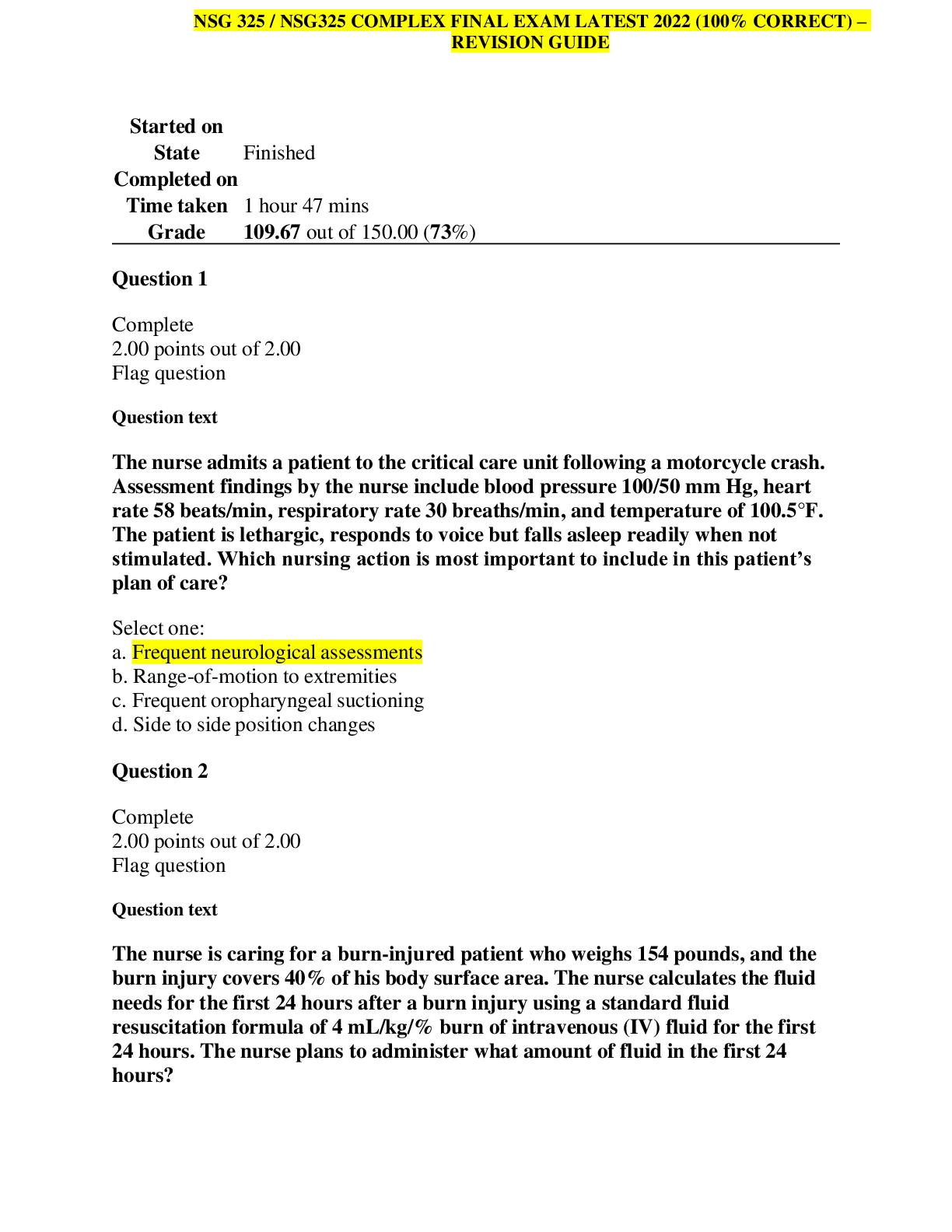

Financial Accounting > EXAM > Saint Louis University – ACCT 220ACCT review. All Solutions Provided. (All)

