c. You need to buy additional shares of stock at 10:15 am to keep the portfolio delta-neutral d. All of the above • 10:00am = (ln(27.8/(25*exp(-0.02*0.05))) + 0.17^2/2*0.05)/(0.17*sqrt(0.05))=2.838 • 10:15am = (ln(30.2/(25*exp(-0.02*0.05))) + 0.17^2/2*0.05)/(0.17*sqrt(0.05))=5.016 Question 3 1. Which of the following determinants have a negative impact on the price of a call option? a. Price of the underlying security b. Time to expiration c. Strike price of the call option d. Volatility of the underlying security 10 points Question 4 1. Which of the following is NOT one of the assumptions of the Black-Scholes model? a. There are no jumps in the stock price b. There are no transaction costs c. Time is continuous d. Volatility of the stock is normally distributed These are the 5 assumptions of Black-scholes model: 1. Stock prices behave randomly and evolve according to a log-normal distribution 2. Risk-free rate and volatility are constant throughout the options life 3. No friction costs/no taxes and transaction costs 4. Stocks pay no dividends 5. Options are European [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 17, 2021

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Apr 17, 2021

Downloads

0

Views

51

.png)