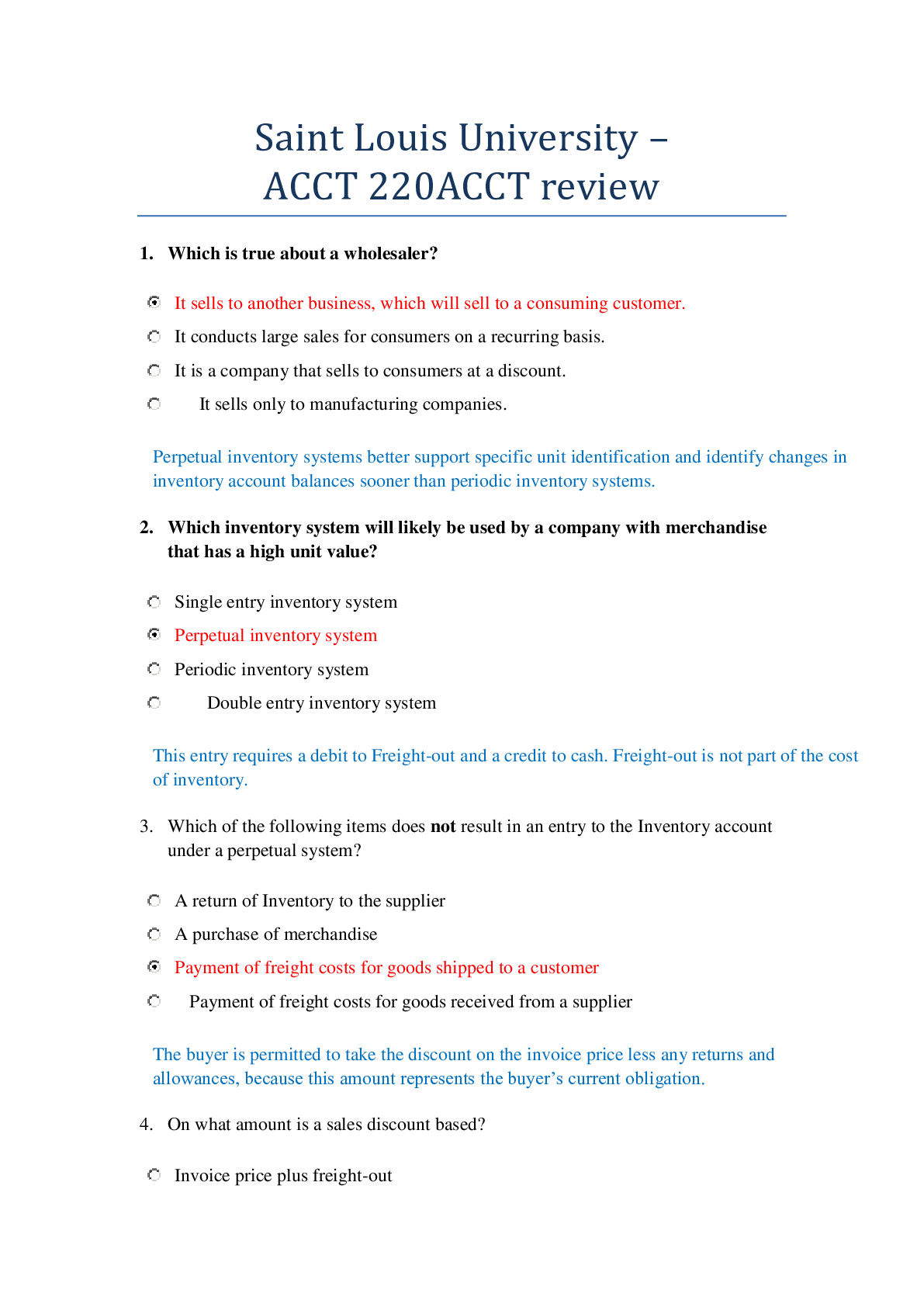

Saint Louis University – ACCT 220ACCT review. All Solutions Provided.

Document Content and Description Below

1. Which is true about a wholesaler? It sells to another business, which will sell to a consuming customer. It conducts large sales for consumers on a recurring basis. It is a company that s... ells to consumers at a discount. It sells only to manufacturing companies. Perpetual inventory systems better support specific unit identification and identify changes in inventory account balances sooner than periodic inventory systems. 2. Which inventory system will likely be used by a company with merchandise that has a high unit value? Single entry inventory system Perpetual inventory system Periodic inventory system Double entry inventory system This entry requires a debit to Freight-out and a credit to cash. Freight-out is not part of the cost of inventory. 3. Which of the following items does not result in an entry to the Inventory account under a perpetual system? A return of Inventory to the supplier A purchase of merchandise Payment of freight costs for goods shipped to a customer Payment of freight costs for goods received from a supplier The buyer is permitted to take the discount on the invoice price less any returns and allowances, because this amount represents the buyer’s current obligation. 4. On what amount is a sales discount based? Invoice price plus freight-out Invoice price less returns and allowances Invoice less discount Invoice price plus freight-in 5. In a perpetual inventory system, which accounts will the seller credit when merchandise is returned by a customer? Sales Returns and Allowances and Accounts Receivable Accounts Receivable and Cost of Goods Sold Sales Returns and Allowances and Inventory Inventory and Cost of Goods Sold Both are contra accounts related to the sales revenue account. 6. Which of these accounts normally have a debit balance? a. Sales discounts b. Sales returns and allowances c. Both a) and b) d. Neither a) nor b) 7. Which of the following is classified in an income statement as a nonoperating activity? Cost of goods sold Advertising expense Freight-out Interest expense Because dividend revenue is not related to the company’s normal business operations, it should be classified as nonoperating activity. 8. Which of the following is classified in an income statement as a nonoperating activity? Receiving dividend revenue from an investment Returning merchandise Receiving an allowance for merchandise damaged in shipment Paying for a purchase of inventory 9. Which of the following would appear on both a single-step and a multiple-step income statement? Other expenses and losses Gross profit Income from operations Cost of goods sold Cost of goods sold is computed by adding beginning inventory and cost of goods purchased and then subtracting ending inventory, or $60,000 + $380,000 - $50,000 = $390,000. 10. If beginning inventory is $60,000, cost of goods purchased is $380,000, sales revenue is $800,000 and ending inventory is $50,000, how much is cost of goods sold under a periodic system? $390,000 $440,000 $410,000 $420,000 Cost of goods available for sale equal the beginning inventory plus purchases minus purchases discounts and purchases returns and allowances plus freight-in: $17,200 + $60,400 - $3,000 - $1,100 + $600 = $74,100. 11. Arbor Corporation had reported the following amounts at December 31, 2011: Sales $184,000; ending inventory $11,600; beginning inventory $17,200; purchases $60,400; purchases discounts $3,000; purchase returns and allowances $1,100; freight-in $600; freight-out $900. Calculate the cost of goods available for sale. $74,100 $56,900 $69,400 $197,700 Net income divided by net sales results in the profit margin ratio. Net sales = $312,000 ‒ $2,000 ‒ $4,000 = $306,000 Net income = $306,000 ‒ $184,000 ‒ $84,000 = $38,000 Profit margin ratio = $38,000/$306,000 or a profit margin ratio of 12.4%. 12. A company has the following balances: Sales $312,000; Sales Returns and Allowances $2,000; Sales Discounts $4,000; Cost of Goods Sold $184,000; Operating Expenses $84,000. How much is the profit margin ratio? 12.4% 12.2% 16.0% 41.0% An increase in the the cost of heat (electricity) causes total expenses to decline. However, electricity is an operating expenses and does not affect gross profit. 13. Which factor would not affect the gross profit rate? An increase in the price of inventory items An increase in the cost of heating the store An increase in the sale of luxury items An increase in the use of “discount pricing” to sell merchandise In general, a ratio significantly less than one suggests that a company may be using more aggressive accounting techniques in order to accelerate income recognition. 14. What quality of earnings ratio might a company have if it is using more aggressive accounting techniques in order to accelerate income recognition? Significantly less than 1 Approximately equal 1 Close to 0 Significantly more than 1 When the purchaser directly incurs the freight costs and is using a periodic inventory system, Freight-in is debited. 15. When using a periodic inventory system and the purchaser directly incurs the freight costs, which account is debited? Freight-In Purchases Inventory Freight-out All purchases are debited to the purchases account in a periodic system. 16. Which statement is true when goods are purchased for resale by a company using a periodic inventory system? Purchases on account are debited to purchases. Purchase returns are debited to purchase returns and allowances. Freight costs are debited to purchases. Purchases on account are debited to inventory Pocras Company buys merchandise on account from Wedell Company. The selling price of the goods is $1,233 and the cost of the goods sold is $675. Both companies use perpetual inventory systems. Journalize the transactions on the books of both companies. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Pocras Company Wedell Company (To record sale of merchandise) Click here if you would like to Show Work for this question Presented below is information for Yu Co. for the month of January 2012. Cost of goods sold $211,900 Rent expense $34,000 Freight-out 7,400 Sales discounts 8,850 Insurance expense 13,100 Sales returns and allowances 17,200 Salaries and wages expense 62,100 Sales revenue 396,700 (a) Prepare an income statement. Assume a 20% tax rate. YU Co. Income Statement For the Month Ended January 31, 2012 $ : $ $ Click here if you would like to Show Work for this question By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 3 of 5 used (b) Your answer is correct. Calculate the profit margin ratio and the gross profit rate. (Round answers to 1 decimal place, e.g. 15.2%.) Profit margin ratio % Gross profit rate % For each of the following cases, state whether the statement is true for LIFO or for FIFO. Assume that prices are rising. (a) results in a higher quality of earnings ratio. L (b) results in higher phantom profits. (c) results in higher net income. (d) results in lower taxes. (e) results in lower net cash provided by operating activities. Worthmore Bank and Trust is considering giving Madsen Company a loan. Before doing so, it decides that further discussions with Madsen’s accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $275,570. Discussions with the accountant reveal the following. 1. Madsen sold goods costing $55,520 to Allen Company FOB shipping point on December 28. The goods are not expected to reach Allen until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $87,750 that were shipped to Madsen FOB destination on December 27 and were still in transit at year-end. 3. Madsen received goods costing $33,620 on January 2. The goods were shipped FOB shipping point on December 26 by Lynch Co. The goods were not included in the physical count. 4. Madsen sold goods costing $53,810 to Finet of Canada FOB destination on December 30. The goods were received in Canada on January 8. They were not included in Madsen’s physical inventory. 5. Madsen received goods costing $43,190 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of $275,570. Determine the correct inventory amount on December 31. The correct inventory amount on December 31 $ Ending inventory−physical count $275,570 1. No effect−title passes to purchaser upon shipment when terms are FOB shipping point 0 2. No effect−title does not transfer to Madsen until goods are received 0 3. Add to inventory: Title passed to Madsen when goods were shipped 33,620 4. Add to inventory: Title remains with Madsen until purchaser receives goods 53,810 5. The goods did not arrive prior to year-end. The goods, therefore, cannot be included in the inventory (43,190 ) Correct inventory $319,810 The following comparative information is available for Prasad Company for 2012. LIFO FIFO Sales revenue $97,600 $97,600 Cost of goods sold 37,100 27,100 Operating expenses (including depreciation) 27,300 27,300 Depreciation 12,500 12,500 Cash paid for inventory purchases 40,100 40,100 (a) and (b) Your answer is correct. (a) Determine net income under each approach. Assume a 31% tax rate. LIFO FIFO Net income $ $ (b) Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. LIFO FIFO Net cash provided by operating activities $ $ (a) LIFO FIFO Sales $97,600 $97,600 Cost of goods sold 37,100 27,100 Operating expenses (including depreciation) 27,300 27,300 Income before income tax 33,200 43,200 Income tax 10,292 13,392 Net income $22,908 $29,808 (b) LIFO FIFO Sales $97,600 $97,600 Less: Cash paid for inventory purchases 40,100 40,100 Cash paid for operating expenses ($27,300 – $12,500) 14,800 14,800 Cash paid for income tax 10,292 13,392 Net cash provided by operating activities $32,408 $29,308 A physical inventory count is usually taken at the end of the company’s fiscal year. 1. When is a physical inventory usually taken? a. When the company has its greatest amount of inventory b. When goods are sold or received c. At the end of the company’s fiscal year d. All of the above Equipment is not an inventory account. It consists of items used in the production of income that are not held for sale. 2. Which of the following is not an inventory account? Work in process Equipment Finished goods Raw materials A manufacturing operation utilizes raw materials, work in process, and finished goods as inventory account classifications. 3. Which one of the foll;’owing statements is true? A manufacturing company will normally have raw materials, work in process, and merchandise inventory as inventory account classifications. A merchandising company will normally have raw materials and merchandise inventory as inventory account classifications. A manufacturing company will normally have raw materials, work in process, and finished goods as inventory account classifications. A merchandising company will normally have raw materials, work in process, and finished goods as inventory account classifications. The specific identification method has this constraint.There is no requirement for the physical flow of goods under the LIFO or FIFO inventory valuation concepts to match cost flow. 4. Which of the following statements is true? a. LIFO inventory valuation requires physical flow of goods to be representative of the cost flow. b. FIFO inventory valuation requires physical flow of goods to be representative of the cost flow. c. Specific identification method inventory valuation requires physical flow of goods to be representative of the cost flow. d. All of the above statements are correct A company’s management decides what inventory costing method it wants to use. 5. Which of the following statements is true? GAAP dictates the method of inventory costing method a company must use. Company management selects the method of inventory costing method a company will use. The IRS dictates the method of inventory costing method a company must use. The SEC dictates the method of inventory costing method a company must use. Because cost of good sold has the most recent costs which are the highest costs, net income with LIFO will be the lowest. 6. In periods of rising prices, what will LIFO produce? Higher net income than average costing The same net income as FIFO Higher net income than FIFO Lower net income than FIFO The type of inventory system is not a consideration. All other choices can be important considerations in the selection of a cost flow method. 7. Which one of the following is not a consideration that affects the selection of an inventory costing method? Balance sheet effects Tax effects Income statement effects Perpetual versus periodic inventory system LIFO provides the closest relationship of replacement cost to cost of goods sold on the income statement. 8. With the assumption of costs and prices generally rising, which of the following is correct? Specific identification method provides the closest cost of goods sold to replacement cost on the income statement. LIFO provides the closest valuation of cost of goods sold to replacement cost of inventory sold. FIFO provides the closest cost of goods sold to replacement cost. LIFO provides the closest valuation of inventory on the balance sheet to replacement cost. Click here if you would like to Show Work for this question To comply with the concepts of conservatism, inventory should be valued at the lower-of-cost-or-market when there is a decline in inventory value. 9. Which situation requires a departure from the cost basis of accounting to the lower-of-cost-or-market basis in valuing inventory? A desire for more profit An increase in selling price A decline in the value of the inventory An increase in the value of the inventory Cost of goods sold is the difference between sales and gross profit: $1,800,000 - $600,000 = $1,200,000 Inventory turnover ratio = Cost of goods sold divided by average inventory: $1,200,000 / [($160,000 + $240,000) / 2] = 6.0 10. The following information came from the income statement of the Wilkens Company at December 31, 2012: sales $1,800,000; beginning inventory $160,000; ending inventory $240,000; and gross profit $600,000. How much is Wilkens' inventory turnover ratio for 2012? 6.0 times 3.0 times 2.5 times 3.75 times When LIFO inventory valuation is used, the declaration of the LIFO Reserve allows comparisons of companies using LIFO and FIFO. 11. Reporting which one of the following allows analysts to make adjustments to compare companies using different cost flow methods? FIFO reserve Inventory turnover ratio LIFO reserve Current replacement cost 12. In 2012, a company shows inventory of $250,000 using LIFO. If the company had used FIFO, its inventories would have been higher by $40,000 and $30,000 in 2012 and 2011, respectively. How much is the company’s LIFO reserve in 2012? $30,000 $10,000 $40,000 $70,000 LIFO reserve must be disclosed by companies in the financial statement notes if they use the LIFO method of inventory. It helps analysts compare companies to one another. 13. LIFO reserve must be disclosed by companies using the FIFO inventory method. True False The LIFO reserve is the difference in ending inventory under LIFO and FIFO. 14. What is the LIFO reserve? An amount used to adjust the LIFO inventory to historical cost The difference between the value of the inventory under LIFO and the value under FIFO An amount used to adjust inventory to the lower-of-cost-or-market The difference between cost of goods sold under LIFO compared to FIFO FIFO calculations under a periodic system are the same as FIFO calculations under a perpetual system. 15. Which statement is true in a perpetual inventory system? A new average is computed under the average cost method after each sale. FIFO cost of goods sold will be the same as in a periodic inventory system. LIFO cost of goods sold will be the same as in a periodic inventory system. Average costs are based entirely on unit-cost simple averages. This represents cost of goods sold under LIFO: Sale on August 8: 200 × $5.20 - $1,040. Sale on August 24: 350 units ×$3.35 = $1,172.50 Total cost of goods sold = $2,212.50. 16. A company just starting business made the following inventory transactions in August: Purchase on August 1 300 units $1,560 Sale on August 8 200 units 3,400 Purchase on August 12 400 units 1,340 Sale on August 24 350 units 5,950 Using the LIFO inventory method, how much is cost of goods sold for August using a perpetual inventory system? $2,120 $2,212.50 $6,450 $9,350 The average cost per unit on August 12 must consider the 150 remaining units and the August 12 purchase of 400 units. [(150 × $5.20) + (400 × $3.35)] / (150 + 400) = $3.85 17. A company just starting business made the following inventory transactions in August: Purchase on August 1 350 units $1,820 Sale on August 8 200 units 3,400 Purchase on August 12 400 units 1,340 Sale on August 24 350 units 5,950 Using the average cost perpetual inventory method, how much is the average cost of the units sold on August 24? $6,450 $4.28 $3.85 $4.14 When a firm is using a perpetual inventory system and is using the average-cost method of valuation, a new average cost is computed after each purchase. 18. If a firm is using a perpetual inventory system and is using the average-cost method of valuation, when is a new average cost computed? At the end of the month After each sale After each purchase At the end of the accounting period The results under FIFO in a perpetual system are the same as in a periodic system. Regardless of the system, the first costs acquired are the costs assigned to cost of goods sold. 19. How do the results under FIFO in a perpetual system compare to the results using a periodic system? FIFO cost of goods sold is higher using a perpetual system FIFO cost of goods sold is higher using a periodic system There is not enough information to determine the answer. They are the same If the ending inventory is overstated, cost of goods sold will be understated which causes net income to be overstated. Whenever net income is overstated, stockholders’ equity will be overstated. 20. Which is true if the ending inventory is overstated? Net income will be overstated and the stockholders’ equity will be understated. Net income will be understated and the stockholders’ equity will be understated. Net income will be overstated and the stockholders’ equity will be overstated. Net income will be understated and the stockholders’ equity will be overstated. An error in the ending inventory of the current period will have a reverse effect on net income of the next accounting period. 21. If there is an error in the ending inventory affecting the net income of the current period, what will happen to the net income of the next accounting period? Cannot be determined from the information given. If net income was overstated in the current period, it will be overstated in the next period. It will have no effect on the net income of the next accounting period. It will have the reverse effect on the net income during the next accounting period. If the ending inventory is overstated, stockholders’ equity for that period will be overstated since the cost of goods sold will be lower and net income higher than it should be. If the error is not corrected, the combined total net income for the two periods will be correct which causes stockholders’ equity at the end of the two periods to be correct. 22. Harold Company overstated its inventory by $15,000 at December 31, 2011. It did not correct the error in 2011 or 2012. As a result, what was the effect of Harold’s owner’s equity? Understated at December 31, 2011, and understated at December 31, 2012 Overstated at December 31, 2011, and properly stated at December 31, 2012 Overstated at December 31, 2011, and understated at December 31, 2012 Overstated at December 31, 2011, and overstated at December 31, 2012 While proper internal controls will enhance accuracy and reliability, honest errors can still be expected and undetected. 23. Internal controls guarantee the accuracy and reliability of the accounting records. True Internal auditors evaluate the system of internal controls for the companies that employ them. 24. Internal auditors are hired by CPA firms to audit business firms. are employees of the IRS who evaluate the internal controls of companies filing tax returns. evaluate the system of internal controls for the companies that employ them. cannot evaluate the system of internal controls of the company that employs them because they are not independent False 25. Reasonable assurance rests on the premise that bonding will prevent employees from stealing. employees are basically honest people. a system of internal controls will prevent errors. the costs of establishing controls should not exceed their expected benefit. Correct! Cash will be debited for $500 while Accounts Receivable will be credited for $500. 26. A company’s monthly bank statement shows a collection of a note receivable by the bank in the amount of $500. Which of the following is one part of the journal entry needed to record the note collection by the company? Debit to Accounts Receivable for $500 Credit to Note Expense for $500 Credit to Accounts Receivable for $500 Credit to Cash for $500 Correct! Cash equivalents are highly liquid investments that are readily convertible to known amounts of cash, and are so near their maturities that their market value is relative insensitive to changes in interest rates. $1,000 + $3,000 + $5,000 + $10,000 = $19,000 27. A company has the following items at year end: cash on hand, $1,000; cash in a checking account, $3,000; cash in a savings account, $5,000; postage stamps, $50; and Treasury bills, $10,000 that mature in less than 90 days. How much should the company report as cash and cash equivalents on its balance sheet? $9,000 $19,050 $9,050 $19,000 Investing excess cash to purchase stock in a small company is inappropriate because the stock of small companies is often not easily converted to cash. 28. Which of the following would not be an example of good cash management? Carefully monitoring payments so that payments are not made too early Investing temporary excess cash into the stock of a small company Providing discounts to customers to encourage early payment Employ just-in-time inventory methods to keep inventory low Paying bills no earlier than the due date is a valid cash management technique as long as payments are not stretched to the point of injuring a company’s credit. 29. Avoiding paying bills too early is an effective cash management principle. True False Correct! Cash is estimated to be collected from May sales: $75,000 × 10% = $7,500 June sales: $60,000 × 30% = $18,000 July sales: $70,000 × 60% = $42,000 The total estimated collections during July are $67,500. 30. Burt Company estimates that sales will be $70,000 during July, $60,000 for June, and $75,000 for May. In the past, the company collected 60% of its receivables in the month of sale, 30% in the month following the sale, and 10% in the second month following the sale. How much are the budgeted collections from customers for the month of July? $42,000 $70,000 $60,000 $67,500 The entry to replenish the petty cash account will have debits to expense accounts totaling $94, a debit to Cash Over and Short for $3, and a credit to cash for $97. After replenishment, the fund will have $100 in it. 31. A check is written to replenish a $100 petty cash fund when the fund contains $3 of cash and $94 of receipts. Which of the following is one part of the entry to be used in recording the check to replenish? Petty Cash will be credited for $3 Cash Over and Short will be debited for $3 Petty Cash will be debited for $94 Cash will be credited for $94 The accounts that are included in the replenishment entry are debits to various expense and asset accounts and a credit to Cash. Petty cash is used only to establish, increase, or decrease the fund. 32. When replenishing the petty cash fund, which of the following accounts will not be involved in the accounting entry? a. Petty cash b. Cash c. Various expense and asset accounts d. All of the above would be involved This is a technique used to control cash disbursements and not cash receipts. 33. Which one of the following is not a control procedure used for over-the-counter receipts? Use of a cash register where the amount rung up is clearly visible to the customer Pre-numbered checks are used to buy supplies Providing the customers with an itemized receipt A cash register’s tape is locked in the register and only a supervisor can access it Deposits in transit are deposits the business knows are in route to the financial institution, but are not yet processed by the bank. They need to be added to the bank's balance in the bank reconciliation process. 34. Deposits in transit are added to the cash balance per books on the bank reconciliation. False True Correct! Because the bank considers the depositor's account balance to be a liability, a credit memo causes an increase in the bank account and a debit memo causes a decrease. Interest earned increases the liability of the bank and is accomplished with a credit memo. 35. For which item below might a bank issue a credit memorandum to a depositor's account? Interest earned An NSF check Monthly service charges Outstanding checks Click here if you would like to Correct! Because the bank considers the depositor's account balance to be a liability, a credit memo causes an increase in the account and a debit memo causes a decrease. Monthly service charges would decrease the liability of the bank and be processed with a debit memo. 36. For which of the following might a bank issue a debit memorandum to a depositor's account? Deposits in transit Monthly service charges Interest earned Collection of a note receivable Correct! NSF checks are deductions made by the bank from the company’s account that must be removed from the company’s accounting records with an adjusting entry that credits Cash and debits Accounts Receivable. 37. For which of the following will an adjusting entry be required as the result of a bank reconciliation? Outstanding checks Bank errors NSF checks Deposits in transit The book side of the cash reconciliation begins with the general ledger cash account balance to which adjustments are made for amounts collected by the bank. Deductions are made for amounts the bank deducted from the account. Outstanding check and deposits in transit affect the bank side of the reconciliation. Note that once the adjusted total on the bank side is determined, this is also the total on the book side of the reconciliation. You can then work backwards to determine the missing balance per books amount. 38. Barker Company collected the following information to prepare its November bank reconciliation: Cash balance per books, November 30 $21,000 Note receivable plus interest collected 9,000 Outstanding checks 6,000 Deposits in transit 5,400 Bank service charges 85 NSF check 2,100 How much is the cash balance per books prior to preparing the reconciliation? $13,585 $20,400 $6,815 $27,815 [Show More]

Last updated: 1 year ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$12.00

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2020

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2020

Downloads

0

Views

49